The XRP neighborhood is worried concerning the impending XRP Ledger (XRPL) Automated Cash Maker (AMM), because the initiative would possibly expertise a setback because of the newly launched cryptocurrency guidelines by the USA Securities and Alternate Fee (SEC).

The US SEC New Guidelines Would possibly Hindered The Upcoming XRPL AMM

In an effort to uphold stringent regulation, the US SEC has announced a set of strict guidelines that require a person who offers liquidity to register with the regulator. These embody belongings like cryptocurrencies which can be categorized as securities or authorities securities.

Crypto fans are inquisitive about this and the way it might impression the longer term XRPL AMM platform. As it’s broadly identified that the function will allow XRP holders to generate passive revenue, by way of their position as liquidity suppliers for various belongings on XRPL.

As per the foundations, a particular group of liquidity suppliers on AMM have to be required to register with the SEC. Nonetheless, this is applicable to those that are concerned with belongings considered securities.

Up to now, pro-crypto lawyer lawyer Invoice Morgan has expressed his displeasure with the foundations. Morgan shared his insights on X whereas noting potential adverse results on sure entities that offer liquidity to the market.

Within the X publish, the pro-crypto lawyer was seen questioning the SEC’s emphasis on liquidity availability. He additionally famous the potential disruption that decentralization on this sector might trigger to the current methods.

Morgan additionally identified in one other X post that the change might make the XRPL DEX register as an change or Different Buying and selling system (ATS). It is because the information states that it might be essential for each centralized and decentralized exchanges to register with the SEC as an change or ATS.

Registered Entities To Turn into Self-Regulatory Group (SRO) Member

In line with the company, those that register with the SEC will change into a member of a Self-Regulatory Group (SRO), adhering to regulatory necessities and federal securities legal guidelines.

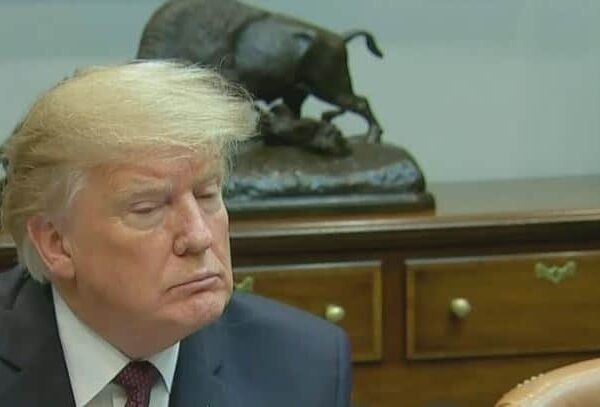

Gary Gensler, the SEC chairman, expressed his pleasure within the developments, noting that they may shield buyers and promote the market. “I am pleased to support this adoption because it requires that firms that act as dealers register with the regulator as dealers, thereby protecting investors as well as promoting market integrity, resiliency, and transparency,” he said.

He added, “Absent an exemption or exception, if anyone trades in a manner consistent with de facto market making, it must register with us as a dealer, consistent with Congress’s intent.”

It’s noteworthy that the SEC made these rules public when it initially launched them in March 2022 whereas making an attempt to incorporate the DeFi sector. Nonetheless, leaders of the crypto area criticized the foundations, saying that they don’t seem to be viable due to the decentralized nature of DeFi protocols.

Regardless of the preliminary clamor, the newest growth factors to the rules being implement. This might current a further issue for centralized exchanges since unclear rules have made it laborious to register with the Fee.

Featured picture from Shutterstock, chart from Tradingview.com