A crypto analyst has revealed a timeline for BlackRock, an American multinational funding firm, to probably announce its launch of an XRP Exchange Traded Fund (ETF). The analyst has highlighted key elements that would contribute to the approval of an XRP ETF, together with the official decision of Ripple’s ongoing battle with america Securities and Alternate Fee (SEC).

BlackRock XRP ETF Anticipated Weeks After SEC Battle

In an X (previously Twitter) submit, crypto analyst Ashley Prosper posed a sequence of compelling questions on BlackRock’s timing for probably launching an XRP ETF. Delving into the hypothesis of whether or not the monetary funding firm would launch an ETF earlier than or after the conclusion of the SEC and Ripple court case, Ashley shared his anticipation, predicting that “the announcement would come within weeks of the court case ending.”

The analyst’s prediction provides an additional layer of anticipation within the already carefully watched authorized battle between Ripple and the SEC. Earlier in 2020, the US SEC filed a lawsuit towards Riople, accusing the crypto funds firm of allegedly violating securities legal guidelines by promoting XRP in an unregistered safety providing.

Regardless of the backlash and developmental setbacks Ripple skilled because of the lawsuit, the corporate has been actively defending its place towards the SEC’s claims. Notably, Ripple gained a partial victory in July 2023 when Decide Analisa Torres dominated that programmatic gross sales of XRP weren’t thought of securities.

This decisive ruling has led varied XRP supporters to imagine {that a} potential XRP ETF could be launched following the resolution of the legal battle. BlackRock at present stands as one of many key contenders speculated to launch an XRP ETF, contemplating the truth that the funding firm had been a number one participant within the earlier Spot Bitcoin ETF approval race.

XRP ETF Projected To Rival BlackRock’s Bitcoin ETF Inflows

Whereas BlackRock has not made any official statements confirming or dismissing the chances of introducing an XRP ETF, a distinguished XRP supporter has projected that an XRP ETF might probably generate extra funds for BlackRock than its Spot Bitcoin ETF.

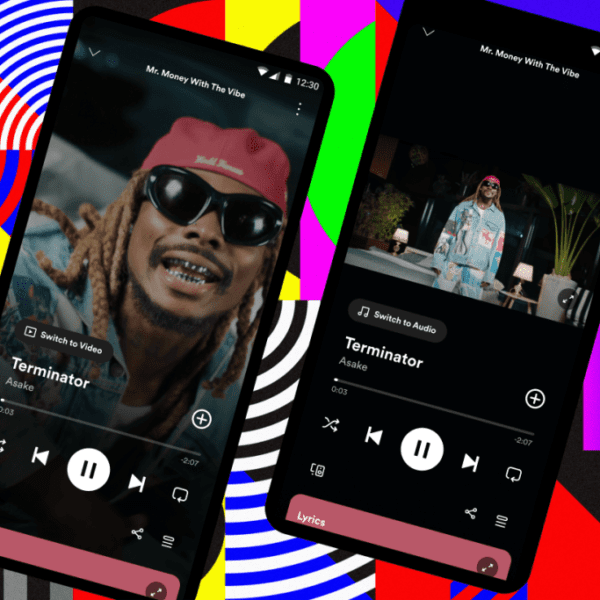

In a latest X submit, XRPcryptowolf expressed sturdy confidence that if BlackRock were to launch an XRP ETF, it might outperform its Spot Bitcoin ETF. As of final week, Spot Bitcoin ETFs noticed a document weekly inflows of $2.45 billion, with BlackRock’s iShares Bitcoin ETF (IBIT) main the cost with about $1.6 billion, based on Coinshares data.

This resounding success in BlackRock’s Bitcoin ETF performance underscores the rising demand for the funding firm’s ETF by institutional buyers. Given BlackRock’s distinguished place within the Spot Bitcoin ETF market, a possible launch of an XRP ETF might appeal to substantial inflows, drawing the eye of buyers and merchants from totally different areas across the globe.

Bulls start to indicate power | Supply: XRPUSD on Tradingview.com

Featured picture from Inside Bitcoins, chart from Tradingview.com