FatCamera

Introduction

Investing in dividend growth stocks often means investing in high-quality businesses. Zoetis Inc. (NYSE:ZTS) is a great company and an undisputed dividend growth beast.

I am impressed with the speed at which the company is growing its dividend, and I am confident that ZTS can continue to do so in the future. Maybe not at the same growth rate as now, but I certainly expect double-digit dividend growth for a long time.

In February, I wrote my first article about ZTS, where it was already clear that it is a quality company, but in my opinion, too richly valued. However, there was some negative news about their osteoarthritis drug Librela and the presence of possible negative side effects. The stock price fell so much that it dipped below my calculated fair value of $154. Therefore, I chose to initiate a position and add ZTS to my personal dividend growth portfolio.

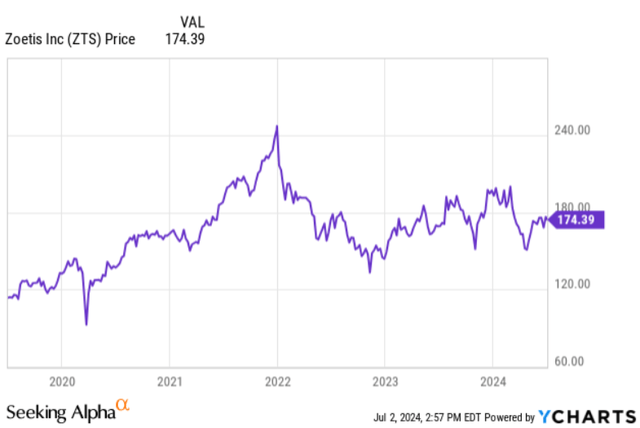

Share price development (YCharts)

This is what CEO Kristin Peck had to say about the safety of Librela in the Q1 2024 earnings call.

It has been used for over three years across the globe and over 14 million dogs and it’s approved in over 50 countries. And if you overall look at the rate of reported adverse events, it’s about 18% per 10,000 or 0.18% globally.

And I think it’s important to keep in mind that no single adverse event is classified under the EMEA guidelines as more than rare, which is more than 1 to 10 out of 10,000. So we remain very confident in the safety and efficacy of this product

This seems to have largely cleared the air. However, the share price is still nowhere near its all-time high.

Today, I would like to take the opportunity to update the investment thesis to see whether ZTS is worth a buy at the current price.

Why Zoetis?

First, I’ll provide a summary of why ZTS is worth considering adding to a diversified dividend growth portfolio.

Market dominance with a secular growth trend

I am not necessarily a “hype” investor or looking for the “next big thing”. I like to invest in companies with an already excellent track record and ZTS is certainly one of them.

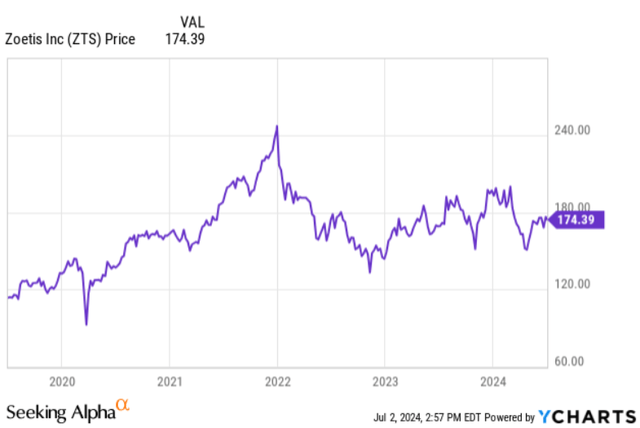

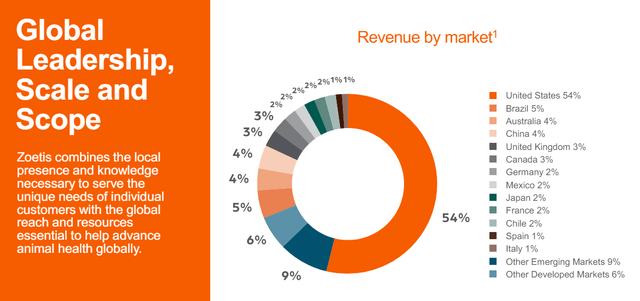

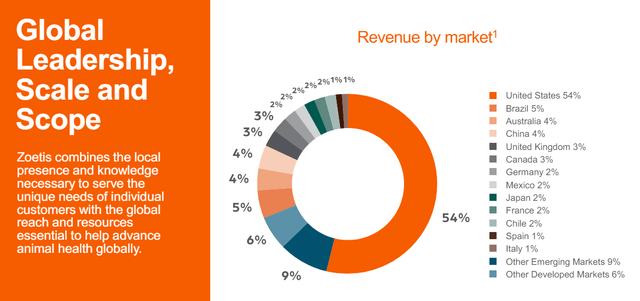

ZTS is a global market leader when it comes to animal health care. The company earns the most of its money in the US, but their revenue is nicely diversified across many different countries.

Revenue distribution (ZTS investor overview)

The company can simply be divided into companion animals and livestock, where they are among the largest in the world in both segments.

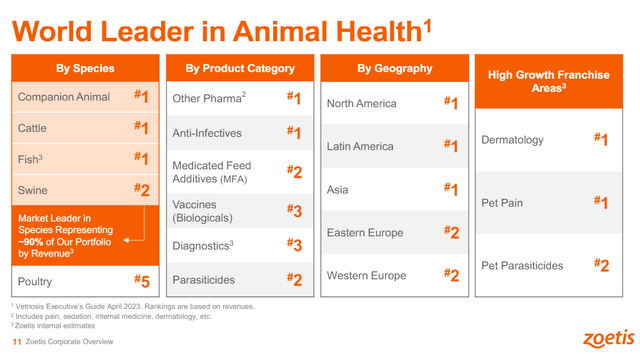

Market dominance (ZTS investor overview)

It is very beneficial for the growth story that the animal healthcare sector in general is subject to a secular growth trend.

Factors like increased medicalization, a growing human-animal bond, and the need for more animal protein play an important role in the continuation of this trend.

Due to pet humanization, people are willing to pay a lot for the well-being of their animal.

This is a quote from Kirstin Peck, the CEO of ZTS, at the Q1 2024 earnings call.

And I know there has been some talk around consumer sentiment and is that really changing. Obviously, we’ve seen some changes in sort of collars or treats and things like that. But what’s really been clear and what we’ve talked about for a long time is when you think about animal health care, it’s essential. They are not skipping on their animal health care. And if you look at the trends in the quarter as you look at increase in [indiscernible] visits, as Wetteny talked about, the reality is when their animal needs care, they are getting that care. And as you look at spend per visit in the U.S., we’re seeing spend per visit up 6% in the U.S., which means, again, consumers and pet owners want to take care of their animals and they continue to invest in this.

This makes ZTS’s business model extremely resilient.

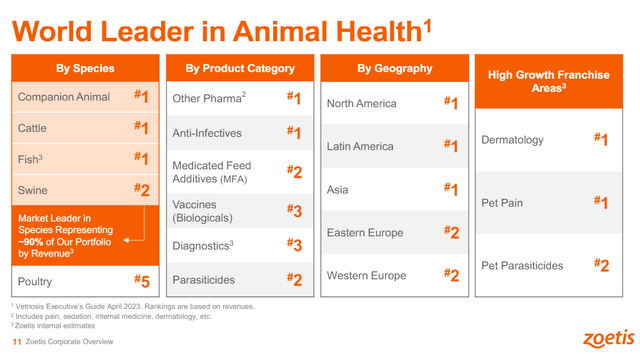

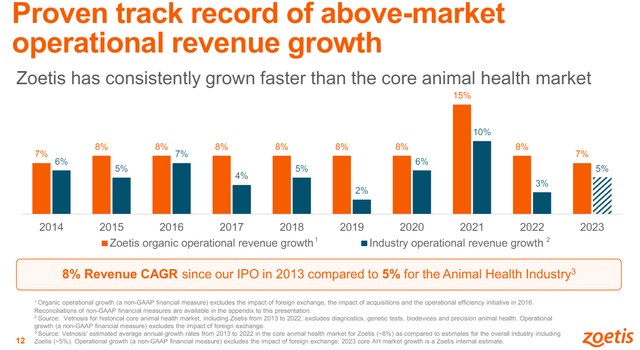

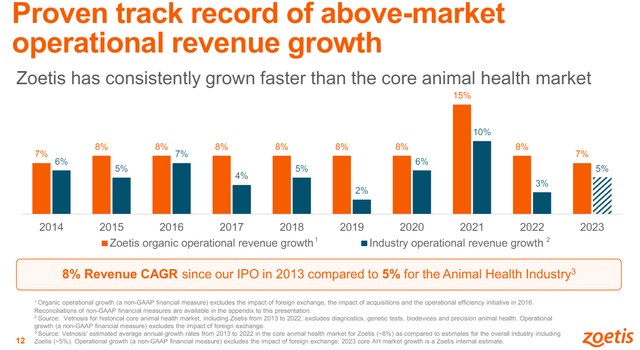

The overall animal healthcare market is expected to grow at a CAGR of 8% through 2030. This is good news for ZTS, especially given the fact that the company has been able to structurally outperform the market.

Market outperformance (ZTS investor overview)

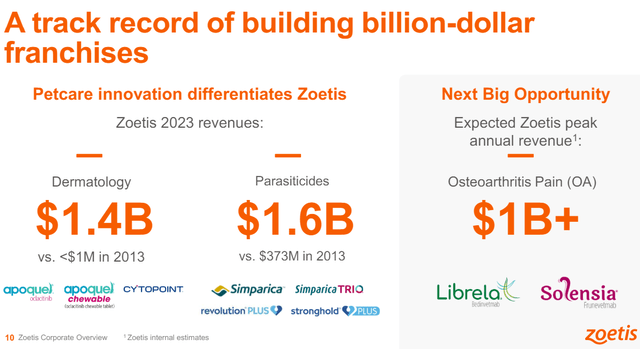

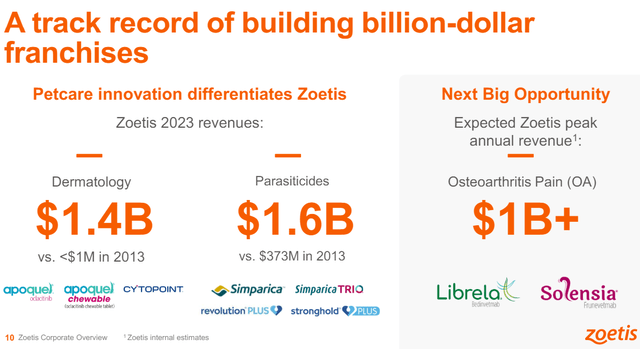

ZTS has a big advantage of being one of the largest. This allows them to make large R&D investments to stay at the top and to enter new markets within the animal healthcare sector. The company has built two billion-dollar franchises in dermatology and parasiticides, and it is possible that their osteoarthritis pain franchise will join the club.

Billion-dollar franchises (ZTS investor overview)

The next success should come from Librela and Solensia. This is an injectable treatment that helps reduce pain due to osteoarthritis in dogs and cats.

These products are based on monoclonal antibody therapy. ZTS is doing large investments in “mAbs” in general because they see lots of opportunities there. These investments include manufacturing expansions and more than 50 monoclonal antibody targets across different species. ZTS is also exploring longer duration mAbs to, for example, further develop pain treatment.

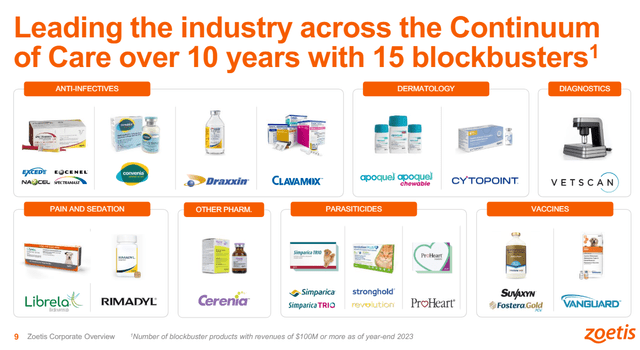

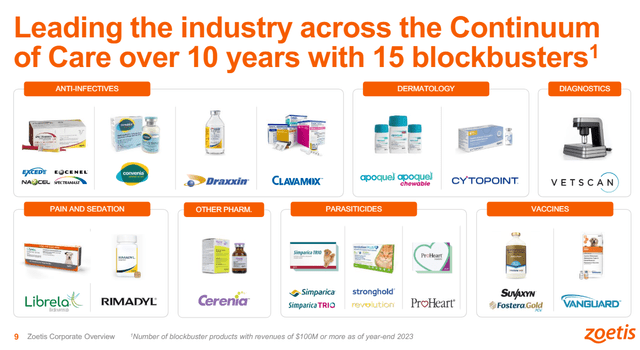

In addition to their absolute top-selling drugs, here is an overview of ZTS’s blockbuster history.

Blockbusters (ZTS investor overview)

Their impressive portfolio and high-quality products enable the company to achieve impressive margins.

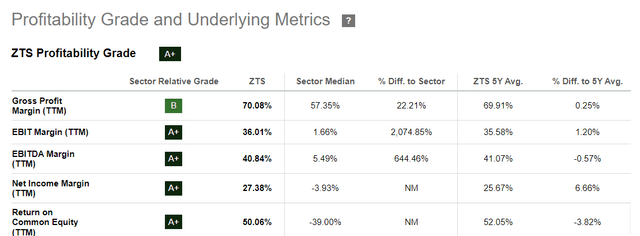

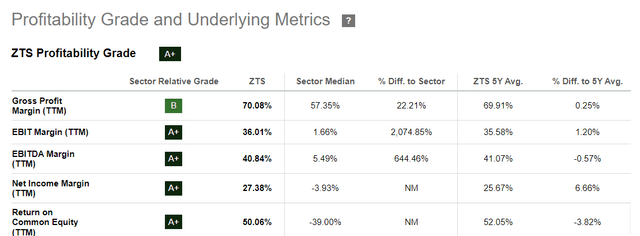

Profitability metrics (Seeking Alpha)

Dividend

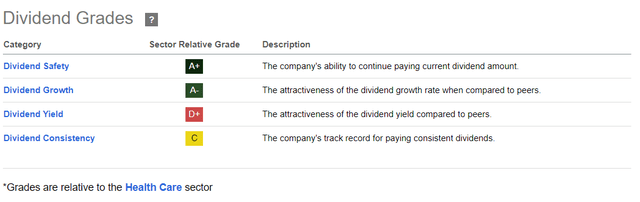

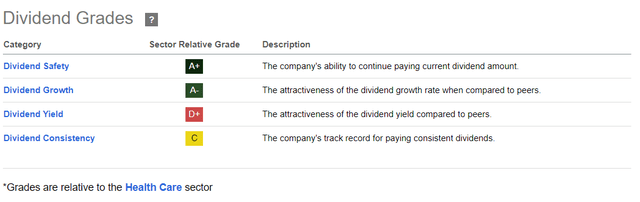

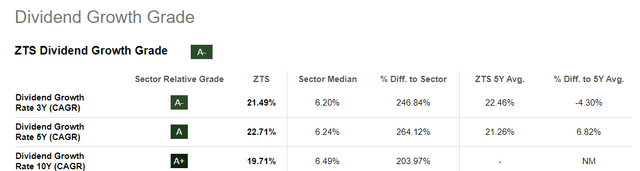

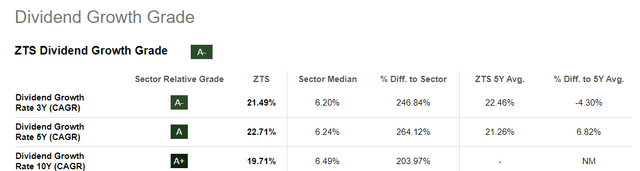

ZTS is a perfect example of a low yield, high growth stock. This is also visible in the dividend scorecard on the Seeking Alpha website.

Dividend scorecard (Seeking Alpha)

At the moment ZTS has a forward dividend yield of 1%, which is quite low from an income point of view. However, for those who have lots of time on their side the dividend can grow into something beautiful. It is true that the yield is well above its own historical average, which may imply a good entry point.

Dividend yield development (Seeking Alpha)

Personally, I don’t mind that the yield is low because the dividend growth is mouth-watering.

Dividend growth metrics (Seeking Alpha)

I do think that these growth rates are not realistic for the future. The last dividend increase was 15%, and I expect this to be more in line with earnings growth in the near future.

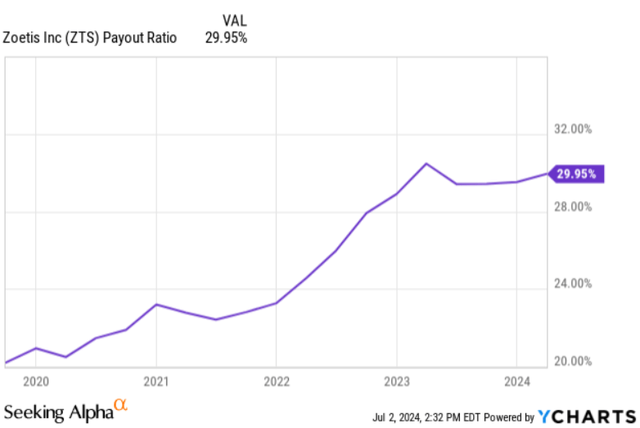

The payout ratio of 29.95% can be called healthy; however, it has to be said that the ratio is slowly increasing over time.

This is also one of the reasons why I think a dividend growth CAGR of +20% is not realistic, and I hope that ZTS remains in a position where they maintain a relatively low payout ratio, allowing them to invest in innovation and growth.

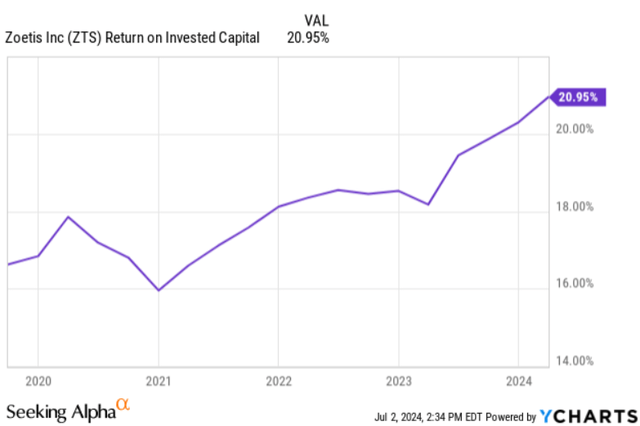

Given the solid ROIC, it is also important that there is sufficient capital available to invest in further growth.

In terms of dividend consistency, a “C” score gives, in my opinion, a distorted picture. ZTS has an 11-year dividend growth streak and given the anticyclical nature of ZTS, I think the company meets the characteristics to become a dividend aristocrat.

Quarterly results

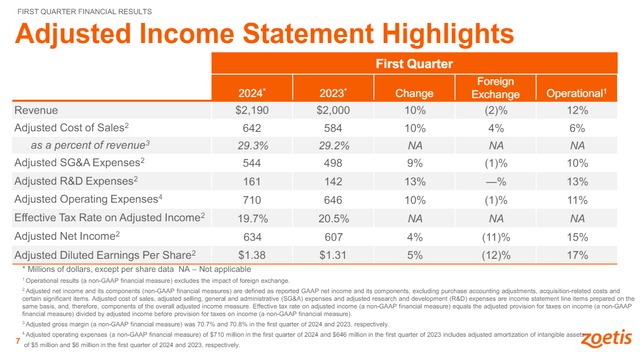

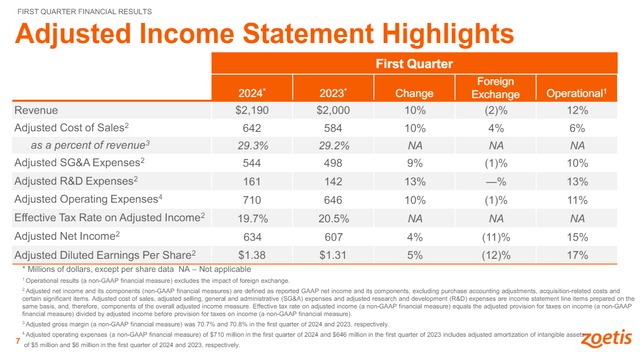

The Q1 2024 results were excellent and immediately led to an increase in share priced during that day.

Income statement (ZTS Q1 2024 report)

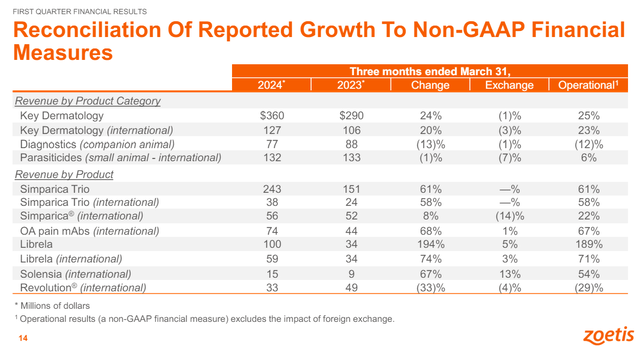

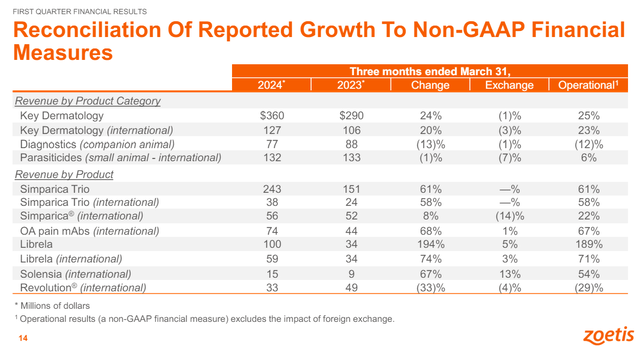

ZTS achieved 12% operational revenue growth, 7% was due to price increases and 5% volume growth.

From a profitability point of view, the results were good as well. The adjusted gross margin of 70.7% was 10 basis points lower. Fx had a negative impact of 180 basis points. So if we exclude the Fx impact, margins would be actually higher.

The Fx impact is also clearly visible in the bottom-line numbers. The adjusted net income (+15%) and adjusted diluted earnings per share (+17%) were significantly higher. However, if we include the currency impact growth changes to 4% and 5%, respectively.

If we break down the results into the companion animal and the livestock segment, things are looking completely different.

The companion animal sales are growing with an impressive +20% compared to the same quarter in FY 2023.

There were a number of things that are looking very good in my opinion. The most important thing was the launch of Librela in the US. Management also saw strong growth in penetration and that there were strong reorder rates. I think this is the main reason why the share price rose sharply. The results in this segment were in line with management expectations, but I think there was relief from investors.

Compared to Q1 2023 the operational sales of Librela increased with 189% and things are just getting started in the US.

Revenue high growth products (ZTS Q1 2024 report)

Management is also very positive about the future and expects the osteoarthritis division to become a billion-dollar franchise.

With more than 18 million doses distributed worldwide, we are providing long lasting relief to animals, many of whom were previously undiagnosed or untreated due to limitations of NSAIDs. With nearly 40% of all dogs suffering from OA pain globally, we believe just one-third of those are being treated. So we’re just scratching the surface of care. And cats are visiting the clinic more often.

We remain confident that OA pain could be our next $1 billion franchise, because we are meeting the needs of an underserved market. We are growing by nearly every metric, including adoption, penetration, reorder rates, patient share and expanded utilization. And looking at our 4-week rolling average in the U.S., we’re excited to report that sales steadily increased through April

Solensia, the equivalent for cats, also has a lot of potential. However, cats are compared to dogs, historically under-medicalized. One of the reasons is clinic fears. Luckily, ZTS has brought the first FDA approved product on the market called Bonqat. This aims to reduce anxiety in cats and can possibly create a whole new area of opportunities. Even though Solensia only accounts for a small portion of total revenue, it showed strong sales growth of 54%.

It is good to know that this is not the only division that is performing well. When it comes to parasiticides and dermatology, ZTS is also growing really fast. Simparica Trio for example is also growing 61% compared to Q1 2023.

And there is enough potential for future growth in these segments as well:

Today, more than 18 million dogs are treated for allergic ish and atopic dermatitis and another 13 million remain untreated globally.

Source: Q1 2024 earnings call transcript.

Livestock showed a sales decline of 1% in Q1 2024. One of the main reasons was the economic headwinds in China. This was actually an outlier compared to the rest because if we exclude China, there would be overall growth. This is achieved purely through price increases.

Historically, livestock has been a segment with slower growth compared to companion animals. Based on data from ZTS itself, livestock grows on average between 2-4% per year.

This makes it nice to see that they stay focused with regard to capital allocation. A good example of this is the agreement with Phibro Animal health Corporation (PAHC). PAHC will acquire the medicated feed addictive portfolio of ZTS for $350 million and will be fully processed in the second half of 2024.

I think this is a good decision, so ZTS can focus more on their more profitable business activities.

Outlook

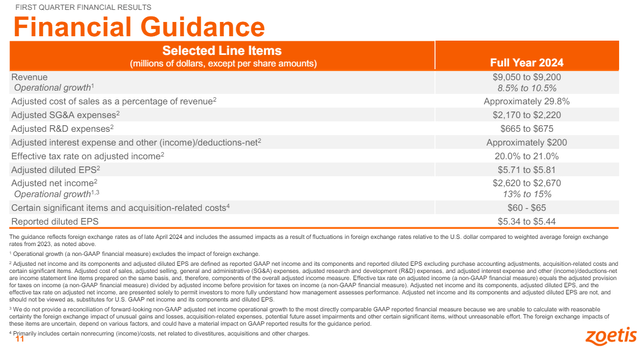

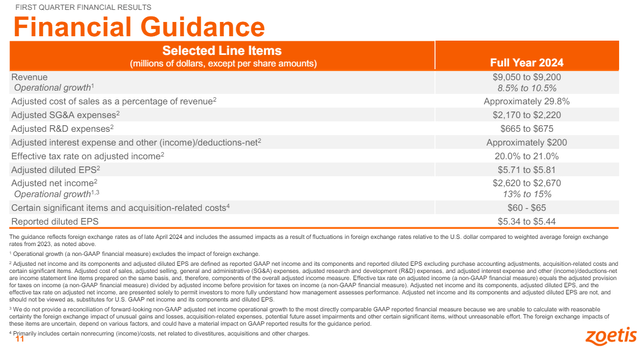

ZTS has also adjusted the outlook slightly upwards based on the good results. In particular, the operational growth in sales and net income are adjusted upwards by 1.5-2%.

The company expects operational growth for Simparica Trio to be double digits and dermatology products to be high-single digits. The expectations for Librela remain unchanged.

Financial outlook (ZTS Q1 2024 report)

All in all, we can say that the results are very good. ZTS shows excellent growth in the largest and most important part of their product portfolio.

I like the fact that the strong growth is in multiple sections of the portfolio. This shows that ZTS is not a one-trick pony. There are also plenty of opportunities left to achieve growth in dermatology, parasiticides and osteoarthritis.

What I also think is an essential message from the Q1 2024 report is that ZTS is currently not affected by the weakening consumer. This underlines the robust business model of the company.

Valuation

There is still a lot to like about ZTS; however, it is still important not to overpay.

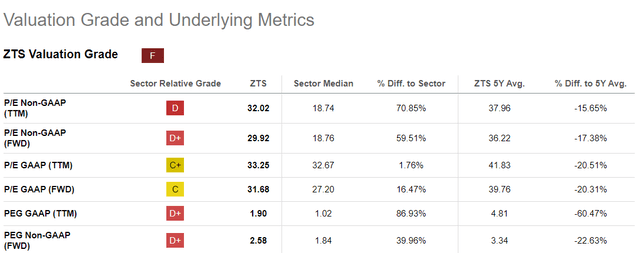

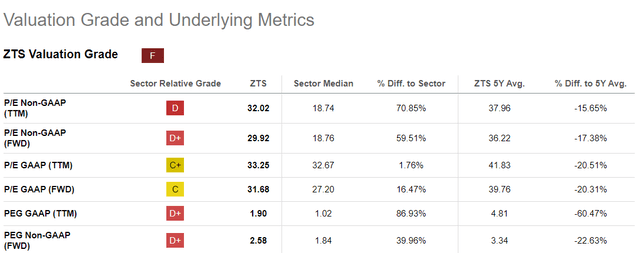

If we look at the valuation grades, ZTS looks quite a bit cheaper compared to a few months ago. The company is now trading at a PE ratio of 32, which is definitely not low. However, it is significantly lower compared to ZTS’s 5Y average. And let’s be fair, if ZTS continues to perform like this, there is very little chance that you can buy this stock at a low multiple. Due to its market leading position, profitability metrics and future growth prospects, it can be justified that ZTS is traded at a premium valuation.

Valuation metrics (Seeking Alpha)

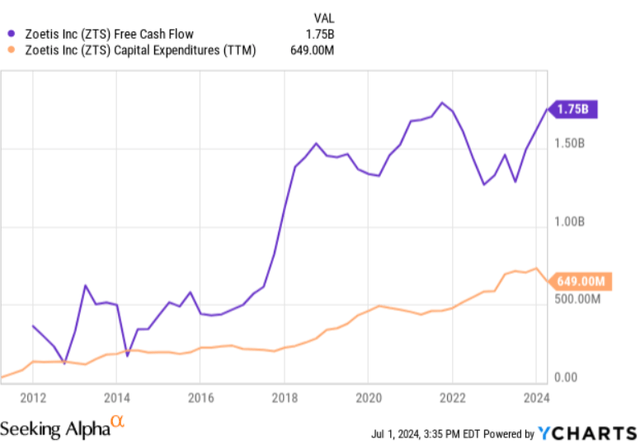

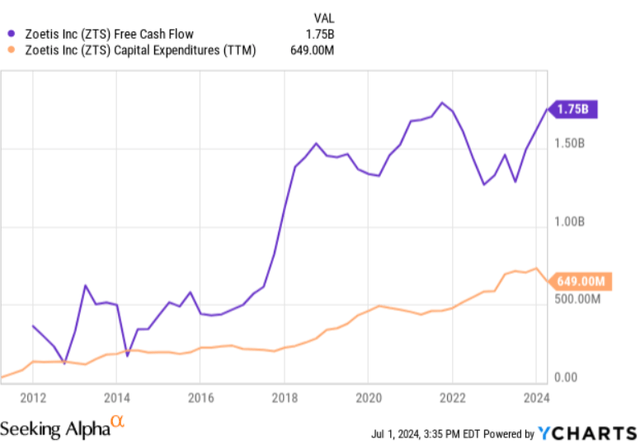

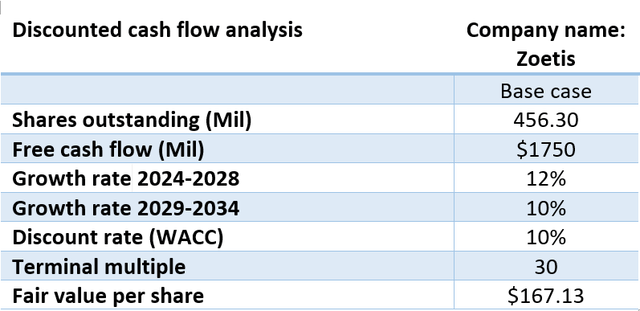

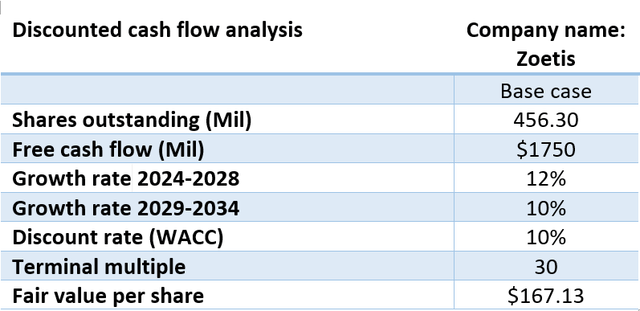

To calculate the fair value of ZTS, discounted cash flow analysis has been used. I used an FCF of $1.75 billion. This is higher than last time; I have adjusted it upwards based on a higher TTM free cash flow per share ($3.81 vs $3.51).

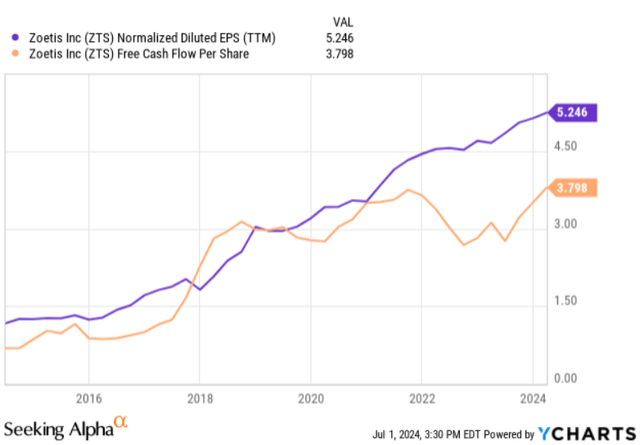

FCF and CapEx development (YCharts)

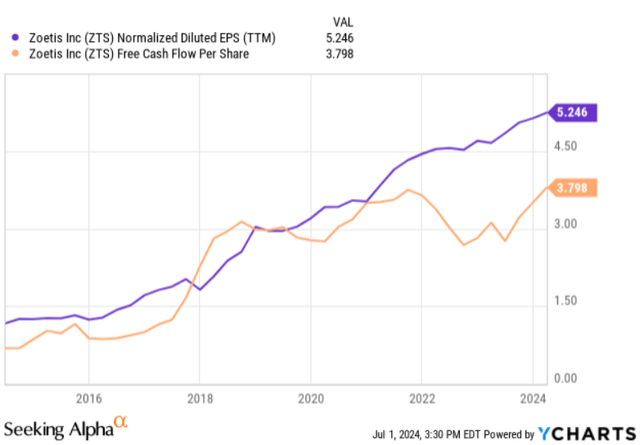

FCF can vary a lot over time, and it has also been significantly influenced in recent years by the increase in CapEx to support future growth. However, I do expect that the FCF per share will follow the trend of EPS growth in the long term.

EPS and FCF per share Development (YCharts)

For the analysis, I stick to my assumptions from my previous article. I used a 5-year growth rate of 12%, and for the 5 years thereafter 10% because it’s harder to make accurate assumptions over longer periods of time.

I used a terminal multiple of 30 and applied a discount rate of 10% because I want this as a minimal annual return on investment.

DCF analysis (Google spreadsheets)

If we do the math, we get a share price of $167.13, which is close to the current share price.

Investment risks

Before investing in ZTS, there are also risks to consider.

Firstly, in my previous article, I stated that one of the biggest risks for the company is embedded in its valuation. This is of course the case for almost all high-quality businesses because quality is often recognized by the market.

Based on my DCF analysis, it looks like that the risk reward is improved, but it is still important not to overpay excessively. The animal health industry is highly competitive and potential disruptive innovation can change the investment case. For example, ZTS is investing heavily into monoclonal antibody treatment, but nowadays, innovative changes are happening faster than ever before. Disruptive innovation can significantly impact ZTS’s operating results and therefore also the share price due to possible severe multiple contraction. Although ZTS has become a leader because of its ability to innovate, this remains a risk and the company will have to maintain its drive to stay innovative.

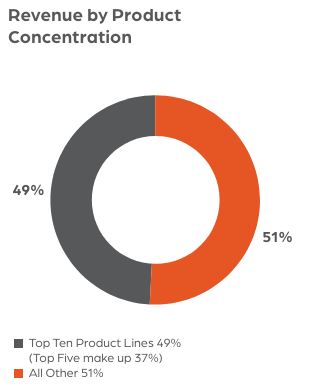

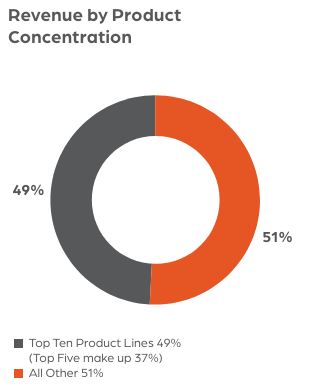

Secondly, ZTS’s product concentration can be a possible risk. The top five products make up for 37% of their total revenue. Their best-selling products, Simparica/Simparica Trio and Apoquel, contribute 13% and 10% of their revenue.

Revenue by product concentration (ZTS 2023 annual report)

There is no threat at the moment, as the big growers in the product portfolio are doing really well. Librela is likely to become a significant contributor in the near future. However, if something happens to their top 5 products, this could have severe consequences for ZTS’s revenue development and profitability.

Conclusion

ZTS is a high-quality company and has potential to be a great long-term compounder. It is a market leader, an innovator, and an excellent capital allocator. The best thing about the investment case is that ZTS still has a lot of growth potential, even when it comes to their best performing products.

In the meantime, ZTS is generating lots of cash, which they can reinvest into new growth opportunities and paying a reliable and fast-growing dividend.

At this moment in time, I think ZTS is reasonably priced. It is definitely not a strong buy, but if you are interested in the company, and you want to slowly build up a position, it could be worth it to do so.

Therefore, I give ZTS a “BUY” rating.

Happy investing everyone!