MF3d

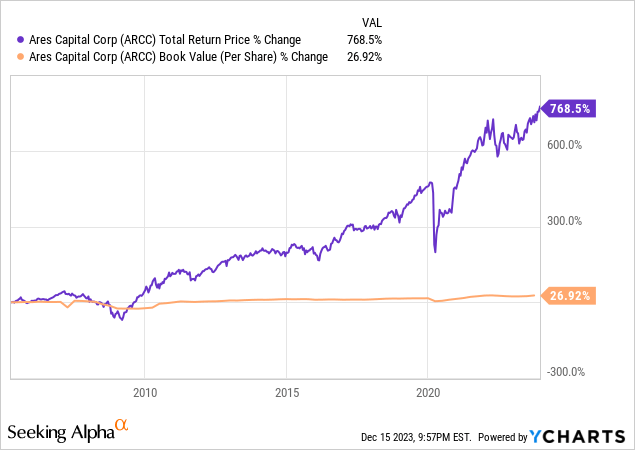

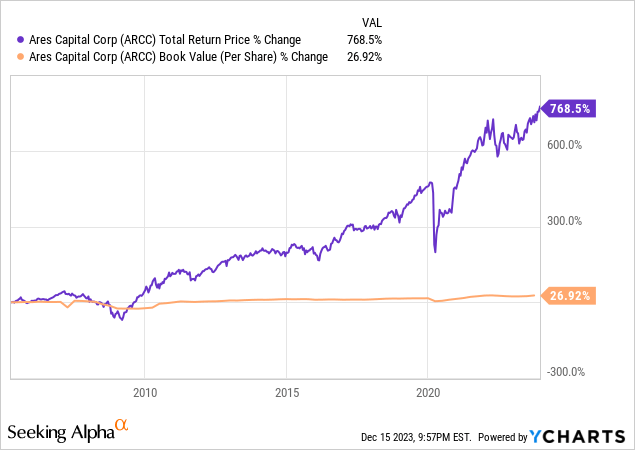

Ares Capital Corp (NASDAQ:ARCC) was my favourite general Enterprise Improvement Firm (i.e., “BDC”) as a result of its phenomenal long-term observe file of producing outsized complete returns in addition to sustaining and even rising NAV per share whereas additionally paying out a hefty dividend:

A lot of this phenomenal efficiency is because of the professional administration offered to the fund by Ares Administration Company (ARES). That being mentioned, I lately parted ways with my ARCC shares, and on this article, I’ll element three the reason why.

#1. Recession and Fee Cuts on the Horizon

I lately bought a number of of my BDCs (BIZD) along with ARCC given my conviction that the ahead macroeconomic outlook was unfavorable for them.

Predictions of a light U.S. recession by Deutsche Financial institution and expectations of rate of interest cuts as forecasted by Morningstar, UBS, and TD Securities recommend a difficult atmosphere for BDCs corresponding to ARCC with their comparatively excessive leverage ratio and substantial publicity (ARCC has 84.2% publicity) to floating-rate center market loans. The substantial anticipated fee cuts subsequent 12 months would doubtless result in a lower in ARCC’s internet funding revenue because the curiosity revenue from its floating-rate loans falls.

Furthermore, BDCs are sometimes hit arduous throughout recessions as a result of their publicity to middle-market firms, that are extra weak to financial downturns. ARCC’s leverage ratio of fifty.25% signifies that any enhance in defaults or non-accruals may considerably influence its backside line and NAV.

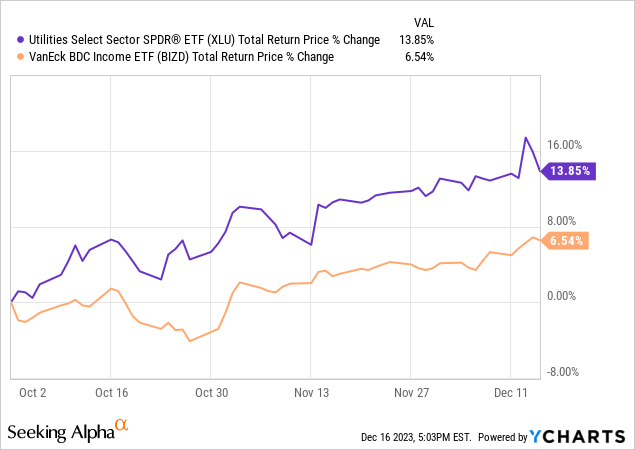

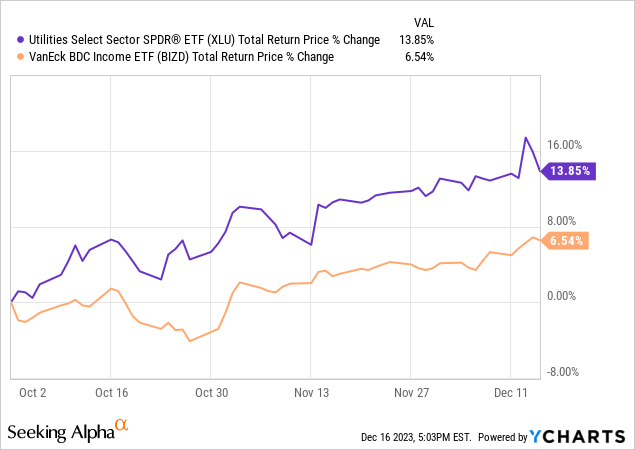

Because of my macroeconomic outlook, I recycled a lot of the capital into deeply undervalued utilities (XLU) that had been overwhelmed down by aggressive rate of interest hikes however appeared poised to profit from fee cuts in 2024 and would doubtless stand up to a recession properly. Over the previous few months, that call has paid off handsomely, and I count on this development to proceed for the foreseeable future:

#2. ARCC Inventory’s Valuation Has Gotten A Bit Wealthy

One more reason I bought my shares is as a result of – as a price investor – valuation means lots to me, and ARCC’s valuation will not be notably compelling for the time being. I base this conclusion on three main elements:

- ARCC’s price-to-book worth ratio is at the moment 1.03x, which is consistent with its five-year common and above its 10-year and all-time averages of 1.00x. Whereas ARCC’s valuation right here will not be notably excessive, it isn’t on sale and seems barely overvalued, particularly contemplating my second purpose…

- As we identified earlier on this article, the macroeconomic circumstances will doubtless shift from extraordinarily optimistic for ARCC to far more destructive. Consequently, we predict that ARCC must be buying and selling at a reduction to its historic common proper now, reasonably than at a slight premium.

- Because the desk beneath illustrates, ARCC’s expense ratio is without doubt one of the highest within the BDC sector, additional making the case in opposition to its worthiness of promoting at a premium to NAV:

| Firm Identify (Ticker Image) | Expense Ratio (%) |

|---|---|

| Fundamental Road Capital Company (MAIN) | 7.38 |

| Capital Southwest Company (CSWC) | 9.99 |

| Hercules Capital (HTGC) | 10.47 |

| Blackstone Secured Lending Fund (BXSL) | 11.25 |

| Goldman Sachs BDC (GSBD) | 12.15 |

| Golub Capital BDC (GBDC) | 12.74 |

| FS KKR Capital Corp (FSK) | 13.22 |

| Owl Rock Capital Company (OBDC) | 14.07 |

| Prospect Capital Company (PSEC) | 14.24 |

| Ares Capital Company | 14.37 |

| Oaktree Specialty Lending Company (OCSL) | 15.14 |

| Sixth Road Specialty Lending (TSLX) | 18.23 |

Desk 1: BDCs Sorted by Expense Ratio (from Lowest to Highest) Based mostly on Information from The BDC Universe

#3. ARCC Inventory’s Portfolio Is Not Significantly Defensive

Final however not least, I bought my ARCC shares as a result of – along with its important publicity to floating fee center market company-backed loans – ARCC’s portfolio additionally has one of many least defensive buildings relative to its friends on a % mortgage and % senior secured mortgage foundation:

| Ticker | % Portfolio Debt |

| GSBD | 99.10% |

| BXSL | 97.80% |

| GBDC | 96.90% |

| HTGC | 95.70% |

| TSLX | 95.10% |

| OCSL | 92.10% |

| CSWC | 91.40% |

| OBDC | 87.90% |

| BCSF | 84.20% |

| MAIN | 82.50% |

| BBDC | 81.70% |

| ARCC | 80.90% |

| NMFC | 80.50% |

| FSK | 79.60% |

| PSEC | 74.30% |

Desk 2: BDCs Sorted by % Debt Publicity (from Highest to Lowest) Based mostly on Information from The BDC Universe

| Ticker | % 1st / 2nd Lien |

| GSBD | 97.50% |

| BXSL | 97.30% |

| HTGC | 93.40% |

| TSLX | 93.30% |

| GBDC | 93.20% |

| CSWC | 87.10% |

| OCSL | 83.00% |

| OBDC | 82.60% |

| FSK | 75.50% |

| PSEC | 73.70% |

| BBDC | 73.50% |

| NMFC | 71.40% |

| MAIN | 68.80% |

| BCSF | 65.80% |

| ARCC | 64.90% |

Desk 3: BDCs Sorted by % 1st/2nd Lien Publicity (from Highest to Lowest) Based mostly on Information from The BDC Universe

Because of this – within the occasion of a recession and non-accruals and defaults enhance – ARCC is ready as much as endure higher revenue and NAV per share losses than a lot of its extra defensively positioned friends who’ve higher debt and senior-secured debt publicity than ARCC does.

Investor Takeaway

Whereas ARCC has a really spectacular observe file, the present macroeconomic outlook makes its present valuation seem unattractive relative to its historical past and its portfolio positioning seem unattractive relative to its friends.

Whereas we do suppose that its administration’s confirmed talent at creating worth over the long-term for shareholders earns it some slack – thereby justifying it buying and selling consistent with NAV regardless of having one of many highest expense ratios within the sector – we can’t justify paying a premium at this level within the financial cycle given the comparatively weak positioning of its portfolio proper now. Consequently, we bought our shares and reallocated the proceeds into extra defensive alternatives which might be poised to profit from rates of interest declining in 2024.