The PPI data for December came in lower than expected:

Good news? Yes … but there is a but. The components that feed into core PCE (PCE is the Federal Reserve’s preferred measure of inflation – more on this below if you are interested) bumped higher.

The PPI inflation report will influence the December PCE inflation data:

- Citi now expects core PCE inflation (excluding food and energy) to rise 0.21% month-over-month in December, slightly higher than their earlier estimate.

- Similarly, Morgan Stanley has raised its projection to 0.23%. This signals a potential acceleration compared to November’s 0.1% increase.

- Some Fed officials aim for the 12-month core PCE inflation to slow closer to the 2% target before easing interest rates.

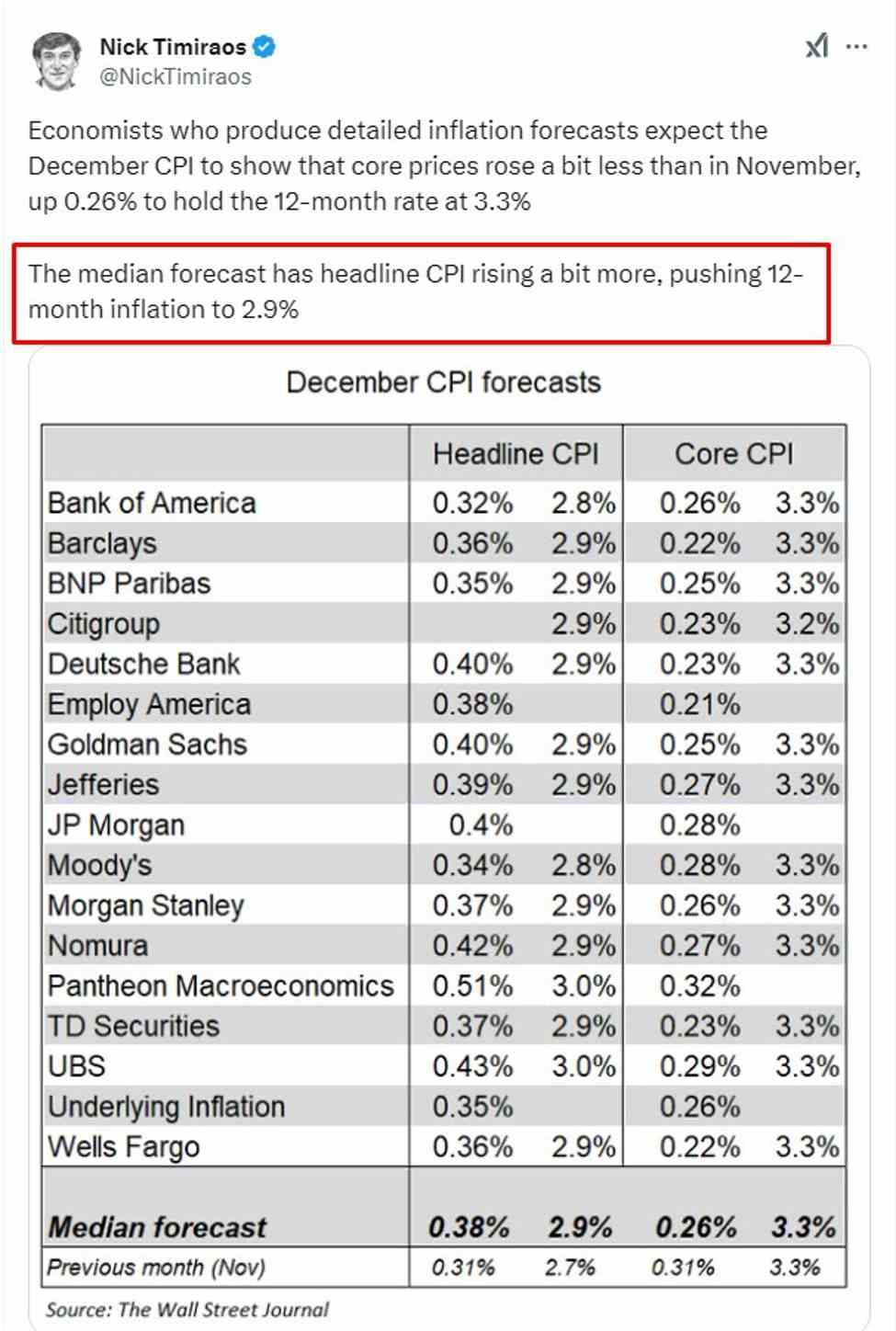

The PCE data will be released on January 31. Ahead of that is the CPI inflation data, due Wednesday, January 15, 2025 at 8.30 am US Eastern time (1330 GMT):

***

In summary, the PCE’s broader coverage, flexibility, and regular updates make it a more accurate and stable indicator for the Fed to assess inflation and guide monetary policy effectively.

Comparison with CPI

| Feature | PCE | CPI |

|---|---|---|

| Scope | Broader (all households and institutions) | Narrower (urban households only) |

| Weight Updates | Regular (dynamic weights) | Less frequent (fixed weights) |

| Substitution Effect | Accounts for substitution | Limited accounting |

| Volatility | Less volatile | More volatile |

***

If you want even more …

The Federal Reserve prefers the Personal Consumption Expenditures (PCE) Price Index as its primary inflation measure because it offers a broader, more accurate, and flexible view of consumer spending and price changes. Here are the key reasons:

1. Broad Coverage of Goods and Services

- The PCE captures a more comprehensive range of goods and services than the Consumer Price Index (CPI), which focuses on urban households.

- It includes expenditures by individuals and institutions, such as spending on behalf of households by employers or government programs like Medicare and Medicaid.

2. Changing Consumer Behavior

- The PCE accounts for substitution effects—when consumers switch to cheaper alternatives as prices rise. This reflects real-world behavior more accurately than the CPI, which uses a fixed basket of goods and services.

- This dynamic adjustment makes the PCE less volatile and more reflective of actual consumer purchasing patterns.

3. Consistent Weighting

- The PCE uses current expenditure weights, which are updated regularly to reflect changing consumer habits. In contrast, the CPI uses fixed weights that are updated less frequently, which can make it slower to adapt to economic shifts.

4. Scope and Data Sources

- The PCE is derived from business surveys, administrative data, and household surveys, providing a robust and wide-ranging data set.

- The CPI relies heavily on household surveys, which can be less reliable due to sampling and reporting issues.

5. Core PCE for Policy Focus

- The Core PCE (excluding volatile food and energy prices) is particularly useful for the Fed. It provides a clearer signal of underlying inflation trends, helping the Fed make informed policy decisions without reacting to short-term volatility.

6. Alignment with the Fed’s Dual Mandate

- The PCE aligns better with the Fed’s dual mandate of promoting price stability and maximum employment, as it gives a more stable and long-term view of inflation trends.