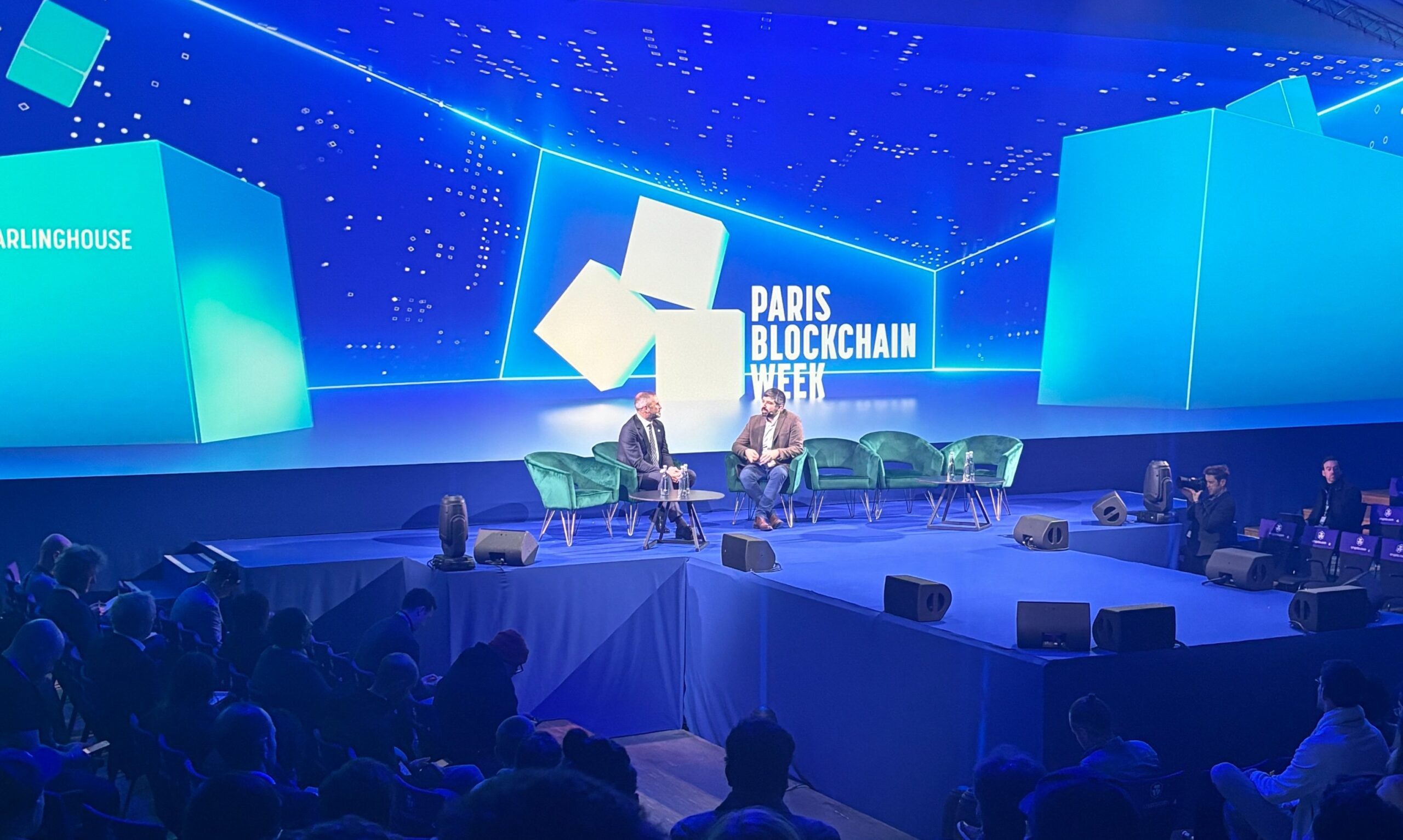

On the current Paris Blockchain Week, working from April Sep 11, Ripple CEO Brad Garlinghouse shared the stage with Xrpl Commons CEO David Bchiri, shedding mild on a variety of matters pertinent to Ripple and the broader XRP ecosystem. Key discussions targeted on the prospect of a spot Change Traded Fund (ETF) in the US, Ripple’s intentions to launch a USD stablecoin later this 12 months, initiatives to increase the neighborhood, and the panorama of crypto regulation.

Solely XRP And Bitcoin Have Regulatory Readability

Garlinghouse, in his speech, emphasised the significance of funding diversification inside the crypto market, saying, “When friends of mine ask me, hey, I want to invest in crypto, how should I do that? I always say invest in a basket. I’m not saying just buy Bitcoin or just XRP. I’m saying you want to invest in a basket and have diversification.”

He highlighted the regulatory readability that XRP enjoys in the US, alongside Bitcoin, as a big issue that units it aside and will pave the best way for future monetary merchandise like an ETF. Whereas Garlinghouse expects altcoin ETFs to be delayed, he’s nonetheless optimistic.

“So look, I think there will be other [US spot] ETFs. Unfortunately, I think it’s going to take a little bit of time because the United States SEC is fighting that,” the Ripple CEO acknowledged. Moreover, Garlinghouse emphasised the distinctive place which XRP has as a result of Ripple’s legal fight with the US Securities and Exchange Commission (SEC):

However I believe one of many issues that individuals don’t totally perceive, they haven’t actually paid consideration to: In the US, there’s solely two cryptos which have regulatory readability — Bitcoin and due to the combat we had on the courts – XRP has regulatory readability that it’s not a safety. And so that’s, I believe it’s completely different, it does matter. To reply your macro level, look, there shall be different ETFs in the US.

The Ripple CEO additionally revealed plans for launching a USD stablecoin later within the 12 months, a transfer that aligns with Ripple’s technique to bolster its presence within the digital funds area whereas adhering to regulatory frameworks. This announcement marks a big step in Ripple’s efforts to increase its suite of choices and tackle the wants of the market.

Beforehand, in a February interview with “Bloomberg Crypto,” Garlinghouse expressed his robust enthusiasm for an XRP ETF, viewing it as a vital evolution for the crypto funding panorama. “I think it only makes sense,” he commented and drew parallels to the early inventory market, the place diversification was essential for funding threat administration.

Garlinghouse advocated for the event of cryptocurrency ETFs, suggesting they’d improve market security and robustness, thereby benefiting the funding neighborhood. “It makes these markets safer. It makes them more robust. And so this is good for the investment community to kind of lean into that,” Garlinghouse remarked.

Regardless of being reticent about particular discussions with main issuers like BlackRock regarding an ETF, Garlinghouse acknowledged the significance of such a monetary product for the neighborhood and Ripple’s function inside this ecosystem. He expressed his robust assist for the thought of an XRP ETF, stating, “We would certainly welcome it. I think it’s inevitable that there’ll be multiple ETFs around different tokens.”

At press time, XRP traded at $0.6169.

Featured picture from X (@bgarlinghouse), chart from TradingView.com