Key Notes

- The NYSE parent company’s investment marks one of the largest traditional finance deals in crypto history.

- Coplan overcame early financial struggles and regulatory challenges, including a 2022 CFTC fine and US user ban.

- Polymarket secured regulatory approval by acquiring a CFTC-licensed exchange for $112 million in September 2024.

Shayne Coplan, the 27-year-old founder and CEO of Polymarket, has ascended to the status of the youngest self-made billionaire following a landmark investment deal with the parent company of the New York Stock Exchange (NYSE), Intercontinental Exchange (ICE).

Coplan, who left New York University in his early twenties to develop a crypto venture focused on prediction markets, now leads Polymarket, a company valued at approximately $8 billion based on ICE’s $2 billion stake.

A few years ago, Coplan faced severe financial struggles after dropping out of NYU, at one point selling personal items to cover rent, according to Bloomberg. He began exploring the societal impact of prediction markets by reviewing the work of economist Robin Hanson.

Coplan launched Polymarket in 2020, initially working from a converted bathroom during the pandemic. Despite regulatory hurdles, including a CFTC enforcement action and a temporary ban on US users alongside a $1.4 million fine in 2022, Coplan’s firm persisted through adversity.

2020, running out of money, solo founder, HQ in my makeshift bathroom office. little did I know Polymarket was going to change the world. pic.twitter.com/TktiCXQgXr

— Shayne Coplan 🦅 (@shayne_coplan) November 6, 2024

NYSE Parent Invests $2B, Values Polymarket at $8B

ICE, the operator of the NYSE, announced a strategic investment of up to $2 billion in Polymarket, valuing the prediction platform at about $8 billion pre-money. The deal positions ICE as a global distributor of Polymarket’s event-driven data, allowing for ongoing collaborations on financial tokenization projects.

The partnership marks a significant step by traditional finance players in integrating blockchain-powered prediction markets, allowing institutional investors to access real-time signals across political, economic, and cultural domains.

Polymarket achieved regulatory milestones on Sept. 4, including the acquisition of a CFTC-licensed exchange for $112 million, which enables its legal US operations.

Prediction Markets Are Back with Polymarket

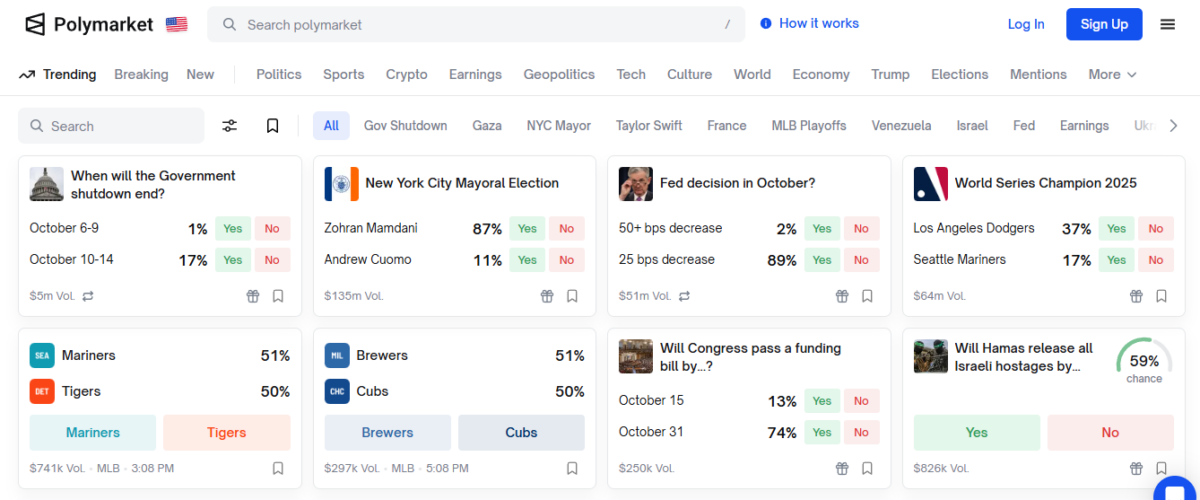

Founded by Coplan in 2020, Polymarket is now the world’s largest prediction market, handling billions in trading volume and hosting more than a million users across diverse market categories, such as politics, sports, and entertainment.

The ICE investment is regarded as one of the largest crypto-related deals for traditional finance and positions Coplan’s creation for robust expansion, especially as it returns to US markets with full regulatory approval.

Current home of Polymarket. Source: Polymarket

Coplan retains a majority stake in Polymarket, and his net worth now crosses the $1 billion threshold, making him the youngest self-made billionaire in the crypto industry, an ascent marked by regulatory resilience, sector innovations, and partnerships with high-profile figures.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

José Rafael Peña Gholam is a cryptocurrency journalist and editor with 9 years of experience in the industry. He wrote at top outlets like CriptoNoticias, BeInCrypto, and CoinDesk. Specializing in Bitcoin, blockchain, and Web3, he creates news, analysis, and educational content for global audiences in both Spanish and English.