USD

- The Fed left interest rates unchanged as anticipated on the final assembly with principally no

change to the assertion. The Dot Plot nonetheless confirmed three charge cuts for 2024 and

the financial projections have been upgraded with progress and inflation increased and the

unemployment charge decrease. - Fed Chair Powell maintained a impartial stance as he stated that it was

untimely to react to the current inflation knowledge given attainable bumps on the way in which

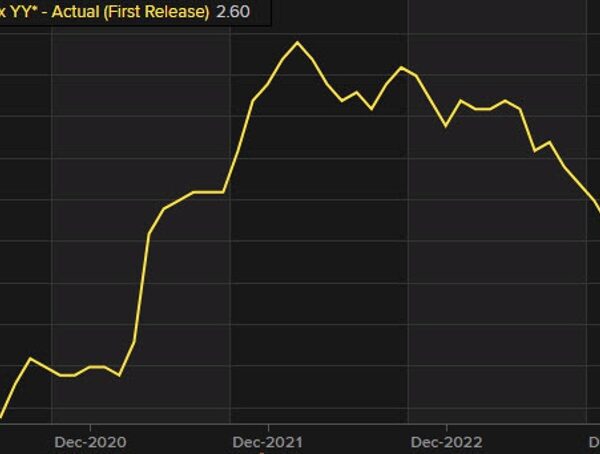

to their 2% goal. - The US CPI and the US PPI beat expectations for the second

consecutive month. - The US NFP beat expectations throughout the board

though the common hourly earnings got here in step with forecasts. - The US ISM Manufacturing PMI beat expectations by a giant margin with

the costs part persevering with to extend, whereas the US ISM Services PMI missed with the value index dropping to

the bottom degree in 4 years. - There’s now principally a 50/50 likelihood of a charge reduce

in June.

EUR

- The ECB left interest rates unchanged as

anticipated on the final assembly revising inflation and progress expectations

downwards and sustaining the standard knowledge dependent language. - The current Eurozone CPI missed

expectations. - The labour market stays traditionally tight with

the unemployment charge hovering at document lows. - The newest Eurozone PMIs beat

expectations on the Companies aspect whereas the Manufacturing one missed dropping

additional in contraction. - The market expects the ECB to chop charges in June.

EURUSD Technical Evaluation –

Each day Timeframe

EURUSD Each day

On the every day chart, we will see that EURUSD bought

rejected lately by the trendline the place we

also can discover the confluence of the

61.8% Fibonacci retracement degree

and the pink 21 moving average. That is

a really robust resistance zone that the patrons might want to break to extend

the bullish bets into the 1.10 deal with. The sellers, alternatively, ought to

pile in round these ranges to place for a drop into new lows goal a break

beneath the important thing 1.0723 degree.

EURUSD Technical Evaluation –

4 hour Timeframe

EURUSD 4 hour

On the 4 hour chart, we will see extra intently the resistance

zone across the 1.0870 degree and we will additionally discover that the most recent leg increased diverged with the

MACD. That is

typically an indication of weakening momentum typically adopted by pullbacks or

reversals. On this case, it is likely to be one other bearish sign, though the value

might want to break beneath the upward trendline to substantiate it.

EURUSD Technical Evaluation –

1 hour Timeframe

EURUSD 1 hour

On the 1 hour chart, we will see that we

have a support zone

across the 1.00845 degree the place we will additionally discover the confluence of the upward

trendline and the 4-hour 21 transferring common. That is the place we will anticipate the

patrons to step in with an outlined danger beneath the assist zone to place for a

rally into new highs. The sellers, alternatively, will wish to see the

worth breaking decrease to extend the bearish bets into new lows.

Upcoming Occasions

Today we get the US CPI report and the FOMC Minutes.

Tomorrow, we may have the ECB Charge Determination, the US PPI and the most recent US

Jobless Claims figures. On Friday, we conclude the week with the College of

Michigan Shopper Sentiment Survey.