Enterprise capital agency Andreessen Horowitz, aka a16z, has introduced that it’s investing $100 million into EigenLayer, a startup that facilitates crypto restaking.

So what really is restaking? It’s a course of that entails repurposing ETH tokens which might be deposited, or staked, as a way of securing the principle Ethereum blockchain. When a validator stakes tokens, it signifies a dedication to the community’s safety.

“They’ve already put up some economic capital and promise in Ethereum that they will not violate the governance of the protocol, otherwise they lose their stake in what it does,” founder Sreeram Kannan, a former College of Washington professor, defined to Fortune. “EigenLayer provides a universal, decentralized, validation marketplace.”

EigenLayer, based in 2021, gives a mechanism for builders to deploy protocols atop Ethereum’s present node-operator infrastructure, which provides considerably extra flexibility, Kannan provides. “That is why I think Andreessen took a bet on us.”

Ali Yahya, an a16z basic associate, wrote in a company blog post, partly: “We’re excited to partner with Sreeram and the whole team on building a platform that unlocks a new dimension of open innovation on top of Ethereum.”

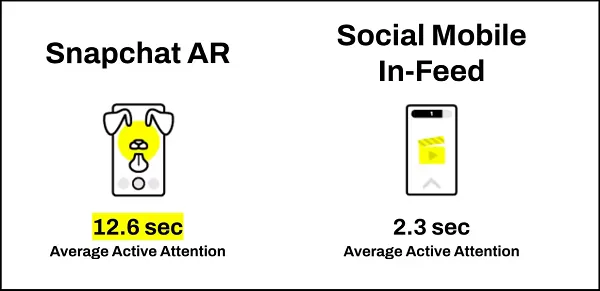

A Silicon Valley stalwart, a16z, which just lately raised a $4.5 billion crypto fund, making a splash within the sector may trace at a reversal in what’s been diminishing attention-grabbing in Web3-related enterprise capital outlays. VC funding for crypto had been declining for the reason that begin of 2022, though the ultimate quarter of 2023 noticed a 2.3% uptick, in keeping with a report by PitchBook, a non-public market knowledge evaluation supplier: “After six straight quarters of decline, an uptick in funding, albeit a tiny percentage, could present welcome news for startups in the coming quarters.”

A possible roadblock for EigenLayer may come through Securities and Alternate Fee Chair Gary Gensler, who instructed crypto corporations final March that digital property utilizing staking protocols might be thought of securities below federal legislation, The Block reported.

The investing public is anticipating a return on these “proof-of-stake tokens,” he mentioned, “and getting 2%, 4%, 18% returns,” Gensler mentioned on the time. “I would just suggest that each of these token operators… seek to come into compliance, and the same with the intermediaries.”

However Kannan mentioned he’s not too involved with such headwinds—”We aren’t wherever in the identical zone”—and that his agency is solely eradicating the necessity for brand new protocols to create extra staking tokens altogether, as an alternative leaning on already-existing financial commitments made to Ethereum.

“It helps many more developers participate in the crypto economy, without each of them having to worry about how to create a new decentralized economy around it,” he says.