shaunl/E+ via Getty Images

ZIM: Incredible Recovery As Tensions Persist

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) investors have enjoyed a spectacular run as persistent geopolitical headwinds and resilient consumer spending underpinned improved investor sentiments. My cautious ZIM article in early February 2024 is assessed to be timely before ZIM fell toward its March 2024 lows. It also coincided with the pullback in global freight rates before ZIM staged a significant rebound in April and May 2024. As a result, ZIM has outperformed the S&P 500 (SPX) (SPY) significantly since bottoming out in November 2023.

ZIM Integrated Shipping’s Q1 earnings release was well-received by the market. ZIM’s management decision to restore ZIM’s quarterly dividend likely helped to bolster buying confidence. ZIM’s ability to raise its full-year 2024 guidance also suggests a confident outlook through the second half of 2024.

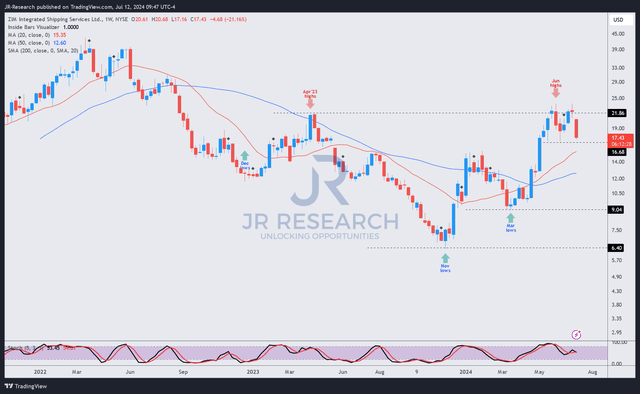

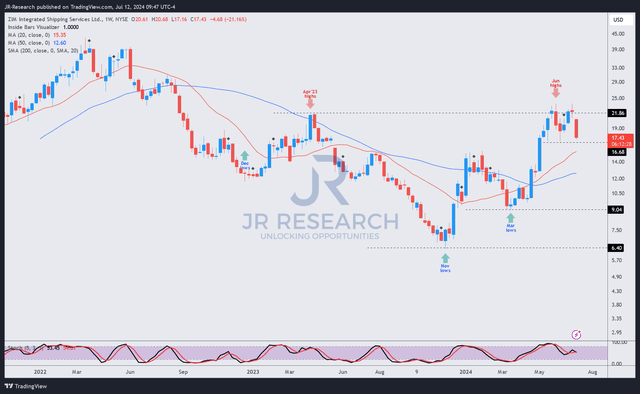

I assess that ZIM has been consolidating close to the $21 level since late May 2024. That level was also tested in April 2023, before ZIM fell significantly toward its November 2023 lows ($6.4 level). Therefore, I believe it’s timely for me to help investors reassess whether there’s still an opportunity to join ZIM’s recovery.

ZIM: Freight Rates Surged. But For How Long?

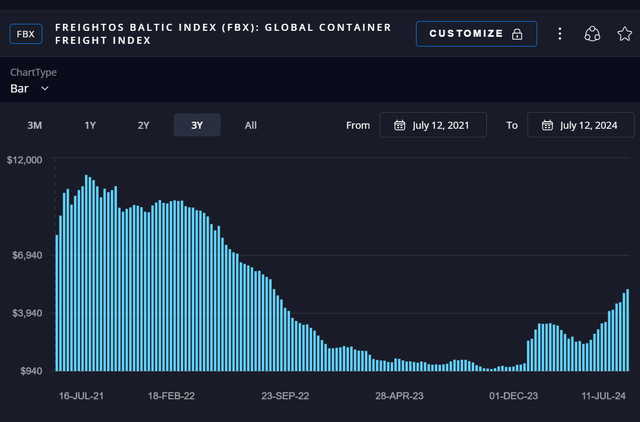

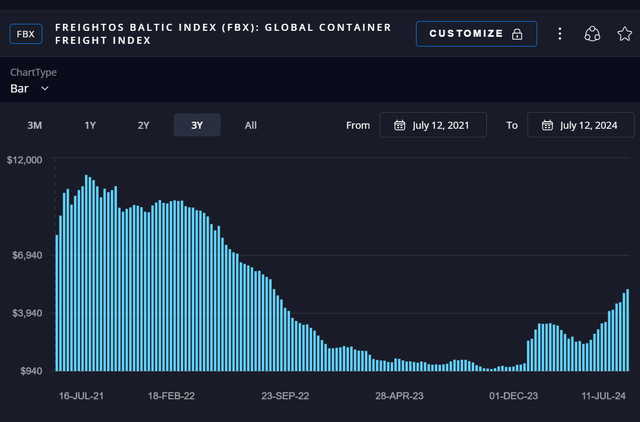

Freightos Global Container Freight Index (Freightos)

As seen above, while the recent recovery in global freight rates has been significant, we are nowhere close to the pandemic highs in 2021. Analysts are mixed on whether the freight rate recovery can rally further or whether the surge in freight rates is merely transitory. Geopolitical headwinds in the Middle East are expected to persist even as a potential ceasefire agreement between Israel and Hamas is being worked out. Therefore, market volatility attributed to the progress of the ceasefire talks should be anticipated. A constructive resolution of the Israel-Hamas conflict could impact the continued bullishness in global freight rates.

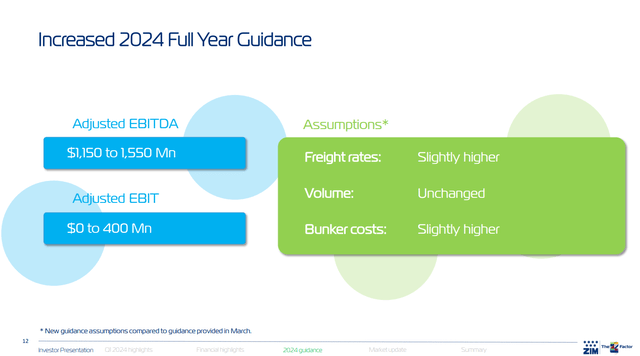

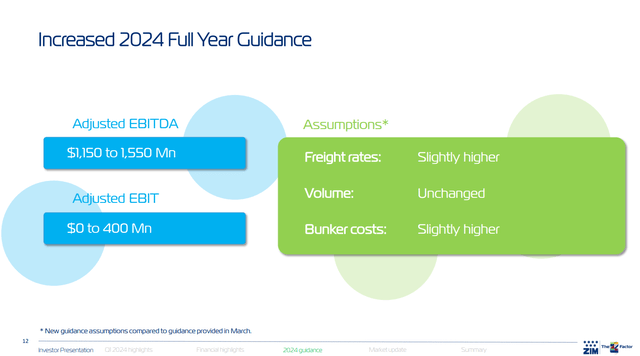

ZIM FY2024 Guidance update (ZIM filings)

As a reminder, the Red Sea attacks have prompted a rerouting of container shipping routes. It has also benefited ZIM, helping to “absorb significant shipping capacity.” It has created a “pseudo-supply constraint that has contributed to higher freight rates across different global trade lanes.”

Consequently, ZIM has become more confident that it will benefit from the rise in spot rates. Accordingly, ZIM Integrated has recalibrated its spot market exposure to capitalize on the market recovery. As a result, ZIM anticipates about “65% of its Transpacific volume to be spot-related,” with the remaining 35% based on contract.

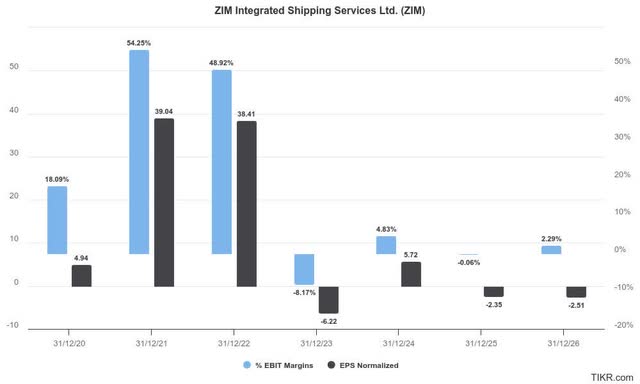

ZIM: Earnings Could Be In The Red In 2025

Wall Street remains skeptical about the sustainability of the recovery in freight rates. As seen above, the earnings accretion is expected to level off in 2024 before falling through FY2026.

I assess that pessimism in ZIM’s recovery thesis is justified. There are concerns about whether the recent surge was attributed to pull-forward demand as US importers look to circumvent potentially higher tariffs. In addition, US manufacturing capacity remains well below the peak observed in the post-pandemic surge. Hence, the supply chain constraints aren’t assessed to be structural. Even if they persist through the end of 2024, significant uncertainties on a further recovery in 2025 could hamper buying sentiments on ZIM.

While consumer spending is assessed to remain resilient, it has already normalized from the pandemic patterns. As a result, it seems unreasonable to anticipate another supply chain snafu like the one we observed during the pandemic chaos.

Moreover, ZIM’s increased exposure to spot rates has also left the company more vulnerable to a potentially sharper downturn in freight rates, hurting its forward guidance. Income investors must not take ZIM’s restoration of its dividend for granted, as it’s predicated on its earnings profile.

Given ZIM’s estimated dividend yield of just 5.2%, it might not be sufficient for income investors to consider returning aggressively. While the Fed is expected to cut interest rates from the September 2024 FOMC meeting, the cadence remains uncertain.

Is ZIM Stock A Buy, Sell, Or Hold?

ZIM price chart (weekly, medium-term) (TradingView)

ZIM’s price action indicates that the stock has been consolidating under the $21 level since late May 2024. Attempts to break out of that resistance zone since then have been futile.

Selling intensity also rose this week, suggesting a re-test of the $17 level looks increasingly likely. Notwithstanding my caution, I’ve also assessed that ZIM has decisively shaken off its downtrend bias. As a result, buyers might return to support the stock as it’s not expensive.

Seeking Alpha Quant rates ZIM with a “B” valuation grade. Upgraded Wall Street estimates on ZIM suggest that ZIM’s dip-buyers could bolster steep pullbacks if heightened freight rates persist.

Despite that, I view the risk/reward as relatively well-balanced, given the stiff resistance zone under the $21 level.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!