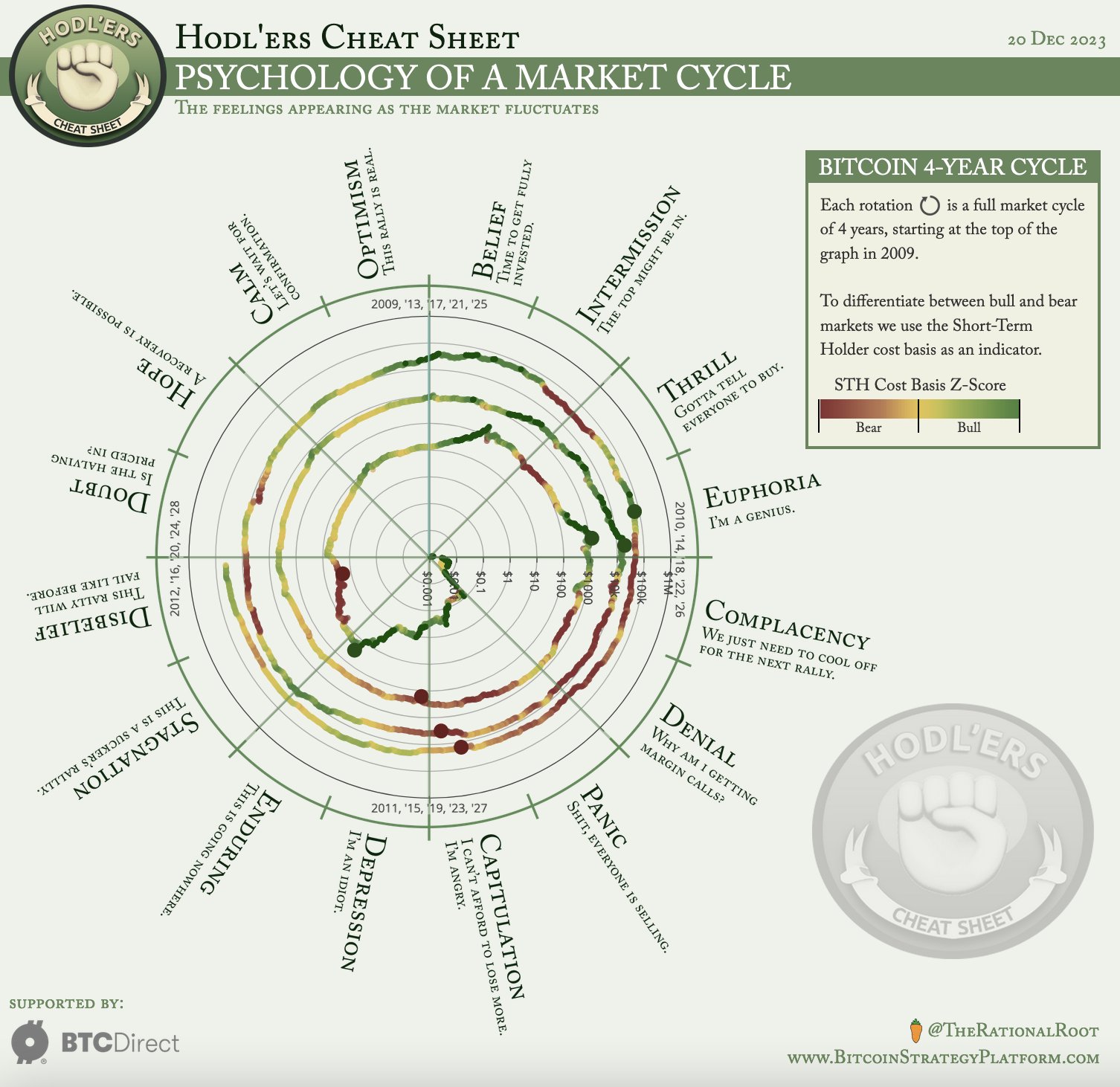

A Bitcoin cycle analyst has revealed a “cheat sheet” for the cryptocurrency’s worth based mostly on the info of an on-chain indicator.

Bitcoin 4-12 months Cycles Have Adopted An Attention-grabbing Sample

In a brand new post on X, cycle analyst Root has shared a Bitcoin chart that breaks down the phases that the cryptocurrency’s worth has gone by over the completely different 4-year cycles.

So as to separate between bullish and bearish intervals, the analyst has made use of an on-chain indicator known as the “short-term holder cost basis.” Now, what do these phrases imply?

First, the short-term holders (STHs) confer with the fickle-minded aspect of the BTC market who purchase and promote usually. Usually, the buyers who purchased inside the final six months are included on this cohort.

The price foundation (additionally known as the “realized price“), the opposite metric of curiosity right here, is the common worth at which your complete market or a specific section of it acquired their cash.

Which means if the spot worth of the asset dips beneath this worth, the common investor within the cohort might be imagined to have dipped into losses. Equally, a break above the fee foundation suggests the holders as a complete have simply returned right into a state of revenue.

Now, right here is the chart shared by Root that breaks down the “cheat sheet” for Bitcoin based mostly on the fee foundation of the STHs:

The development within the indicator over the completely different BTC cycles | Supply: @therationalroot on X

Observe that the Z-score of the STH price foundation is used right here, which is only a measurement of how far-off the indicator’s worth is from its imply. The “bull market” happens at inexperienced values of the metric, whereas “bear market” happens at pink values.

Curiously, it could seem that moreover the primary few years of the cryptocurrency’s existence, the peaks of the bull markets and the bottoms of the bear markets have occurred fairly shut to one another.

The tops, represented by the inexperienced dots, have occurred throughout “euphoria,” the section of the market the place the STH price foundation rises considerably above the imply. Such a rise within the metric means that these buyers have been taking part in a considerable amount of shopping for on the excessive bull run worth ranges.

Equally, bottoms (the pink dots) have taken place throughout the capitulation section, the place the STHs promote their cash at excessive losses, that are promptly picked up by extra resolute fingers on the low bear market costs, thus pushing the fee foundation significantly beneath the imply.

From the chart, it’s seen that at current, Bitcoin is at present contained in the “disbelief” section, the place the buyers aren’t fairly but able to consider the present rally has hopes of continuous for lengthy.

If the sample adopted within the earlier cycles is something to go by, there’s nonetheless some time earlier than the BTC bull run kicks off correctly for the present cycle, the highest of which could kind someday in 2025.

BTC Worth

Bitcoin has now recovered again above the $44,000 mark after going by an uplift of just about 3% within the final 24 hours.

BTC seems to have loved an uptrend over the last couple of days | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, BitcoinStrategyPlatform.com