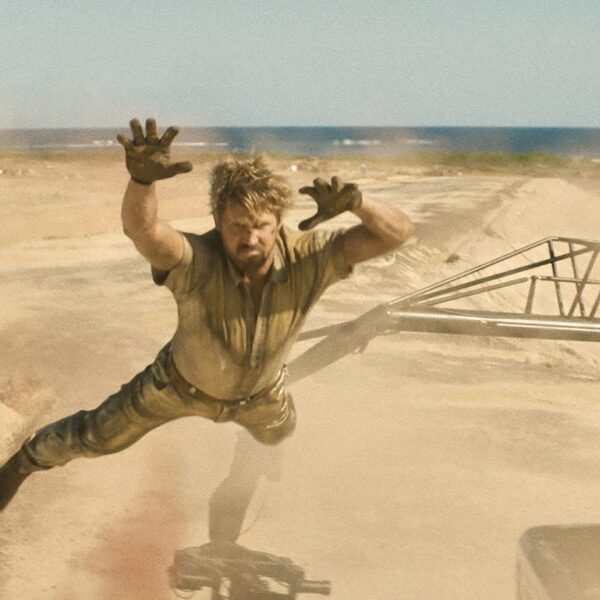

A buyer enters Comerica Inc. Financial institution headquarters in Dallas, Texas.

Cooper Neill | Bloomberg | Getty Photos

A trio of regional banks face rising stress on returns and profitability that makes them potential targets for acquisition by a bigger rival, in accordance with KBW analysts.

Banks with between $80 billion and $120 billion in belongings are in a troublesome spot, says Christopher McGratty of KBW. That is as a result of this group has the bottom structural returns amongst banks with at the least $10 billion in belongings, placing them within the place of needing to develop bigger to assist pay for coming rules — or struggling for years.

Of eight banks in that zone, Comerica, Zions and First Horizon may finally be acquired by extra worthwhile rivals, McGratty stated in a Nov. 19 analysis be aware.

Zions declined to remark. Comerica and First Horizon did not instantly have a response for this text.

Whereas two others within the cohort, Western Alliance and Webster Financial, have “earned the right to remain independent” with above-peer returns, they may additionally think about promoting themselves, the analyst stated.

The remaining lenders, together with East West Financial institution, In style Financial institution and New York Group Financial institution every have larger returns and will find yourself as acquirers moderately than targets. KBW estimated banks’ long-term returns together with the influence of coming rules.

“Our analysis leads us to these conclusions,” McGratty stated in an interview final week. “Not every bank is as profitable as others and there are scale demands you have to keep in mind.”

Banking regulators have proposed a sweeping set of changes after larger rates of interest and deposit runs triggered the collapse of three midsized banks this 12 months. The strikes broadly take measures that utilized to the largest world banks right down to the extent of establishments with at the least $100 billion in belongings, rising their compliance and funding prices.

Invesco KBW Regional Financial institution ETF

Whereas shares of regional banks have dropped 21% this 12 months, per the KBW Regional Banking Index, they’ve climbed in latest weeks as issues round inflation have abated. The sector remains to be weighed down by issues over the influence of recent guidelines and the chance of a recession on mortgage losses, notably in industrial actual property.

Given the brand new guidelines, banks will ultimately cluster in three teams to optimize their profitability, in accordance with the KBW evaluation: above $120 billion in belongings, $50 to $80 billion in belongings, and $20 to $50 billion in belongings. Banks smaller than $10 billion in belongings have benefits tied to debit card income, that means that smaller establishments ought to develop to at the least $20 billion in belongings to offset their loss.

The issue for banks with $80 billion to $90 billion in belongings like Zions and Comerica is that the market assumes they may quickly face the burdens of being $100 billion-asset banks, compressing their valuations, McGratty stated.

Alternatively, bigger banks with robust returns together with Huntington, Fifth Third, M&T and Regions Financial are positioned to develop by buying smaller lenders, McGratty stated.

Banks are ready for readability on rules and rates of interest earlier than they may pursue offers, however consolidation has been a constant theme for the trade, McGratty stated.

“We’ve seen it throughout banking history; when there’s lines in the sand around certain sizes of assets, banks figure out the rules,” he stated. “There’s still too many banks and they can be more successful if they build scale.”