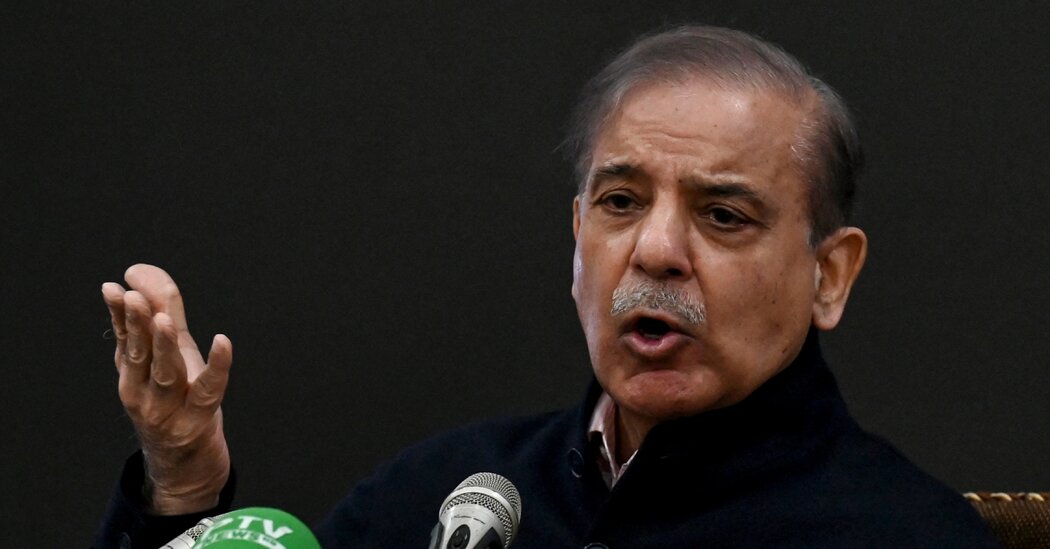

Among the many illustrious nameplates adorning the workplaces of Ivy League enterprise colleges is one Joao Gomes. A Wharton Enterprise College finance professor, Gomes is issuing a warning cry lots of his friends to date have chosen to disregard: America’s burgeoning public debt mountain.

Professor Gomes is what some may name up-and-coming: He was appointed senior vice dean of analysis in 2021, including College of Pennsylvania’s Marshall Blume Prize to his CV in 2018.

However the fresh-faced skilled isn’t afraid to step away from the pack if it means pushing presidential hopefuls for some solutions. Gomes admits he’s “probably” extra nervous than his colleagues about authorities debt, however refuses to remain silent on a broiling subject he believes will throw the worldwide economic system into disarray.

Gomes predicts America’s $34 trillion debt burden might upset the world’s monetary markets as early as subsequent 12 months—ought to a president-elect announce a raft of costly insurance policies.

And bear in mind the UK’s mortgage meltdown following a disastrous premiership below Prime Minister Liz Truss? That’s on the playing cards as properly, as Gomes mentioned charges may spiral to 7% “or higher” if the subject is swept below the rug by Washington.

The warning isn’t chiming alone. Because the starting of the 12 months an growing cacophony of alarm bells has been ringing out: JPMorgan Chase CEO Jamie Dimon says there shall be a market “rebellion” over the problem whereas Bank of America CEO Brian Moynihan says it’s time to stop “admiring” the problem and as an alternative do one thing about it.

This worry is echoing outdoors of Wall Avenue, too. The Black Swan writer Nassim Taleb says the economic system is in a “death spiral,” whereas Fed Chairman Jerome Powell says it’s previous time to have an “adult conversation” about fiscal responsibility.

However regardless of this, presidential candidates probably gained’t be getting on stage with guarantees of how they’ll wrestle down the debt-to-GDP ratio to a extra palatable determine (consultants are presently predicting it’ll attain 190% by 2050.)

“I wish it was a big issue but I’m not sure it’s in the interest of either party to make it a big issue,” Gomes advised Fortune. “As we discuss promises about: ‘What we’re going to do with tax and programs’ it’s going to be important to put it in the context of: ‘Can we afford that?’”

“It’s a really obvious moment in history for us to say: ‘OK, what are our choices, what can we feasibly do, who has the better plan?’ I suspect neither party is interested in that and it might all be pushed under the rug.”

I in all probability fear concerning the US debt greater than most of my skilled colleagues. However on this election 12 months I imagine voters ought to ask a lot harder questions of politicians that don’t take this risk significantly. https://t.co/TDMDbCssVi

— Joao Gomes (@ProfJoaoGomes) February 16, 2024

Certainly, whereas one celebration should make some unpopular selections to deal with the problem, it’s an issue created by each of them. Financial institution of America Analysis’s Movement Present workforce, led by funding strategist Michael Hartnett, calculated in February that the deficits run up below the tenures of Presidents Trump and Biden are the best since Franklin D. Roosevelt within the Thirties.

Trump and Biden each handled a crisis-struck economic system attempting to navigate a worldwide pandemic. FDR, after all, was firefighting the Nice Melancholy after which oversaw the American entry into World Battle II.

Gomes believes that regardless of who contributed to the mess, one celebration goes to should shoulder the accountability for unpicking it: “Toward the latter part of the decade we will have to deal with this.”

“It could derail the next administration, frankly. If they come up with plans for large tax cuts or another big fiscal stimulus, the markets could rebel, interest rates could just spike right there and we would have a crisis in 2025. It could very well happen. I’m very confident by the end of the decade one way or another, we will be there.”

Warning indicators

As with every monetary disaster, there shall be warning indicators when the nationwide debt comes residence to roost—although for customers and markets this realization might not occur in synchrony.

At a coverage degree, Gomes believes, this shall be when the events shopping for debt determine the mannequin is solely not sustainable. This might even be triggered by authorities insurance policies introduced early within the subsequent administration, which in flip will spook a market seeing a hefty price ticket hooked up.

“The most important thing about debt for people to keep in mind is you need somebody to buy it,” Gomes advised Fortune. “We used to be able to count on China, Japanese investors, the Fed to [buy the debt]. All those players are slowly going away and are actually now selling.”

America’s potential to pay its money owed is a priority for the nations all over the world that personal a $7.6 trillion chunk of the funds.

The nations most uncovered are Japan, which owned $1.1 trillion as of November 2023, China ($782 billion), the U.Ok. ($716 billion), Luxembourg ($371 billion), and Canada ($321 billion).

“If at some moment these folks that have so far been happy to buy government debt from major economies decide, ‘You know what, I’m not too sure if this is a good investment anymore. I’m going to ask for a higher interest rate to be persuaded to hold this,’ then we could have a real accident on our hands,” Gomes mentioned.

On this case, Gomes believes America would see one thing of a Liz Truss-like implosion. In 2022, the British MP backed a mini-budget that includes a raft of fiscal stimulus, spooking the Metropolis to the extent that the pound spiraled to its lowest worth ever towards the greenback.

After the shortest premiership in British historical past, Truss was promptly ousted, however not earlier than leaving a legacy: British mortgage charges elevated by roughly 2% in a matter of weeks.

And following this pattern, mortgages—a cornerstone of Western economies—are exactly the place customers will begin to really feel the warmth. When mortgage charges go above 7% is when customers will begin pushing for change, mentioned Gomes, including that if policymakers don’t take steps now the general public shall be again to those charges, “if not worse.”

Avoiding publicity

The excellent news is, there are a few methods to keep away from this disaster. The unhealthy information is, nothing in any respect must occur for presidency debt to develop into the financial subject of the subsequent decade—and it’ll be fairly unavoidable as soon as it will get right here.

And should you’re questioning how a lot debt the federal government would wish to recoup per particular person, it’s not fairly: present estimates are that it’s over $100,000 for each individual.

The path to avoiding this downside sounds easy: In spite of everything, if the debt-to-GDP ratio is what’s acquired everybody so involved, simply upping the second variable will rebalance it, proper? Sure, but it surely means rising the economic system fairly swiftly, and few are convinced America can do that.

The second answer is unpopular, however will be the solely various the federal government is left with: Chopping spending. “Responsible budget proposals” might suffice to stave off any market upset, Gomes mentioned, whereas “imposing major cuts on some programs … opens a Pandora’s box of social unrest that I don’t think anybody wants to think about.”

If markets do certainly insurgent throughout the globe and throw the world’s largest economic system into disarray, the ripple results shall be felt throughout borders. Sadly, Gomes believes there shall be no avoiding it: “A authorities that runs into funding difficulties, that can’t persuade buyers to fund its debt, that authorities goes to in all probability have to boost taxes. There’s no manner you may shield your self from that.

“Any exposure you have, whether it’s mortgages or loans, is really hard to avoid in any dimension. It’s bad across the board for the country but it’s hard to avoid exposure wherever you live in the world.”