Danish startup Whistleblower Software is rebranding as Formalize because it expands into the broader compliance software program sphere — and it has raised a recent €15 million ($16 million) to fund the enlargement.

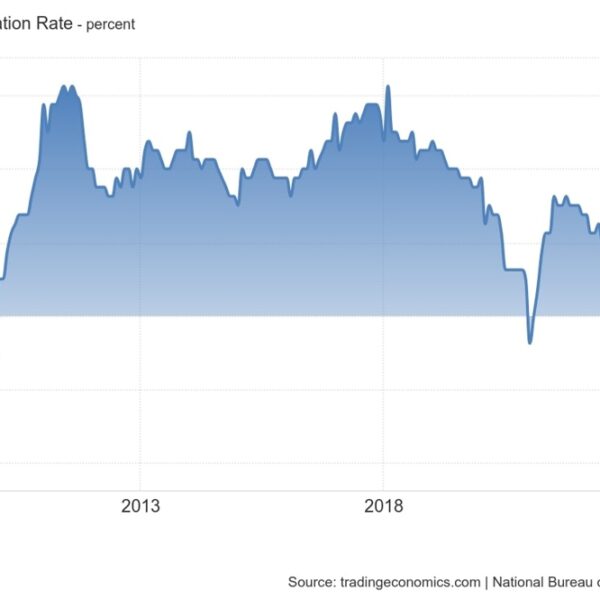

The announcement comes because the compliance software program market has exploded, due largely to rising regulatory stress — and traders have taken notice. Personal fairness big Thoma Bravo took German compliance and investor relations software program firm EQS Group personal in a $435 million deal last month, whereas startups Cypago, Hyperproof, Certa, and Anecdotes have all raised sizeable enterprise rounds for numerous flavors of compliance software program these previous few months.

And now Formalize needs a bigger piece of the $54 billion GRC (governance, threat, and compliance) pie too.

“The compliance software market is booming, driven by the EU’s robust regulatory agenda,” Formalize co-founder and CEO Jakob Lilholm informed TechCrunch over electronic mail. “While compliance is beneficial for society, it can burden companies without efficient management tools.”

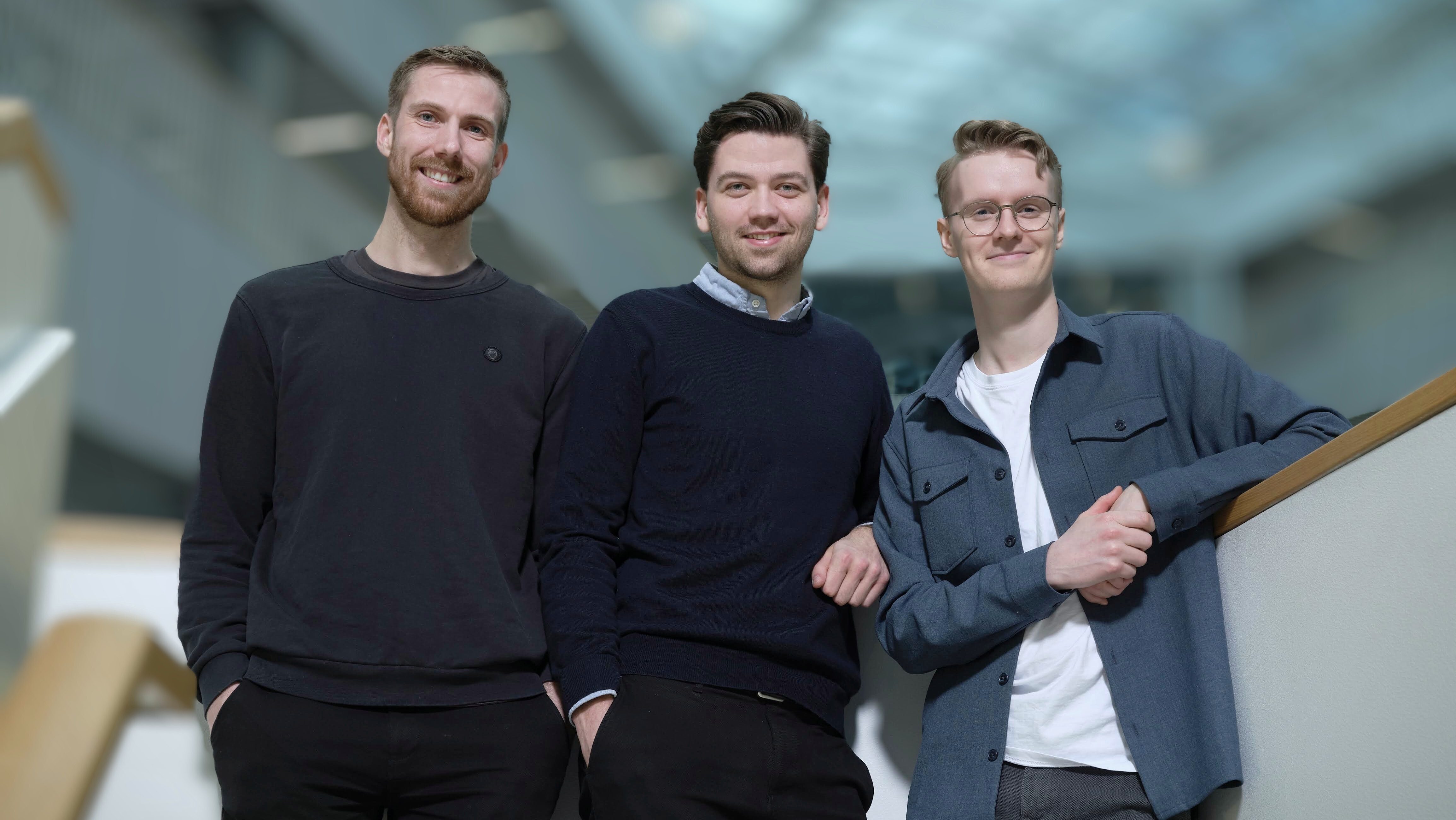

Formalize founders Kristofer Abell (CTO), Jakob Lilholm (CEO), and Magnus Boye (lead developer) Picture Credit: Formalize

Whistleblow when you work

From the Facebook and Cambridge Analytica data harvesting scandal via Tesla’s accident report revelations final yr, whistleblowing has performed a serious contributing half to among the greatest information tales in latest instances — however conscientious employees are sometimes deterred from reporting inside misdeeds on account of fears of retaliation.

Formalize emerged in 2021 after Europe’s new whistleblowing directive got here into power, requiring most bigger firms to introduce inside reporting methods for whistleblowers to soundly report company wrongdoings in confidence. Companies with greater than 250 staff needed to implement their methods by the tip of 2021, and people with between 50 and 249 staff got till December, 2023 — two months in the past.

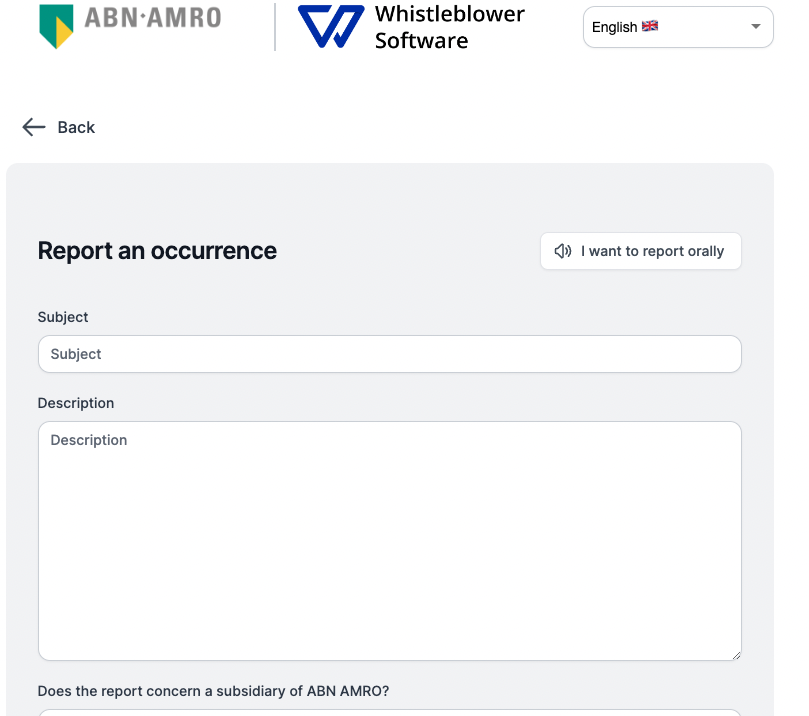

And this, basically, is what Formalize helps firms obtain. Its prospects combine the whistleblowing software program to supply staff a strategy to file a report anonymously in writing, whereas people who wish to report orally can achieve this secure within the information that the software program distorts the caller’s voice.

Formalize claims a slew of big-name prospects already, together with McDonald’s, Hole, and Dutch banking big ABN-AMRO.

Whistleblower Software program Picture Credit: Formalize

Compliant

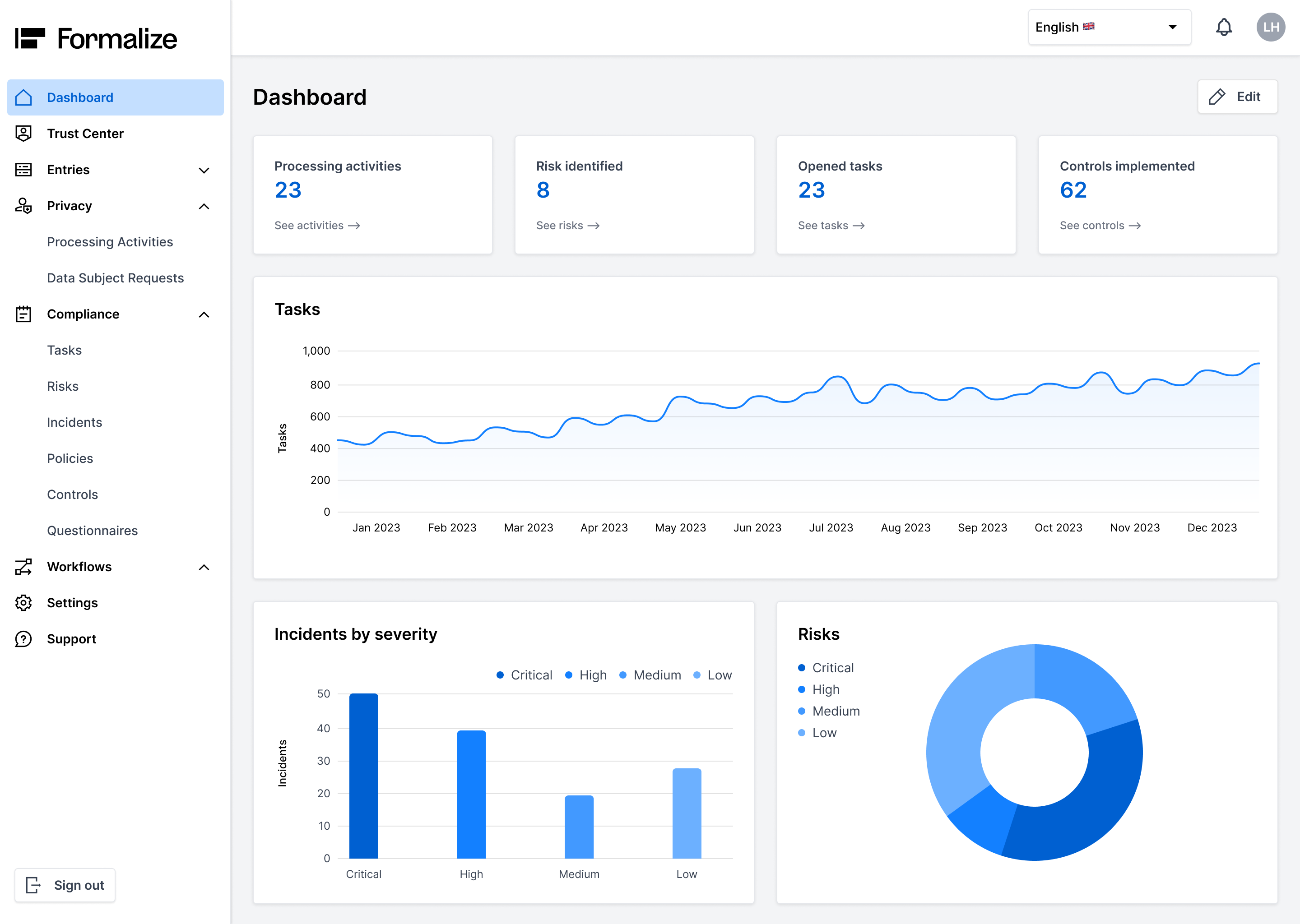

Formalize raised a small $3 million seed round of funding 16 months in the past. And with one other €15 million within the financial institution, the corporate is now gearing as much as develop past whistleblowing software program with the launch of a brand new compliance platform designed to “gather, structure, and automate” all of the compliance work that firms are more and more anticipated to have interaction in as a part of GDPR information safety legal guidelines in Europe. It’s additionally value noting the NIS2 cybersecurity rules which has provisions for information safety, entering into force last January with European member states given till October this yr to transpose it into nationwide regulation.

“Each new law, like GDPR or the upcoming NIS2, requires time to implement and operate — effectively managing regulations is a business advantage in an evolving landscape of new legislation,” Lilholm stated.

The brand new compliance system might be built-in with different methods equivalent to CRMs or provider databases — this allows firms to conduct all their threat assessments and incident studies from a single interface, and map information processing actions, insurance policies, and tangential GDPR procedures.

Formalize dashboard Picture Credit: Formalize

That is additionally why the corporate is altering its overarching firm identify from Whistleblower Software program, because it diverges from its preliminary focus into a much more in depth (and profitable) market.

“They [data compliance and whistleblowing] are primarily connected by the intention of the [GDPR] regulation,” Formalize co-founder and CTO Kristoffer Abell informed TechCrunch. “Where whistleblowing is enforced to help companies detect non-compliance across a wide range of areas of ethics and compliance, most other compliance areas are there to define a new standard for organizational responsibility that aligns better with the public interests.”

For its €15m Collection A spherical, Formalize has ushered in France’s BlackFin Capital Partners as lead investor, with participation from the startup’s seed spherical lead investor, London-based West Hill Capital.