A robust efficiency in monetary markets, notably an outsize achieve for the inventory market in 2021, helped entrench current developments of wealth inequality through the pandemic, new knowledge launched this week present.

In line with a report from the New York Federal Reserve Financial institution, the true internet value of white people outgrew that of Black and Hispanic people by 30 proportion factors and 9 proportion factors respectively, from the primary quarter of 2019 by means of the second quarter of 2023.

The interval featured a exceptional stage of presidency monetary help and, after the preliminary shock of the pandemic, a surprisingly sturdy job market. The unemployment price for Black Individuals specifically is now at 5.3%, close to a report low, in comparison with an general unemployment price of three.7%. Earnings for the everyday Black full-time employee are up 7.1% since earlier than the pandemic.

Closing the wealth hole is harder as a result of a considerably bigger variety of white households historically have cash in shares and mutual funds. A separate Fed survey exhibits that as of 2022, about 65.6% of white households had investments in shares, in contrast with 28.3% for Hispanic households and 39.2% for Black households.

“The study really shows the difference between making gains when it comes to income, and closing that gap, versus when it comes to wealth,” mentioned Janelle Jones, Vice President of Coverage and Advocacy on the Washington Heart for Equitable Development.

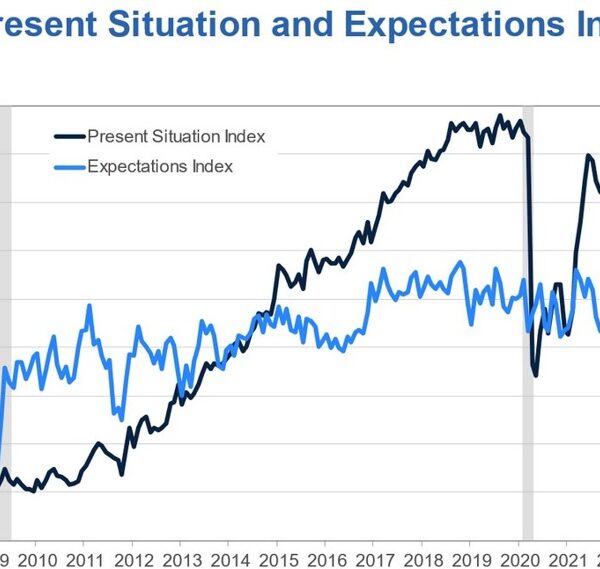

Whereas authorities help corresponding to elevated unemployment advantages and stimulus checks helped stave off a COVID-induced recession, monetary asset costs rose so considerably with the reopening of the financial system by means of 2021 that racial wealth disparities elevated. And whereas these market-linked belongings did fall in 2022 when the Federal Reserve quickly elevated rates of interest, “those declines did not fully offset the earlier rises,” based on the New York Fed.

“Much of the divergence in net worth by race and ethnicity since 2019 can be attributed to divergence in the real values of financial asset holdings,” wrote the report’s authors — together with the truth that Black households have extra wealth concentrated in pensions than in shares, mutual funds and exchange-traded funds, or ETFs.

Greater than 50% of Black monetary wealth is invested in pensions, the New York Fed discovered. Lower than 20% of Black wealth is saved in personal companies, company equities, and mutual funds. In distinction, lower than 30% of white monetary wealth is invested in pensions, with about 50% invested in companies, equities, and mutual funds.

“Black workers are still more likely to be unionized, which may play a part in the pension story,” mentioned Jones. “But how folks are exposed to the ability to invest in the stock market — whether or not it’s something they grow up doing — we know that’s different for white families than for people of color.” Black members of the family are much less more likely to get an inheritance, she mentioned.

Through the pandemic, the true worth of Black-held monetary belongings dropped in 2022 to under its 2019 stage and continued to say no steadily, whereas the true worth of Hispanic-held monetary belongings dipped under its 2019 stage in 2022 and stagnated. Neither group’s actual monetary belongings have recovered to their 2019 values.

Proudly owning a enterprise is one other element of economic wealth, and separate knowledge present Black-owned companies had a harder time through the pandemic.

Whereas lower than 10% of all U.S. enterprise homeowners are Black, Black-owned companies have been additionally extra concentrated in industries hardest hit when COVID first unfold, based on Financial Coverage Institute evaluation of presidency knowledge. In April of 2020, greater than 40% of Black enterprise homeowners reported they weren’t working, in contrast with solely 17% of white enterprise homeowners.

The industries with the most important complete job losses early within the pandemic have been additionally sectors the place extra Black-owned companies are concentrated — lodging, meals companies, retail, well being care, and social help. About 28% of Black-owned companies are present in these industries, in contrast with just below 20% of white-owned companies, based on the Bureau of Labor Statistics.

Nonetheless, Treasury Deputy Secretary Walley Adeyemo mentioned Wednesday that financial circumstances are bettering for Black households, citing rising employment and wages for Black Individuals since earlier than the pandemic, and a rise in Black enterprise possession and participation within the inventory market.

Adeyemo instructed that some “policy prescriptions” could be wanted to even out the distribution of economic wealth within the U.S.

“The gap between Black and white wealth in America is still too great,” he mentioned.

___

“The Associated Press receives support from Charles Schwab Foundation for educational and explanatory reporting to improve financial literacy. The independent foundation is separate from Charles Schwab and Co. Inc. The AP is solely responsible for its journalism.”