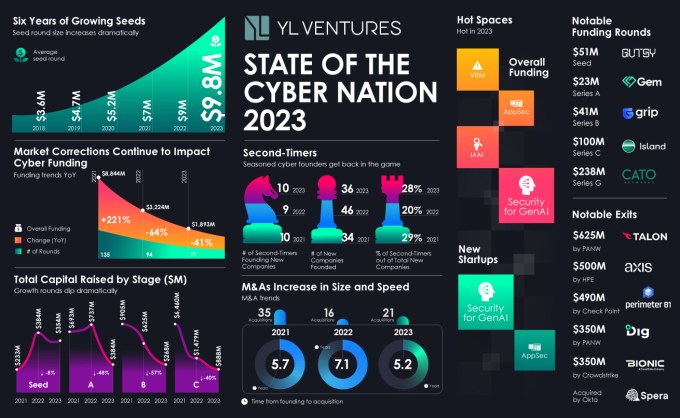

The Israeli cybersecurity trade, very like the worldwide one, has been present process an evolution that appeared to peak in 2021 with hovering funding rounds, overwhelming valuations, and a number of newly minted unicorns, solely to chill down dramatically amidst the market slowdown of 2022 with steep declines and frozen development rounds. The breakneck pace of those fluctuations led to ramifications that reverberated throughout the trade all through 2023, as Israeli cybersecurity startups needed to adapt and discover their footing on this new post-bonanza funding actuality.

Annually, YL Ventures displays, analyzes, and publishes information on funding and acquisitions within the Israeli cybersecurity market, with insights from trade luminaries to light up the traits and shifts on this fiercely aggressive and relentlessly trailblazing trade. In 2023, regardless of declines in fundraising total, we will establish traits indicating a optimistic trajectory for the trade, together with a rise in exits. These traits are evident in continued funding in promising cybersecurity startups and within the willpower of expert, skilled entrepreneurs to search out and handle essentially the most acute and pressing safety issues ailing the enterprise world at this time.

Picture Credit: YL Ventures

Past the final macro points, particularly within the cyber area, the prevailing clarification for this downward trajectory is a continuation of market corrections following the sharp will increase of 2021. Towards the top of 2023, Israel was confronted with nationwide, financial, and geopolitical challenges. The continued conflict between Israel and Hamas has impacted the Israeli tech sector very like the remainder of Israeli society, however its resilience and willpower kind the inspiration for elevated development, stability, and longevity regardless of unprecedented challenges. There have been a number of spectacular funding rounds and acquisitions of Israeli cybersecurity startups within the remaining quarter of 2023, regardless of the circumstances, and the consequences of those occasions will most certainly be evident solely within the first half of 2024.

Total Funding in 2023

Picture Credit: YL Ventures

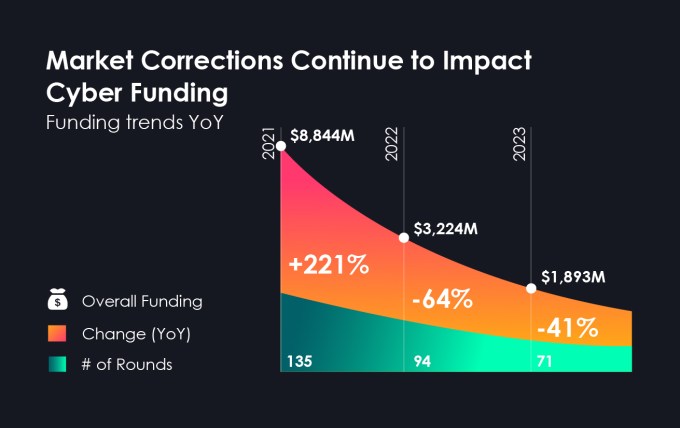

In 2023, the general decline in tech investments continued, with complete funding of Israeli cybersecurity startups reaching solely $1.89B throughout 71 funding rounds, down 41% from 2022’s complete – $3.22B throughout 94 funding rounds. “In 2021, the irrational exuberance in the financial markets led to inflated valuations across the startup landscape, including cyber,” remarks Erica Brescia, Managing Director at Redpoint Ventures. “What we’re witnessing now is not a slowdown, but rather a return to pre-pandemic sanity – a market correction that paves the way for healthier startups.”

Early Stage Funding

Not like total funding traits, there was a big enhance within the common seed spherical for the sixth consecutive 12 months, from $9M in 2022 to a document $9.8M in 2023. This may be attributed to the fixed and rising want for groundbreaking safety options to resolve unrelenting safety points and sustained investor urge for food for supporting modern founding groups in a position to take action. Whereas the common seed quantity grew, the variety of seed rounds in 2023 was solely 36, decreased from 46 in 2022.