After years of struggling with the rising cost of living, Americans are finally getting some minor relief. U.S. inflation fell 0.1% month-over-month in June, beating analysts’ consensus forecast for an 0.1% rise, the Bureau of Labor Statistics reported Thursday. On an annual basis, consumer prices also rose just 2.97%—the smallest jump in over three years.

“Expectations were that this was going to be a good report. But as you can see, it was better than expected,” Bill Sterling, global strategist at GW&K Investment Management, told Fortune of the consumer price index (CPI) data.

A 3.8% dip in gasoline prices was responsible for much of the drop in inflation during June, but core inflation, which excludes more volatile food and energy prices, also came in cooler than anticipated. Slowing shelter price increases led core inflation to rise just 0.06% month-over-month, and roughly 3.3% from a year ago—another three-year low.

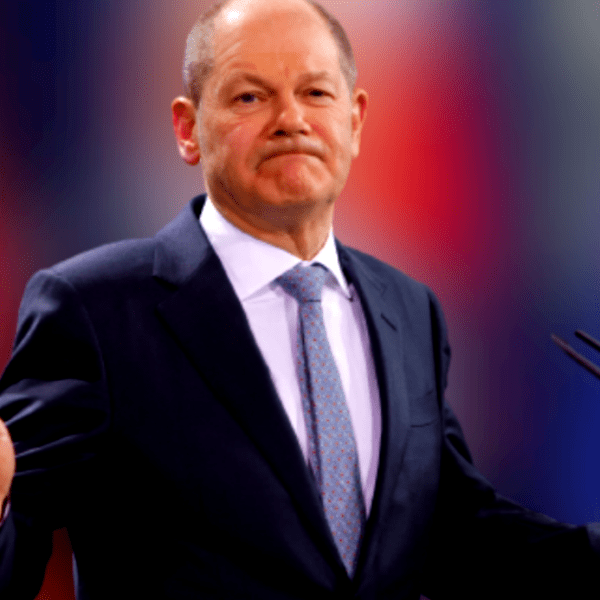

After years of the Federal Reserve fighting inflation with relatively high interest rates, professional investors have long been predicting the central bank would win in its battle against rising prices, only to be disappointed time and again. But this time, many experts are convinced that the Fed has finally tamed inflation, and interest rate cuts are on the way.

“All in all, it was a very encouraging report from the point of view of the Fed. And markets are pretty convinced now that this tees up a Fed rate cut in September,” Sterling said.

Why you should expect rate cuts

The optimistic outlook after the CPI report was evident across Wall Street. Citi economist Veronica Clark noted that inflation came in “below already soft expectations” in June, signaling the hotter-than-expected inflation seen in the first quarter was likely “an aberration.” Now, particularly with shelter inflation fading, the Fed should have the green light to cut rates by September, Clark argued in a Thursday note to clients.

Shelter inflation has been a thorn in the side of Fed chair Jerome Powell for years, but throughout that period, a number of analysts and economists including Wharton’s Jeremy Siegel have noted that the Fed’s measurements tend to lag the reality on the ground, where home and rent price growth has cooled.

Eric Pachman, chief analytics officer at Bancreek Capital Advisors, believes we’re now finally seeing evidence that the lagging shelter metric is moving more in line with current prices. That’s critical because shelter inflation alone accounts for roughly one-third of the consumer price index. “We finally have at least one data point to hang our hat on. So, maybe I’m overreacting, but I’m pretty excited,” he said of the shelter inflation data.

Brian Rose, senior U.S. economist at UBS Global Wealth Management, echoed Clark and Pachman’s optimistic comments, while adding that the recent rise in the unemployment rate could also provide more ammunition for Fed officials to turn dovish. “With both inflation and the labor market softening, the door now appears wide open for the Fed to begin cutting rates,” he told Fortune via email.

The probability of a July interest rate cut based on Fed funds futures contracts—which provide insight into bond market investors’ expectations—rose after the CPI report, but remains under 10%, according to CME’s FedWatch tool. However, the odds of a September cut have soared from roughly 50% after last month’s CPI report to 98% on Thursday. And by December, the odds of at least one rate cut are sitting at nearly 100%.

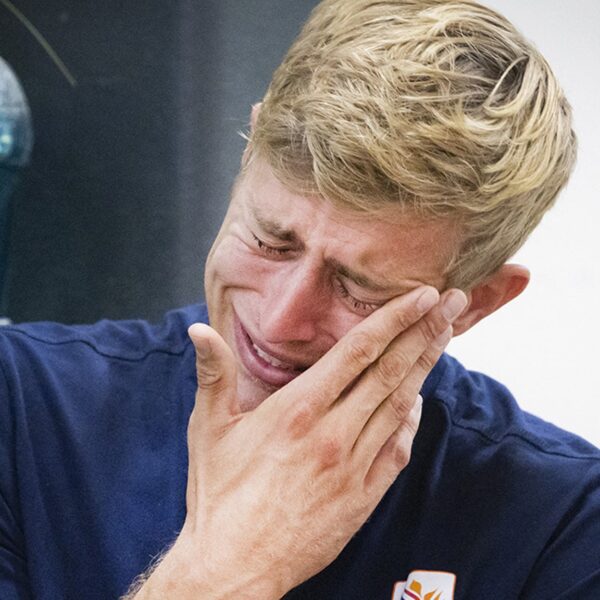

Why are stocks down?

Typically, interest rate cuts are seen as a net positive for stocks. Lower rates signal lower borrowing costs, which means more money for companies to invest in their growth. But after the cool CPI report Thursday, which signaled rate cuts are more likely than ever, two out of three major indices fell.

The blue chip S&P 500 sank 0.88%, while the tech-heavy Nasdaq plummeted roughly 1.95%. But interestingly, an equal-weighted version of the S&P 500—one that doesn’t bias exposure to companies based on their market cap—actually rose more than 1.21%.

“Is the market down? Or is this the most extreme rotation that we’ve ever seen out of everything that people have been hiding in?” Bancreek Capital Advisors’s Pachman asked when faced with this data.

The reality is, most stocks didn’t fall on Thursday, he noted, but the big tech and AI-linked stocks that have made investors euphoric over the past two years sure did. This is not a broad-based stock market drop for now, it’s an investor rotation into more value-focused offerings—one that’s long been predicted.

To that point, shares of big tech leaders, which have soared in recent years leading to one of the most concentrated markets in history, fell sharply on Thursday. Nvidia was down 5.6%, while Apple sank 2.3%, Microsoft fell 2.5%, and Tesla dropped 8.4%.

Pachman wasn’t alone in his investor rotation diagnosis. Eric Wallerstein, chief investment officer at Yardeni Research, said that he believes “the great rotation” may be underway in a post on X (formerly Twitter) Thursday. Wallerstein noted that investors shifted away from growth-focused large caps and into mostly value-oriented small- and mid-caps en masse on Thursday.

That’s not entirely illogical, given that the S&P 600 small cap index is trading at just 13.9 times forward earnings, while the large cap S&P 500 index is trading at over 21 times forward earnings. Small caps, which have far more debt on average than their large cap peers, have suffered under a higher-rate regime, but that could be changing.

small caps were trading at less than half the valuation of the mega-cap 8. A little rotation makes sense. https://t.co/HHHMkqPYI9 pic.twitter.com/6MUVITwQB2

— Eric Wallerstein (@ericwallerstein) July 11, 2024

The second possible explanation for the pain in stocks after the bullish CPI report, particularly big tech and growth stocks, is simply that the market has been rallying in anticipation of rate cuts throughout 2024. Even after its Thursday drop, the S&P 500 is still up roughly 17% year-to-date, and the Nasdaq Composite has soared around 23% amid the AI boom.

“Stocks have been on such a tear for such a long time, you could argue that [the] good news was already baked in the cake,” Sterling, of GW&K Investments, explained.

To his point, it’s not necessarily surprising that inflation is coming down, particularly with so many once-red hot price categories falling sharply. And that means many investors have likely been pricing in falling rates when valuing stocks. Take lumber, for example, where futures prices are down more than 75% from their 2021 peak. Or used cars, where the average price nationwide is down from its 2022 peak of over $30,000 to just $25,328.

At the end of the day, maybe market participants just listened to the classic Wall Street line given to rookie investors on Thursday: Buy the rumor, sell the news.