Khanchit Khirisutchalual

U.K.-based Wise PLC (OTCPK:WPLCF) is recognized as a leader in international money transfers with 13 million active customers. The fintech platform has generated impressive growth and climbing profitability, capturing not only increasing activity in transaction volumes but also the response from new banking features and debit card adoption.

We like WISE for its solid fundamentals and positive long-term outlook. Despite some recent volatility in shares, several tailwinds and new growth opportunities can lead to a rebound going forward.

WISE Earnings Recap

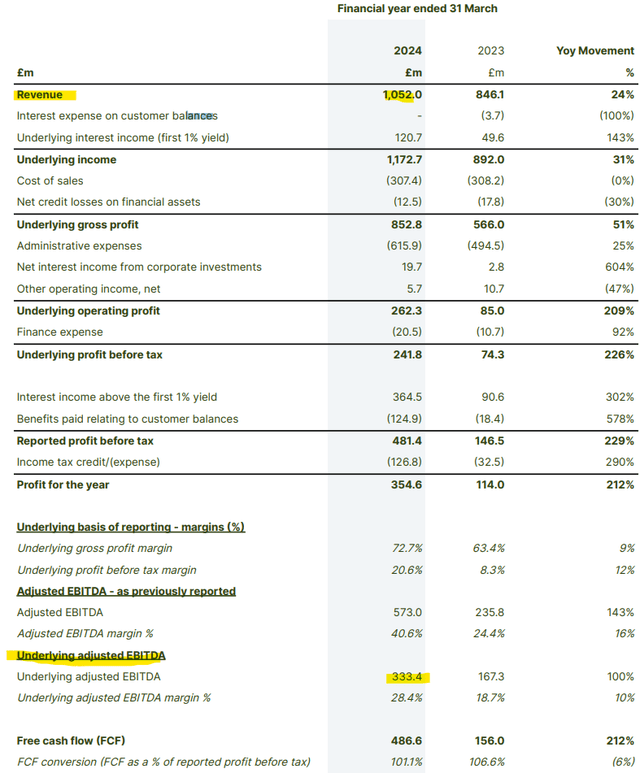

Wise reported its fiscal 2024 result on June 13. For the full year, revenue of GPB 1.1 billion or $1.3 billion represented an increase of 24% from 2023. This momentum was driven by a 29% increase in the total number of customers collectively moving GBP 118.5 billion in transactions, up 13% year over year.

While the volume per customer has slowed, the context considers that more customers are utilizing multiple products beyond the core cross-border payments. This is evident in the level of total customer holdings between account balances and assets under custody for financial products increased by 45% to GBP 16.2 billion.

This is important as Wise has been able to translate those funds into a significant source of underlying interest income adding to the overall profitability. 2024 underlying adjusted EBITDA of GBP 333.4 million doubled from 2023 with a corresponding margin of 28.4% up from 18.7% last year. Similarly, Wise free cash flow has also ramped up.

The strong trends reflect not only the company’s ability to scale but also the brand’s ability to engage a loyal user base. During the earnings conference call, management projected confidence for trends to continue with a medium-term outlook for customer growth between 15-20% as a composite average growth rate.

Wise is also guiding for fiscal 2025 underlying income growth within this same 15-20% range in the context of the particularly strong 2024 with efforts focused on improving efficiencies.

What’s Next for WISE?

From a high-level perspective, the market for cross-border transfers benefits from the ongoing digitalization of global economies. Consumers are shifting away from traditional hard cash remittances toward the convenience of electronic payments gaining adoption.

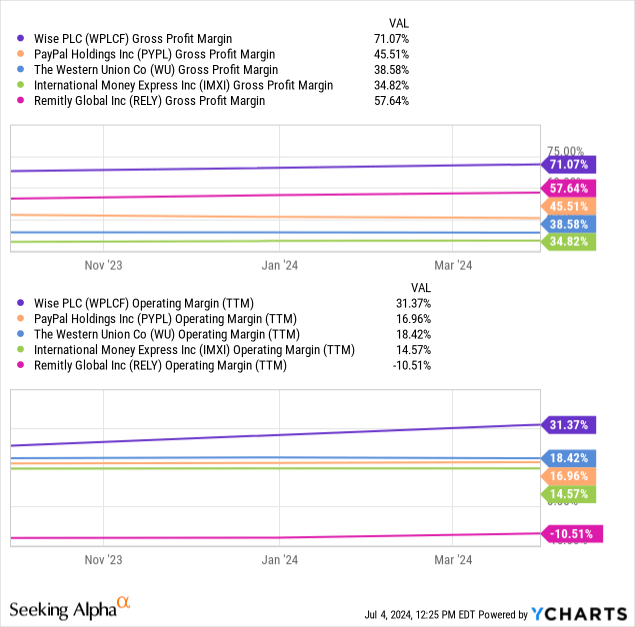

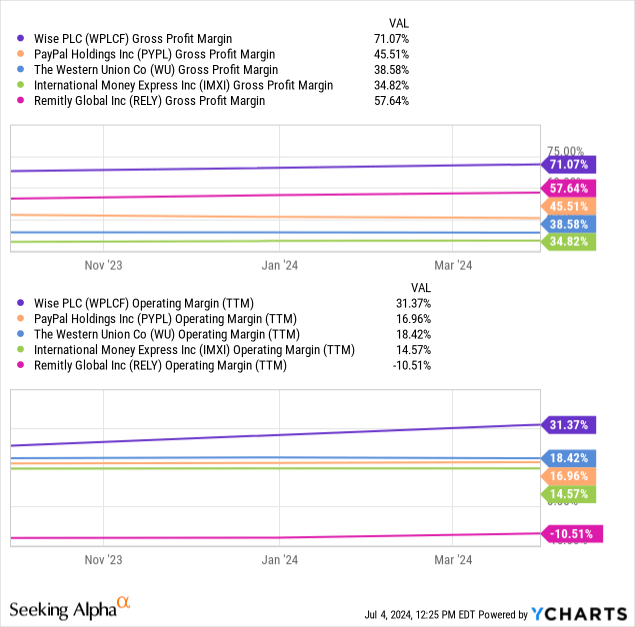

At the same time, it’s understood this market is highly competitive considering specialists like the Western Union Co (WU), Remitly Global (RELY), or International Money Express Inc (IMXI) which typically have strengths in certain regions or categories of transfers. We can also bring up larger, more diversified fintechs such as PayPal Inc (PYPL) or even digital banks such as Nu Holdings Ltd (NU) that offer similar services.

The good news is that Wise’s operational and financial results speak for themselves as an indication of growing and consolidating market share by focusing on its areas of core strength. Notably, the company is finding success with new products covering business accounts, and debit card-only customers attracted to the multi-currency transactions flexibility.

For example, card and “other” revenue outside remittances climbed by 54% in 2024 with management citing a shift of customers utilizing more and more services. The importance here is that the business is becoming more diversified which translates into high-quality earnings and underlying cash flows.

In terms of valuation, at a current market capitalization of $9.5 billion, WISE is trading at approximately 21 times earnings over the trailing twelve months. The forward price-to-earnings multiple has room to narrow towards 18x based on management 2025 earnings growth guidance.

While these levels represent a premium compared to a peer like Western Union trading at 7 times forward earnings or even PayPal at a forward P/E of 14x, Wise stands out by its ability to generate higher margins given its focus on highly profitable cross-border transfers.

In our opinion, the company’s ability to consolidate market share and generate profitable growth as it expands its global footprint can support a higher premium.

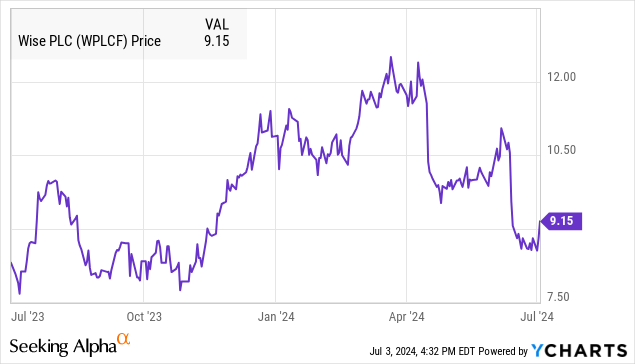

WISE Stock Price Forecast

From the stock price chart for WPLCF, we highlight that the stock is up around 15% in the past year but also volatile, currently down about 26% from its 52-week high. It appears the $8.50 stock price level represents an area of technical support that shares need to hold to maintain the longer-running uptrend.

On the upside, the potential that shares reclaim their high from April above $12.00 can offer a 30% return potential assuming a sustained rally going forward. A solid company update to kick off fiscal 2025 could go a long way to bring back renewed bullish sentiment.

Final Thoughts

We are bullish on WISE considering the recent share price weakness as a buy-the-dip opportunity.

In terms of risks, keep in mind that the operating environment remains exposed to global macro conditions. A deterioration of financial markets or liquidity could undermine transaction volumes. Weaker-than-expected results over the next few quarters would force a reassessment of the earnings outlook.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.