On-chain knowledge reveals the Bitcoin HODLers are taking part in main promoting. Right here’s what number of months the previous two bull runs took to prime after this.

Bitcoin Lengthy-Time period Holders Now Promoting 500,000 BTC Per Month

As defined in a post on X by CryptoVizArt, a senior researcher on the on-chain analytics agency Glassnode, the BTC long-term holders have been promoting lately, no matter how bullish the temper across the market has been.

The “long-term holders” (LTHs) right here seek advice from the Bitcoin buyers who’ve been holding onto their cash since greater than 155 days in the past. These holders are recognized to show a powerful resolve, as they don’t promote that always, regardless of no matter could also be happening within the wider market.

Due to this power, they’re popularly often known as the “diamond hands” of the sector. Because it’s unusual to see the LTHs promoting, the occasions that they do take part in distribution could be price being attentive to, particularly if the selloff is of any important diploma.

One technique to observe the habits of those HODLers is thru the “net position change” metric, which retains observe of the web quantity of BTC that entered into or exited out of the wallets of those buyers over the previous 30 days.

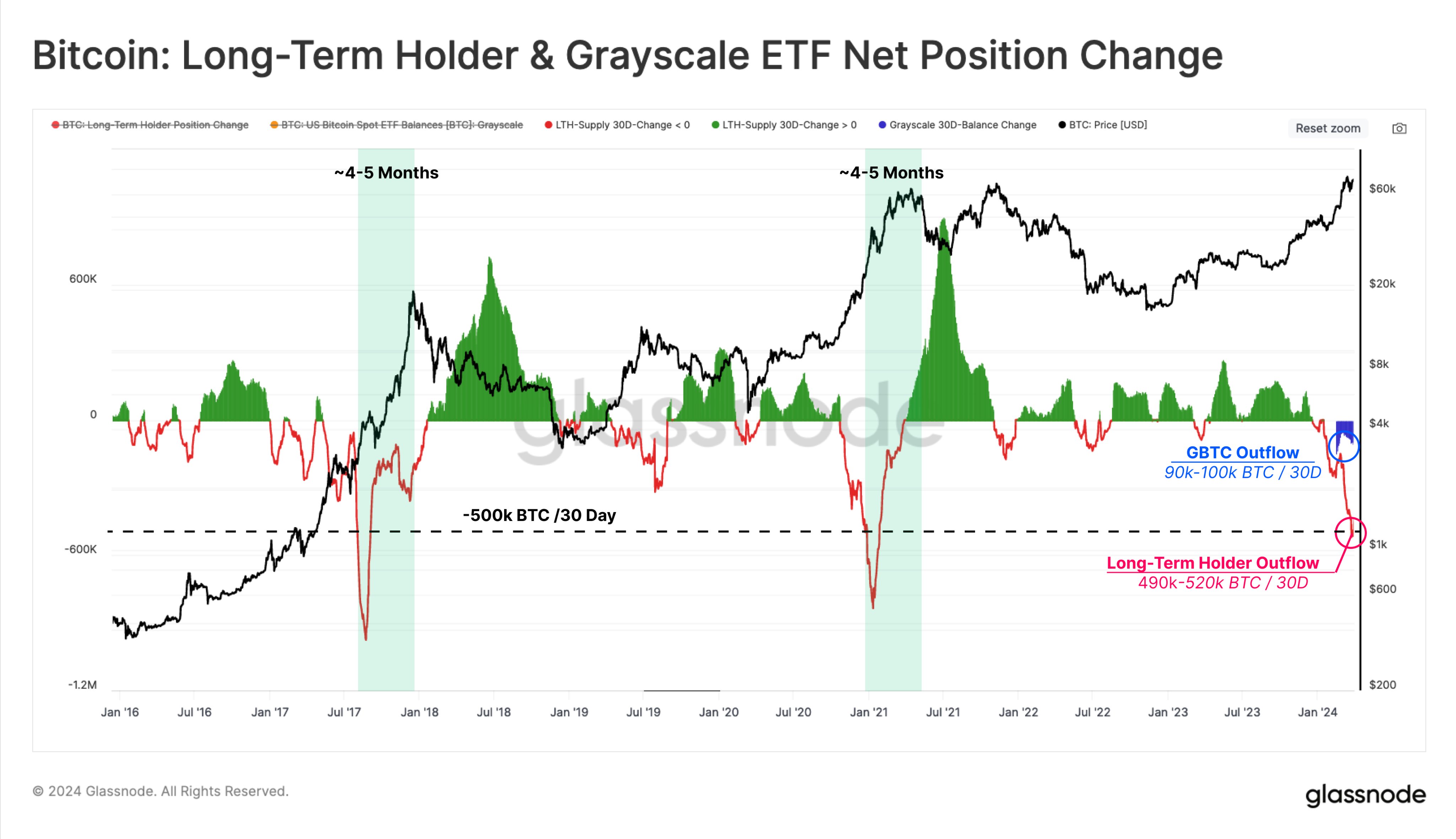

Under is a chart shared by the analyst that shows the pattern on this indicator for the LTHs over the previous few years:

The worth of the metric seems to have been deep pink in latest days | Supply: @CryptoVizArt on X

As is seen within the above graph, the Bitcoin LTH web place change has been detrimental lately. This could suggest that cash have been leaving the addresses of those HODLers.

This promoting from the cohort has come because the cryptocurrency’s value has gone by means of a pointy rally and has achieved contemporary all-time highs (ATHs). From the chart, it’s seen {that a} pattern like this additionally performed out over the past two main bull runs.

Within the latest distribution, the LTHs have been making web outflows on the fee of 490,000 to 520,000 BTC per thirty days. Because the Glassnode researcher has highlighted within the chart, the earlier bull runs took round 4 to five months to prime out after the LTH web place change hit such pink ranges.

It’s potential that if an identical sample follows within the present bull run as effectively, a peak could also be encountered within the subsequent 4-5 months. One thing that’s completely different this time round, although, is the presence of the Bitcoin spot exchange-traded funds (ETFs).

The Grayscale Bitcoin Belief (GBTC) was an ETF with the US SEC approval in January and since then, the fund has been observing main outflows. The cash held by GBTC fall contained in the LTH vary, so promoting of them is of course being counted beneath the LTH web place change.

Because the analyst has famous, GBTC month-to-month outflows have ranged from round 90,000 to 100,000 BTC, which signifies that they’ve made up for about 20% of the latest LTH distribution.

BTC Value

Bitcoin had surged past the $71,000 degree earlier, however the unique digital asset has seen a plunge over the previous day that has now taken it to $69,700.

Appears like the value of the asset has plummeted over the past 24 hours | Supply: BTCUSD on TradingView

Featured picture from Bastian Riccardi on Unsplash.com, Glassnode.com, chart from TradingView.com