Whilst fast commerce is slowly fading in lots of markets and several other heavily-funded startups have folded up to now two years, India is rising as a placing outlier the place the mannequin stays vibrant.

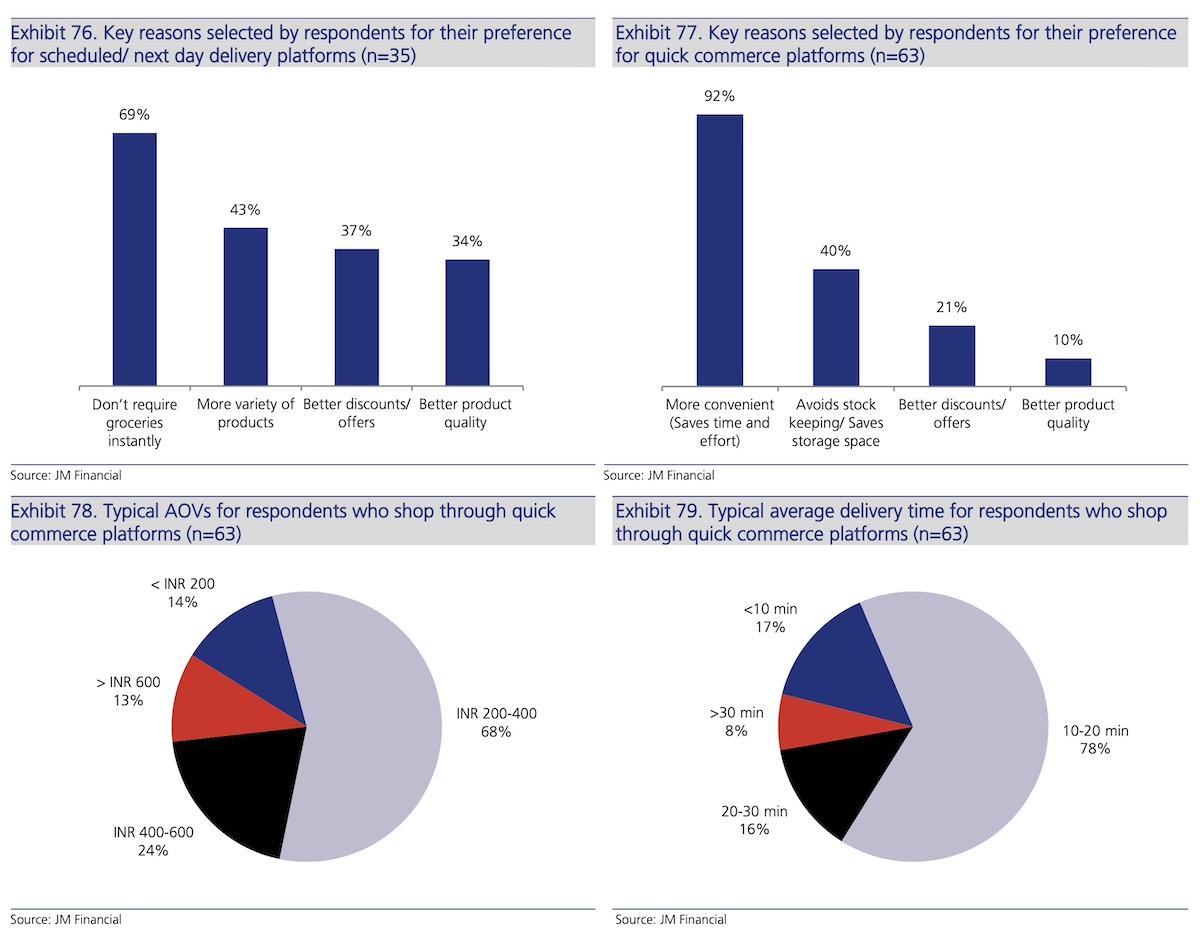

India’s fast commerce market has witnessed a staggering 10-fold development between 2021 and 2023, fueled by the sector’s skill to cater to the distinct wants of city shoppers searching for comfort for unplanned, small-ticket purchases. Nonetheless, regardless of this fast growth, fast commerce has solely captured a modest 7% of the potential market, with a complete addressable market (TAM) estimated at $45 billion, surpassing that of meals supply, in keeping with JM Monetary.

Zomato’s Blinkit leads the fast commerce market in India, having cornered as a lot as 46% of the market share by GMV within the quarter that resulted in December, in keeping with a brand new evaluation.

Swiggy’s Instamart follows with a 27% share, newcomer Zepto has shortly gained floor, securing 21% of the market and Bigbasket’s BB Now trails with a 7% share, in keeping with brokerage agency JM Monetary. Reliance Retail-backed Dunzo, which pioneered the fast commerce mannequin in India, has nearly misplaced its total market share.

“With more than 10 active players, the space was very competitive a couple of years back,” JM Monetary wrote of the fast commerce market in a latest observe. “It appeared that an intense phase of multi- year cash-burn would soon follow. However, contrary to expectations, several players including some well-funded ones folded early in their endeavour. While some faced funding challenges, a few others were affected by structural issues such as lack of product market fit, inability to solve the hyperlocal complexity, inability to build a robust end-to-end supply chain and 4) failure to create a strong brand recall.”

As fast commerce gamers vie for a bigger slice of the market, the success of their ventures hinges on the event of environment friendly provide chains. Corporations are making substantial investments in darkish retailer operations, streamlining stock administration, and establishing direct partnerships with FMCG producers and farmers. By circumventing conventional distribution channels, these companies goal to boost product high quality, expedite supply instances, and increase general operational effectivity, trade consultants stated.

Darkish shops, the spine of fast commerce operations, have considerably expanded their product choices, now carrying over 6,000 SKUs per retailer, a considerable improve from the two,000 to 4,000 SKUs they housed only a few years in the past, stated JM Monetary. In distinction, conventional neighborhood kirana shops, that are ubiquitous throughout Indian cities, cities, and villages, sometimes inventory between 1,000 and 1,500 gadgets. Massive trendy retail shops, then again, provide a a lot wider choice, with 15,000 to twenty,000 gadgets accessible to prospects.

There has additionally been a noticeable surge in common order worth amongst fast commerce gamers, which has risen to round Rs 500 ($6) from the earlier vary of Rs 350 to Rs 400. This improve in common order worth units fast commerce other than kirana shops, the place prospects sometimes spend between Rs 100 and Rs 200 per transaction.

Whereas the comfort supplied by fast commerce is simple, profitability stays a priority for buyers. Blinkit — which Zomato acquired in 2022 — goals to attain adjusted EBITDA break-even by the primary quarter of fiscal 12 months 2025, whereas Zepto has set its sights on EBITDA profitability in 2024. Swiggy’s Instamart can also be specializing in profitability, with the guardian firm indicating that the height of investments within the enterprise is now behind them.

Nonetheless, the long-term sustainability of the fast commerce mannequin stays to be seen. With intense competitors and the fixed want for heavy investments in expertise and provide chain, profitability could show elusive for some gamers. Moreover, the market’s development potential could also be restricted by the focus of demand in city areas, with smaller cities and rural areas presenting distinctive challenges when it comes to inhabitants density and client conduct.

And the market could entice much more heavily-funded gamers. Flipkart is weighing entering the quick commerce market by as early as Might this 12 months, TechCrunch reported final week.