Honestly, I don’t get rich guy math sometimes.

Today, Elon Musk’s xAI announced that it has completed its latest funding round, raising an additional $20 billion, and putting xAI’s valuation up to around $230 billion in total.

As per xAI:

“xAI completed its upsized Series E funding round, exceeding the $15 billion targeted round size, and raised $20 billion. Investors participating in the round include Valor Equity Partners, Stepstone Group, Fidelity Management & Research Company, Qatar Investment Authority, MGX and Baron Capital Group, amongst other key partners. Strategic investors in the round include NVIDIA and Cisco Investments, who continue to support xAI in rapidly scaling our compute infrastructure and buildout of the largest GPU clusters in the world.”

So, somehow, despite not generating much direct revenue as yet, xAI, which owns X the app, is now valued at $230 billion. How, exactly, the company is ever going to live up to that valuation, in terms of intake, remains to be seen, but X’s initial Series E funding round, which was reported back in November, was targeting a $15 billion injection. The demand has superseded that, which would suggest that these investors see a lot more potential than I can, and they likely know a lot more about those opportunities.

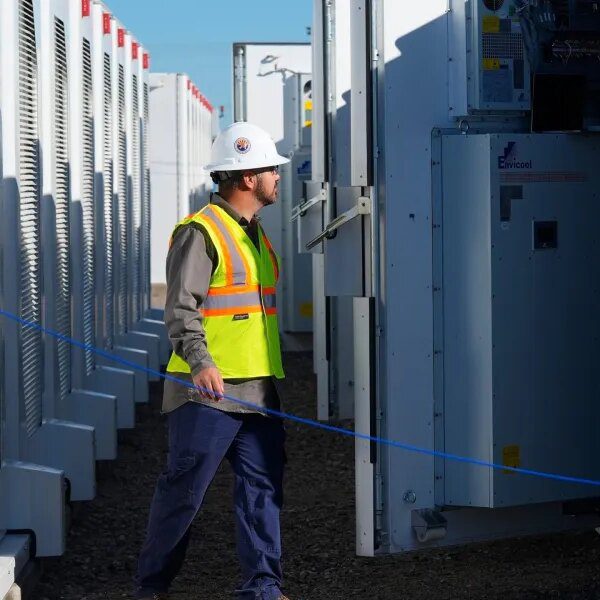

Elon’s AI project, which he launched seemingly in retaliation for being booted out of OpenAI, has burned through billions already, as it’s constructed several massive datacenters in the U.S. xAI now has three datacenter sites, and has rapidly pieced together its AI infrastructure, which is now powered by more than 200,000 Nvidia H100 GPUs.

H100’s are the benchmark hardware unit required for AI development. For context, OpenAI is also reportedly also operating around 200k H100s, while Meta is on track to reach up to 600k H100 capacity.

Elon reportedly has plans to expand xAI’s capacity on this front to 50 million H100 equivalent units within five years, so there is some vision for a much bigger boost to xAI’s operating systems. But right now, xAI is still well behind Meta, and with Zuck and Co. looking to lead the way on AI “superintelligence,” it’s going to be a big challenge for xAI to make real money, as its offerings compete against similar AI options from both Meta and Google in the space.

But clearly, investors believe in Musk’s vision, and the capacity for xAI to win out. That’s also despite the most recent controversies about xAI’s Grok model generating non-consensual nude images of celebrities, and even children in some cases, and despite Elon seemingly falling out with the U.S. government, which could have been a valuable pathway for Grok, in supplying AI infrastructure to power the government sector.

That had seemed like X’s main pathway to viability, but then again, xAI has still signed government contracts since then, while Musk and Trump appear to have made up after their initial spat.

Maybe that’s where the money will come from, in government contracts, but I just don’t see how xAI will ever be able to make enough to justify a $230 billion valuation. It’s possible that the infrastructure projects alone will account for a significant amount, even if xAI falls flat, but realistically, xAI will need to generate upwards of $46 billion per year, in order to meet this valuation.

According to Bloomberg’s reporting back in June, xAI was on track to generate around $500 million in revenue in 2025, which it projected would rise to $2 billion in 2026, through expanded AI access and partnerships.

So, yeah, a long way to go, but clearly, trust in the vision of Elon Musk still carries a lot of weight, while his potential links to the U.S. government could also be a lure for foreign investment.