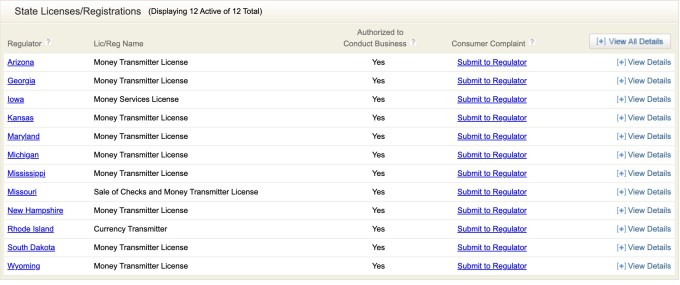

Elon Musk is shifting ahead along with his plans to show the corporate previously often known as Twitter, now known as X, into an “everything app” that features its personal funds system. The corporate in late November was granted three further cash transmitter licenses within the U.S. states of South Dakota (on Nov. 27), Kansas (on Nov. 28), and Wyoming (on Nov. 30), bringing the full variety of states the place the corporate is allowed to interact in cash transfers to 12.

The opposite states the place the corporate had beforehand been granted a cash transmitter license embrace Arizona, Georgia, Iowa, Maryland, Michigan, Mississippi, Missouri, New Hampshire, and Rhode Island. The entire states had been licensed this 12 months, beginning with New Hampshire on June 29.

Arizona, Michigan, and Missouri had been added in July adopted by Georgia, Maryland, and Rhode Island in August, and Iowa and Mississippi in September. The registrations are related to a enterprise named “X Payments LLC,” previously “Twitter Payments LLC,” which is able to function the cash switch operations at X. (The identify of the license could range, however all would enable X to course of funds or transfer cash within the state.)

Musk confirmed the additions in a post on X, in response to an article by The Street which famous the Nov. 27 addition of South Dakota. The Avenue’s reporting indicated the corporate had solely been registered in 10 states, in line with the Nationwide Multistate Licensing System’s database. Now, the database is exhibiting the latest additions, as effectively.

Picture Credit: screenshot of NMLS database

“Progress,” was Musk’s solely touch upon the brand new registrations.

Nonetheless, Musk has beforehand spoken about his plans to morph X right into a funds platform, having earlier detailed his imaginative and prescient for the way forward for the corporate shortly after the acquisition. He has described Twitter, now X, as a spot the place customers would be capable to ship cash to others on the platform, and extract their funds to authenticated financial institution accounts, and maybe later, a high-yield cash market account that may encourage folks to maintain their money in accounts with X. This plan would put X into competitors with PayPal, an organization Musk is crediting with co-founding through its merger along with his X.com. With Twitter, Musk is hoping to as soon as once more full the imaginative and prescient he had for X.com as a disruptor to the prevailing banking system. Whether or not or not that transfer will even contain crypto is but to be decided, however it’s price noting {that a} cash transmitter license can be required if X had been to help cryptocurrencies.

Funds are additionally tied into X’s broader transfer into the creator financial system, the place X customers with a minimum of 500 followers and 5 million natural impressions on their posts over the previous 3 months can turn into eligible for ads revenue sharing.

After all, X’s capability to monetize through adverts has taken a downturn in current days, as an advertiser exodus was prompted by Musk’s endorsement of an antisemitic put up on the platform and stories that manufacturers’ campaigns had been showing subsequent to hate speech. Consequently, X has misplaced a number of bigger advertisers, together with Apple, Disney, IBM, Paramount, Warner Bros., Lionsgate, Comcast/NBCU, Walmart and others. The corporate additionally misplaced a deal with Paris Hilton’s 11:11 Media, which might have seen the celeb tout reside audio, reside video, and reside buying on X. Musk lashed out at Hilton after the deal went south, however the departures might spell hassle for X’s monetization plans, and therefor its creator financial system and funds ambitions.

The corporate stated it could focus on small business advertisers within the close to time period and can also be planning to make Musk’s new AI, Grok, available to X’s paid subscribers as one other income.