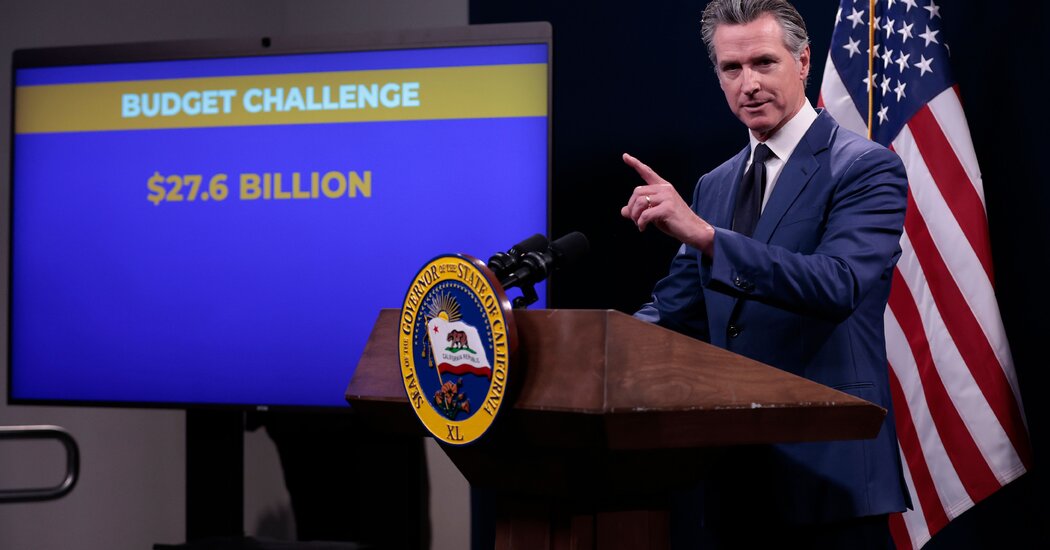

Slammed by a post-pandemic drop in state revenue projections, California lawmakers on Saturday announced a deal to close a state deficit estimated at $47 billion, paving the way for a nearly $300 billion state budget for the next fiscal year.

The budget, which has vexed the state’s Democratic leaders for months, was announced just days before the state’s legal deadline and after weeks of negotiation.

It will tap reserves, delay a planned increase in the minimum wage for health workers, suspend some tax breaks for businesses and cut or postpone billions of dollars in state spending, state finance officials said.

“This agreement sets the state on a path for long-term fiscal stability — addressing the current shortfall and strengthening budget resilience down the road,” Gov. Gavin Newsom said in a statement.

The moves are just part of a two-year effort that was launched after lawmakers realized they had significantly underestimated a projected shortfall. Such budgetary issues have become common in California, even though the state reported a record surplus just two years ago.

California’s budget dwarfs the gross domestic products of some countries, underpinning the nation’s most populous state and the world’s fifth-largest economy. But when Golden State finances swing, they have an impact — and they can swing wildly.

What kind of a budget deal did the lawmakers settle on?

The $297.9 billion budget, which will take effect July 1, will include a general fund of $211.5 billion. It will cover the state’s projected $46.8 billion gap with a hodgepodge of maneuvers, including $17 billion or so in trims that lawmakers agreed on earlier in the year.

About $5 billion will be pulled from the state’s reserves, with about $7 billion more to be tapped the following year in the 2025-26 budget. The state will eliminate about 10,000 jobs that are currently unfilled. Some tax breaks for businesses will be suspended starting this year.

The state prison budget will be cut by more than what Mr. Newsom initially suggested in order to forestall proposed cuts in programs to address homelessness, subsidized child care and other social services. A popular scholarship for students from middle-income families will also be trimmed, but not until mid-2025.

And a law that would gradually increase the minimum wage to $25 an hour for nearly all health care workers will be changed to delay raises for several months or into next year, depending on the state’s revenue picture. The wage increase affects the state budget because many of the employees work at state hospitals and clinics or at facilities whose patients are reimbursed through California’s version of Medicaid.

How did the lawmakers reach an agreement?

In December, the state’s nonpartisan budget analyst projected a deficit of about $68 billion for the 2024-25 fiscal year. A month later, the governor’s finance experts, using different methods, pegged the shortfall at about $38 billion, which was slightly more manageable.

Governor Newsom and state lawmakers made some early cuts, shifts, delays and other spending maneuvers that, by the governor’s estimate, whittled the gap by about $17 billion for the coming year.

In May, the governor proposed a grab bag of solutions that included no new taxes but would cancel some planned spending, spread the pain across a range of state programs, suspend some tax breaks for businesses and dip into state reserves. His proposal also omitted funding for the increase in the health workers’ minimum wage.

Legislators countered with a plan to make deeper cuts in the state’s prison funding and speed up the suspension of business tax breaks, leaving more money for the social safety net, including child care and health care.

Why do California’s finances jump around so much?

Volatility is a natural byproduct of California’s system of taxation. Designed to be progressive and fairer to low-income taxpayers, it relies heavily on taxes on personal income and capital gains.

When rich taxpayers have a good year, the state government reaps a windfall. But when initial public offerings slump or the stock market reverses, revenue plunges. And the state has limited flexibility in raising revenue in times of shortfall because, in most cases, the law requires a two-thirds supermajority in the Legislature to pass a tax increase.

What has the state done to manage the volatility of its finances?

Californians have chipped away for some time at the state’s budget dysfunction, which used to be much worse. In 2004, voters passed a constitutional amendment requiring the state to reserve 3 percent of general fund revenue every year, regardless of the state’s economic performance. But the reserve fund barely got off the ground before the 2008 financial collapse slammed the state.

The recession’s aftermath prompted a number of budget reforms. In 2010, for example, lawmakers successfully put forward a ballot measure that bolstered the reserve fund. Voters also approved a ballot measure that streamlined the budget-making process, lowering the two-thirds supermajority threshold for budget passage to a simple majority vote.

As the economy rebounded, Jerry Brown, the governor at the time, and state lawmakers capitalized on those reforms to further stabilize the state’s finances, persuading voters to increase the reserve fund, require that even more money be funneled into it when capital gains tax revenue is booming and toughen the rules for using the money in lean times.

But the system still has room for improvement, as the recent fluctuations have shown.

What caused California’s recent huge swing from surplus to shortfall?

In 2021, a robust stock market drove state revenue up, only to drag it back down when the market slumped the next year. As the Federal Reserve raised interest rates in an effort to curb post-pandemic inflation, higher borrowing costs for businesses led to higher unemployment and fewer initial public offerings and startups, which in turn depressed revenue from the tax on capital gains.

The economy bounced back in 2023, but write-offs from the previous year dampened the state’s rebound. On top of that, winter storms prompted the Internal Revenue Service to extend the tax filing deadline for most California taxpayers, making it hard for the state to accurately project its own tax receipts.

Lawmakers had to pass the budget the state is currently operating on before it was clear how much money would be coming in, and they were too optimistic. When the state’s financial picture finally became clear, it showed that state tax receipts were 22 percent below expectations.

Will this year’s budget deal address California’s structural budget issues?

Yes, at least in some ways.

Lawmakers budgeted for two fiscal years rather than just one, allowing an early start on projections that revenue will come in short again next year. The deal also includes a commitment to set aside extra reserve funds, to better cushion the state for future lean years.

Lawmakers also agreed to pursue a new rule that would effectively set aside part of any future projected surpluses and prevent the state from spending the money until it is actually in hand.

What’s left to be decided?

State lawmakers also have been weighing whether to place one or more proposed bond issues on the November ballot. Those measures, which would be subject to voter approval, would let the state borrow to help pay for items such as climate, housing or public school programs.

That approval is far from guaranteed, however. Earlier this year, voters barely approved a bond measure that was key to the state strategy for caring for people who are mentally ill and homeless, and support for more bonding has been unclear.