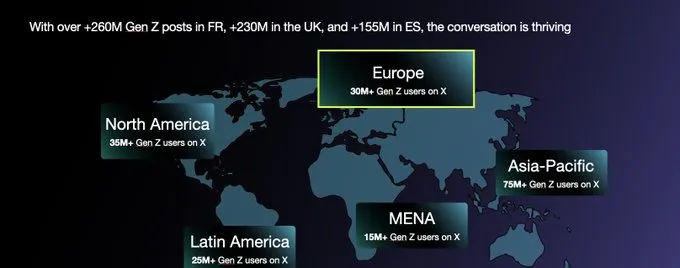

After sharing insights into how younger audiences in the U.S. are engaging in its app earlier in the month, X has now published new research into how European Gen Z users are using the app, and the opportunities for brands to reach this influential consumer group via X ads.

Which seems potentially incorrect, based on X’s EU usage disclosures, but we’ll get to that.

First off, X says that more and more young people in EU are coming to the app.

As per X:

“Gen Z in Europe is not just online, they’re on X, and they’re turning cultural moments into commercial impact. With over 30 million Gen Z users on the platform across Europe – a +37% increase since 2022 — the time for brands to connect is now.”

Okay, to clarify, overall, X has actually been losing active users in Europe, based on its official disclosures.

Under the EU Digital Services Act (DSA), all online platforms with over 45 million users in the region need to share transparency data every six months, which includes total active EU users. And X has reported declines, down from 111 million total users in August 2023, to 106 million at last report (October 2024).

So overall, X has lost around 6% of its total EU audience, based on total reach.

Which conflicts with X’s claim in this report:

“Across Europe, 119.3 million people use X every month – and Gen Z is powering that momentum.”

Again, based on X’s official, publicly reported data, X is currently serving 106 million total EU users. And it’s never been up to 119 million in its DSA reports, so not sure where this info is coming from.

As such, given that the platform has seen an overall decline in EU users, it seems unlikely that X has also seen a 37% increase in Gen Z users within the same period.

Then again, Gen Z is also growing, so that number is inevitably going to go up. But essentially, we don’t really know what these overall growth figures represent, nor how relevant they may be within this context.

Math queries aside, X says that Gen Z users are drawn to X because it’s “fast, raw, and real-time,” and it remains the home of breaking news in many sectors.

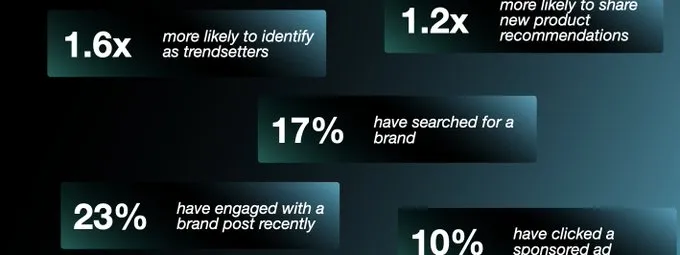

“Gen Z users on X aren’t just present, they’re actively leaned into the topics that matter to them, at significantly higher rates than their peers on other social platforms. For example, they are 22% more likely to express interest in technology compared to non-X users, showing a strong appetite for content around innovation, devices, and digital culture. This makes X a valuable space for brands in the tech sector looking to engage early adopters and digitally native consumers.”

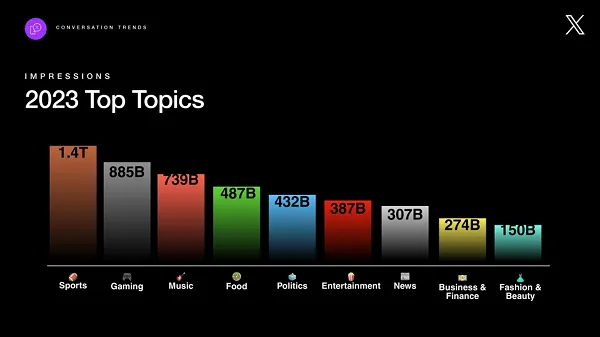

In terms of popular topics, it’ll come as no surprise to learn that gaming and sports are key topics of discussion among younger audiences in the app:

That aligns with X’s previous reports on top topics of conversation, highlighting the enduring value the app provides for users looking to stay up to date in these categories.

X also says that Gen Z users actively engage with fashion content, and are also looking to shop based on X posts.

Finally, X also notes that European Gen Z love video content:

“Gen Z is 1.5x more likely to engage with long-form video on X – and advertisers have a powerful combination: intent + attention.”

So, should X be on your radar if you’re looking to engage with younger audiences?

On balance, I would say that TikTok, Snapchat, and Instagram have more appeal to a broader scope of younger users. But maybe, in certain verticals, X could serve a purpose, in tapping into relevant conversations in certain segments and topics.

But I don’t understand X’s marketing push, and its use of data points that conflict with its own official reporting. That puts all of its claims under a cloud, and I’m not sure how much stock I’d be putting into the data specifics here.

You can check out X’s full EU Gen Z data overview here.