In a watershed second for the cryptocurrency world, the US Securities and Trade Fee (SEC) on Wednesday greenlit the first-ever spot Bitcoin ETF, granting buyers direct entry to the world’s largest digital asset by regulated monetary devices.

Nonetheless, the SEC’s approval was delivered with a dose of warning, highlighting the company’s continued issues in regards to the nascent cryptocurrency market.

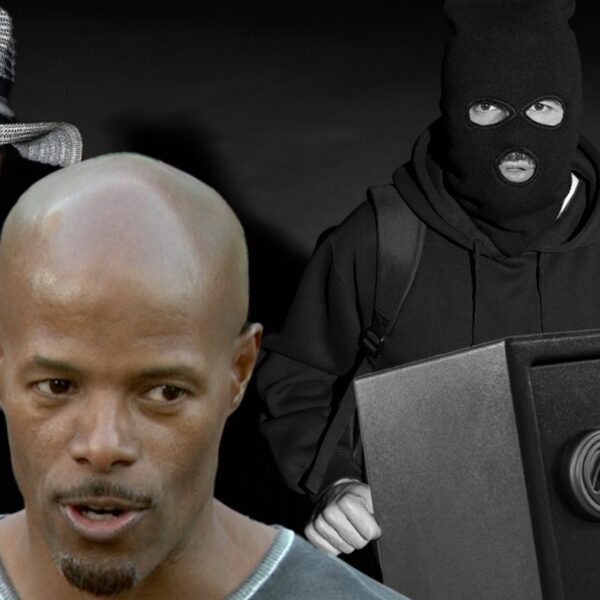

SEC Chair Gary Gensler acknowledged the importance of the choice, calling it “a new chapter” for Bitcoin, however he swiftly distanced the company from any endorsement of the cryptocurrency itself.

Ark’s Wooden Condemns SEC Chair

These funds ought to supply extra choices for buyers who need publicity to Bitcoin, however buyers have to take care, Gensler warned, citing the “highly volatile and speculative nature” of Bitcoin and different crypto belongings.

The cautious tone underscored the SEC’s balancing act – offering entry to new funding avenues whereas safeguarding buyers from potential dangers.

SEC Chair Gary Gensler. Picture: The Monetary Expertise Report

This stance drew blended reactions.

Cathie Wooden, founding father of Ark Funding Administration and a vocal Bitcoin proponent, welcomed the approval however criticized Gensler’s remarks, calling them a traditional instance of how the established system usually reacts to disruptive innovation.

Wooden stated in a Bloomberg Radio interview aired on X:

“He just denigrated the whole crypto space. I couldn’t believe it.”

The Ark huge boss added:

“This is par for the course in disruptive innovation.”

Wooden, whose Ark Make investments 21Shares Bitcoin ETF was additionally authorized, expressed optimism in regards to the long-term potential of this new chapter for Bitcoin.

Whereas the fast impression on Bitcoin’s worth was modest, with a brief bump to $47,000, the long-term implications of the ETF approval are vital.

BTC market cap at present at $913.167 billion. Chart: TradingView.com

With conventional monetary establishments now holding the inexperienced mild to spend money on Bitcoin, the floodgates may open for a wave of institutional capital getting into the crypto market. This inflow may doubtlessly stabilize Bitcoin’s worth and bolster its legitimacy as a mainstream asset class.

Bitcoin ETF Launch Raises Regulatory Uncertainties

Nonetheless, uncertainties stay. The success of those ETFs will hinge on their skill to draw substantial investor funds. Moreover, the SEC’s cautious method, with its stringent custody necessities and potential for future regulatory tweaks, may deter some establishments from venturing into the crypto house.

The launch of the Bitcoin ETFs is simply step one in what guarantees to be an extended journey for digital belongings and their integration into the normal monetary system.

The SEC’s choice units a precedent for future innovation within the crypto market, nevertheless it additionally serves as a reminder of the regulatory hurdles and investor safeguards that may have to be addressed as this new asset class evolves.

As Cathie Wooden aptly acknowledged:

“It’s the old DNA basically bashing the new DNA.”

Wooden underlined that establishments ought to “work through” the brand new framework extra totally due to the SEC’s “trepidation” over it.

Featured picture from The Inside Investor