Drazen_/E+ via Getty Images

The heightened market volatility over the past several weeks, especially after interrupting months of calm, has returned the feeling of fear into many investors’ mindsets. And yet, it’s precisely when the market is jittery that some of the best long-term investments can be made, especially in out-of-the-limelight growth stocks.

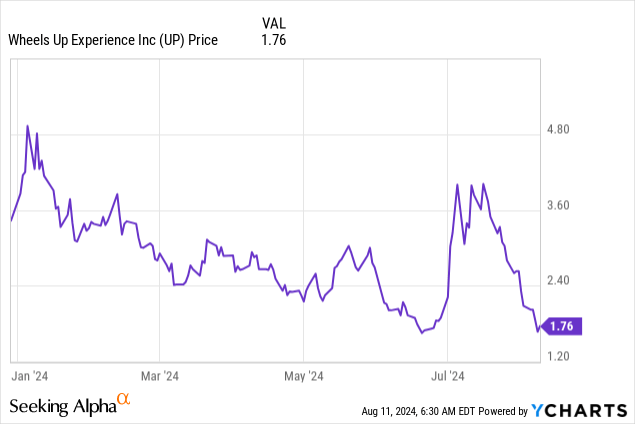

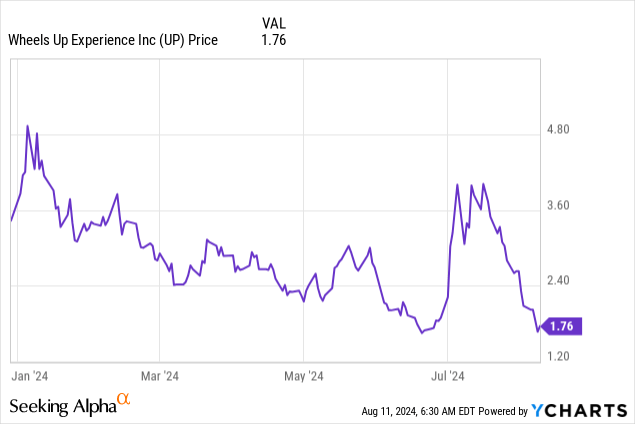

And while I wouldn’t recommend dedicating large chunks of your portfolio to risky plays, these market junctures are great for betting on a few high risk-high reward names, and Wheels Up Experience (NYSE:UP) fits this bill perfectly. The private aviation company has lost more than 50% of its value year to date, bringing its market cap to just over $1 billion: but in spite of undue pessimism, there are catalysts in place to guide this stock higher if it excites correctly.

Wheels Up is an incredibly interesting stock, if not solely for the fact that it offers a window into a rarefied service that is meant for the global 1%. But what Wheels Up has been doing more recently is to de-mystify its product offering and put it more into mainstream territory (though we should probably classify it as mainstream for the “aspirational” class), especially by more broadly advertising its membership programs and solidifying its partnership with Delta (DAL) (whose flight cancellation snares may tarnish the number-one U.S. airline for a while, but has little reputational ramifications for Wheels Up, in my view).

I last wrote a neutral opinion on Wheels Up in May. Since then, two major factors have occurred:

- The company has announced a new and more simple product proposition, including new interconnected benefits for Delta fliers

- It also published Q2 results in early August, showing acceleration in flight transaction value as well as improving profitability, proving progress against the company’s target to hit adjusted EBITDA breakeven by FY24

In light of this, I’m upgrading my rating on Wheels Up to a buy – especially after the company has given up all the gains it made in July after the first announcement of the expanded Delta partnership. I’ll underscore again that despite my bullish outlook on this stock, Wheels Up remains laden with operational and brand risks and that investors should treat this as a high risk-high reward position that shouldn’t be overly concentrated in their portfolios.

New go-to-market strategy and customer offers

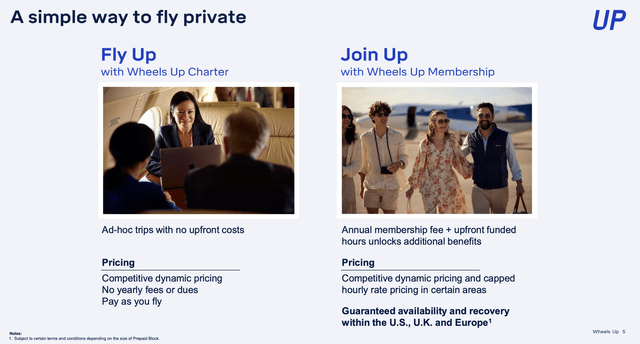

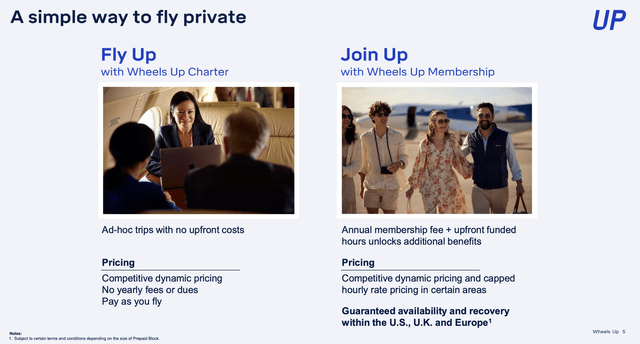

First things first: what Wheels Up has achieved so well over the past few months is to clean up its customer messaging to be clearer and easier to understand. The company offers potential fliers two different options: charter or membership. Charter is essentially a pay-as-you-go program, whereas memberships (starting at a cool $100,000 per year for individuals, and more for business memberships) offer guaranteed availability and price protection on certain routes.

Wheels Up charter vs. membership (Wheels Up Q2 shareholder deck)

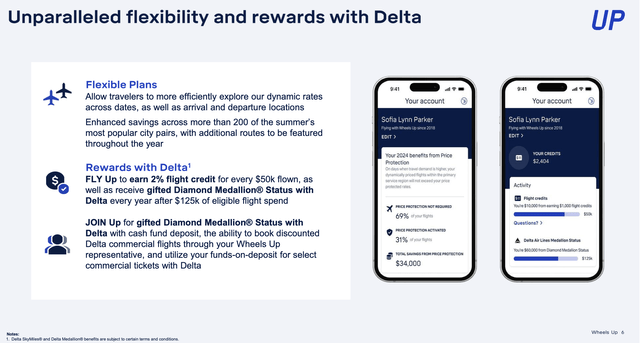

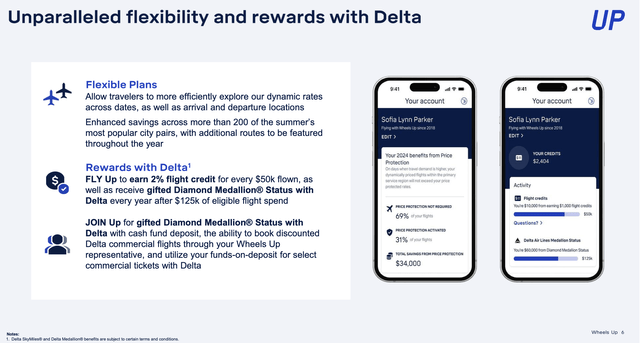

Another update: even the wealthy enjoy savings, and Wheels Up caters to a more price-conscious market by introducing price transparency when booking via its app or website. Customers can now toggle their search to “flexible dates” to be shown alternative flights or similar routes that can offer substantial savings versus their original routes.

Lastly, the company rolled out new premium perks alongside Delta, its strategic partner. Notably, the company is now essentially offering 2% cash back in the form of flight credits with every flight.

Wheels Up & Delta benefits (Wheels Up Q2 shareholder deck)

Additionally, fliers who spend more than $125k earn Delta’s highest and most coveted frequent flier status, Diamond. Diamond status comes with a bevy of perks, including 11 miles earned per dollar spent on flights (versus 7 for a Silver tier member), complimentary Clear Plus membership for airport security, top priority for upgrades and boarding, and an annual perk of choice where customers can select from rewards like $2,000 in Wheels Up flight credit, 6,000 Starbucks (SBUX) stars, American Express (AXP) statement credits or Delta flight vouchers.

These program updates just activated in mid-June, so we haven’t yet truly seen the benefit of this rollout on Wheels Up’s results. This will be a major test for the company going forward, especially as its membership base has been in decline: one of the core risks for this stock.

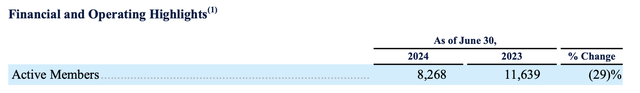

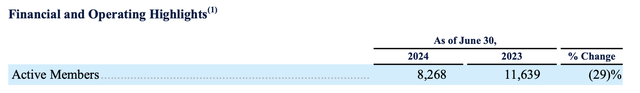

As of Q2, the company counted only 8,268 active members, down -29% y/y and a loss of ~1k members relative to Q1.

Wheels Up member count (Wheels Up Q2 shareholder deck)

Investors should look ahead to Q3 and beyond to see how these new perks, plus Wheels Up’s more aggressive corporate marketing plays that it already implemented earlier this year, impact membership counts.

Q2 highlights

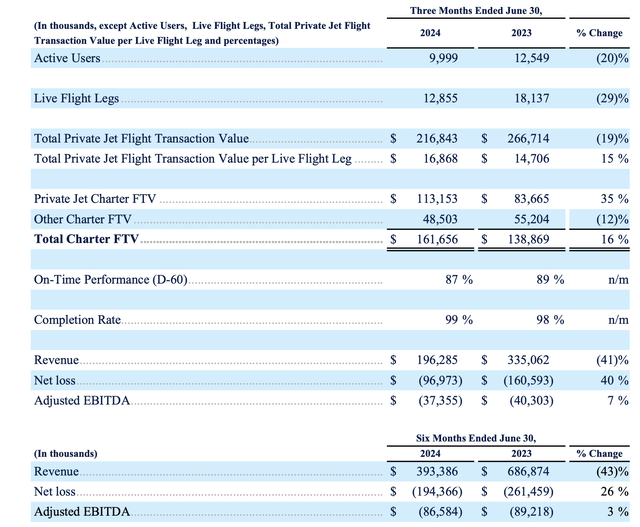

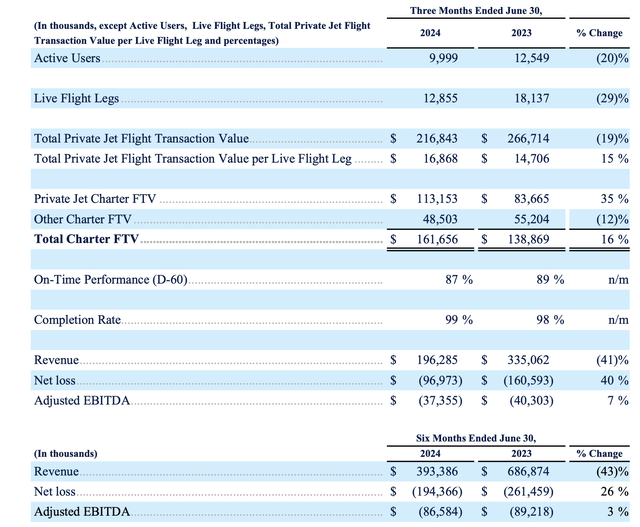

Now, we’ll say upfront that Wheels Up hasn’t yet delivered a silver arrow that allows us to claim the company has successfully executed a turnaround. That being said, the company’s latest results do show a number of metrics moving in the right direction.

Wheels Up Q2 highlights (Wheels Up Q2 shareholder deck)

As a reminder for investors who are newer to this stock: Wheels Up, in its far-ranging strategic overview, decided to divest its aircraft management business, while also cutting down its flight routes to focus on the most profitable segments.

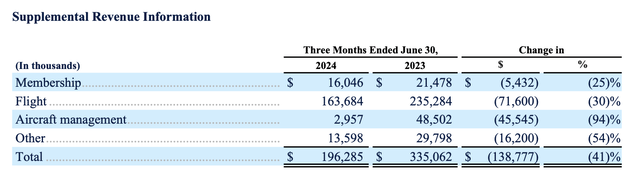

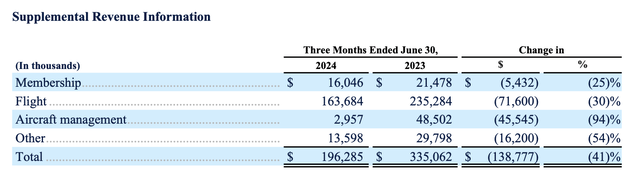

The exit of the aircraft management business is the primary driver, dragging total revenue down -41% y/y to $196.3 million, but this isn’t that meaningful of a metric. Instead, focus on flight revenue – down -30% y/y as a result of the company’s decision to slim down its route offerings, but sequentially this improved from a -35% decline in Q1.

Wheels Up revenue disaggregation (Wheels Up Q2 shareholder deck)

Furthermore, private jet flight transaction value (FTV) grew 35% y/y, accelerating over 33% y/ growth in Q1. Total FTV, meanwhile, grew 15% y/y and also 30% sequentially relative to Q1.

Management notes that, amid a burgeoning trend of lapsed members who are returning, the company is also seeing stronger corporate block sales. Per CEO George Mattson’s remarks on the Q2 earnings call:

We’ve seen strong commercial momentum among our members. Block sales for the quarter were up over 25% sequentially and over 50% over last year. We’re seeing members return to Wheels Up who had left over the last couple of years, and we are bringing on new corporate customers from our growing pipeline of prospects through our corporate sales initiative with Delta. We have also begun working with the Delta SkyMiles loyalty team to identify and engage with their high-net-worth individual customers who represent attractive private aviation prospects, who are either already flying private or could fly private, accessed through their deep existing relationship with Delta. We believe this represents a large and attractive growth opportunity we will jointly market to and target alongside our ongoing Delta corporate sales initiatives.”

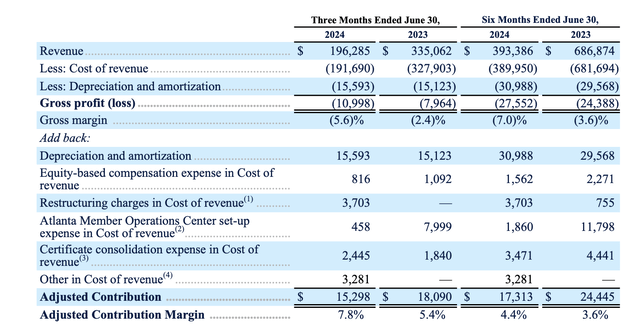

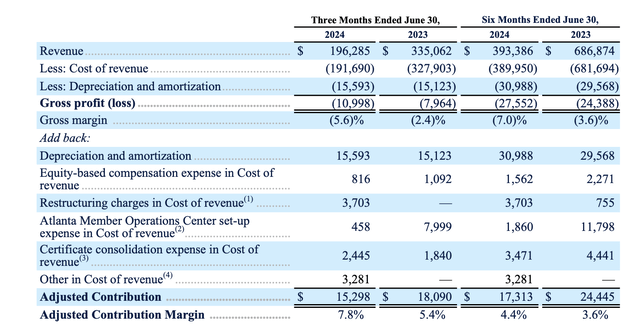

We should also applaud Wheels Up’s improvements in profitability. Adjusted contribution margin, which is a measure of flight revenue less flight cost, adjusted for non-cash expenses, expanded to 7.8%: 240bps better y/y.

Wheels Up contribution margins (Wheels Up Q2 shareholder deck)

The company notes that by concentrating its flight offerings within its preferred service areas, it has been able to more fully utilize maintenance and repair facilities, which has also improved aircraft availability. The company expects adjusted contribution margins to continue improving in the third quarter.

Meanwhile, we’re already seeing adjusted EBITDA losses improve 7% y/y to -$37.4 million. The company continues to believe it can hit adjusted EBITDA profitability at some point this year, which may provide a major catalyst for a stock rally. GAAP net losses also improved much more substantially, 40% better y/y at a -$97.0 million loss.

Risks and key takeaways

Needless to say, Wheels Up faces a bevy of operating risks as it seeks to turn around its business and hit profitability while resuscitating growth. It has to contend with declining membership, a tough macro climate in the U.S. which may push even higher-income private fliers to cut back on spending, and continued losses.

But at the same time, I now see a lot of positive seeds planted that can help boost the stock in the latter portion of this year. New growth initiatives and a more compelling membership proposition may help to re-spark membership growth. Dynamic and flexible pricing options may help to boost private charter demand, which is already growing. And continued route network optimization has the potential to continue pushing up margins and improving losses, with an eye toward becoming profitable in the back half of this year.

To me, I see a lot of reasons to place a bet on this stock while it’s on a dip.