baona

The highlighted companies are currently out of favor with the market. The share prices of two of the three stocks are on the decline in 2024, while the third lags by a sizable margin.

However, rather than viewing this development as a negative, I claim the poor performance represents an opportunity to add to my investments in three fairly high yielding stocks. I contend each is undervalued and is a high-quality company with prospects for future growth.

To make this list, a company had to have at least a narrow moat rating from Morningstar, pay a safe dividend with a yield above 3%, have investment grade credit ratings, and have a share price that I calculate as being at least 10% below fair value.

First Up: Medtronic (MDT)

Medtronic is the largest pure-play medical-device maker in the world. The company holds the largest market share in heart devices, spinal products, insulin pumps, and neuromodulators for chronic pain.

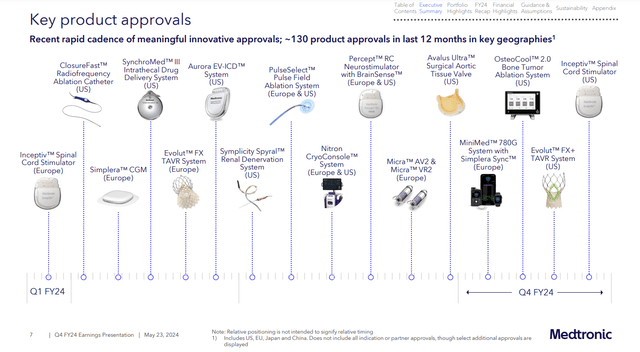

Towards the end of May, Medtronic provided Q4 2024 results. The company reported annual revenue growth of 3.6%. While those numbers aren’t particularly impressive, investors should know that MDT is in the process of spinning off its slow growth businesses and has also gained approval for a number of new products.

Furthermore, results have been weighed down by decreased demand for Medtronic’s devices during the COVID crisis, when patients opted to forgo medical procedures. With the coronavirus largely behind us, there has been a revival in MDT’s sales.

Additionally, demand for Medtronic’s diabetes products is on the upswing with the recent approval by the Food and Drug Administration of the company’s MiniMed 780G insulin pump. Even though the company had gained overseas approval for its insulin pump in 2020, the FDA did not approve the device until the middle of last year. MiniMed 780G is now available for ages seven and above in over 100 countries.

Along with Medtronic’s Guardian 4 glucose monitoring sensor and SmartGuard technology, the MiniMed 780G is used to provide automated insulin adjustments. With the SmartGuard system, diabetics automatically receive a bolus dose when their blood sugar surges above a preset range.

The 780G provides autocorrections every five minutes. Studies revealed that following six months on the MiniMed 780G system, patients’ average blood sugar readings dropped 1.4%, and the amount of time in which their glucose levels were in an ideal range increased about 27%.

This year, the company received EU approval for the Simplera Sync, a disposable continuous glucose monitor that eliminates finger sticks. Used with the 780G, Simplera Sync is half the size of previous Medtronic sensors.

The MiniMed 780G and Simplera Sync are but two examples of the cutting-edge technology and innovation that make MDT a leader in the industry.

MDT will soon launch the Hugo surgical robot in the US. Like the 780G, Hugo’s US approval is lagging that of the EU by years. Hugo is now used throughout most of the world for minimally invasive surgeries and laparoscopic procedures, and Medtronic estimates that Hugo can perform 80% of the robotic-assisted surgeries worldwide.

When one ponders that robots may be used in as few as 2% of surgeries worldwide, and then considers that a report by Grand View Research estimates that the surgical robots market will post a CAGR of 9.5% through 2030, it is reasonable to assume that US approval of Hugo could generate significant sales for Medtronic.

The above is by no means an exhaustive review of the company’s pipeline. Additional products could eventually move the company into a leadership position in other arenas including treatments for atrial fibrillation, mitral valve disease, and renal denervation for hypertension.

Medtronic trades for $77.38 per share. The forward P/E of 21.05x is well below the stock’s average P/E over the last five years of 28.49x. Combined with a 5-year expected PEG ratio of 1.11X and the above detailed growth prospects, I believe MDT is undervalued and trades with a significant margin of safety.

Shares of MDT yield 3.63%. With a payout ratio a hair below 53% and a 5-year dividend growth rate of 6.31%, Medtronic provides a safe dividend that is likely to continue to grow for the foreseeable future.

The company is scheduled to report Q1 2025 earnings on 08/20/24. I intend to provide an in-depth analysis of the stock shortly after the earnings call.

Next In Line: U.S. Bancorp (USB)

As the largest regional bank in the US, USB has a long history of conservative underwriting and efficient operations.

A prime example of the bank’s conservative underwriting culture lies in a review of the last banking crisis. During that period, with the exception of a single quarter, USB’s net charge-offs were below 2.5%. Meanwhile, it was common for competitors to post charge-offs of 3% or more for several quarters.

Analysts use banks’ efficiency ratios to measure profitability. While a lower efficiency ratio is better, a ratio in a range of 50% to 60% is generally considered desirable.

In a prior article published on iREIT, I used the following to compare USB to rivals:

USB has a history of very solid efficiency ratios. For the four quarters that constituted FY 2022, USB’s efficiency ratio ranged between 57.5% and 63.3%. The bank’s efficiency ratio would have been better were it not for the acquisition of Union Bank.

Contrast that to the efficiency ratios of JPMorgan (JPM), Goldman Sachs (GS), Citigroup (C), Morgan Stanley (MS), and Wells Fargo (WFC) during the first six months of 2022, which were 60%, 62%, 66%, 71%, and 77%, respectively.

U.S. Bancorp sits in a sweet spot relative to other banks. With $663.5 billion in, the bank is large enough to benefit from scale advantages. (PNC Financial Services (PNC), the second-largest regional bank, has $553 billion in assets.)

However, USB is small enough that it does not qualify as a global systemically important bank. Consequently, USB is not subject to the regulatory capital requirements that weigh down larger banks’ profits.

Another aspect of USB’s business model that provides a competitive edge lies in the strong non-banking segments it operates. With 26% of the firm’s total net revenue stemming from Payment Services fees, fee income represents 40% of U.S. Bancorp’s total net revenue. This provides a recurring, low-cost stream of revenue for the bank.

USB trades for $39.51 per share. The stock’s forward P/E of 10.61x is below the average P/E over the last five years of 11.86x. US Bancorp’s 5-year expected PEG ratio of 1.08X is well below the bank’s average PEG ratio over the last 5 years of 1.99x.

USB currently yields 4.96%. With a payout ratio of 64.24% and a 5-year dividend growth rate of 5.67%, the stock provides a safe dividend that is likely to continue to grow for the foreseeable future.

U.S. Bancorp’s next earnings report is scheduled in about two weeks. I intend to provide a detailed analysis of the stock shortly after the earnings call.

Last On The List: Comcast (CMCSA)

Comcast stock is down over 13% in 2024. Bears focus on the company’s exposure to traditional TV, particularly cable, and the firm’s rather heavy debt load. Those do represent legitimate headwinds, but I contend the positives associated with an investment in CMCSA far outweigh the negatives.

For one, along with Charter (CHTR), CMCSA is a member of a duopoly with a virtually impregnable position.

Within Comcast’s area of operations, it is the primary provider of broadband service. A 2020 report noted that Charter and Comcast combined hold “an absolute monopoly” over 47 million people with CMCSA being the sole provider of broadband for 30 million customers.

An additional 33 million households can opt for other providers, but those competitors offer markedly slower, less reliable broadband service.

In most areas, CMCSA provides the best download speeds among all fixed broadband providers. Furthermore, the company’s investment in DOCSIS 4.0. will boost its broadband offerings.

A major improvement over DOCSIS 3.1, DOCSIS 4.0 will increase upstream capacity from 1-2 Gbps to 6 Gbps. Comcast projects DOCSIS 4.0 will be available to 50 million households in the US by the end of 2025.

Comcast is also more than just a cable/broadband provider.

The Peacock streaming service, while currently operating in the red, will hopefully add an additional revenue source.

However, Comcast’s theme parks are already a solid source of revenue. Last fiscal year, the theme parks broke the company records for revenues with a 19% increase along with $3.3 billion in adjusted EBITDA. Plus, Universal Epic Universe is scheduled to open in Orlando in 2025.

Comcast also held the #1 studio box office position in 2023, with The Super Mario Brothers, Fast X, and Oppenheimer among the top-five movies for the year.

I’ll add that the claim that Comcast is on the decline seems a bit misleading when one considers that since 2018, the stock’s adjusted EPS is up over 50%, and free cash flow per share has grown by nearly 25%.

CMCSA trades for $38.10 per share. The stock’s forward P/E of 9.84x is a fraction of Comcast’s average P/E over the last five years of 16.58x. The 5-year expected PEG ratio for the stock of 0.68X is roughly half the average PEG ratio over the last 5 years of 1.23x.

The current yield is 3.26%. With a low payout ratio of 28.85% and a 5-year dividend growth rate of 8.45%, the dividend is well funded and is likely to grow at a solid pace for the foreseeable future.

Comcast’s earnings report is scheduled in less than three weeks. I’ll write an update on the company shortly after earnings debut.

Summation

The three highlighted companies have investment grade credit ratings and offer well-funded and growing dividends.

In terms of valuations, I will point to each stock’s projected 5-year PEG ratios, with Comcast’s standing at 0.68x, US Bancorp’s at 1.08x, and Medtronic’s at 1.11x, there is reason to believe each is undervalued.

While they have lagged the S&P 500’s performance over the last year, I view their underperformance as an opportunity to invest in three solid companies.

I rate CMCSA, USB, and MDT as Buys.

I hold mid-sized to large investments in each name. I’ve been adding to those positions over the last few months, and I will continue to increase my share count in each.