As we head into the Asia-Pacific market, what’s forward for financial releases and occasions:

- Japan is on vacation

- At 4:45 PM ET, New Zealand retail gross sales for This fall will likely be launched with estimates of -0.2% versus 0.0% final quarter. The core retail gross sales are anticipated to additionally declined by -0.1% versus 1.0%. This week, the Reserve Financial institution of New Zealand will announce their interest-rate choice subsequent Wednesday (in New Zealand). There was some calling for an increase, however the next inflation expectations introduced final week have eased a few of that thought. However, RBNZs Orr nonetheless feels that the central financial institution has “more work to do” of their quest to get inflation again within the 1-3% goal space. CPI inflation for This fall got here in at 0.5% which was as anticipated however nicely under the 1.8% from Q3.

- FOMC member Cook dinner is scheduled to talk at 5 PM ET.

- At 7:01 PM ET the UK GfK client confidence will likely be launched with the expectations of -18 vs -19 final month.

- FOMC member Waller can be scheduled to talk. He’ll converse at 7:35 PM ET concerning the financial outlook

- China Home costs YoY for January will likely be launched at 8:30 PM ET. Final month they got here in at -0.45% (no estimate)

Coming into the week’s finish, the most important indices are principally increased:

- Japan’s Nikkei will likely be closed, however closed the week up 1.59%

- Shanghai composite index is up 4.27%

- Hong Kong’s Grasp Seng index is up 2.47%

- Australia S&P/ASX index is down -0.6%

The US inventory market was goosed sharply increased on the again of the surge in AI shares and will present a tailwind for inventory markets.. The S&P index closed at a file degree. The NASDAQ index examined the excessive closing degree at 16057.44, however backed off a bit into the shut. It nonetheless rose by 2.96% on the day. The Dow Industrial Common closed at a file degree as nicely.

Within the US debt market, yields had been combined within the US with the quick finish increased and the longer finish modestly decrease:

- 2-year yield 4.715%, +6.3 foundation factors

- 5-year yield 4.342%, +4.3 foundation factors

- 10-year yield 4.338%, +1.6 foundation factors

- 30-year yield 4.474%, -1.7 foundation factors

Crude oil was increased within the day by $0.62 or 0.80% at $78.53. Gold was down marginally by $2.56 or -0.13% at $2023.36. Bitcoin was close to unchanged at $51,778 because the movement of funds moved into shares.

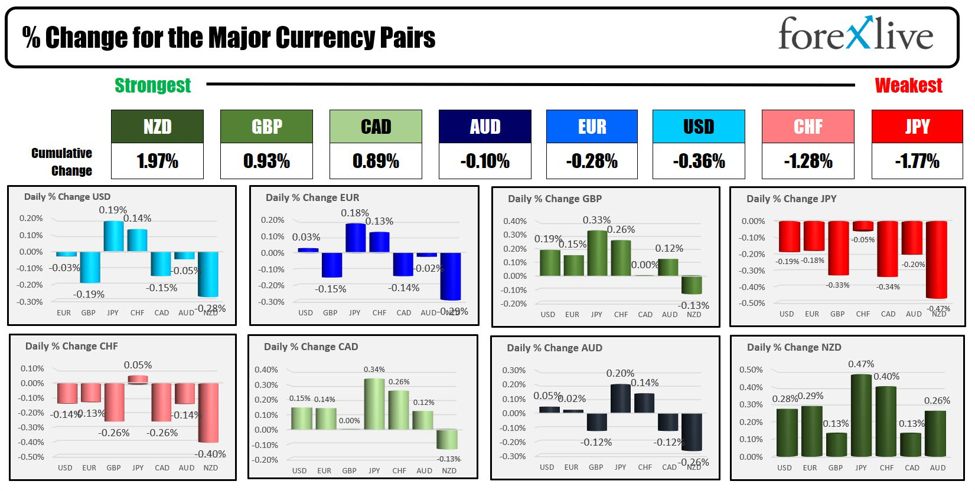

IN the foreign exchange market within the US session, the most important indices are comparatively shut collectively. The NZD is ending the day because the strongest of the most important currencies (though it had it is ups and downs), whereas the JPY is the weakest. The USD is ending modestly decrease however combined.

In FedspeaK within the US session:

- Fed Governor (and voting member) Philip Jefferson offered insights into the present financial and inflation outlook, expressing a cautious stance on the way forward for financial coverage. He famous the potential of starting to chop the coverage fee later this 12 months, underscoring the bumpy path down for inflation as highlighted by the disappointing Shopper Value Index (CPI) knowledge for January.Jefferson identified three key dangers to the financial outlook: resilient client spending that might halt progress on inflation, potential weakening in employment, and ongoing geopolitical dangers. Regardless of these challenges, he stays cautiously optimistic about making progress on inflation, emphasizing the significance of reviewing a complete set of information to evaluate the financial outlook and to information future financial coverage selections.

- In the meantime, Fed’s Harker expressed cautious optimism concerning the U.S. financial outlook, acknowledging the chance that the Federal Reserve could be approaching a degree the place it may contemplate slicing charges, although the timing stays unsure. Latest CPI knowledge indicated progress in the direction of inflation management, albeit inconsistently. Harker highlighted the danger of the Fed slicing charges too prematurely, amidst considerations over growing credit score delinquencies. Nevertheless, he famous a number of indicators suggesting that the labor market is reaching higher steadiness, and remarked on the continued energy of the U.S. GDP. Harker emphasised the necessity for additional assurance that inflation is steadily returning to the Fed’s 2% goal, suggesting that the Fed is shut however not fairly there but in reaching its inflation objective. He additionally talked about that the latest uptick in layoffs shouldn’t be interpreted as a precursor to a recession, reinforcing a typically optimistic however cautious financial outlook.