AzmanL

Abstract

Following my coverage of Workday, Inc. (NASDAQ:WDAY), I really useful a maintain score as I didn’t see any enticing upside to the share value. Actuality has confirmed in any other case, because the inventory went as much as $276. This put up is to present an replace on my ideas on the enterprise and inventory. I’m revising my score from maintain to purchase as I turned extra bullish on WDAY’s skill to speed up development in FY25. As WDAY reveals that development can speed up again to twenty%, I anticipate the market to re-rate valuation upwards because the WDAY development narrative is again on the desk.

Funding thesis

Beginning with WDAY 3Q24 financial results, income got here 100bps forward of my FY24 development estimate, with power seen in each Skilled Companies and Subscription income. WDAY additionally continued to indicate margin enlargement with its EBIT margin increasing by 500bps to 25%. FCF margin additionally regained its 21% stage (just like 3Q23) after a 100bps enlargement from 2Q24.

WDAY 3Q24 outcomes had been nice, and I feel there’s a good chance that development can speed up from right here. Particularly, WDAY disclosed very constructive, forward-looking development metrics which are pushing me to imagine development can speed up sooner than I anticipated. As an illustration, the 12-month subscription backlog grew 22% y/y, which was an acceleration from the 21% development seen in 2Q24. It was additionally talked about by administration that the macro has remained steady, neither bettering nor worsening in comparison with earlier quarters. This clearly appears like stabilization to me, which is a constructive because the macro situation was evidently destructive for almost all of CY2023. Inside WDAY, I feel there may be additionally compelling proof that implies companies are selecting up on spending their IT price range. Administration emphasised in the course of the name the broad power of internet new offers and its present buyer base, which incorporates massive and medium-sized companies in addition to areas, particularly the US and EMEA. Particularly concerning net-new offers, administration talked about that new full-platform wins are growing and that win charges are staying robust. Additionally they shared that Workday now has greater than 5,000 core HCM prospects.

WDAY’s development power was not restricted to the home market; they’ve additionally discovered additional success within the worldwide market, particularly in EMEA. For reference, worldwide income grew 17% to $462 million, making it 25% of whole income. This development was an acceleration from the 15% seen in 2Q24, and importantly, EMEA has surpassed $1 million in ARR [annual recurring revenue]. Whereas EMEA was within the highlight, development momentum was seen in different nations as effectively, just like the UK, Germany, France, and Spain. Wanting forward, I anticipate WDAY’s worldwide area to develop into a bigger development driver and in addition a extra predictable one. Each of those will stem from the improved gross sales crew and go-to-market technique that administration is imposing. The implication of the success in worldwide development is that it extends the expansion runway of WDAY, as worldwide is 50% of WDAY’s TAM. Over the course of WDAY’s historical past as a public firm, most of its income has come from the states, and development has actually decelerated over time because the trade has matured and in addition as a result of the WDAY income base is so much bigger immediately. Therefore, for development to speed up, efficiently penetrating the worldwide market is significant.

We mentioned with you at our Monetary Analyst Day. Beginning with worldwide, which represents over half our addressable alternative. In EMEA, I am happy to say that our management additions are driving improved and extra constant outcomes. 3Q24 earnings results call

Lastly, I feel the elevated utilization of AI is a long-term development driver for WDAY. WDAY, as a platform, has entry to an unlimited quantity of knowledge from numerous capabilities (payroll, attendance, basic ledger, and so on.). This places WDAY in the most effective place to return out with AI choices that may enhance effectivity and be correct. Importantly, WDAY is ready to leverage AI to enhance its worth proposition to managers and builders. For instance,

- For managers: WDAY leverages AI to assist managers higher determine expertise throughout the group and assemble a crew for the best undertaking. WDAY can do that as a result of it already has all the required information concerning the staff within the group.

- For builders: WDAY leverages AI to scale back the necessity for coding. This dramatically reduces the complexity of constructing apps, which additionally means sooner deployment time.

As WDAY will increase its worth proposition, I feel it’s pure that its win charges will enhance accordingly, accelerating development.

Valuation

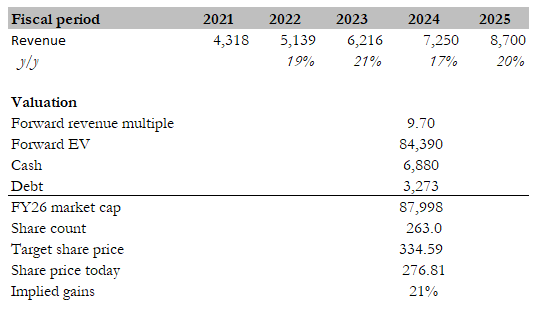

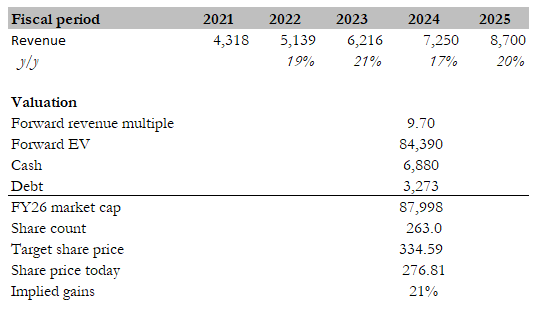

Personal calculation

My goal value for WDAY, primarily based on my mannequin, is $334. My mannequin assumptions are that WDAY will obtain administration FY24 income steering (17% development) and see development speed up again to twenty% in FY25. The rationale for utilizing administration steering in FY24 is because of two causes. Firstly, the steering was given in December (administration has 4 weeks of knowledge already). Secondly, administration has a superb monitor report of assembly income steering for the previous 10 years (solely lacking as soon as in 4Q21). For FY25, I’ve a stronger development assumption as

- I imagine underlying companies are beginning to deploy extra IT budgets (as seen from WDAY profitable extra offers);

- The worldwide phase, which is rising sooner than the home phase, will develop into a bigger development contributor because it turns into a bigger a part of the enterprise.

- WDAY’s AI product will result in enhancements in win charges.

In my view, a big a part of why the WDAY valuation has been detracting is as a result of its development has been decelerating and the market is anxious that it’ll proceed to take action. Therefore, if WDAY is ready to obtain what I anticipate, I imagine the market will rerate WDAY ahead income multiples upwards because the WDAY development narrative is again on the desk. I’m modeling WDAY to commerce again to its historic common of 9.7x.

Dangers

The area that WDAY is competing in may be very aggressive, with a variety of deep-pocketed opponents like Oracle and SAP. These gamers have a variety of connections and distribution companions that they will leverage to compete towards WDAY. Whereas I’m constructive that WDAY is a pacesetter amongst the pack, irrational competitors by any of those massive gamers might trigger volatility in WDAY’s development trajectory. Competitors apart, if the macro circumstances proceed to worsen from right here, I’m afraid that underlying companies will do one other spherical of IT price range cuts, which is able to affect WDAY development.

Conclusion

In conclusion, I’m revising my suggestion on WDAY from maintain to purchase. WDAY’s 3Q24 outcomes, working metrics, and administration feedback have led me to be extra bullish about WDAY’s development prospect in FY25. As an illustration, 12-month subscription backlog development accelerated to 22% and WDAY proceed to see robust worldwide success. Moreover, the long-term potential of AI integration enhances the platform’s worth proposition, which I anticipate to boost WDAY’s win charges.