Ringing in a brand new yr — and seeing your December bank card assertion — could tempt you to do a finances overhaul.

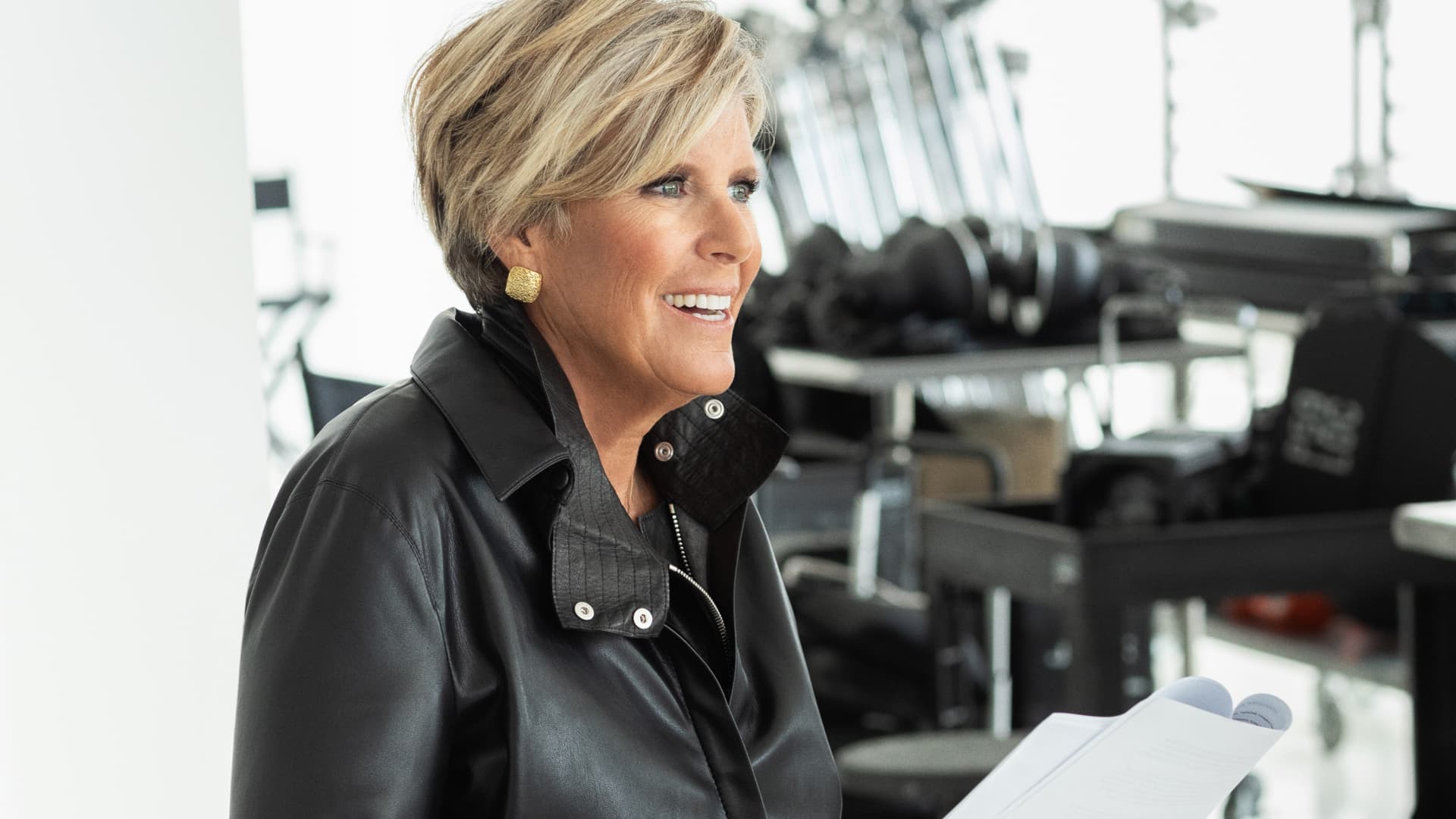

For those who actually wish to lower your expenses this January, resist pulling out your spreadsheet, Suze Orman, private finance skilled and host of the podcast “Women & Money (and Everyone Smart Enough to Listen),” lately informed The Wall Street Journal. She in contrast budgets with crash diets, and mentioned the restrictiveness virtually at all times results in a purge.

“I hate budgets,” she mentioned within the interview. “If you restrict, you limit, you cut back, you don’t buy this, you don’t buy that and then all of a sudden, you explode and you go out and you buy everything at once.”

Orman is not the one one that has drawn that comparability. Making ethical judgments about the way you spend can really damage your progress towards monetary objectives, in keeping with monetary educator Melissa Browne.

“Budgets don’t work for many people in the same way diets or one-size-fits-all eating approaches don’t work long term,” Browne recently told CNBC Select. “I don’t believe it’s about budgeting, but rather spending and investing well.”

The excellent news: There’s a straightforward, much less demoralizing different, Orman mentioned. As a substitute of fixating on what you should not purchase, Orman advisable interested by smaller selections that make you are feeling extra in command of your checking account.

“Just do one thing that might make you feel more secure,” she mentioned. “Is that saving $10? Is that not going out to eat?”

Which means you do not have to chop out date nights or a seasonal procuring spree to really feel higher about your funds. You’ll be able to take alternatives to economize when it feels empowering, moderately than robbing your self of stuff you get pleasure from.

Extra excellent news: A strict finances is not the one option to observe your spending. In truth, 73% of People don’t regularly follow one, in keeping with a 2022 survey by OppLoans.

Self-made millionaire Ramit Sethi, star of Netflix’s “How to Get Rich,” equally called meticulous budgets “pointless” in 2019.

As a substitute, create a spending plan that does not have you ever ruminating over each greenback spent, he informed Make It in 2022.

He advisable growing a “conscious spending plan” that tracks your month-to-month prices, financial savings, investments and “guilt-free spending.” That approach, you possibly can make sure you’re setting apart sufficient to cowl your payments, and even save a bit, earlier than you spend on discretionary objects and actions.

Spending is exclusive for everybody. Regardless of hating budgets, Orman informed The Wall Road Journal she would “drop dead before I bought a coffee” out and known as consuming out “one of the biggest wastes of money out there.”

As a substitute, she makes use of that cash to splurge on personal home journey, she mentioned.

DON’T MISS: Wish to be smarter and extra profitable together with your cash, work & life? Sign up for our new newsletter!

Get CNBC’s free Warren Buffett Guide to Investing, which distills the billionaire’s No. 1 greatest piece of recommendation for normal traders, do’s and don’ts, and three key investing rules into a transparent and easy guidebook.