narvikk

Funding Thesis

World Ship Lease (NYSE:GSL) not too long ago reported This fall 2023 earnings. Its income of $178.89 million beat expectations and was up 8.4% yr over yr. It declared a $0.375 dividend ($1.50 annualized, 7 p.c yield) as anticipated. With a pointy give attention to the intermediate-size container ship section, GSL gives shareholders steady dividend funds utilizing its sturdy money flows and lengthy contract period.

The caveat is its ageing fleet, which can attain a mean age of 20 years in 2026 if GSL does nothing. Its fleet has been getting older yearly since a competitor’s then-young fleet was merged into GSL in 2018. Whereas retrofits are potential, if GSL can’t renew its fleet, it might lose out to its rivals. In any case, this situation lies sooner or later and is at the very least years away. Consequently, GSL is a transparent purchase at this level.

Firm Overview

GSL is a containership lessor (tonnage supplier), controlling 68 ships, starting from feeders of about 2,200 TEU to bigger vessels of about 11,000 TEU. Its focus is “high-reefer, mid-size & smaller containerships” (present investor presentation, p. 11). The enterprise mannequin is straightforward: chartering out its vessels to the numerous liner gamers on fixed-rate time charters. GSL is integrated within the Marshall Islands and has been listed on the NYSE since 2008.

Throughout the increase years of 2021-2022, it firmly centered on signing multi-year time charters at traditionally excessive charges. This technique rewarded the corporate with wonderful earnings visibility and robust money flows, that are set to proceed effectively into 2025 and 2026.

Steady and Competent Administration

GSL’s CEO for 16 years, Ian Webber, not too long ago introduced his retirement and was succeeded by Chief Business Officer Thomas J. Lister in what seems to be an orderly transition. Mr. Webber was an skilled chief, beforehand a PwC associate and serving as CFO and director of CP Ships Restricted, based on GSL’s web site. Mr. Webber and Mr. Lister have been with GSL since its founding in 2007, and the previous will proceed being with GSL however now serve on the board. The remainder of the administration crew has been with GSL since 2018. All in all, the hallmarks of steady and competent administration.

GSL Reveals Transparency With Associated Celebration Transactions

George Youroukos. That is the identify of:

- GSL’s government chairman,

- one among its largest shareholders, controlling 5.9% of the corporate (2022 20-F, p. 73)

- one of many house owners of Technomar Transport, GSL’s technical supervisor, and

- the only proprietor of ConChart, GSL’s business supervisor.

Mr. Youroukos started his profession in delivery in 1993 and has since been concerned in additional than 270 vessel transactions, based on GSL’s web site. He holds a Grasp’s in Engineering from Brunel College and based Technomar in 1994.

After all, a hands-on and lively proprietor concerned in technical and business companions of a tonnage supplier isn’t uncommon. Different examples embody the Pittas household, which owns almost 60 p.c of Nasdaq-listed feeder tonnage supplier Euroseas (ESEA) by means of varied entities. John Fredriksen’s portfolio of delivery firms shares technical administration providers. His funding automobiles are vital shareholders within the portfolio firms.

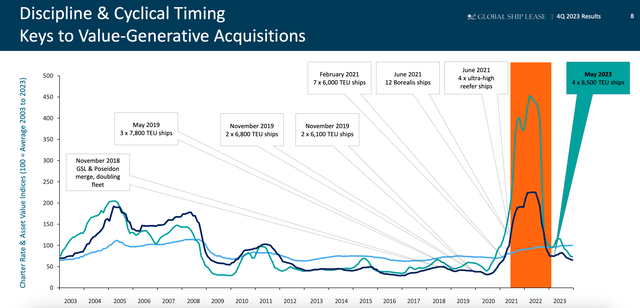

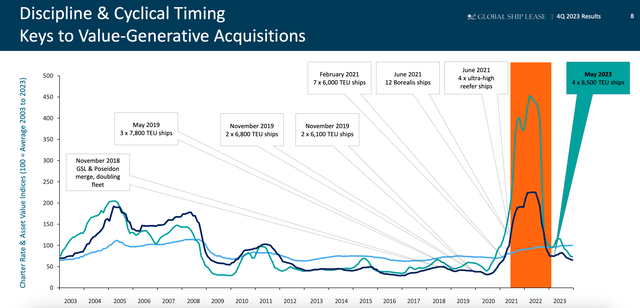

GSL’s Fleet Renewal Technique: Shopping for Previous Ships With An Present Contract

Judging by GSL’s acquisition exercise prior to now few years, its fleet alternative technique is about one thing aside from contracting new ships from yards. As an alternative, it purchases used vessels with present contract protection hooked up. Typically, these vessels are near coming into an age when scrapping may very well be an alternate. In Q3 of 2023, GSL acquired four 8,500 TEU post-panamax ships in-built 2003 and 2004. In accordance with the supply, they got here with two-year charters at $26,000/day. This buy follows GSL’s technique of buying used vessels with present contract cowl:

Fleet additions and charges, 2003-2023 (Present investor presentation, p. 8)

Think about the desk beneath, displaying its fleet common age (TEU-weighted) by year-end for the previous seven years.

| Yr | Common age of fleet (TEU-weighted) | Variety of ships within the fleet |

| 2023 | 17.3 *) | 68 |

| 2022 | 15.9 | 65 |

| 2021 | 14.9 | 65 |

| 2020 | 13.7 | 43 |

| 2019 | 12.5 | 43 |

| 2018 | 11.0 | 38 |

| 2017 | 13.0 | 18 |

All figures pulled from the annual 20-F. *) The 2023 common age determine was calculated by the writer utilizing out there knowledge from GSL’s fleet overview web page on its web site. Each vessel was assumed to be delivered in the midst of the yr (June 15)

Discover a sample? The fleet retains getting older.

The final time the fleet decreased its common age was in 2018, when GSL merged with Poseidon Transport and took over its 20 ships. If you happen to examine the fleet lists within the 20-F types from 2017 and 2018, you may see that 15 of the 20 latest ships within the 2018 fleet had been added that yr.

This quote from Mr. Youroukos, in a 2022 article, sums up GSL’s technique:

We imagine that this long-term ahead constitution on a vessel that might be approaching 20 years previous [illustrates] {that a} extremely specified and well-maintained older vessel can stay a key contributor effectively into its third decade of operation.”

GSL estimates the helpful lifetime of its ships to be 30 years (2022 20-F, p. 61). Nevertheless, contemplating the adjustments within the regulatory atmosphere, the ship’s helpful life may very well be lower than 30 years, given tougher emissions discount calls for. These rules are beginning to have an effect on all industries, together with delivery, and can get steadily stricter in the course of the 2020s.

Lengthy-Time period Debt: No Refinancing Wants within the Close to-Time period

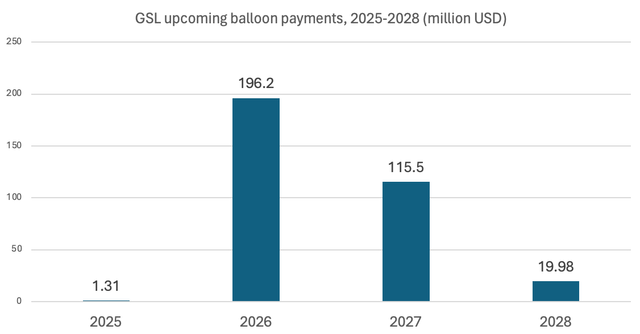

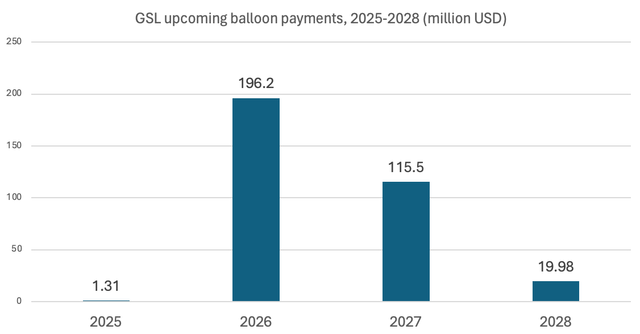

Based mostly on p. 29 in GSL’s present investor presentation, I put collectively the next diagram:

GSL’s upcoming balloon funds, 2025-2028 (Creator’s work based mostly on This fall 2023 investor presentation, p. 28)

As of This fall 2023, GSL had $619.2 million in long-term debt. In different phrases, about 30 p.c of its debt might be due for refinancing in 2026 and a further 18 p.c in 2027.

619 million is decrease than the years prior however nonetheless greater than a few of its friends, corresponding to Danaos (DAC), which have been approaching a web money place. GSL has, as a result of its low rate of interest publicity by means of swaps, had a distinct incentive to de-leverage its enterprise.

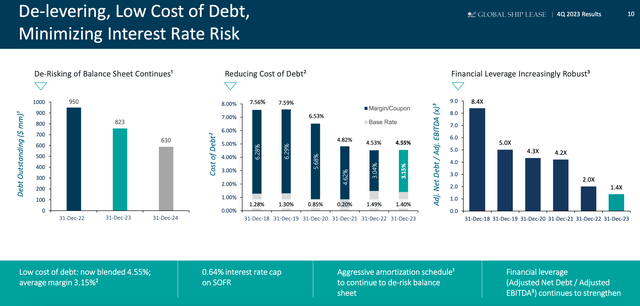

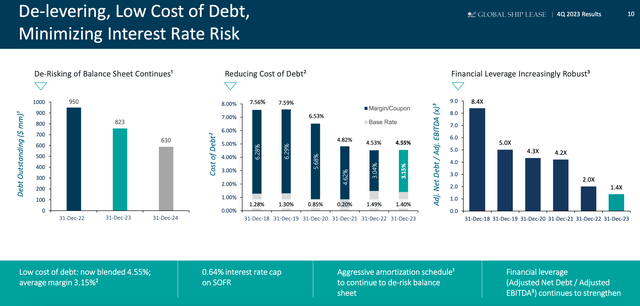

Think about this slide from its This fall 2023 investor presentation:

Leverage and price of debt (GSL This fall 2023 investor presentation)

GSL plans to scale back its gross debt by greater than 20 p.c in 2024. Given its contract cowl and robust money flows, it’s going to seemingly have the ability to take action.

Fundamentals

Inventory Value Efficiency and Returns

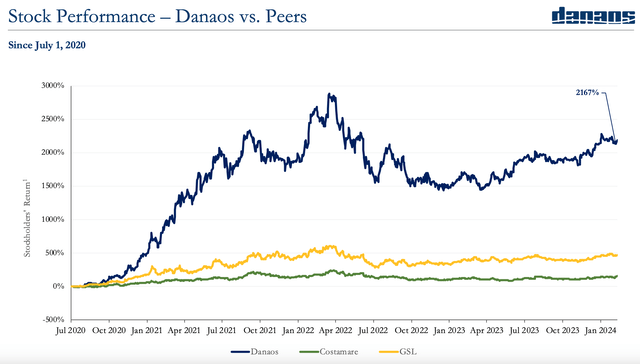

GSL peer DAC exhibits the next slide in its February 2024 investor presentation (p. 45)

GSL, DAC, and CMRE inventory value efficiency, 2020-2024 (DAC investor presentation)

At first look, DAC seems to be outperforming. Wanting extra carefully on the graph, beginning in Q1 2022, one will discover that each one three firms reached an all-time excessive and have but to get well. That makes good sense, contemplating the constitution charges at the moment.

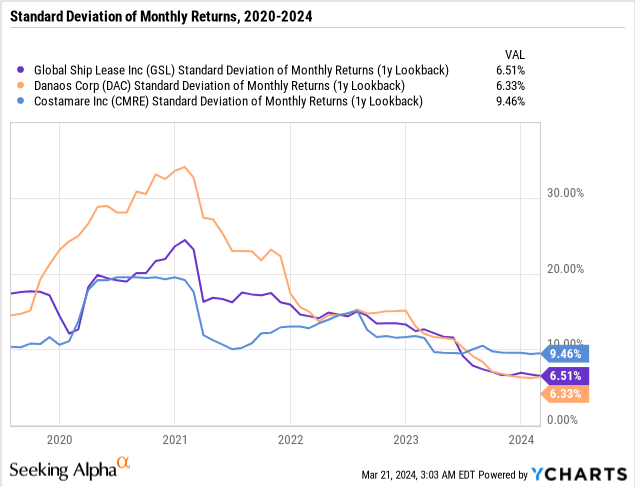

Discover additionally that each one three firms have approached an identical danger profile—as measured by the usual deviation of month-to-month returns—since mid-2022:

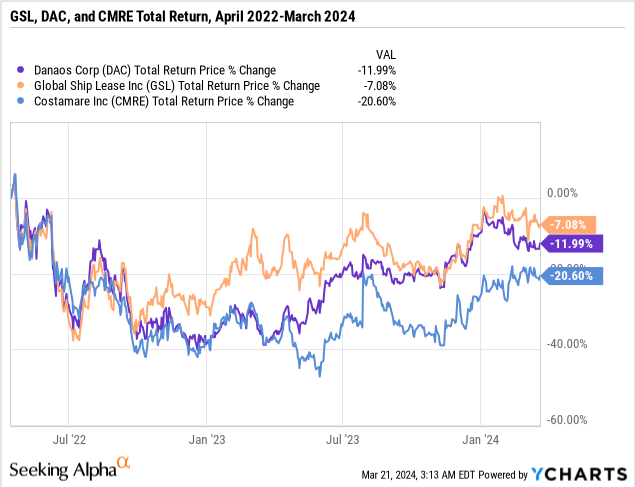

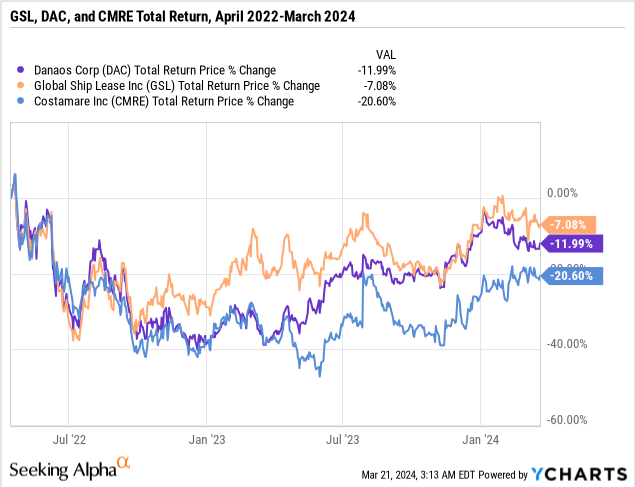

Wanting on the whole return value since in regards to the time constitution charges reached their peak, a a lot completely different image emerges:

Since its peak, GSL has been a barely higher performer, although not by a major quantity. The market views these three firms as broadly related, which is smart given their give attention to securing long-term charters at favorable ranges.

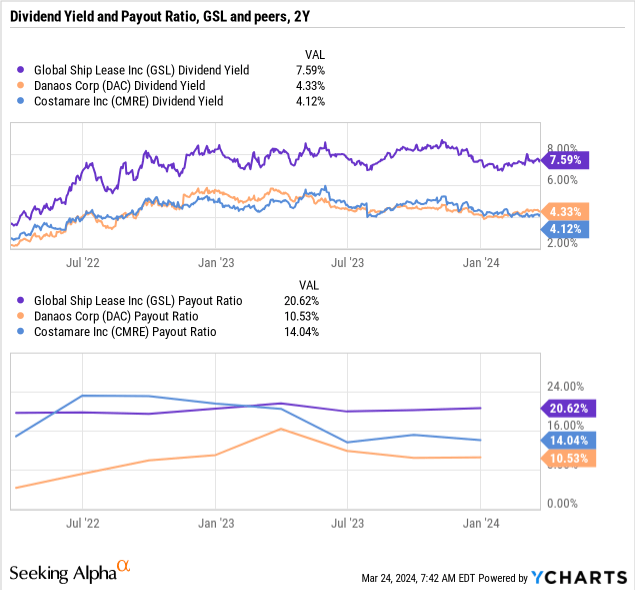

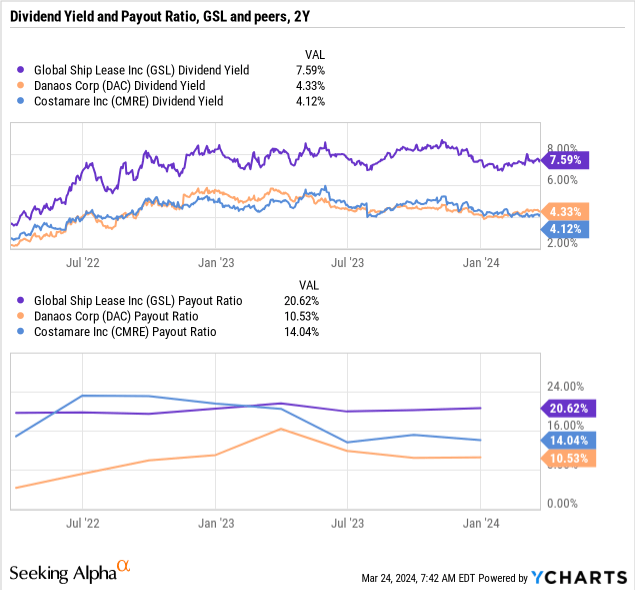

Dividend Yield and Payout Ratio

Let’s examine how GSL’s 7 p.c dividend yield compares to its friends. Its payout ratio of 20 p.c is increased, however given its contract backlog and debt load, it ought to be sustainable.

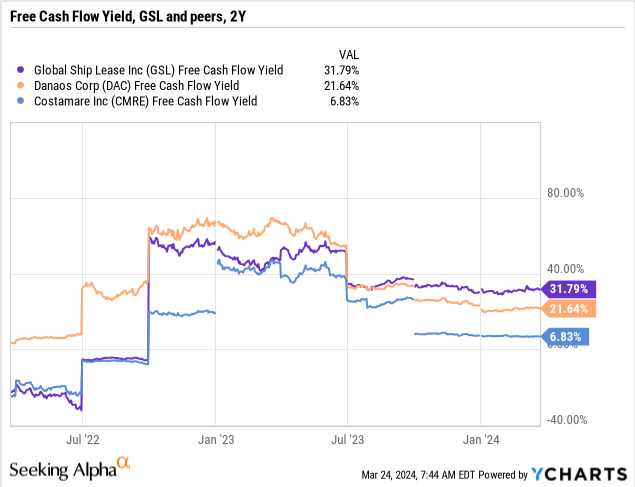

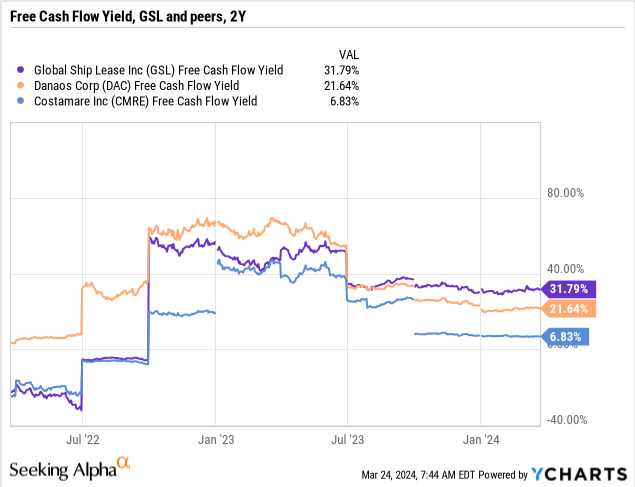

its yield from a distinct perspective, the free money move yield provides one other stage of certainty to its dividend. A FCF yield of round 30 p.c supplies a buffer to its 7 p.c yield. Additionally, in its newest earnings call, the manager chairman assured shareholders:

The sustainability of our $1.5 annualized dividend stays a key precedence and we proceed to be lively within the opportunistic buyback of shares.

EV/EBITDA

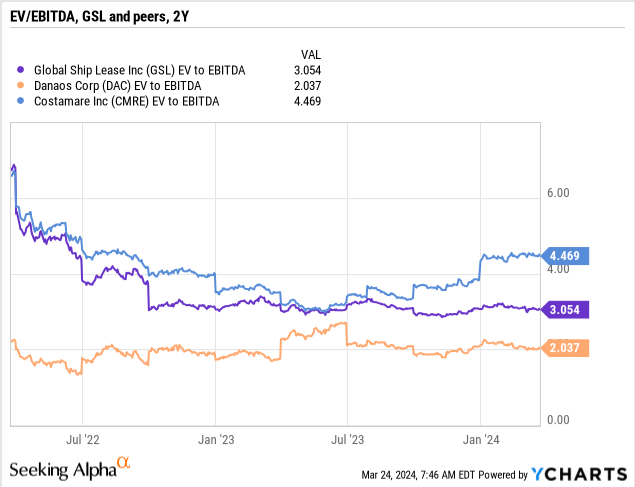

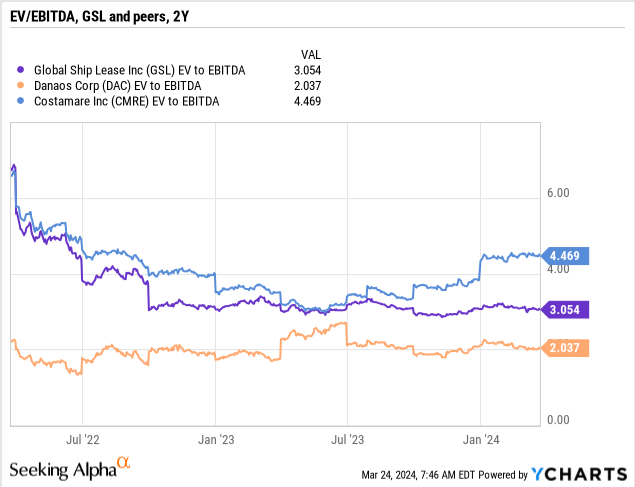

However in the end, the value one pays for a inventory comes down as to if it’s overvalued or undervalued. Measured by EV/EBITDA, GSL is barely dearer however supplies a better yield. Peer CMRE’s current increased valuation could also be because of the bettering dry bulk market (half of CMRE’s whole fleet are dry bulkers).

Dangers

Additional disruptions in maritime chokepoints. Whereas the rerouting of ships across the Cape elevated crusing distances materially, thus absorbing provide out there, it additionally illustrates the unstable nature of immediately’s world. An finish to the wars in Ukraine and Gaza may scale back the crusing distances considerably, successfully growing provide. And, in fact, the conflicts might unfold.

Scrapping exercise will improve lower than anticipated. Throughout the increase years of 2021 and 2022, scrapping exercise in GSL’s segments was decrease because of the earnings house owners might make. With charges nearer to regular, a lot new capability is approaching water.

The ageing fleet turns into too previous. GSL can create good earnings from buying ships out there that have already got present contract protection. As proven above, the age of its fleet has elevated yearly for the reason that Poseidon merge in 2018. In accordance with its present investor presentation, it is usually capable of off-load dangers relating to retrofits associated to environmental regulation: “Capex related to energy-saving and emissions-reducing retrofits (“ESDs”) will be subject to a commercial agreement with charterers on a case-by-case basis (..)”. For instance, LPG and dry bulk market lessors get pleasure from price premiums for his or her newer dual-fuel vessels. GSL might lose out if it retains its fleet renewal technique too lengthy. As an alternative of getting a mature fleet producing stable money flows, it might find yourself with an outdated fleet that the liner firms draw back from.

Market Outlook

In its newest earnings name, GSL reported indicators of optimism from its prospects, saying that ships are being fastened for 12 months, whereas in late 2023, they’d have been fastened for 2-6 months.

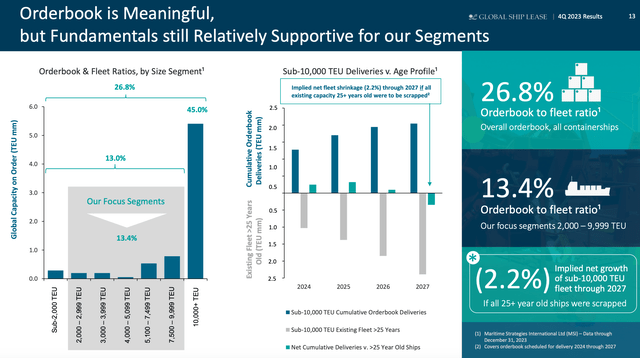

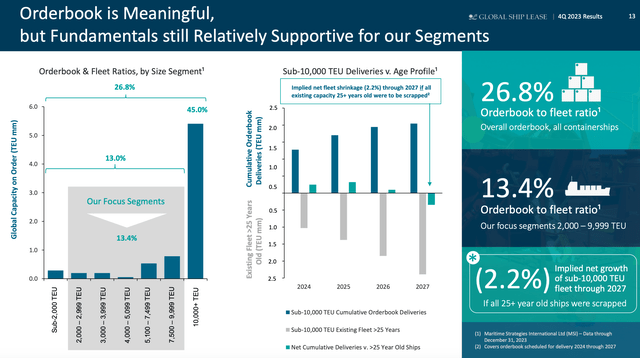

GSL devoted a while to the present order e book in its presentation and earnings name. The order e book to fleet ratio is 13.4 p.c for GSL’s focus segments, a lot decrease than the huge 45 p.c for the mega ships of 10,000 TEU and above. GSL’s principal level is that if all 25+ years previous ships had been to be scrapped yearly from 2024-2027, the sub-10,000 TEU fleet would shrink by 2.2 p.c. GSL doesn’t say how that scrapping schedule would have an effect on its enterprise. As of 2024, GSL has:

- eight vessels delivered in 2000 (can be scrapped in 2025)

- seven vessels delivered in 2001 (can be scrapped in 2026)

- 5 vessels delivered in 2002 (can be scrapped in 2027)

Which means, in 2027, GSL would have scrapped 20 ships, near a 3rd of its fleet.

Order e book outlook (GSL’s present investor presentation)

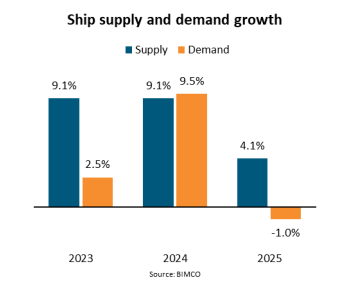

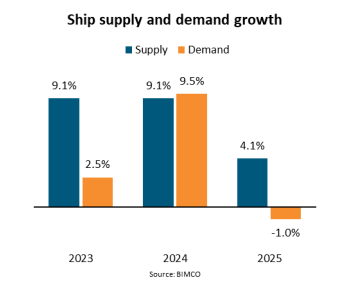

BIMCO’s Q1 report exhibits that whereas demand is forecast to exceed provide this yr, the Pink Sea disruptions are a major contributor to that demand improve – not cargo volumes:

Provide and demand expectations, 2023-2025 (BIMCO)

Nevertheless, based on BIMCO, 75 p.c of this provide progress comes from essentially the most vital segments (12,000 TEU and up). The Pink Sea scenario has additionally prompted house owners to defer scrapping, as much less scrapping is predicted in 2024.

GSL’s lengthy common contract period of two.1 years and staggered expirations restrict its re-contracting danger and publicity to a specific market local weather. In an unsure market, GSL has the luxurious of ready for a while as we advance.

Conclusion

This evaluation has thought of GSL to be an funding for income-oriented buyers. It has proven that whereas GSL’s fleet is ageing, the corporate can generate sturdy money move and dividends in comparison with its friends. With no refinancing danger till 2026 and a contract backlog guaranteeing stable money flows effectively into 2025, GSL’s 7 p.c dividend seems safe. Its contract backlog additionally permits GSL to attend out some present market uncertainty.