Authorized consultants warn that Hunter Biden might face “a real chance of jail time” if convicted on his new felony tax fees.

George Washington College legislation professor Jonathan Turley advised Fox Information Digital mentioned Biden might face jail time if he’s convicted of the three felony tax charges filed by particular counsel David Weiss in California Thursday.

Turley mentioned Weiss repeatedly emphasised in Biden’s indictment “that this was a four-year effort to knowingly evade taxes to spend on ‘an extravagant lifestyle.'”

HERE’S WHAT’S IN HUNTER BIDEN’S NEW CALIFORNIA INDICTMENT

George Washington College professor and Fox Information contributor Jonathan Turley (Fox Information)

“It is hard to see how prosecutors would make such a case and not seek jail time for knowingly criminal conduct. Moreover, given the evasion going back to 2016, it is hard for the court to dismiss this as a first-offender novice,” Turley mentioned.

“There is a real chance of jail time if he is convicted on the three felonies.”

Former deputy impartial counsel Sol Wisenberg advised Fox Information Digital “it is very hard to say” what the typical American would face if convicted of Biden’s fees “because federal judges typically grant a ‘downward variance’ from the advisory sentencing guidelines range in tax cases.”

“Also, the sentence depends on whether you plead guilty and accept responsibility or take the government to trial and lose,” Wisenberg mentioned.

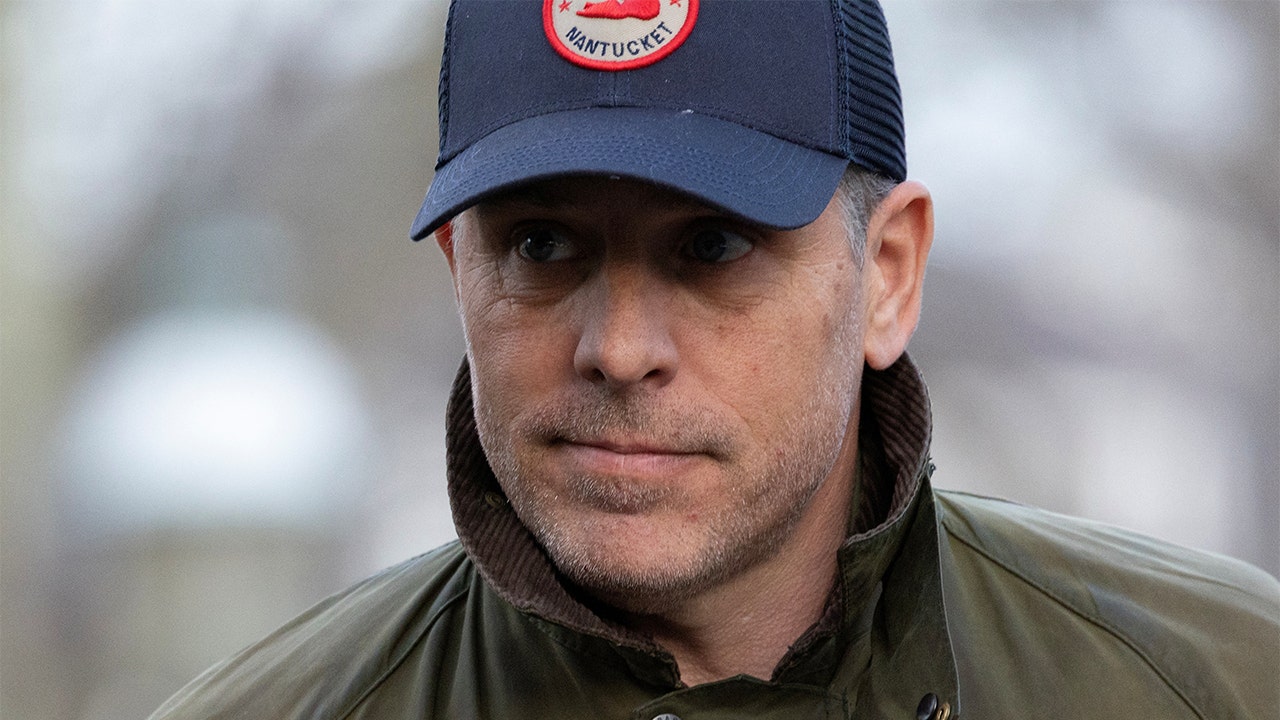

Hunter Biden is going through 9 fees alleging a “four-year scheme” when he didn’t pay federal earnings taxes from January 2017 to October 2020 whereas additionally submitting false tax experiences. (Brendan Smialowski/AFP by way of Getty Photos)

“I would guess that a typical citizen who pleaded guilty to the charges would end up getting anywhere from one to three years,” he added.

The consultants’ feedback come because the youthful Biden navigates increasing authorized woes as his father, President Biden, seeks re-election to a second time period.

Hunter Biden is going through 9 fees alleging a “four-year scheme” when he didn’t pay his federal earnings taxes from January 2017 to October 2020 whereas additionally submitting false tax experiences.

The costs break down to 3 felonies and 6 misdemeanors from $1.4 million in owed taxes which have since been paid.

The consultants’ feedback come because the youthful Biden navigates increasing authorized woes and his father, President Biden, seeks re-election to a second time period. (Brendan Smialowski/AFP by way of Getty Photos)

Particular counsel David Weiss alleged Hunter Biden “engaged in a four-year scheme to not pay at least $1.4 million in self-assessed federal taxes he owed for tax years 2016 through 2019, from in or about January 2017 through in or about October 15, 2020, and to evade the assessment of taxes for tax year 2018 when he filed false returns in or about February 2020.”

Weiss mentioned that, in “furtherance of that scheme,” the youthful Biden “subverted the payroll and tax withholding process of his own company, Owasco, PC by withdrawing millions” from the corporate “outside of the payroll and tax withholding process that it was designed to perform.”

Counts one, two, 4 and 9 allege that Hunter didn’t pay his taxes within the years 2016, 2017, 2018 and 2019.

Counts three and 5 allege Hunter didn’t file his taxes within the years 2017 and 2018.

Particular counsel David Weiss alleged Hunter Biden “engaged in a four-year scheme to not pay at least $1.4 million in self-assessed federal taxes he owed for tax years 2016 through 2019’ (REUTERS/Tom Brenner)

Count five of the indictment noted Hunter raked in a “gross earnings in extra of $2.1 million” and alleged the presidential scion failed to pay his taxes on his millions of dollars of income.

Count six alleges Hunter’s “evasion of evaluation for 2018 Kind 1040” regarding his taxes, while count seven alleges Hunter filed “a false and fraudulent 2018 Kind 1040.”

The sixth count also alleges Hunter “lastly filed his 2018 Kind 1040 in 2020 in an effort to keep away from being held in contempt of courtroom in two civil proceedings.”

Additionally, count eight alleges Hunter filed “a false and fraudulent 2018 Kind 1120.”

White House press secretary Karine Jean-Pierre mentioned Friday the president wouldn’t be pardoning his son if he is convicted.

CLICK HERE TO GET THE FOX NEWS APP

“Nothing has modified. That’s nonetheless the case,” Jean-Pierre mentioned when asked if Biden will pardon Hunter.

“I imply, the president has mentioned this earlier than, and he’ll proceed to say, which is that he loves his son and helps him as he continues to rebuild his life,” Jean-Pierre said.

“And I will be actually cautious to not touch upon this and consult with Division of Justice or my colleagues on the White Home counsel. However that is what I will. I am not going to transcend telling you all what the president has mentioned again and again. He is happy with his son, and he’s constructing his life again.”

Fox News Digital’s Stepheny Price contributed reporting.