Former president Donald Trump’s digital media firm is shedding cash, and plenty of it. However why is that any totally different from different “startups,” which regularly battle to put up a revenue for years, in the event that they ever do?

There are a pair causes.

First, as a recap: Trump Media and Know-how Group just lately merged with Digital World Acquisition Firm in a SPAC, the ill-starred monetary instrument that, as a rule, represents a last-ditch choice for a considerable money infusion. The corporate is on the NASDAQ as, predictably, $DJT.

An necessary a part of going public is revealing your funds to all of the world, and TMTG just lately filed its first quarterly financial report with the SEC that everybody can take a look at and analyze. The monetary press is having a subject day, however the upshot is that TMTG is shedding some huge cash and producing subsequent to none. Particularly, the corporate misplaced $58 million on solely $4 million in income.

These inclined to be charitable to a tech startup difficult entrenched rivals — no matter its “mission” or management — could fairly observe that this imbalance is frequent amongst early-stage corporations with large ambitions. And so it’s — who can neglect that Uber operated with super losses for years with a view to undermine the taxi trade’s enterprise mannequin?

TMTG is superficially comparable, primarily in that it doesn’t earn a living. However that doesn’t make it a startup on the verge of explosive development. There are three large, simple the explanation why:

- TMTG isn’t rising. Reality Social, the primary enterprise of TMTG, has failed to draw various million customers. It has not demonstrated the sort of traction any startup would wish to point out with a view to recommend that it’s the subsequent large factor, or actually something in any respect (as others have identified, Twitter had $665M in yearly income when it IPO’d). The extremely low income numbers inform us that its solely earnings supply, advertisers, don’t need to pay for what viewers is there. And there’s no actual purpose to anticipate this to alter.

- TMTG doesn’t have VC runway. Enterprise capital is a high-risk, high-reward technique the place basically unprofitable companies are propped up till one thing modifications they usually can earn a living. This provides startups freedom to do dangerous issues like overhire, cost too little, and kick the “business model” can down the highway, typically perpetually. If buyers are assured, and the product has traction — like Uber — they are going to pour billions into it as a result of they’re assured that they are going to finally make that again. However in his present precarious state, Trump could be a dangerous wager even for a VC. However that’s all moot as a result of:

- TMTG is now accountable to its shareholders. Small startups could should report back to their VC masters at times, however they’ve free rein in contrast with public corporations, which have fiduciary responsibility to their shareholders. Although Trump is the most important TMTG shareholder at 60%, the opposite 40% are watching carefully for any breach of this responsibility — comparable to a fireplace sale on shares, or a mortgage that drastically undervalues the corporate. However the necessary piece right here is that TMTG doesn’t have the liberty to throw money round (they’ve none anyway) and take dangers. The fundamental thought of going public is that you’ve got a enterprise that others need to share in — TMTG merely doesn’t.

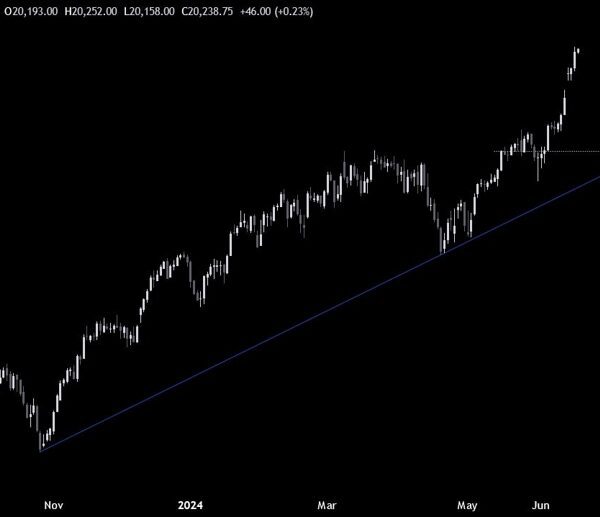

The result’s, because the analysts have already identified, that $DJT is basically and wildly overvalued. The corporate is vanishingly unlikely to make a revenue any time quickly, not to mention the sort of revenue that will justify the share worth and multi-billion-dollar valuation. Even probably the most optimistic eventualities most likely envision solvency as a far-off aim.

Alternatively, given the bulk proprietor’s private, political, authorized, and enterprise woes, there’s a very actual danger that the entire thing will implode earlier than the 12 months is out.

The actual fact of the matter is that the share worth is totally unconnected to the efficiency of the corporate, rendering it primarily a “meme stock” that can be priced arbitrarily and maybe manipulated by public buyers.

Whereas which will make just a few day merchants and quick sellers cash over the subsequent few days and weeks, it’s not the sort of factor that retains worth long run, notably with TMTG’s lack of property. By the point Trump is ready to promote his shares, it’s possible this firm can be value something like what it supposedly is right now. It’s not even value what it was this morning, with the inventory down greater than 20% because the market opened.