With the

US presidential election drawing nearer, the query of which final result can be

higher for the worldwide economic system is gaining urgency. Either side have their sound

methods, however let’s deal with the affect on the greenback by taking a

closer look at the dollar index chart.

Analysts

recommend {that a} Trump victory can be a extra bullish state of affairs for the greenback,

whereas a Biden re-election is seen as extra impartial. Total, the greenback is

anticipated to proceed strengthening towards main currencies forward of the US

presidential election and depreciate afterward.

Why is

the previous president helpful to the greenback?

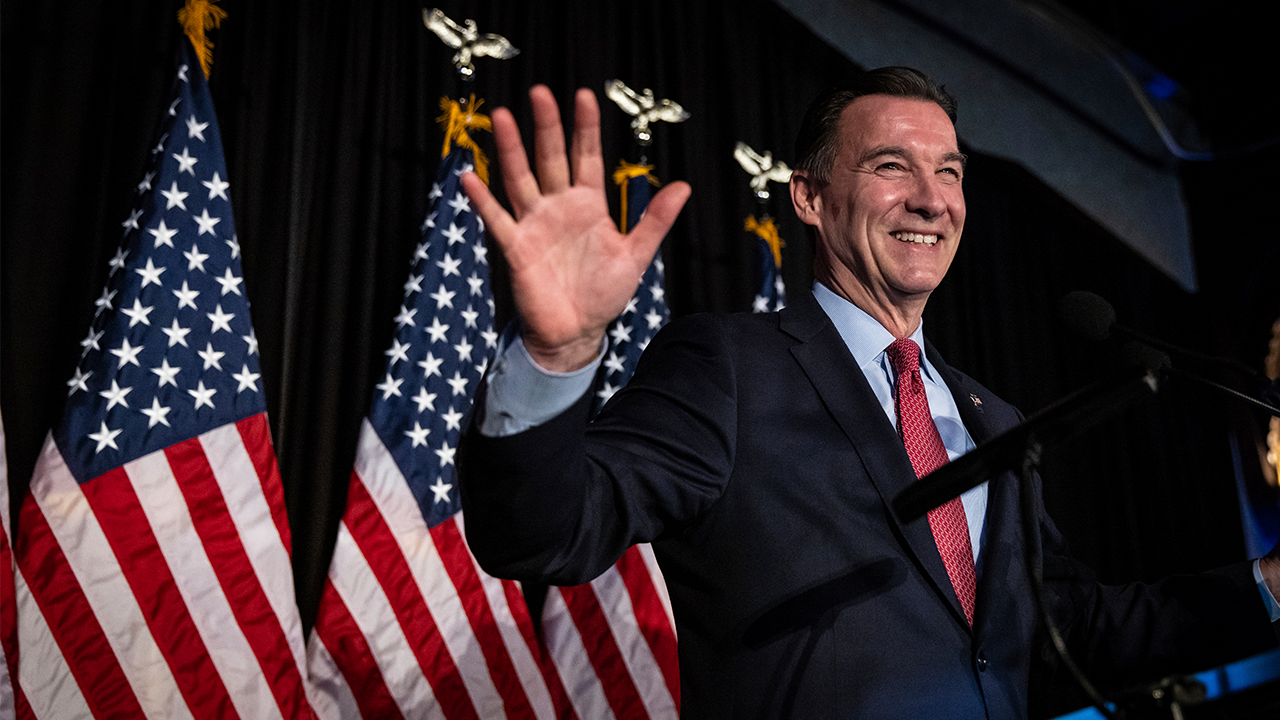

Donald

Trump reportedly considers imposing new commerce restrictions with the EU if he

returns to the White Home, primarily reigniting the commerce wars.

This

consists of the introduction of a minimal 10% tariff and countermeasures towards

European taxes on digital companies. As well as, he guarantees substantial

tariffs that might considerably affect trade with China.

Biden,

for his half, has already ready new restrictions towards China, which the

administration is able to implement earlier than the elections. Total, the development

in the direction of protectionism has solely simply begun.

However what

in regards to the Federal Reserve’s doable rate of interest minimize?

Amid continuing tensions in the Middle East and the

reluctance of the events to agree on a peace plan, companies face rising

logistics prices.

This

improve in transport prices is more likely to be mirrored within the costs of client

items sooner or later. On this context, the regulator appears hesitant to handle

the difficulty with an early charge minimize.

For

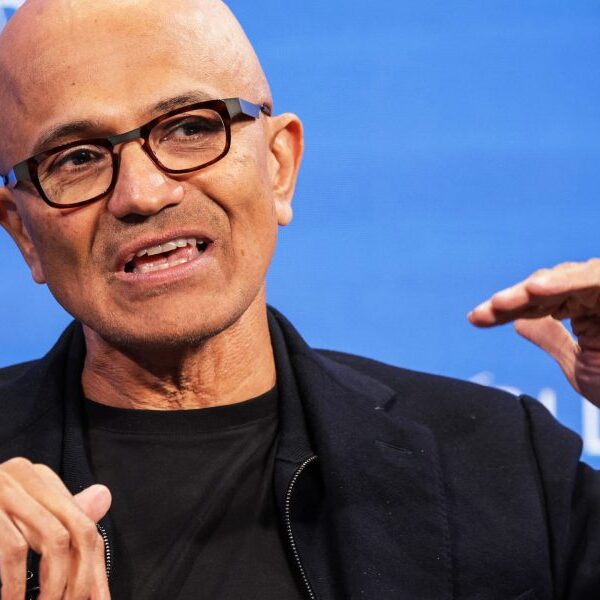

occasion, Atlanta Fed President Raphael Bostic, who’s voting on the Federal

Open Market Committee’s coverage choices this yr, means that the primary

transfer may come someday within the summertime.

Nonetheless,

two components may drive the regulator to rethink its stance. First, as has

been repeatedly identified, preserving charges at a excessive stage impacts not solely the

inhabitants but in addition the industrial actual property market and regional banks.

As a

end result, the latter’s paper losses have soared once more to report ranges. If

buyers begin withdrawing cash, as they did final yr, a banking disaster

may resume.

To keep away from

this state of affairs, the regulator is more likely to initially resort to printing extra

cash and will have to think about a sudden charge minimize if that’s not sufficient.

The

second potential stress issue is the labor market. Formally, January’s

month-to-month employment report shocked economists with creating 353,000 new jobs, well above expectations.

Nonetheless,

each month, there are studies of huge layoffs in varied corporations. Maybe

a number of the newly unemployed will not be being thought-about, and never every thing is as

rosy because it appears.

What

ought to merchants do?

Frankly

talking, it’s inconceivable to be prepared for each state of affairs, so it’s extra

affordable to behave relying on the developments, keeping track of

macroeconomic indicators and pre-election polls.