Twilio’s foray into the shopper information (CDP) enterprise might be heading for an early conclusion. The previous startup affords communications software program companies through APIs, and lately expanded its product footprint by means of the acquisition of firms like Phase, which added CDP capabilities to its bigger portfolio.

Now, within the wake of the corporate’s development slowing to a near halt in late 2023 and the exit of its founding CEO Jeff Lawson, Twilio is executing “an extensive operational review” of the asset, in line with its latest earnings name. Requested by an analyst if the overview might lead to a sale, the corporate confused that Phase has strategic worth, however that it’s approaching its overview of the enterprise “with an open mind.” That doesn’t essentially bode nicely for Phase to stay a part of the corporate for much longer.

Over the past quarters of Lawson’s tenure atop the corporate, Twilio got here beneath strain from activist traders Anson Funds and Legion Capital to divest assets to bolster shareholder worth. Twilio’s personal share value soared to greater than $400 per share in 2021 earlier than falling to $72.27 Wednesday earlier than the corporate shared its fourth-quarter efficiency. The inventory value was off one other 15% on Thursday to $61.15 per share, suggesting that traders weren’t thrilled with the report.

Whether or not Twilio will really promote Phase is an open query proper now, but when it does, activists are betting that it’s going to enhance the worth of the father or mother firm by specializing in its core communications enterprise.

Twilio’s historical past with Phase

When activist traders begin circling an organization, one CEO who went by means of the expertise stated that the very first thing to do is to determine if perhaps they’re proper, or a minimum of partly proper, of their evaluation. That takes a capability to step again and see what they’re complaining about.

On this case, it’s a couple of massive acquisition and whether or not it was the most effective place to place sources. Ah, however hindsight is at all times 20/20, isn’t it, particularly on this case. Assume again to October 2020 once we had been on the peak of the pandemic, and Twilio was flush with a wholesome market cap of over $40 billion. With all that worth and an eye fixed towards increasing its market, Twilio went out and spent $3.2 billion to acquire Segment.

Phase was a high-flying startup that raised over $283 million. Its final spherical in 2019, a 12 months earlier than the acquisition, was a $175 million Collection D at a $1.5 billion post-money valuation, per PitchBook. It was additionally a time the place firms had been actually starting to grasp the worth of buyer information by bringing it right into a single view, and Phase was one of many prime startups going after giant incumbents like Salesforce and Adobe.

But it surely was honest to ask, even on the time, the place Phase would match inside an organization the place the core enterprise was constructing communications APIs. The consensus was that Twilio needed to assist prospects construct data-fueled customer-centric functions to reap the benefits of the information saved within the Phase CDP to supply a brand new development path for the corporate.

It felt like that development path was in attain, a option to increase the corporate’s markets past the communications APIs enterprise. It really made sense till the market shifted fairly dramatically post-pandemic and Twilio’s inventory value plunged.

With its market cap dropping, Twilio was left with an asset that wasn’t actually pulling its weight, making it susceptible to activist investor complaints about the place it matches within the enterprise. The query is whether or not activists are placing the corporate in an unimaginable place.

What’s Phase price?

In its most up-to-date earnings report, Twilio moved its “Flex and Marketing Campaigns products” to its Communications line of enterprise, leaving its former Information and Purposes unit a lot slimmed and now working beneath the Phase identify. It additionally contains some non-Phase efforts, like the corporate’s Interact merchandise.

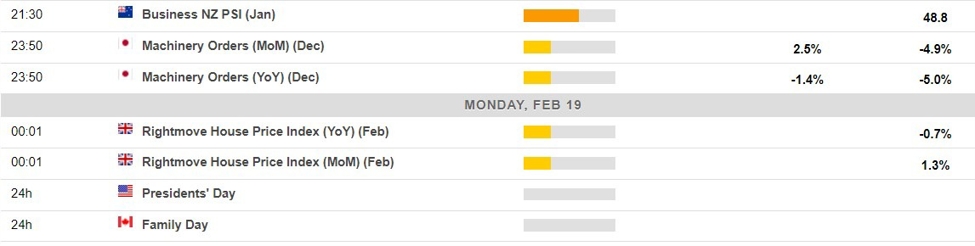

In accordance to Twilio, its Phase unit generated $75 million price of income in This autumn 2023, up 4% from a $73 million end result within the year-ago quarter. Its gross margin slipped 80 foundation factors to 74.4%, posted a non-GAAP working margin of –24.6% and noticed its dollar-based internet enlargement charge enhance by 2% to 96% in comparison with its This autumn 2022 metrics.

In less complicated phrases, Phase will not be rising a lot, is seeing its income high quality decline barely, and continues to be seeing spend from current prospects contract. (Twilio took a cost regarding Phase in its most up-to-date quarter: $286 million concerning “developed technology and customer relationship intangible assets,” which it added didn’t embody any of Phase’s “reporting unit goodwill.”)

Given Phase’s recognized underperformance — in its earnings call, Twilio’s new CEO Khozema Shipchandler stated that Phase is “not performing at the level it needs to,” including later that its most important precedence is “mitigating churn and contraction” — and a extra conservative marketplace for tech valuations at current in comparison with late 2020, it’s uncertain that Twilio might hope to get the $3.2 billion it spent on the company again in a sale. This attitude has been floating around since even earlier than the corporate better-surfaced Phase’s metrics. Now with extra information, we will be extra exact.

Phase’s enterprise unit at Twilio generated $295 million price of income in 2023, up 7% year-over-year. If we anticipate that Phase will handle the identical development this 12 months, the enterprise unit would shut 2024 with about $316 million in income.

With that development charge in hand, Phase would seemingly be valued equally to different, slowly rising software program companies. Market information analyzed by Altimeter’s Jamin Ball indicates that software program firms which might be rising at 15% or much less per 12 months are price about 4.4x their subsequent 12 months’ income. At that a number of, Phase is price about $1.4 billion.

You can argue that even that determine is a bit wealthy, on condition that Phase has stiffly adverse working margins, even on an adjusted foundation. Some firms in its development bucket have higher profitability ratios, so we’d anticipate Phase to earn a a number of in a sale that was barely decrease than the median determine that Ball calculated.

On the similar time, the worth of Phase gained’t essentially be measured straight from its potential public-market price. If a purchaser will be discovered that has a selected want or use for what Phase affords, Twilio would possibly be capable of juice a light-weight premium. However irrespective of whether or not you regulate up or down, Phase’s development charge and income base give it a light-unicorn worth by present metrics, and nothing near what it bought for.

It was simpler to worth software program companies at greater ranges when development was sooner and cash cheaper. Certainly, when the deal was covered by TechCrunch, we famous that by then-current norms it didn’t appear too costly. Phase was additionally rising at greater than 50% on the time, a determine that has dramatically come down within the intervening years. Regardless of, it’s exhausting to purchase an organization when software program income multiples are within the excessive teenagers, see it decelerate, after which attempt to get your a refund when single-digit multiples are the norm.

Aside from valuation dickering, one other $1.4 billion in money would possibly probably not change the sport for Twilio. The corporate is price round $11 billion immediately, has greater than $4 billion in money and equivalents, and beneath $1 billion price of debt. So with additional cash, it might extinguish debt and bolster its share buyback program, however the cash doesn’t appear transformative for the father or mother org, on condition that it’s cash-rich and debt-light.

That is the conundrum: Buyers need motion and information that would bolster Twilio’s share value. They’ve lobbied for Phase to be bought off to assist enhance the worth of their holdings. However Phase is simply so beneficial immediately, and the corporate is caught deciding between potential strategic features from retaining one foot within the realm of CDP and divesting an asset at a loss that might see its income base erode. That’s a troublesome spot to be in.