The 2 huge takeaways from the FOMC statement and Powell’s press convention had been:

- The Fed will solely minimize charges when “it has gained greater confidence” that inflation will get to the two% goal

- Powell says that “it is likely we don’t have enough confidence to cut in March”

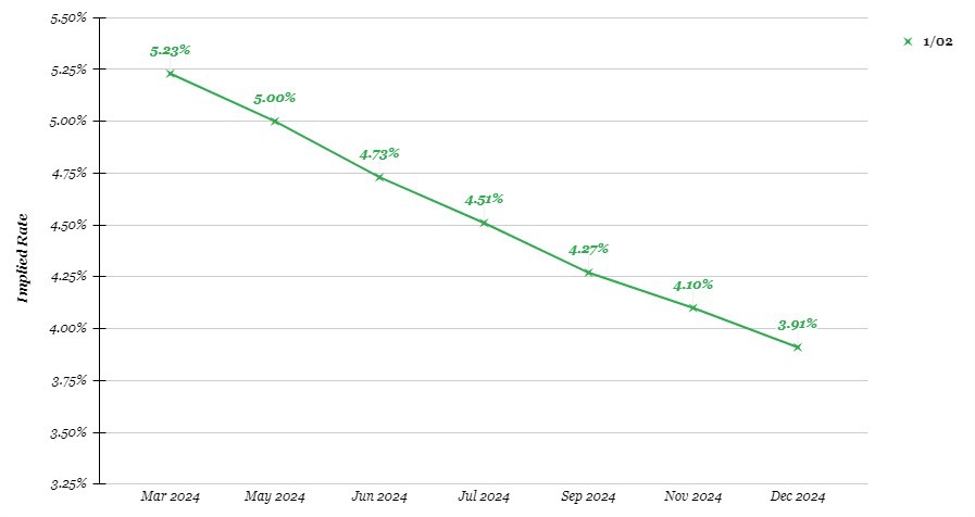

The chances of a March fee minimize had been sitting round ~62% going into FOMC assembly itself. Proper now, that has been minimize all the way in which all the way down to ~35%. In the meantime, the entire discount in charges for the yr is seen at round ~140 bps for the time being.

So, what’s subsequent for markets?

The Fed has already laid out their supposed ‘base case’ state of affairs for the months forward. And which means all else being equal, a fee minimize in March needs to be off the desk. Thus, it’s as much as the info now to actually assist that argument or subtract from it.

And that can be what merchants must look out for within the weeks forward, all earlier than we get to the March FOMC assembly. Do take into account that whereas the assembly resolution is on 20 March, the Fed blackout interval will start on 9 March.

For buying and selling this week, the US jobs report tomorrow would be the subsequent huge information for merchants to have a look at. That would be the first step in figuring out the energy of Powell’s steerage yesterday. Bear in mind, this can be a market that’s determined for something to vindicate their view on fee cuts. So, that can be one thing to be aware about relating to the response to the labour market information tomorrow.