J. Michael Jones/iStock Editorial through Getty Photos

Introduction

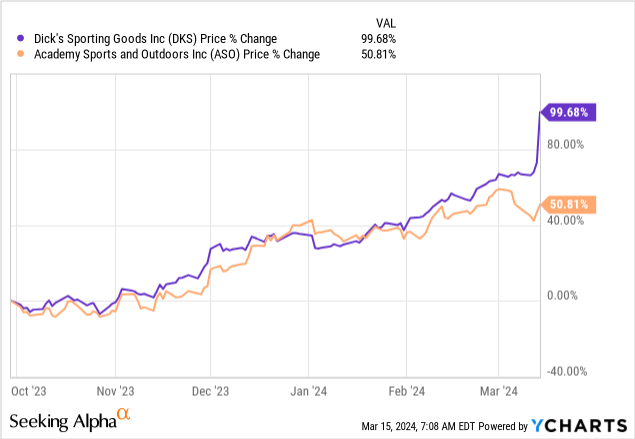

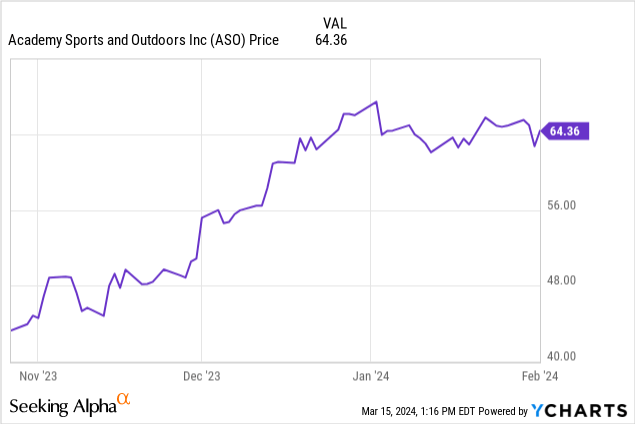

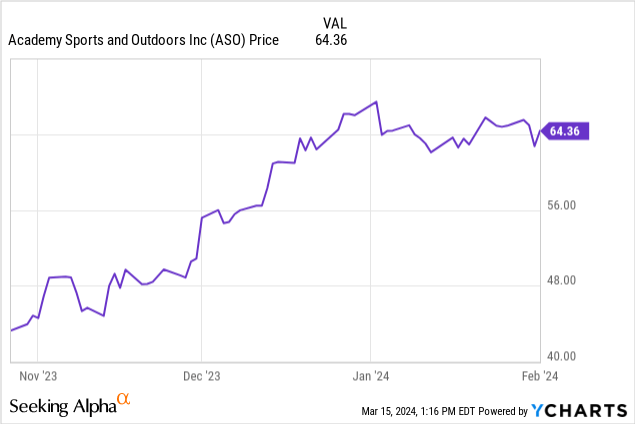

Academy Sports activities and Outside’ (NASDAQ:ASO) This autumn and FY2023 earnings are coming and there are causes to imagine the retailer will beat estimates. With a lot speak about inflation and excessive rates of interest, everybody was anticipating prolonged shopper spending weak point. Moreover, increasing shrink appeared to verify an general misery in lots of areas throughout the nation. Because of this, retailers noticed some downward stress, with DICK’S Sporting Items (DKS) dropping 25% of its market cap in in the future, bottoming at a share value simply above $100. Since then, DICK’S inventory has doubled. However up till the start of February, DICK’S was buying and selling at par with Academy. It was primarily after its current earnings report that the inventory soared, resulting in an enormous leap in good points.

I truly anticipate Academy to indicate related habits, and on this article, I’ll clarify why I feel so.

Abstract of earlier protection

Amongst the main reasons I am lengthy Academy, there are two I highlighted in my previous article, which I now wish to recall:

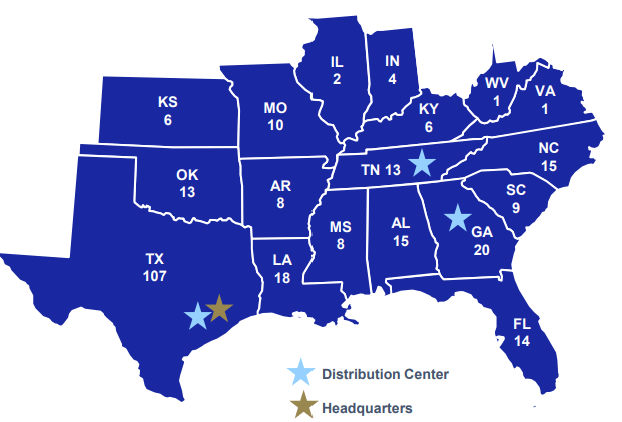

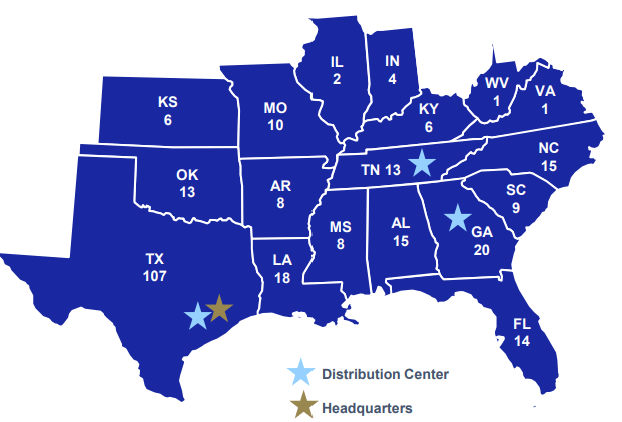

- In opposition to its rivals, Academy has extra geographical room to develop within the U.S. as a result of its footprint covers primarily these states within the South and the East of the nation.

- The pandemic created a brand new tailwind for its gross sales, however Academy has proven it has been capable of rebase its enterprise metrics (high and backside line) and consolidate the enterprise into renewed and enhanced profitability.

ASO 2023 Investor Presentation

Its retailer growth plan is convincing, and I am anticipating it’s going to drive gross sales as much as nearly $10 billion by 2027, with a minimum of a 16% EBITDA margin. This gave the outcome the company was trading round a fwd 2027 EV/EBITDA a number of of three.5 whereas the inventory value of $47. Thus, my truthful worth got here in round $65. However recent favorable developments for retailers pushed by stronger-than-expected shopper spending, leads me now to revise upwards my estimate.

Constructive Information From DICK’S

Academy often experiences earnings after its important competitor DICK’S. Due to this fact, although the latter has a distinct measurement and footprint from Academy, as we are able to see from the map under, we are able to nonetheless really feel the heart beat of the business and modify our expectations for Academy accordingly.

Dick’s This autumn Earnings Presentation

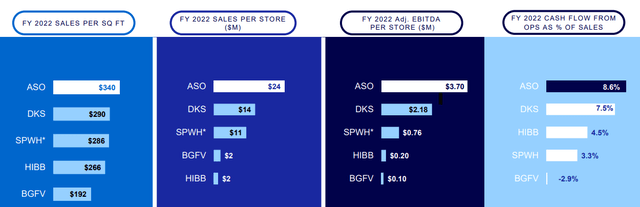

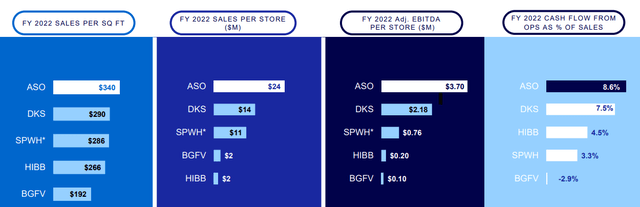

Nonetheless, this isn’t a easy linear equation to be solved. The truth is, given Academy’s footprint, we all know the corporate operates in a number of the wealthiest states within the nation and thus has clients from households whose earnings is between $30k and $140k. Furthermore, Academy’s profitability metrics at present lead the business, with the very best gross sales per sq. foot outcome, the very best gross sales per retailer and EBITDA per retailer, and one of the best working money movement as a share of gross sales.

ASO 2023 Investor Presentation

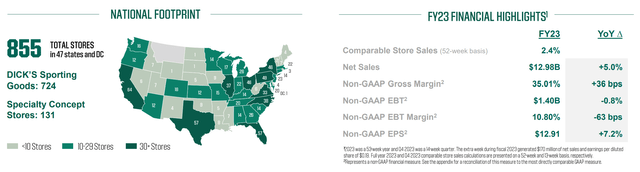

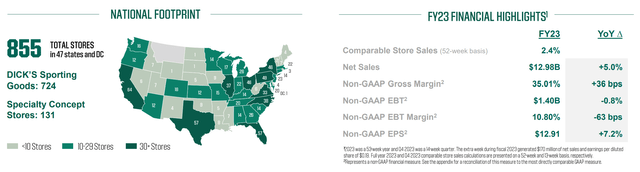

DICK’S shares rallied after Q4 earnings because, in its press release, it reported quarterly comparable gross sales progress of two.8% (2.4% for the total 12 months). However, much more importantly, DICK’S reported EPS progress above 14%, confirming its gross margin has re-baselined effectively above 2019 ranges. In line with the 2024 guidance, DICK’S expects comparable gross sales progress of 1%-2%.

DICK’S administration, nevertheless, reported the problem of shrink (i.e. theft) to be nonetheless ongoing and hitting merchandise margin. Alternatively, we have seen Academy a bit more insulated from this issue, because of its totally different demographics.

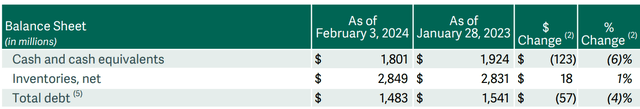

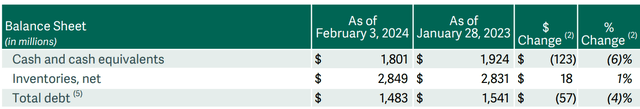

A optimistic information from DICK’S was that its stock stage elevated only one%, which means the corporate is definitely managing its shares effectively and it may promote its merchandise at an honest tempo.

DKS This autumn Earnings Report

Because of this, traders confirmed their renewed enthusiasm for the inventory, pushing it at its all-time highs, effectively above $200 a share.

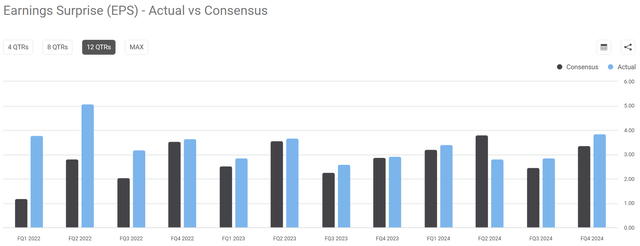

Now, earlier than we transfer on, let’s take a look at DICK’S earnings shock observe file. Prior to now 12 quarters, it at all times beat consensus, other than Q2 2023.

In search of Alpha

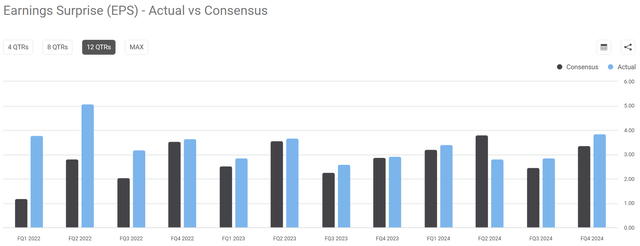

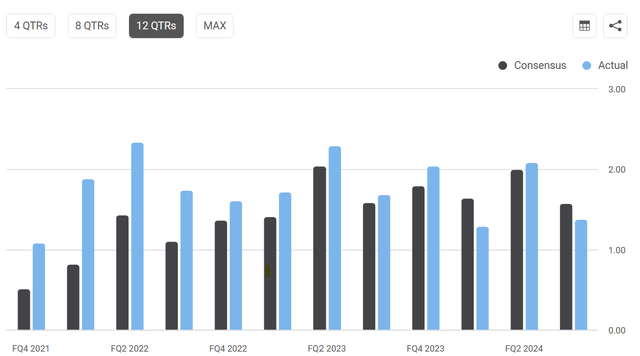

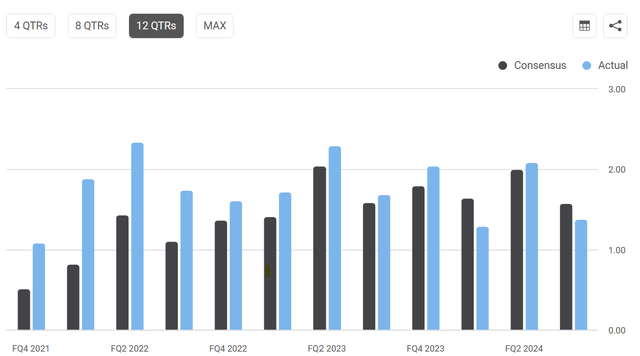

Let’s examine this with Academy’s observe file:

In search of Alpha

Academy missed estimates twice prior to now three quarters. Alternatively, when it beats estimates, it often does so by a better margin than DICK’S.

Since This autumn shopper spending has been robust and since DICK’S reported an enormous and surprising beat, issues are poised for Academy to over-deliver.

Academy This autumn Earnings Preview

So, let’s take a look at a number of numbers and make an informed guess in regards to the earnings Academy is about to report.

ASO is predicted to publish This autumn EPS of $2.29, which might equal to a year-over-year progress of 12.4%. DICK’S, however, was already anticipated to report a 14% progress YoY. Nicely, as we mentioned, its outcomes got here one other 14% above this forecast. We’ve a large fork between what the market expects from Academy and what DICK’S delivered. I am inclined to assume this hole between the 2 outcomes will slender, since no specific indicators are displaying that DICK’S execution is crushing Academy’s to the extent it may ship such surprising outcomes.

Income estimates see Academy report a 2.55% progress to $1.8 billion.

I feel analysts are being too conservative, and I anticipate Academy to report its highest This autumn ever, with a YoY income progress above 7%. This leads me to anticipate a This autumn income of $1.89* billion. Margins must be barely bettering, although a bit little bit of shrinkage and wage hikes could nearly fully offset the profit from cooling inflation and decrease transportation and logistics prices. Because of this, I anticipate an EBITDA margin of 13% and a internet earnings margin of 9%. This could lead Academy to report $170 million in internet earnings. Dividing it by the variety of shares excellent – 74 million – we’ve got a This autumn EPS estimate of $2.29.

Nonetheless, on the finish of Q3, the corporate nonetheless had round $100 million accessible on its share repurchase authorization, along with the brand new $600 million share repurchase authorization. That is $700 million accessible for the subsequent three years. I anticipate the corporate to have returned one other $40 million to its shareholders through buybacks. Throughout This autumn, Academy’s inventory value moved from the low $40s to the mid $60s. Let’s assume the common buying value was then $54. This implies the corporate purchased again 740k shares.

Let’s assume the common buying value was then $54. This implies the corporate purchased again 740k shares. This might make Academy’s EPS go as much as $2.32, which is 1.3% above the present consensus. I set this because the minimal threshold to contemplate Academy’s upcoming report good.

If Academy delivers in line with my estimate, it’s going to report FY2023 EPS of $7.06, which implies the inventory is buying and selling at a ten PE. DICK’S currently trades around a 16 PE, and this makes Academy extremely undervalued to its closes and fewer worthwhile peer.

However let’s deal with crucial metric: Free money movement. In spite of everything, investing is in regards to the free money movement a enterprise is predicted to generate.

Presently, DICK’S trades at a FCF yield below 4%, whereas Academy sports a 7.3% FCF yield. True, Academy is spending extra on capex as a result of it is at present increasing and constructing new shops at a sooner tempo than DICK’S. Because of this, traders ought to concentrate on the present process funding cycle. This explains why the yield is larger: Traders are discounting some unpredictability of future free money flows. But, if Academy’s funding results in the returns the corporate expects (20%), the present FCF yield remains to be a compelling alternative.

Beneath this attitude, if Academy had been to commerce on the identical FCF yield as DICK’S, the inventory value must be price round $118 a share.

Let’s bake in a reduction because of Academy’s funding cycle, however let’s decrease the yield to six%. The truthful worth could be round $80. This is the reason I’ve come to revise upwards my truthful worth estimate and charge Academy as soon as once more as a purchase.