The answer to the issue appears easy: Convert these unused workplace areas into residential items. Simple repair, proper? Not a lot, consultants say.

Workplace-to-residential conversions will be extremely sophisticated—and extremely costly. Certainly, a Goldman Sachs report launched this week says workplace acquisition costs would wish to fall practically 50% for these initiatives to be “financially feasible.”

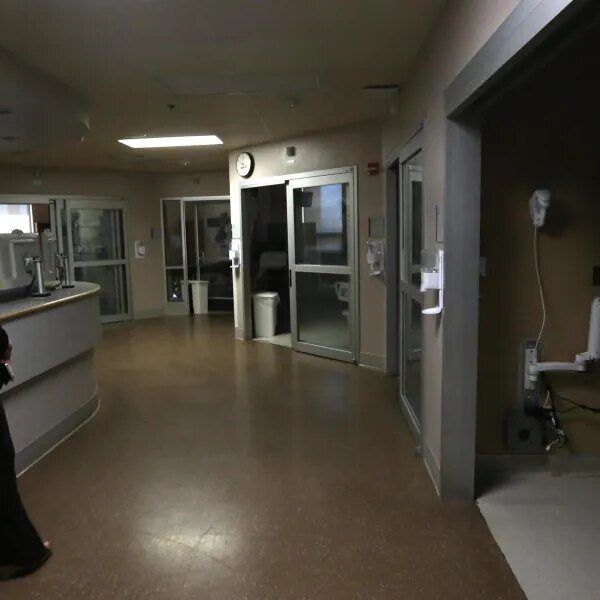

Though the urge for food for workplace area is so low that there could also be as a lot as 1 billion sq. ft of unused U.S. workplace area by the tip of the last decade, per Cushman & Wakefield, so few of these workplace areas would truly work out as a residential property, whether or not as a result of age of the constructing, value, or redevelopment challenges. Merely, it might be too troublesome to transform sure buildings as a result of zoning restrictions and structure.

“Not all buildings can be easily modified for residential use, and even for the ones that can, it can take years of planning and significant costs to complete,” John Walkup, co-founder of actual property data-analytics firm UrbanDigs, tells Fortune. “In short, the incentive for conversion is only realized at the end of a long process filled with risks that new ground-up buildings don’t really experience.”

Goldman Sachs defines a “nonviable” workplace area as one in a suburban space or central enterprise district constructed earlier than 1990, has not had renovations since 2000, and has a emptiness charge larger than 30%. “Nonviable” workplace areas are literally those which might be extra doubtless to achieve success as a conversion property as a result of buildings have to be virtually fully vacant. By Goldman Sachs’ calculations, changing a nonviable workplace that’s priced on the present degree will lead to a $164 loss per sq. foot—which means workplace costs would wish to drop 50% “for the cost to be fully covered by the stream of discounted future revenues.”

In different phrases, builders gained’t recoup their investments in conversion initiatives except costs drop.

“In addition to zoning and other regulations, conversions can be very expensive and must overcome structural and financial challenges,” Ran Eliasaf, founding father of actual property non-public fairness agency Northwind Group, tells Fortune. “Often, it’s far less expensive to build housing from scratch and only certain kinds of buildings can be converted successfully.”

Workplace-to-apartment conversions are a ‘fringe trend at best’

Regardless of the excessive prices and lengthy runway for office-to-residential conversions to occur, some are nonetheless getting off the bottom. A Deloitte study launched in July 2023 discovered 217 conversion projects within the quick pipeline for completion. Whereas there have been indicators of a “conversion wave” within the quick post-pandemic period (2021-2022), Moody’s Analytics reported in its 2022 study “Why Office-to-Apartment Conversions are Likely a Fringe Trend at Best” that “it’s much easier to theorize about office-to-residential conversions than to execute and profit on them.”

Earlier than the pandemic, solely about 0.4% of workplace area was transformed to multifamily area per yr, which elevated to only 0.5% in 2023, based on Goldman Sachs. At this tempo, it is going to take one other eight years to transform the 4% of places of work they deem nonviable. In some instances, it may be simpler, cheaper, and faster to only construct fully new condominium buildings.

Components that play into office-to-residential conversions

The principle elements at play when contemplating office-to-residential conversion initiatives embody current constructing infrastructure, value, zoning, and authorities help, Richard Whitney, vp of structure, inside design, and sustainability agency FitzGerald, tells Fortune. Whitney’s agency has accomplished greater than 100 conversions and renovations to historic buildings, and has a number of elements to think about earlier than beginning a challenge.

Architects at FitzGerald have to think about the ground plate measurement of the constructing—or the quantity of usable sq. footage of the ground of a constructing. That is crucial as a result of it helps the agency outline whether or not they can design a flooring plan that can present sufficient mild and air flow to every unit to fulfill constructing codes. That is solely made harder once they don’t have entry to unique drawings or flooring plans of the constructing. Plus, designers should assume that current HVAC, electrical, and plumbing techniques must get replaced—particularly if the constructing is older.

“The unknown factors of historic buildings can make some people hesitant to pursue these kinds of conversions,” Whitney says. “If we cannot locate the original drawings, it can be more difficult to determine how the building was built, and we might uncover hidden challenges down the line. It is something to factor into the conversation.”

Authorities incentives

In late October 2023, the White Home launched a multi-agency effort to encourage states and cities to convert empty office buildings to apartments, with Transportation Secretary Pete Buttigeg saying there could be “over $35 billion in lending capacity” to offer below-market charge loans to finance housing development and conversions close to transportation hubs.

Such a authorities involvement in office-to-residential conversions is “critical,” Whitney says.

“Construction costs are high and real-estate developers are facing tremendous struggles with financing,” Whitney says. “These projects are much more likely to ‘pencil out’ if city governments are creating incentives and subsidies to help with the costs.”

Some cities, together with Boston, have began providing their very own incentives for office-to-residential conversion initiatives. Final summer time, the city announced a program that waives as much as 75% of property taxes for as much as 29 years, with objectives to create extra downtown housing items in Boston and “more consistent foot traffic throughout the week to support downtown businesses.”

“Through this conversion program, we seek to incentivize lenders, property owners, downtown stakeholders, and the state to partner with the city to increase the production of much needed housing in our downtown core,” Arthur Jemison, the town of Boston’s chief of planning, stated in an announcement.

These kind of incentives will “go a long way” in bringing extra inexpensive housing to cities, Whitney says. Plus, established packages like this may help streamline approval processes, shortening completion occasions.

“The sooner that a project can move forward, the more likelihood it has to be successful,” Whitney says. “Protracted approval processes can be a huge drag on conversion projects.”