The adoption of open banking and instantaneous funds is transferring slowly in america in comparison with different markets world wide, for instance, Brazil. That stated, the brand new program FedNow went dwell in July 2023, and data-sharing laws are forthcoming, so extra potential is on the horizon.

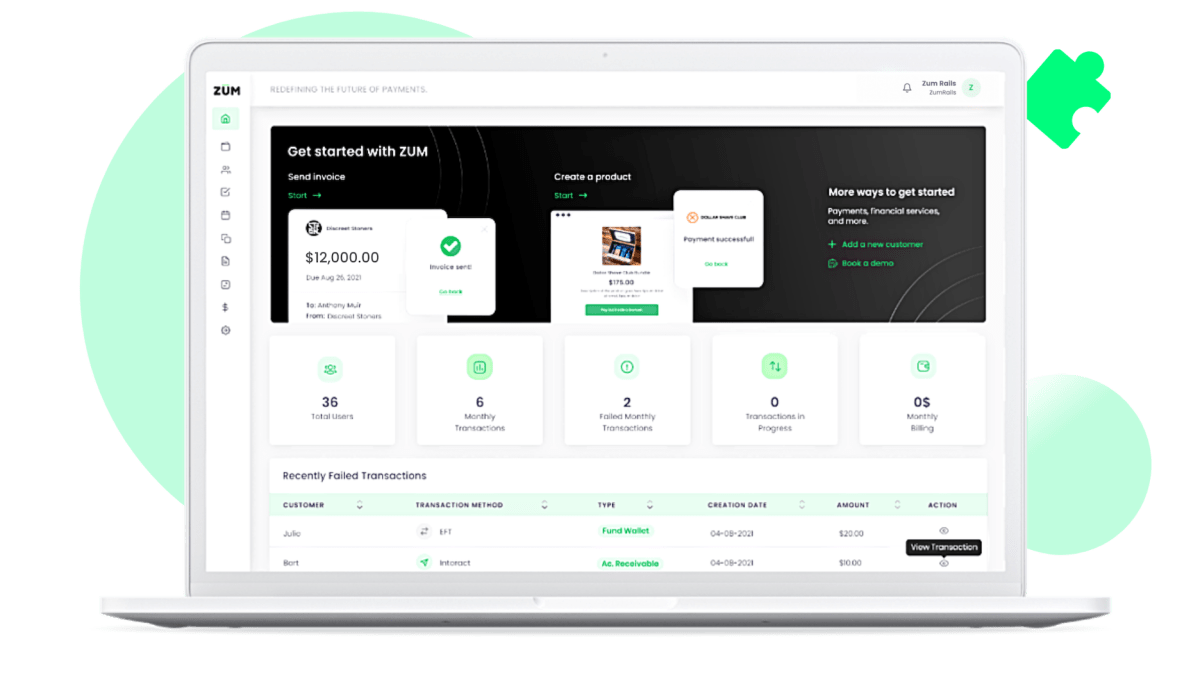

Till then, the co-founders of Zūm Rails say the experiences customers have with funds continues to be fragmented, that means corporations should create a tech stack to offer a variety of companies to their prospects. The Montreal-based firm is taking the strategy of offering an all-in-one funds gateway that merges open banking with instantaneous funds.

Marc Milewski and Miles Schwartz began the corporate in 2019. Milewski’s background is in treasury funds and he was an early worker at accounts receivable automation software program firm Versapay. Whereas there, he labored on what finally turned Canada’s first webhook-enabled EFT gateway.

“You learn about all the problems everyone has moving money,” Milewski advised TechCrunch. “Open banking was discussed, but I thought it was more about payments. Miles and I talked about building a whole new gateway that unified these experiences. Companies don’t want to be payment experts — that’s our job.”

They began constructing software program to simplify the complexity of transferring cash by way of completely different fee rails so corporations can use whichever strategy is smart for his or her enterprise. Their expertise leverages “omni rails” for funds, whether or not it’s conventional credit score, debit or digital funds switch choices. It additionally gives for real-time choices by means of companions, together with Visa Direct, Mastercard, MX and Canada’s Interac community.

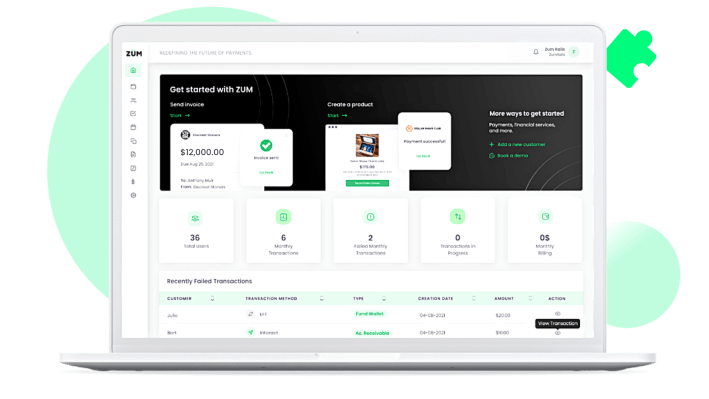

Zūm Rails manages the circulation of cash, together with the discount of fraud and failed transactions, by verifying a buyer’s id, linking immediately with financial institution accounts and facilitating funds by way of the tactic of the client’s selecting.

The corporate now processes greater than $1 billion in funds by means of its platform every month for over 500 corporations, together with Questrade, Coinsquare and Desjardins, which is a big federation of credit score unions in North America. Previously yr, the corporate grew over 200% and launched within the U.S. on the finish of 2023.

Milewski and Schwartz bootstrapped Zūm Rails, constructing it as much as a group of 30 folks. Final yr, the pair determined to lift enterprise capital.

“We reached the point where we realize that bootstrapping is no longer healthy for our business,” Schwartz advised TechCrunch. “We have some big initiatives we want to work on and grow on. Now it makes sense to do it all at once, and it’s healthy for the business to now go all-in and use the fuel.”

Zūm Rails’ expertise leverages “omni rails” for funds, whether or not it’s conventional credit score, debit or digital funds switch choices. Picture Credit: Zūm Rails

They closed on a $10.5 million Sequence A funding spherical, led by Arthur Ventures, and intend to put money into rising within the U.S. and increasing its funds choices that can embrace the introduction of latest banking-as-a-service options for retailers. As well as, Zūm Rails is engaged on a FedNow providing within the U.S. that can allow companies to ship and obtain FDIC-insured funds inside seconds.

Zūm Rails’ efficiency thus far “is really impressive,” Jake Olson, vice chairman at Arthur Ventures, advised TechCrunch. He referred to as the corporate “a great fit” for its funding thesis, which is high-growth and capital-efficient B2B software program corporations.

“Achieving profitability without any outside capital is impressive,” Olson stated. “Their product positioning is also really compelling. Rather than weaving together different systems, Zūm Rails can provide organizations with a comprehensive solution that powers the entire transaction journey and enables them to have a seamless experience for their end users. Any organization that views the streamline digital financial interaction coupled with the instant payments capability as a competitive advantage will be a great fit for Zūm Rails.”