Nigerian fintech Cleva, targeted on making a banking platform for African people and companies to obtain worldwide funds by opening USD accounts, has raised $1.5 million in pre-seed funding.

The spherical was led by 1984 Ventures, an early-stage enterprise capital agency primarily based in San Francisco. Different contributors within the spherical embrace The Raba Partnership, Byld Ventures, FirstCheck Africa, and a number of other angel buyers.

Aaron Michael, a accomplice at 1984 Ventures, expressed assist for Cleva’s founders, Tolu Alabi and Philip Abel, noting that their product gives a method for Africans to navigate hyperinflation challenges, which he describes as an enormous alternative. “The team is uniquely qualified to address this given their experience building banking products at Stripe and robust platforms at AWS. The impressive early growth is a testament to the team’s unique capacity to execute across Africa and the U.S.,” he added.

Y Combinator additionally participated in Cleva’s pre-seed spherical because the fintech begins its involvement within the accelerator’s winter 2024 batch this month. The famed accelerator has beforehand backed African startups serving to freelancers and distant staff on the continent open U.S. financial institution accounts for receiving funds, financial savings, and forex alternate, comparable to Grey Finance and Elevate (previously Bloom).

CEO Alabi, in an interview with TechCrunch, defined the rationale behind launching the platform in August regardless of a aggressive panorama with different platforms like Techstars-backed Geegpay and Payday.

First, she underscored the persistent challenges Africans nonetheless face in receiving worldwide funds for his or her expertise and merchandise, a ache level each founders recognized by way of secondhand expertise and intensive analysis. They estimate the marketplace for facilitating funds for distant staff and freelancers in Africa to be an $18 billion alternative.

Picture Credit: Cleva

One other essential issue is founder-market match. Each founders share a powerful reference to the African market. Born and raised in Nigeria, they moved to the U.S. on faculty scholarships, the place Abel attended MIT whereas Alabi subsequently went to enterprise college at Stanford. Notably, they convey helpful technical and product expertise from their roles at main tech corporations, together with Amazon, Stripe, AWS and Twilio.

“Then there’s the market opportunity,” famous Alabi within the interview. “The problem that we’re trying to solve, which is enabling people to receive international payments, is not a Nigerian problem nor an African one. It’s a global problem; people in Latin America, Asia, and even Canada need to receive dollars for their work and service. We’re starting with Nigeria because we know the market and it’s also a big market. But we feel like because of our backgrounds, we’re very well positioned to solve this problem at a global scale.”

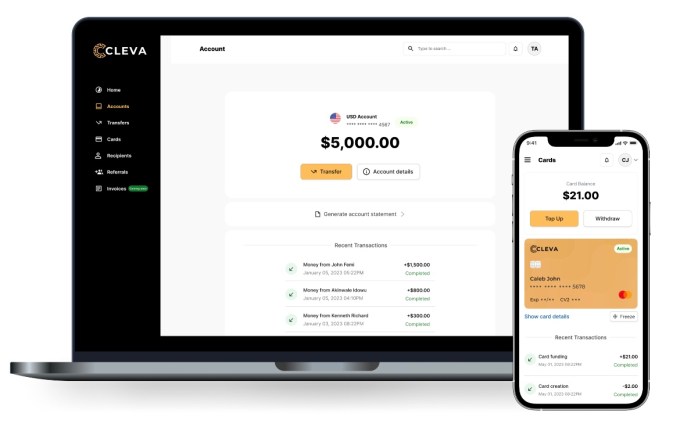

Cleva has initially launched its providers to Nigerians, permitting customers to open USD accounts, with onboarding requiring a Financial institution Verification Quantity (BVN) and a government-issued ID. (It’s value highlighting that whereas Cleva completely gives USD accounts, different gamers supply GBP and EUR accounts.) Within the 4 months since its launch, the Delaware- and Lagos-based fintech has facilitated the opening of US-based accounts for “thousands” of Nigerians, processing over $1 million in month-to-month funds whereas experiencing month-on-month income development of 100%, in keeping with the CEO.

As Alabi highlights, the fintech differentiates itself from the competitors in two key areas: buyer expertise and enterprise mannequin. “We believe in going above and beyond for our customers to have a great experience. This is the feedback we’ve gotten from customers. They know that when they email us or reach out to our customer support, it won’t take one week or two weeks,” she remarked.

In the meantime, the YC-backed startup, which generates income when customers swap and alternate their funds (in USD accounts) for the native forex (in naira for now), additionally expenses a 0.9% payment on deposits into prospects’ USD accounts. Notably, Cleva caps charges at $20, distinguishing itself from opponents who usually apply an uncapped 1% payment whatever the quantity obtained.

Wanting forward, Cleva has a number of upcoming merchandise in its pipeline to diversify income streams, together with USD playing cards and financial savings in U.S. belongings, CTO Abel mentioned within the interview. Additionally, Cleva, which has needed to scale by way of the widespread challenges for fintechs in its class, comparable to discovering the fitting banking accomplice and expertise, will quickly goal Africans within the diaspora. To that finish, different upcoming merchandise, per its web site, embrace permitting customers to create skilled invoices and ship USD globally, coming into a aggressive remittance class the place platforms like Flutterwave’s Ship, Chipper Money, Lemfi, and Afriex are energetic.

The overall addressable marketplace for fintechs specializing in freelancers and Africans within the diaspora is poised for sustained development. This pattern is fueled by a globalizing world, the place extra younger Africans upskill and export their abilities to satisfy the rising demand for expert people. “Long term, we are open to Cleva evolving from just being a product-only service to being a platform issuing APIs to do a bunch of other things that help us distribute services across other African countries or around the world,” Abel mentioned, offering extra particulars on Cleva’s future roadmap.