In a big milestone for the cryptocurrency trade, the US Securities and Alternate Fee (SEC) has approved all 11 Bitcoin ETF candidates. This landmark decision is anticipated to usher in a brand new period of inflows, institutional investments, and regulatory readability, probably reshaping your entire crypto market panorama.

Bitcoin ETF, A Essential Step For Integration Into Society?

According to market analyst Michael Van de Poppe, this approval holds historic significance because it comes precisely 15 years after Hal Finney, certainly one of Bitcoin’s early builders, despatched a tweet proclaiming the message, “Running Bitcoin.”

The analyst claims that from its origins as a counter-voice within the 2008 monetary disaster, Bitcoin has now secured its place within the mainstream monetary realm as Wall Street institutions acquire the power to take part within the digital property.

Whereas Bitcoin itself is decentralized and might perform independently of presidency rules, Van de Poppe means that the approval of a Bitcoin ETF holds immense significance in integrating the cryptocurrency into at present’s society.

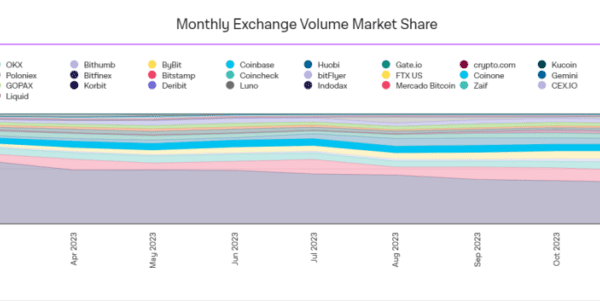

Van de Poppe additional highlights that an ETF is a regulated product that tracks the efficiency of an underlying asset, on this case, Bitcoin. It permits for Bitcoin exposure to be traded on conventional exchanges reminiscent of Nasdaq or AEX, fairly than solely on cryptocurrency exchanges.

The pricing dynamics of a Bitcoin ETF differ considerably from the precise value of Bitcoin attributable to its nature as a by-product product. An ETF features as a fund, with its measurement predetermined, and shares issued accordingly.

Crypto Market Growth

The approval of those Bitcoin ETF functions opens the door for institutional traders, who’ve been hindered by regulatory restrictions and the unregulated nature of Bitcoin itself.

It supplies them with a regulated avenue to achieve publicity to Bitcoin and take part within the rising cryptocurrency market. This transfer aligns with anti-money laundering practices and regulatory frameworks, permitting institutional traders to confidently embrace Bitcoin of their portfolios.

As institutional traders enter the market via ETFs, the worth of the ETF will likely be influenced by market demand. An increase in ETF value signifies optimistic market sentiment and curiosity, resulting in elevated collateral necessities.

The ETF issuer should guarantee adequate Bitcoin holdings as collateral, which additional drives demand for the cryptocurrency. Van de Poppe predicts that institutional traders may usher in roughly $200 billion in investments, probably impacting Bitcoin’s value considerably.

The broader significance of Bitcoin ETF approval lies within the maturation of Bitcoin as an asset class. With elevated consideration from training, regulation, politics, and finance sectors, Van de Poppe believes Bitcoin is poised for additional progress and adoption.

The analyst additional claims that the approval additionally units the stage for the potential creation of ETFs encompassing multiple cryptocurrencies, often called “baskets,” and the chance of Ethereum securing an analogous ETF approval sooner or later.

This growth is anticipated to have a optimistic impact on all stakeholders within the crypto market, together with builders, miners, and traders.

In the end, Van de Poppe means that this marks a big step towards mainstream acceptance and brings Bitcoin nearer to its standing as “digital gold,” attracting a wider vary of people and organizations looking for to incorporate it of their funding portfolios.

Featured picture from Shutterstock, chart from TradingView.com