Welcome to TechCrunch Fintech (previously The Interchange)! Apologies for being out final week — a chilly bought the perfect of me, however I’m again and right here to speak about the truth that shutting down startups is huge enterprise, Stripe’s new valuation, Klarna’s newest AI replace and extra.

To get a roundup of TechCrunch’s greatest and most necessary fintech tales delivered to your inbox each Sunday at 7:30 a.m. PT, subscribe here.

The massive story

Final week, I wrote about two startups — Sundown and SimpleClosure — that assist different startups shut down, elevating capital. Past the raises, the article was a deep dive into how and why this enterprise has turn into one that’s so wanted by buyers. I additionally lined Stripe’s tender offer that resulted in a 30% greater bump in valuation — to $65 billion — for the funds big. Because of this the corporate possible received’t go public this yr in any case. You may hear Alex Wilhelm and I talk about each matters on Friday’s Equity Podcast episode. You too can hear me discuss to Nubank CEO David Vélez about a wide range of fascinating matters under.

Evaluation of the week

Klarna has been within the information loads recently. Final week, a failed coup on the a part of one investor, Sequoia Capital’s Matthew Miller, made headlines and resulted in his ousting. This week, the Swedish BNPL big posted a narrower year loss forward of its potential IPO. Then the corporate stirred up a little bit of controversy when it mentioned its new AI assistant is doing “the equivalent work of 700 full-time agents.” A spokesperson for the corporate informed me by way of electronic mail that since launching globally only a month in the past, the AI assistant had 2.3 million conversations, managing two-thirds of Klarna’s customer support chats. She emphasised, although, that the corporate had not made any cuts as a consequence of launching this AI assistant. She added: “Klarna’s customer service is supported by 4-5 large global partners who collectively have over 650,000 employees and work with thousands of different companies around the world. When one of the companies, like Klarna, requires less support, these agents are assigned to new tasks at another company … With the AI assistant, our customer service can operate with fewer people and require significantly less resources. However, there still is a need for more experienced and senior staff, for example, with specialized training in complex or sensitive cases.”

{Dollars} and cents

Almost two years after securing $20 million in Sequence A capital, Colombian B2B monetary options startup Simetrik is again with further funding to the tune of $55 million in a Goldman Sachs-led Series B funding.

Embat, a Spanish fintech which does what they name “real-time treasury management,” closed a financing spherical of $16 million Series A led by Creandum.

Deel — the $12 billion HR business — mentioned it’s scooping up Zavvy, a Munich-based AI-based “people development” startup constructing instruments for personalised profession development, coaching, and efficiency administration.

FairMoney, a digital financial institution primarily based in Lagos and headquartered in Paris, is in discussions to acquire Umba, a credit-led digital financial institution offering payroll and monetary companies to prospects in Nigeria and Kenya, in a $20 million all-stock deal, sources inform TechCrunch.

What else we’re writing

Google is sunsetting the Google Pay app in the US later this year

Paytm wallet and FASTag products will cease to exist, Bernstein says

Grifin’s new model can automatically invest your money as you shop

Cash App takes on Apple with a 4.5% APY for savings accounts (with direct deposit)

Excessive-interest headlines

Finix launches integrated payments offering in Canada

Robinhood launches a retirement plan for gig workers

Flourish Ventures promotes Narváez and Gupta to Principal

Embedded payments fintech Monite just raised $6M in a round co-led by Peter Thiel’s Valar Ventures

Marqeta ‘still on track’ despite post-earnings stock dip: CEO

Cheese, a neobank for Asian-Americans that pivoted to credit-building, calls it quits (TC first reported on Cheese here)

Morgan Stanley-backed TomoCredit isn’t paying its bills, faces mounting legal challenges

Knock opens funding to individuals through Wefunder

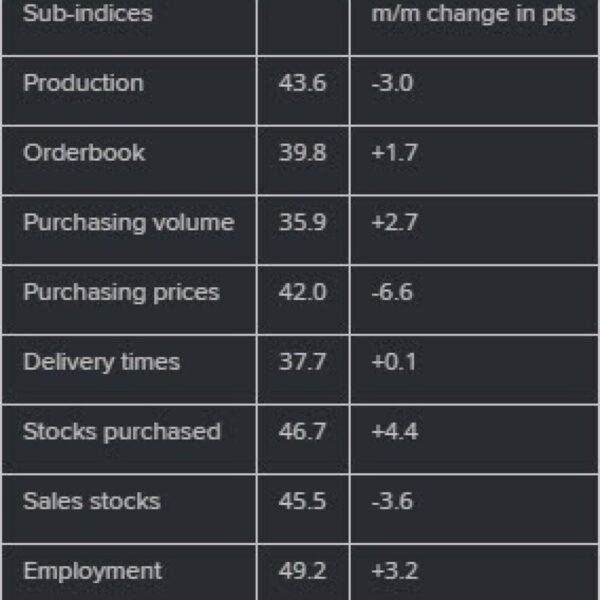

KPMG’s Pulse of Fintech H2’23

CB Insights’ State of Fintech 2023 Recap & Emerging Trends in 2024

PitchBook’s Fintech’s M&A landscape unveiled

Comply with me on X @bayareawriter for breaking fintech information, posts about espresso and extra.