Kevin Frayer/Getty Images News

Introduction

When most westerners think about China, we often think of a few things:

- China’s liberalized economy and illiberal, authoritarian social institutions, euphemized in China as “socialism with Chinese characteristics”

- Mass manufacturing, i.e. “Made in China”

- Massive, dense cityscapes like Beijing, Shanghai, and Shenzhen

- Geopolitical threats made to the US, South Korea, Japan, and Taiwan

- TikTok and its contested US ban

When discussing Chinese markets in western circles, some other topics also come up regularly:

- The ongoing US-China trade war

- China’s changing demographics and rising middle class

- The Chinese Communist Party’s (“CCP’s”) crackdown on business magnates like Jack Ma and Bao Fan

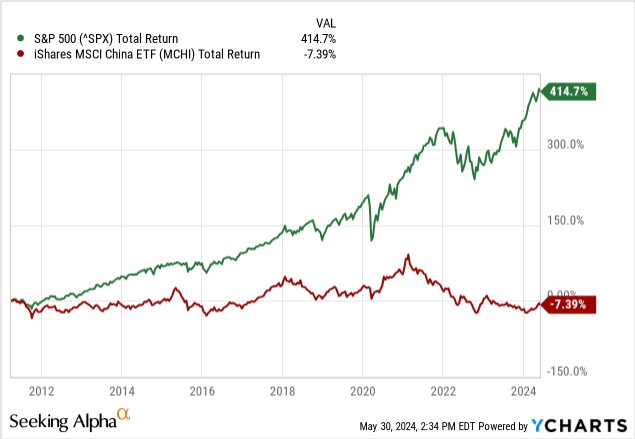

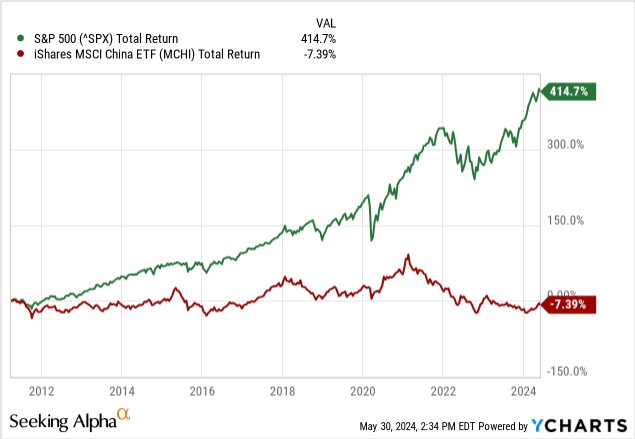

Due to a cacophony of reasons, which I will detail in this article, I am going short the Chinese stock market in a pair trade with a long position in the US markets.

I believe that the flat trend the MSCI China ETF (MCHI) has been on since its market debut will continue and investors will be better off avoiding Chinese markets moving forward.

The US-China Trade War

The US and China have been in a trade war for some time, with both sides working to levy tariffs and sanctions against the other in order to enable easier competition from domestic firms.

A spokesperson for the Biden administration published the administration’s thoughts when the new tariffs were announced a few weeks ago:

China’s unfair trade practices concerning technology transfer, intellectual property, and innovation are threatening American businesses and workers. China is also flooding global markets with artificially low-priced exports. In response to China’s unfair trade practices and to counteract the resulting harms, today, President Biden is directing his Trade Representative to increase tariffs under Section 301 of the Trade Act of 1974 on $18 billion of imports from China to protect American workers and businesses.

Tariffs

Recently, the Biden administration imposed greater trade tariffs on China, furthering the trade war that the Trump administration started back in 2017.

These tariffs include:

- Increased rates to 25% for:

- Face masks, lithium-ion vehicle batteries, medical gloves, permanent magnets, ship-to-shore cranes, and some steel and aluminum products

- Increased rates to 50% for:

- Semiconductors, solar cells (completed and partial), and syringes and medical needles

- Increased rates to 100% for:

These trade tariffs are designed to limit Chinese firms’ ability to compete with domestic firms. The US electric car market is one such battlefield where cheaper Chinese EVs could compete with the offerings from Tesla Motors (TSLA), which currently dominates most of the US EV market.

This is bad news for big name Chinese stocks, who are going to see far less demand in US markets now that the price has doubled for their products. These tariffs are unlikely to go away or change anytime soon, as they are one of the few policy designs the Biden administration has made that is truly bipartisan.

App Banning

Add onto that the recent potential banning of Chinese-owned app, TikTok, by the US, forcing its sale within a year, and we see a greater picture of how much control the US is willing to exert over Chinese-owned businesses in order to keep China from collecting data on US citizens.

While ByteDance, the parent company to TikTok, has said that they will take the Biden administration to court for violating the 1st Amendment (the free speech clause), it’s unlikely that a federal court will rule in their favor, in my opinion. Instead, this gesture from the company is mostly to stall time for a future with more favorable legislators, I believe.

It is most likely, despite ByteDance’s current stance that they will not be selling TikTok, that TikTok is either banned or sold off to a US-based competitor. This case is too high profile for ByteDance to get away with transferring the company to its own US-based subsidiary. With all eyes on them, at the end of the year-long timer that ends in 2025, ByteDance will be forced to act.

Semiconductors

The largest concern for Chinese tech stocks is the country’s inability to acquire new semiconductor tech from the west. The Netherlands’ ASML Holding N.V. (ASML) has a full monopoly on extreme-UV (“EUV”) lithography machines, which are the best-in-class machines for semiconductor manufacturing at the moment. The Biden administration was able to convince the Dutch government to force ASML to halt several shipments of older lithography systems to Chinese firms, as well as outright ban the sale of EUV machines to them.

If you want to read more about ASML and its monopoly, I wrote about that last month, here.

Not having access to these machines means that Chinese firms will need to invent their own, or access them through dark channels smuggled in from other countries. Either way, it will be extremely difficult and will put China on the backfoot for technological progress in the semiconductor space for years, if not a decade.

These machines are not something you can start creating overnight, and even ASML doesn’t make all of the components in house. Chinese firms are also slated to be banned from purchasing from these other suppliers as well, limiting their ability to participate in global technology sharing.

Geopolitical Tensions

Outside of the trade war, there is a risk of real war on the horizon. China has had a very long history with Taiwan, which I will not go into much detail on here, but the long and short of it is this:

- A civil war in the 1940s & 50s saw the CCP take over mainland China

- This is the clique still in charge today, and the one that President Xi represents

- The nationalist clique that lost the war fled to Taiwan and ran a concurrent government that claims all of mainland China

- Today, Taiwan and China operate as separate entities politically and economically, despite both having claims on all of China and Taiwan

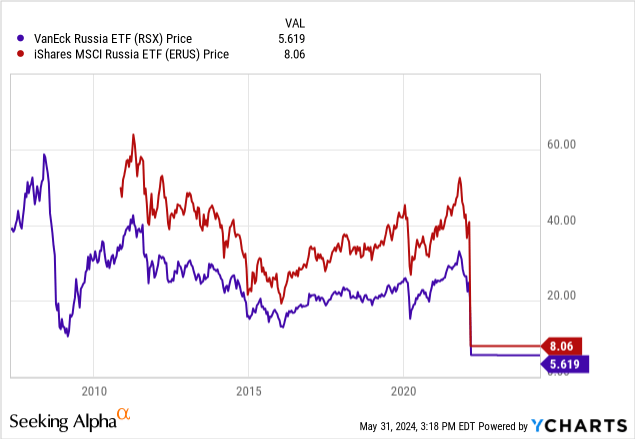

The Russian Treatment

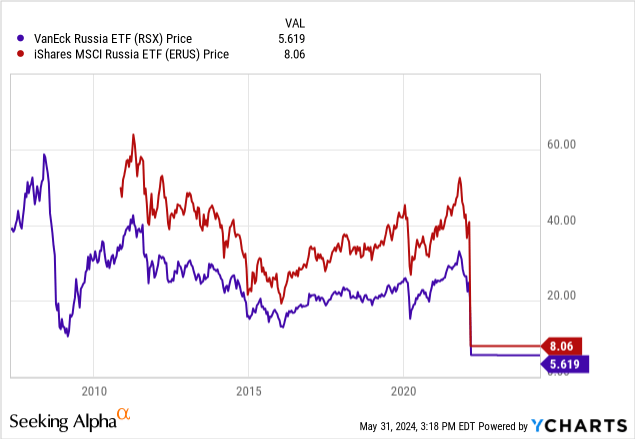

The most major risk to the Chinese stock market is an invasion or blockade of Taiwan, because of how the west could respond. In the event that the CCP decides to actually crack down on Taiwan and declare war, they would potentially get the “Russian treatment,” as I’ve been calling it; that is a full shutdown of international trading of their stocks, a pulling out from western businesses, and full sanctions on monetary systems like SWIFT. This is what happened to Russia following their invasion of Ukraine in 2022.

The associated ETFs did not fare well.

The worry of a full financial block placed on China following a potential invasion of Taiwan should be enough to scare off all potential US-based investors. Investors in RSX and ERUS (shown above) had their investments liquidated at effectively zero and received very little if anything back from their holdings in the Russian economy. Those businesses are still operational, but stock in them is worthless.

The US would absolutely be involved in any escalation to war in Taiwan, as confirmed by President Biden in 2022. This commitment means that China will not only face the kind of financial sanctions and punishments that would liquidate and crash all investors’ holdings in funds like the iShares China Large-Cap ETF (FXI) and the MSCI China ETF (MCHI), but also a military escalation that could crash the whole market.

The Pair Trade

So what am I going to do with this thesis? I am too risk-adverse to short the Chinese market outright, but I will take it in a pair trade. I am going to short the Chinese markets with shares of FXI, the aforementioned China Large-Cap ETF, and go long the US markets via the SPDR S&P 500 ETF (SPY).

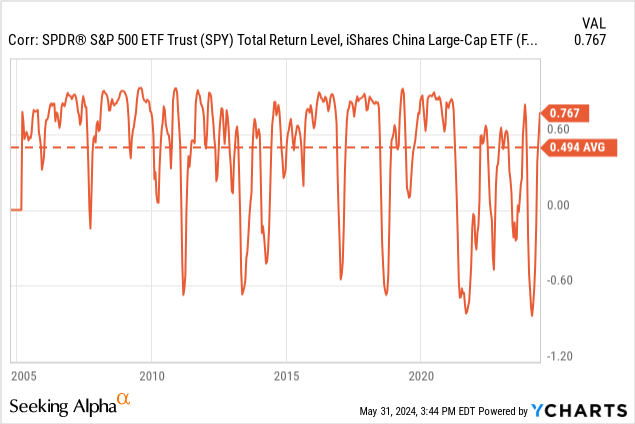

Because the two ETFs trade differently, we should see a divergence between them based on the quality of the underlying companies. General market trends should drive both funds the same, meaning that “beta,” or the amount the stocks move due to general market forces, is almost neutral. There are far more sophisticated methods to get the portfolio to exactly market neutral, but this is enough for my purposes.

FXI has a moderate correlation with SPY, meaning that we should expect it to perform alongside SPY most days, but potentially not as strongly. This is where we will see the divergence that will drive returns in the pair trade.

This trade will take advantage of the stagnation in Chinese markets and risk premium put on the stocks (they are valued lower than their western counterparts) in comparison to the sustained growth of the US markets. It also carries a massive payoff in the event of a “black swan,” that is something we don’t expect, tanking the Chinese markets like getting the “Russian treatment” from the west over its belligerence of Taiwan.

Conclusion

The Chinese markets face many threats that investors should take seriously. A ratcheting up of the US-China trade war, escalating Chinese threats against US-ally Taiwan, and a general trend of stagnation in the market make the Chinese market ripe for a long/short pair trade against the US markets.

I intend to take this trade for the foreseeable future and will re-evaluate in 2025 when the decision regarding TikTok is made. Once TikTok is either sold or banned, that will set the new tone for US-Chinese tech relations, something that is vital to this thesis.

Thanks for reading.