Justin Sullivan/Getty Photographs Information

Funding thesis

I reaffirm my Promote score on Zoom Video Communications, Inc. (NASDAQ:ZM) regardless of the corporate outperforming my expectations during the last eight months. Regardless of its latest optimistic developments, Zoom Video continues to face a difficult panorama within the ever-evolving videoconferencing trade. The preliminary surge in demand fueled by the work-from-home pattern in the course of the COVID-19 pandemic supplied Zoom with substantial development, however because the trade matures and competitors intensifies, the corporate’s struggles have develop into extra obvious.

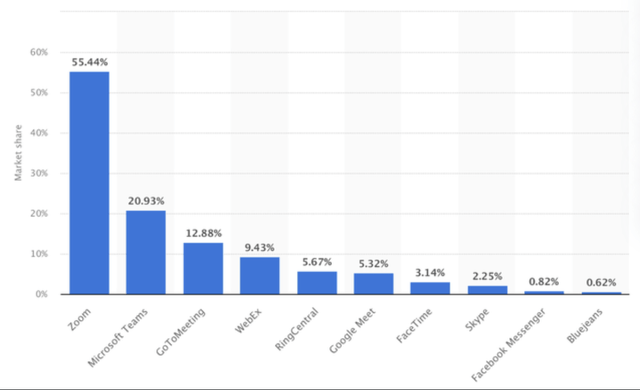

Whereas the general videoconferencing market is projected to expertise low-double-digit development, Zoom’s market share, sitting at a formidable 55%, seems more and more susceptible. The emergence of formidable rivals, significantly Microsoft Groups (MSFT), geared up with superior AI capabilities and seamless integration, has eroded Zoom’s once-dominant place. Whereas a commendable effort, the corporate’s makes an attempt to enter the productiveness market with Zoom Docs could face challenges towards established gamers like Microsoft Workplace and Google Docs (GOOG) (GOOGL).

On a optimistic word, Zoom has stunned observers with its fast deployment of AI functionalities, outpacing rivals like Cisco (CSCO) and Microsoft. The corporate’s investments in AI, notably by way of the partnership with Anthropic, have led to the profitable integration of AI options just like the Zoom AI companion, Zoom Telephone, and Zoom Contact Middle. These improvements, coupled with the optimistic adoption charges, improve Zoom’s worth proposition and probably mitigate a number of the challenges it faces.

Financially, Zoom has outperformed expectations in 2023, displaying resilience in income and reaching better-than-expected development. Nonetheless, considerations persist, significantly when it comes to market share losses, persistent stock-based compensation (SBC) bills, and the corporate’s excessive reliance on M&A for future development. Trying forward, Zoom’s steerage for This fall displays a slowdown in development, indicating ongoing challenges.

Regardless of an improve in monetary estimates, the inventory’s present valuation, buying and selling at 14.5x this yr’s earnings, doesn’t current a compelling funding case. With an outlook of mid-single digits CAGR for income and low-single digits for EPS, coupled with the prevailing dangers, the chance/reward profile seems unfavorable. In mild of those issues, the advice stays a promote, with the expectation that Zoom is more likely to underperform over the following 12 months. Buyers are suggested to strategy the inventory cautiously, contemplating different alternatives available in the market, particularly given the present high-interest price setting.

Zoom Video – An trade chief going through challenges

It has been some time since I final coated Zoom, the corporate behind one of many world’s largest videoconferencing platforms, right here on Looking for Alpha. I last discussed the inventory in April after I rated shares a promote and never with out purpose. The corporate emerged as a winner from the COVID-19 pandemic, absolutely benefiting from the working-from-home pattern and quickly rising demand for videoconferencing instruments. Nonetheless, these tailwinds driving development for Zoom from 2020 to mid-2021 have eased away, placing stress on the corporate as development is tough to return by, competitors is intensifying, and its financials didn’t align with its new development profile. Whereas the corporate basically undoubtedly had potential, I noticed too many negatives and headwinds for it to get previous to contemplate this a stable funding.

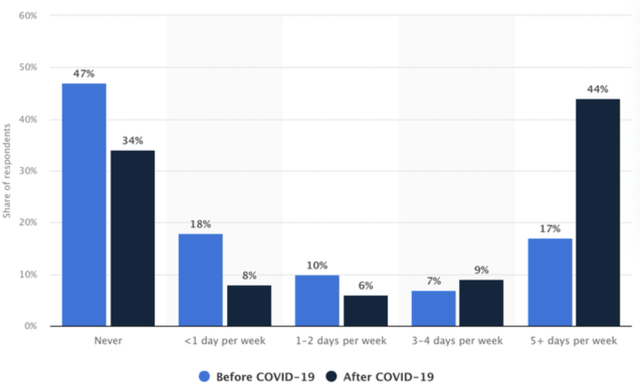

This was regardless of the videoconferencing trade outlook truly trying actually first rate. Trying on the newest information and estimates, we will see that whereas the work-from-home pattern depth has undoubtedly eased off from COVID ranges, it’s right here to remain. The variety of full workdays from dwelling increased from simply 6% pre-pandemic to 50% within the midst of the pandemic and has since retracted to twenty-eight% since early 2023, nonetheless considerably above the pre-pandemic stage. That is what has thus far allowed Zoom to keep away from reporting destructive development. Each customers and enterprises proceed to see worth within the firm’s providing as distant working stays widespread.

For perspective, as of 2023, 12.7% of full-time workers nonetheless do business from home, whereas 28.2% work a hybrid mannequin. Moreover, 98% of workers wish to work remotely no less than a number of the time. Consequently, in keeping with a research by Upwork, 22% of all Individuals will likely be working remotely by 2025, which interprets to 36.2 million individuals, up 87% from 2019 ranges. This analysis exhibits that the distant working pattern is right here to remain and will solely enhance going ahead, which bodes effectively for Zoom as demand for its platform will stay and most certainly develop over time.

proportion of workers working from dwelling as of 2022 (Statista)

Because of these dynamics, the global videoconferencing market, from a steady stage in 2023, is anticipated to develop at a CAGR of low-double digits. Trying on the projections of a number of market analysis companies, a CAGR of across the 11% mark appears extremely probably. That is pushed by the rising demand for videoconferencing as distant or hybrid work is right here to remain however can also be pushed by fast developments and improvements within the platforms themselves, like the combination of cloud and AI capabilities, which enhance the worth and functionalities of those platforms, growing each worth and usefulness.

And but, whereas development within the videoconferencing trade is trying stable, the numerous competitors and disappearing moat for Zoom imply it won’t be there to completely profit. That is what I concluded again in April:

Zoom emerged as one of many winners of the COVID-19 pandemic as its share worth skyrocketed to over $500 per share. Right now, the share worth has come all the way down to round $70 per share as buyers realized that the COVID-19 tailwinds boosting development for Zoom weren’t right here to remain, leading to a considerably weak development outlook for the corporate. And that is mirrored in its FY23 outcomes and FY24 outlook with development of simply 7% and 1%, respectively. The corporate appears to have entered a mature stage during which development is anticipated to stay within the mid-single digits and administration ought to give attention to profitability and its shareholders. But, the corporate reported SBC bills of $1.3 billion in FY23, leading to it solely barely making a GAAP revenue.

Along with this, I imagine the present spectacular market share of above 55% within the videoconferencing trade just isn’t sustainable for Zoom as it can shortly be overtaken by its huge tech rivals which seem a lot stronger in superior AI capabilities which might be anticipated to drive new options and development on this trade. Moreover, whereas Zoom operated the perfect platform in the course of the pandemic, specializing in simplicity and assembly options, competitors has caught up, leading to a weakening moat for Zoom. Consequently, I’m projecting weak development for the corporate going ahead, with it underperforming the videoconferencing trade and its rivals, pushed by market share losses, making this a tough funding alternative with a weak risk-reward profile.

Clearly, the corporate is working in a difficult setting and struggling to develop income and earnings. That is additionally mirrored within the inventory worth efficiency. Whereas we’ve got seen many expertise inventory costs skyrocket thus far in 2023, Zoom inventory is up simply 7% YTD. Moreover, shares are up simply 2.5% since I final coated these in April, underperforming the SP500 index considerably as this one is up 14.5% over the identical interval.

That is although Zoom is, in truth, one of many corporations that might considerably profit from the AI increase and has truly proven fairly some promising developments over latest months. I need to admit that the corporate has carried out higher financially and basically when it comes to improvement than I anticipated in April. Nonetheless, this doesn’t imply that essential points have totally disappeared.

Subsequently, let’s dive into crucial developments from the final eight months, each optimistic and destructive.

Zoom exhibits optimistic developments however will proceed to wrestle

As mentioned earlier, the outlook for the videoconferencing trade could be very stable, with development at a CAGR of low-double digits. But, I didn’t count on Zoom to have the ability to absolutely profit from this development. I nonetheless don’t, which is basically a results of the numerous competitors it faces from Microsoft with its Groups platform, Zoom’s weak moat, and its monetary drawback.

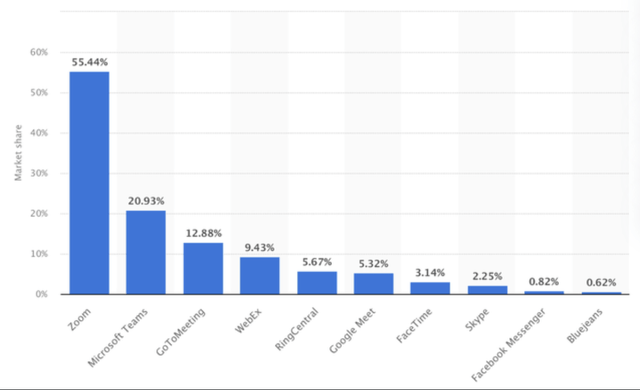

Remarkably, as of the tip of 2022, the corporate holds a really important market share of 55% within the trade, far forward of its closest peer, Microsoft, at 21%. Nonetheless, I don’t view the market share as anyplace near sustainable.

Market shares within the videoconferencing trade (Statista)

Whereas Zoom supplied the perfect platform in the course of the pandemic due to its head begin, specializing in simplicity and assembly options, competitors has caught up, with Microsoft’s Groups platform providing very related options to that of Zoom. For many assembly necessities, each will most likely do the job, and because of this, Zoom has seen its moat disappear quickly over latest years.

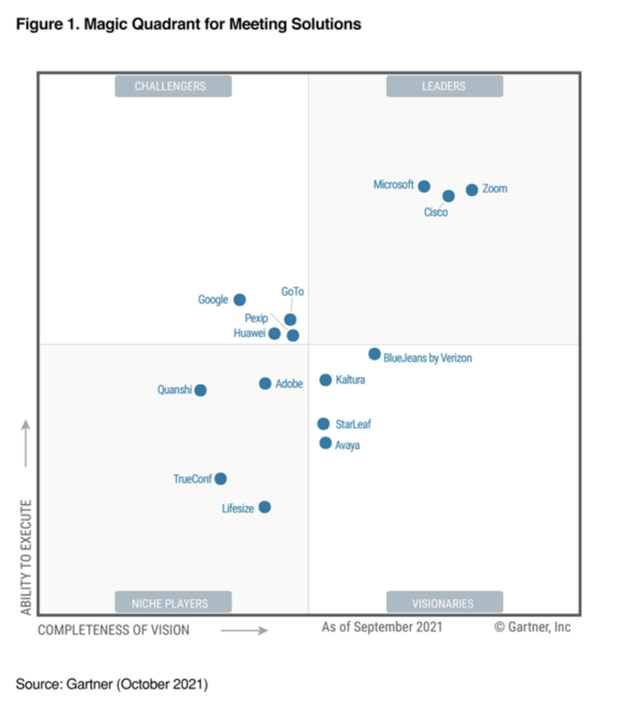

In fact, its moat was by no means actually sturdy. Aside from the first-mover benefit and the truth that enterprises are unlikely to change platforms resulting from prices, Zoom has had little or no going for it. The platform is by no means distinctive, which is confirmed by Gartner’s analysis, which supplies each Zoom and Microsoft Groups very related rankings and locations on its magic quadrant.

Inside the videoconferencing trade, there are simply three actual elements to leverage as a option to set your platform aside from the competitors, and these are options, prices, and compatibility. In every of these, Zoom has had bother combating Microsoft.

Whereas when it comes to value, there’s little distinction between the 2, on the compatibility entrance, Microsoft has the advantage of Groups being built-in into its workplace bundle, giving prospects seamless integration between Groups and applications like Excel, Phrase, and PowerPoint. With this software program being utilized by thousands and thousands of people, governments, establishments, and companies worldwide, this provides Microsoft a really highly effective benefit, one Zoom can’t struggle or match.

This has been one of many key the reason why Microsoft has reported quicker person development in latest quarters and years. On the finish of 2021, Microsoft reported 270 million customers of its Groups platform, rising to 300 million by the tip of 2022 and 320 million as of the most recent financial report. This consists of over 1 million organizations and 91% of the Fortune 100.

Moreover, whereas exhausting to find out, some analysts imagine Groups is about to succeed in $8 billion in income in 2023. That is up from $6.8 billion in 2020, when, after all, utilization was a lot greater. A technique or one other, it’s secure to say that Microsoft continues to shut the hole and is gaining on Zoom.

Nonetheless, positively, Zoom is now, in truth, trying to struggle Microsoft on the compatibility entrance by coming into the productiveness market to compete with Microsoft workplace and provide what Microsoft is ready to provide by way of Groups and Phrase with its Zoom Docs powered by AI. Whereas Zoom just isn’t about to completely compete with Microsoft, it’s merely attempting to match the performance of getting a program to create paperwork, monitor tasks, handle duties, and plenty of extra, with glorious compatibility with the Zoom platform to make it extra aggressive on the productiveness entrance. The corporate will introduce this system in 2024 to go up towards Microsoft Workplace and Google Docs.

Will it have the ability to compete? Outdoors of constructing notes inside the Zoom platform, I don’t suppose so. Microsoft Workplace and Google Docs have very sturdy person bases with nice compatibility and accessibility with different apps and platforms of these corporations.

Moreover, regardless of my general destructive view thus far, Zoom has additionally positively stunned me during the last eight months when it comes to function developments and the combination of AI functionalities specifically. In my April article, I defined how I anticipated Zoom to fall behind the competitors on this entrance because it has to compete with huge tech friends like Cisco and Microsoft with superior monetary sources and way more expertise in AI. And but, Zoom has confirmed me unsuitable over these previous couple of months, with the corporate quickly rolling out new options and beating Microsoft and Cisco to the feat.

Zoom has invested in AI start-up Anthropic in an effort to spice up its AI choices. The corporate is leveraging Anthropic’s massive language mannequin, generally known as Claude, throughout its platform, together with its name heart and the corporate’s AI companion. I need to admit that Zoom’s quick roll-out of AI functionalities has impressed me as the corporate, in a number of areas, appears to outpace the competitors with these improvements, including to the attractiveness of the Zoom platform.

The corporate’s AI companion, which is now obtainable to paying customers at no extra value, is a differentiator to different AI assistants, with these of Microsoft and Google, both costing up to $30 per month. Consequently, the AI functionalities have seen nice adoption within the first three months because the launch, with over 200,000 accounts enabling it and a couple of.8 million assembly summaries having been created by the assistant.

Aside from sturdy development in these AI functionalities, the corporate has additionally seen sturdy adoption of different new functionalities, with Zoom Telephone reaching 7 million paid seats, Zoom Contact Middle reaching 700 prospects, and the Zoom Digital Agent reporting a quarter-on-quarter doubling of consumers. Clearly, Zoom prospects are desirous to undertake the brand new functionalities, including to Zoom’s worth per buyer, which may develop into a robust development driver over time, particularly if it continues to wrestle so as to add new prospects.

These new integrations are essential for Zoom as these next-generation applied sciences are essential in profitable over prospects and sustaining them. As I mentioned earlier than, inside the trade, higher or extra in depth options are among the best methods to set your self aside, and that is exactly what Zoom is doing, giving it a greater probability at combating the competitors and sustaining its market share.

Whereas this doesn’t change my perception that Zoom is unlikely to broaden its market share and can most certainly proceed to lose share, I do imagine it softens the scenario and exhibits that Zoom does nonetheless stand an opportunity to struggle its bigger, financially superior friends, making me barely much less bearish on the potential market share losses for Zoom. The corporate has outperformed my expectations when it comes to improvement, permitting for some cautious optimism in my eyes. Nonetheless, I do nonetheless count on a slight market underperformance from Zoom.

Zoom outperforms financially, however weak spot persists.

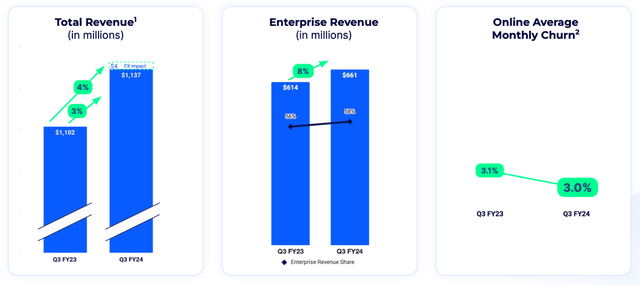

Progress thus far in 2023 had turned out significantly better than what administration had guided for at first of the yr when it had guided development of simply 1%. In Q3, complete income got here in at $1.14 billion, up 3% year-over-year, bringing the YTD development to three.2%, a slowdown from the 7% development reported in its fiscal FY23. Nonetheless, that is higher than I anticipated, primarily as a result of enterprise displaying to be stickier than anticipated and administration’s rollout of recent options, including new income streams.

Nonetheless, Zoom continues to face a slowdown within the underlying trade, primarily pushed by a slowdown in development within the enterprise section, which was up simply 8% in Q3, down from 24% development in fiscal FY23. This displays the depressed IT spending we at the moment see amongst enterprises and doesn’t shock me. This was additional highlighted by a weakening internet retention price, which got here in at 105% in Q3, down from a 115% stage in fiscal FY23, reflecting a decrease demand setting. That is in step with my expectations.

Q3 monetary information (Zoom)

Nonetheless, Zoom reported a 5% development in Enterprise prospects in Q3. Enterprise now accounted for 58% of income, up from 56% in the identical quarter final yr. Additionally, the enterprise stays comparatively sticky, with churn reducing YoY to three% from 3.1% one yr in the past, and continues to develop RPO, though at a slower tempo of simply 10% in comparison with 30% in fiscal FY23, leading to an RPO of $3.6 billion as of the tip of Q3. To this point, there aren’t many surprises.

Shifting to the underside line, the corporate has additionally carried out significantly better than anticipated, pushed by the resilient top-line efficiency and the optimization of utilization throughout the general public cloud, partially offset by investments in new AI applied sciences. The gross margin in Q3 was 79.7%, up 20 foundation factors YoY and barely beneath the extent achieved within the first half of the yr. Nonetheless, contemplating weak spot, it is a sturdy gross margin efficiency.

The resilient gross margin, mixed with value efficiencies and a few one-off advantages, allowed Zoom to enhance the working margin to 39.3%, up 470 foundation factors YoY. This resulted in a non-GAAP working revenue of $447 million, up 17% YoY.

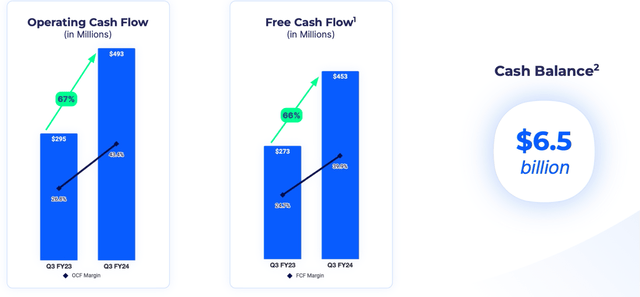

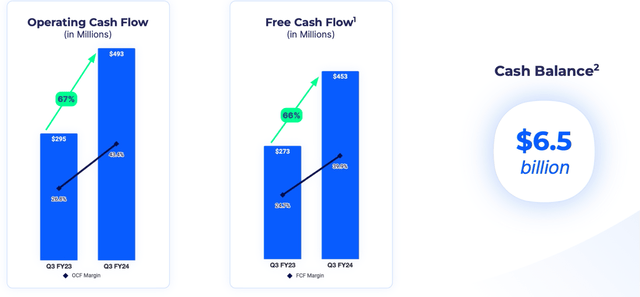

This huge margin enchancment additionally boosted EPS development, up 21% YoY to $1.29, bringing the YTD EPS development to twenty%, far above my start-of-the-year estimate of an EPS decline. Money flows additionally grew strongly, with FCF up 66% YoY to $453 million, bringing the YTD complete to a major $1.14 billion, representing an FCF margin of 34%. This enhance was pushed by stronger collections, focused expense administration, and better curiosity revenue. This allowed Zoom to additional strengthen the steadiness sheet because it ended Q3 with a complete money place of $6.5 billion, up just a little over a billion from the beginning of the yr. In the meantime, the corporate has no debt on the steadiness sheet, leaving it in glorious monetary well being with loads of money to speculate or use for acquisitions.

Q3 monetary information (Zoom)

Administration has already indicated that it’s not planning to leverage its important money place to purchase again shares. Administration is totally centered on investing within the enterprise and is probably going to take a look at smaller tuck-in acquisitions and bigger ones.

Whereas I’m in favor of this technique on many events, I’m not certain on this scenario because it leaves buyers extremely uncovered to the numerous ranges of SBC. SBC in Q3 was $259 million, down 14.5% YoY. Nonetheless, YTD SBC continues to be up 4.6%, outpacing income development. Moreover, because of this, GAAP EPS remained a lot decrease at simply $0.45, indicating that SBC continues to take up 66% of non-GAAP internet revenue, which is important. YTD, this will increase additional to 70% of non-GAAP internet revenue, with SBC of $813 million. General, SBC will likely be down barely from fiscal FY23 ranges however stay elevated.

For an organization that has entered a comparatively mature stage with no fast development anticipated over the following decade, this type of profitability and SBC is solely unacceptable to me because it barely makes an actual revenue and massively dilutes its shareholders. To me, that is certainly one of my largest considerations concerning an funding in Zoom, as administration doesn’t appear to care and continues to dilute shareholders.

General, I need to, nonetheless, admit that I’m fairly impressed by Zoom’s fiscal FY24 thus far, as the corporate has proven the power to roll out options a lot quicker than friends, keep current prospects, and proceed to draw new prospects. Sure, Microsoft’s Groups platforms appear to be rising barely quicker, however Zoom’s market share losses appear to be much less important than I anticipated eight months in the past. As well as, administration is ready to enhance margins and money flows at the same time as income development retains slowing down, which is outstanding.

Merely put, I’ve underestimated the corporate. Nonetheless, this doesn’t imply all weaknesses have disappeared, with the corporate nonetheless shedding market share and repeatedly diluting its shareholders. Together with SBC, the corporate can nonetheless barely report a revenue with a GAAP internet revenue margin of simply 10%, which raises considerations.

Outlook & Valuation – Is ZM inventory a Purchase, Maintain, or Promote?

For This fall, administration has guided income to be within the vary of $1.125 billion to $1.13 billion, up simply 1% on the midpoint of the vary, indicating that development continues to decelerate. Nonetheless, administration has been very conservative in its steerage over latest quarters, so these estimates most likely have some upside. Administration additional guides for an working margin of round 36.5%, up 30 foundation factors YoY. This could end in an EPS of $1.13 to $1.15, down 6.5% YoY.

This could end in fiscal FY24 income of $4.506 billion to $4.511 billion, up barely from administration’s prior expectations and up 3% on the midpoint. Moreover, the gross margin is anticipated to be roughly 80% for all the yr, and working revenue within the vary of $1.74 billion to $1.745 billion, representing an working margin of roughly 39%. Lastly, this ends in an EPS estimate of $4.93 to $4.95, up 13% and much above my $4.20 estimate from the beginning of the yr.

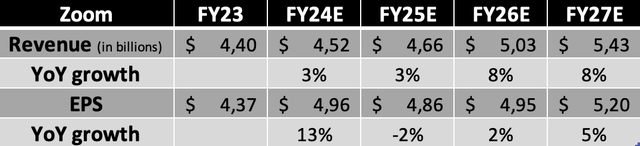

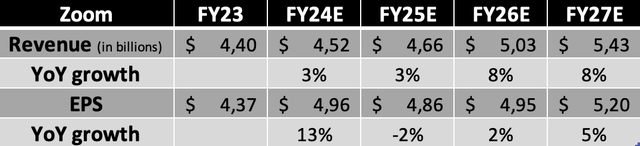

Considering the corporate’s better-than-expected YTD efficiency, the fast roll-out of recent options, and the This fall steerage laid out above, I improve my monetary estimates for Zoom and switch barely extra bullish on its long-term potential, at the same time as I proceed to see a major variety of headwinds. I’ve elevated each my income and EPS estimates by way of the corporate’s fiscal FY27. Nonetheless, from a stable base fiscal FY24, this nonetheless represents very disappointing income development of a mid-single digits CAGR and EPS development at a low-single digits CAGR as the corporate is going through a really robust comparability with the present fiscal yr, rising prices, and growing competitors and investments. I count on the corporate to have reached a peak in its margins and these to ease barely within the upcoming years. These expectations end result within the following monetary projections.

Monetary projections (Creator)

Based mostly on these expectations, Zoom shares are at the moment buying and selling at 14.5x this yr’s earnings, which is a barely extra favorable a number of in comparison with the 16x it traded on in April, however the present share worth of $72 continues to be above my newest goal worth of $66. Moreover, I nonetheless don’t view shares as buying and selling at a reduction in any means, as the expansion outlook stays considerably depressed and dangers stay important, at the same time as the corporate has proven some optimistic and shocking developments in latest quarters.

The corporate’s development outlook just isn’t trying very inspiring, it continues to lose market share and barely generate a GAAP revenue resulting from important SBC, and administration is desperately on the lookout for M&A alternatives to spice up development, which can carry dangers of its personal. Merely put, based mostly on the present development expectations and dangers concerned with accelerating development, I imagine buyers shouldn’t be prepared to pay a lot of a premium for this firm, if something in any respect.

Even when I keep my 15x honest worth a number of, the marginally greater EPS expectations solely enable for a minor goal worth enhance to $73 per share, based mostly on my FY25 EPS projection. This leaves just about no upside potential over the following 12+ months, which is why I reconfirm my promote score on Zoom, regardless of some optimistic developments and outlook upgrades.

The danger/reward profile stays unfavorable for buyers, particularly as rates of interest stay excessive. On the present time, I imagine there are significantly better alternatives obtainable available on the market, and I count on Zoom to maintain underperforming over the following 12 months.