Richard Drury

Rose’s Revenue Backyard Portfolio

Rose’s Revenue Backyard “RIG” portfolio ended March with 83 shares from all 11 sectors with a purpose to maintain a majority of revenue from defensive high quality investment-grade widespread inventory. The opposite investments and particularly the monetary sector has excessive yield (HY), enterprise improvement corporations (BDCs), a couple of mREITs, most popular inventory and actual property including to the revenue to assist in giving it a yield of 6%. Admittedly development shares are the least represented as revenue is the next precedence, however preserving worth stays an necessary purpose.

The defensive inventory in RIG comes from the next sectors with the variety of shares following:

-Client Staples (10)

-Healthcare (9)

-Communication/Tele (4)

-Utility (9)

-Mounted bonds and ETFs (3)

-Industrial defensive (2)

-Actual Property Healthcare (3)

These present ~54% of worth and roughly 46.4% of the revenue.

Notice that money is about 0.67% and money equivalents that earn revenue is 6.2%.

The money and money equivalents enable for the revenue to be above the portfolio purpose of fifty% of it coming from defensive inventory/positions.

March Revenue

March dividend assortment got here from 40 corporations or 48% of the “RIG” portfolio. There have been 7 dividend raises that are reviewed, analyzed and a Rose advice supplied for every.

The 40 Funds have been as follows:

1- particular 8c cost from Blue Owl Capital (OBDC) the BDC or enterprise improvement firm.

9- Month-to-month: from a wide range of BDCs, ETFs, and CEFs. My January article lists or mentions them.

30- Quarterly corporations with 7 giving their regular yearly raises. The yields of those 30 payers vary from 0.5% from Visa (V) to excessive yields like 12.3% from most popular shares NorthStar and 13.3% from BlackRock TCP (TCPC) a BDC.

2 of the quarterly payers often provide different funds and fortunately they each went up. The Canadian power firm, Enbridge (ENB), often varies with the US$ change charge, this time it went from 64.7c to 67.5c. The opposite is a delivery inventory Star Bulk Carriers (SBLK) that hardly ever ever pays the identical. It went up properly from 22c to 45c or ~100%. These each make investing with them fairly fascinating.

This text focuses on the 7 corporations that gave raises and my considering or Rose advice for his or her future in “RIG”.

The Raises- 7

Here is what I wish to search for in dividends for revenue and I’ll talk about every of those 3 causes for the shares beneath that gave raises.

1. Raises/development of the dividend- a rising dividend comes from rising earnings that translate to greater funds and even the next share value.

2. Steady payouts over many years- The dividend rising, over no less than 5 years, reveals the corporate is on a optimistic earnings development which is an investor’s good friend. The 5-year DGR is also used to find out the Chowder#.

3. Dependable common quarterly or month-to-month funds assist the investor plan yearly revenue and maybe estimating it for future years.

The statistics that comply with for the S&P credit standing, 20-year dependable dividend funds, present P/E and regular 10-year P/E, in addition to 5-year DGR come from FASTgraphs, “FG”, an investing service I subscribe to and make the most of typically.

The Rose advice follows every inventory analysis.

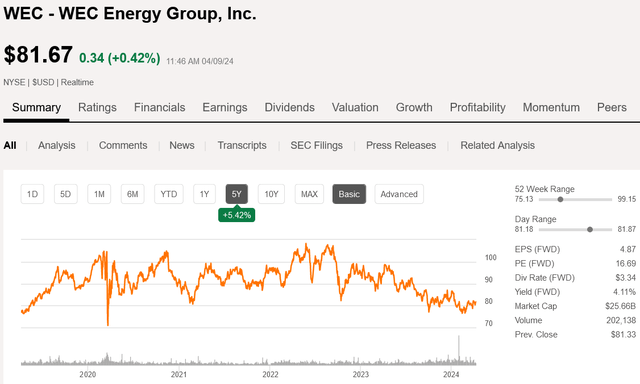

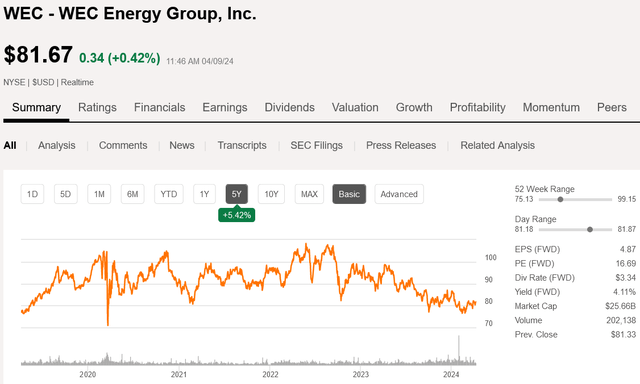

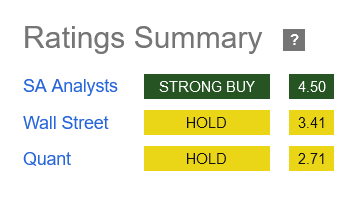

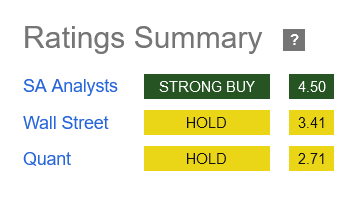

(WEC) $ 80.18 present value.

WEC Power Group is a $25.5 Billion market cap power firm based in 1896, is headquartered in Milwaukee, Wisconsin and has an “A-” S&P credit standing.

1. It has 21 years of rising dividend funds.

2. The 5.5c quarterly elevate from 78c to 83.5c = 7.05% giving it a 4.1percentyield and a 11.15% or 1-year optimistic development quantity. The 5-year DGR charge is 7.1% + yield is 11.2% (some name it the Chowder # “C#”). For utilities a C# of 8 is the minimal desired, so this makes WEC excellent for its raises. I like to check the previous with the latest which reveals the elevate was virtually precisely proper on.

3. WEC has paid quarterly dividends reliably for no less than 21 years.

The conventional 10-year P/E is 21.8x, and it is promoting at present at 16.7.x, which makes it undervalued by that metric.

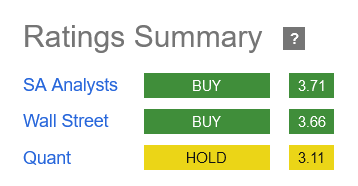

Under is a 5-year value chart from SA service with some technical data supplied and displaying the value motion. Under is an analyst scores abstract discovered on SA.

WEC 5-year technical chart (In search of Alpha April 9, 2024) WEC analyst scores (In search of Alpha April ninth, 2024)

Rose Advice:

The 4.1% yield may be very fascinating and excessive for WEC. It has a 5-year DGR of seven.14% which provides it a chowder# of 11.24%, above the fascinating 8 for a utility and in addition makes it a sexy purchase if you happen to don’t personal it.

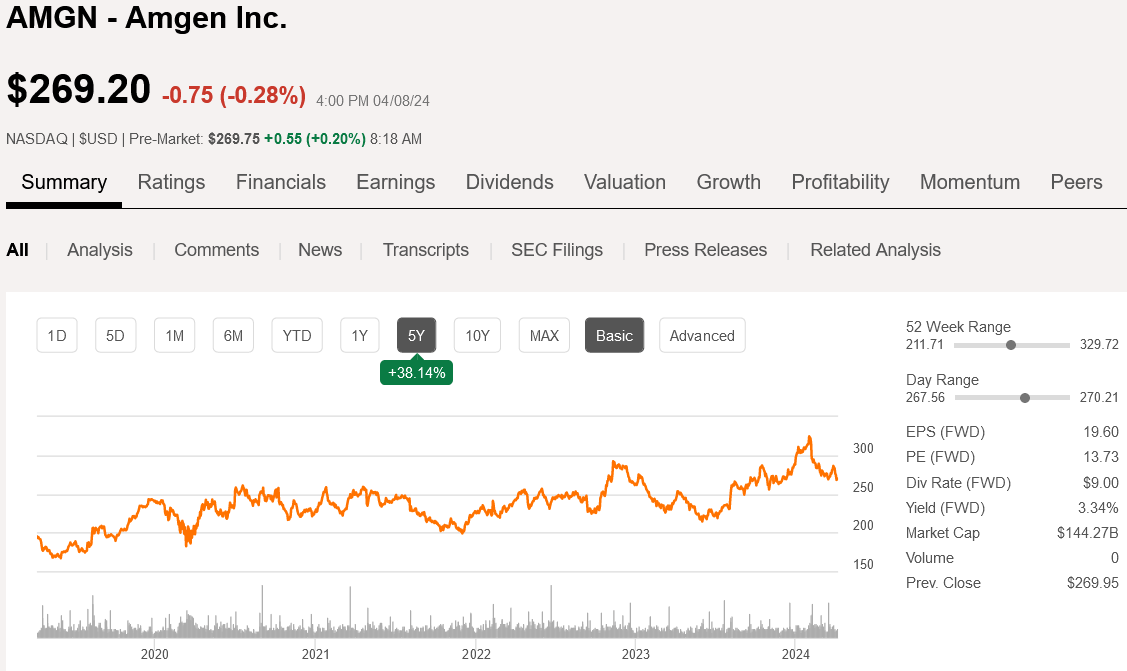

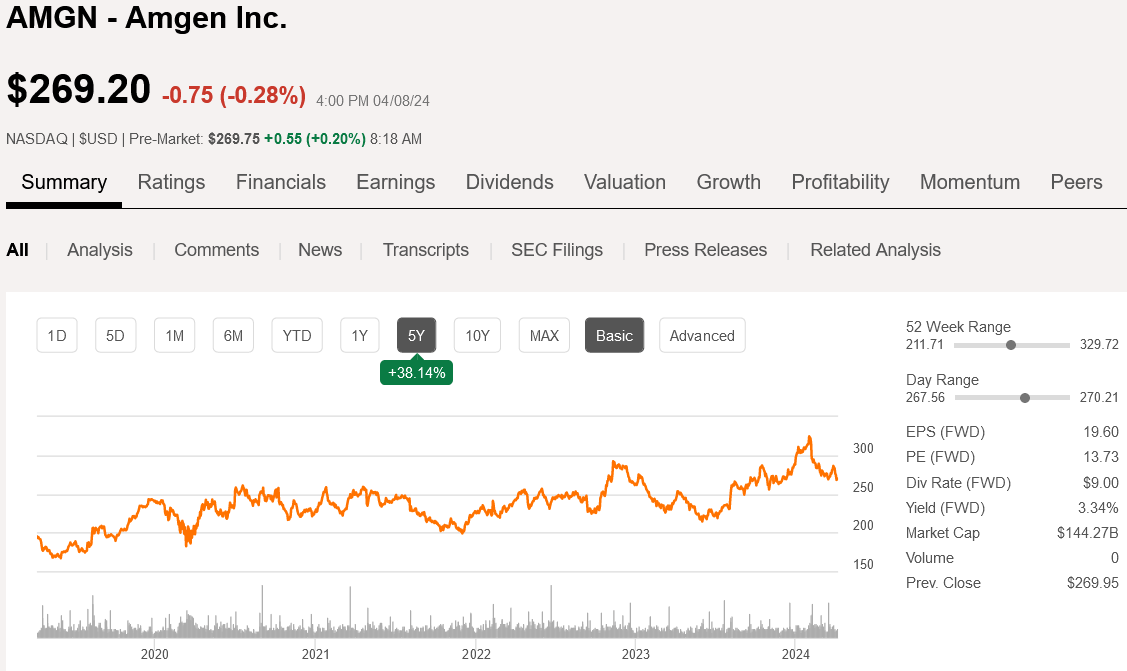

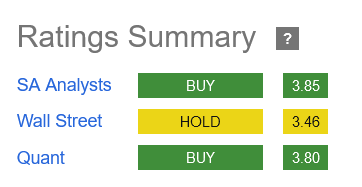

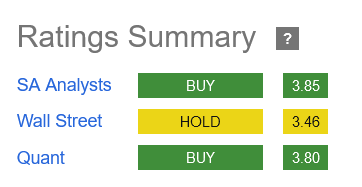

(AMGN) $269.20 present value.

Amgen Inc. is a worldwide healthcare/biotech human therapeutic drug developer producer with a $198.4 billion market cap and an S&P BBB+ credit standing. It was included in 1980 and is headquartered in Thousand Oaks, CA.

1. It has 14 years of rising dividend funds.

2. The 12c quarterly elevate from $2.13 to $2.25 = 5.6% giving it a 3.3percentyield and an 8.9% or 1-year optimistic development quantity. The 5-year DGR charge is 10% giving it a 13.3% Chowder #. For corporations with a yield larger than 2.5% the minimal C# desired is 12. The newest elevate of 5.6% is beneath the norm, however good, nonetheless only a bit disappointing.

3. It began paying a dividend in mid 2011 which has been a rising one too!

The conventional 10-year P/E is 14.6x, and it is promoting at present at 14.2x, which makes it near honest worth by that metric.

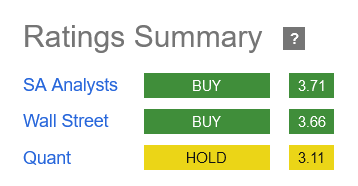

Under is a 5-year value chart from SA service with some technical data supplied, displaying the value motion. Under that could be a scores abstract additionally from SA.

AMGN 5 12 months technical chart (In search of Alpha April ninth, 2024) AMGN analyst scores (In search of Alpha April ninth, 2024)

Rose Advice:

It is a high quality firm that belongs in any portfolio. Truthful worth is nice which makes it engaging, however as I personal it, I’ll look ahead to a dip so as to add extra. Nevertheless, if you happen to do not personal it, take into account beginning a place.

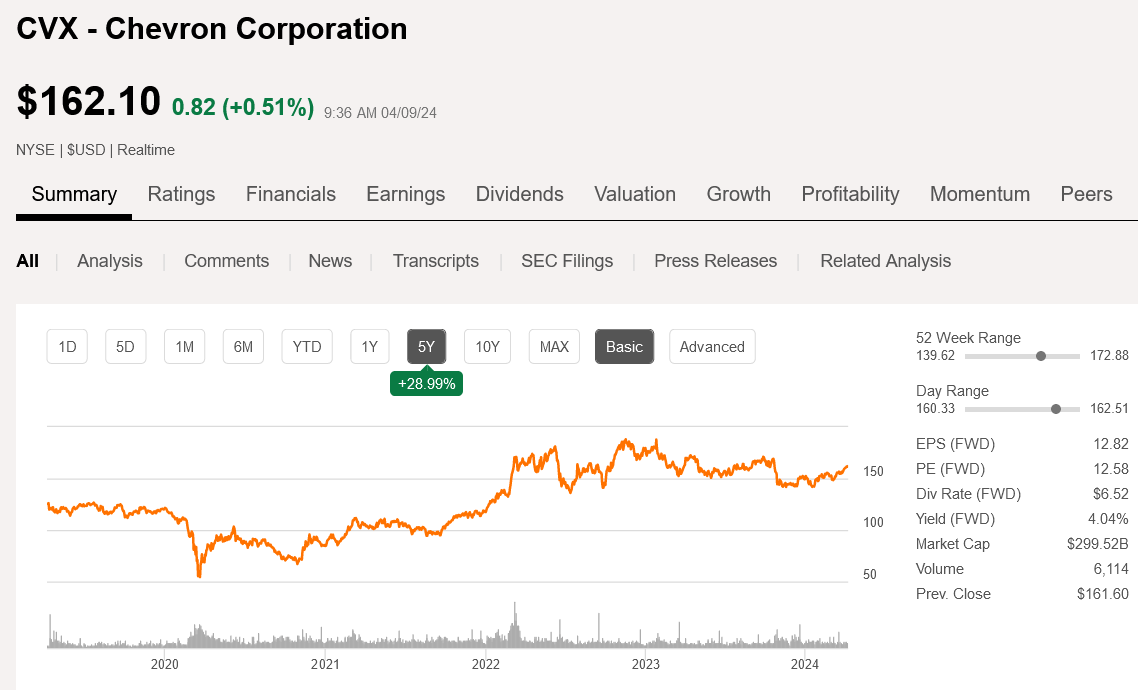

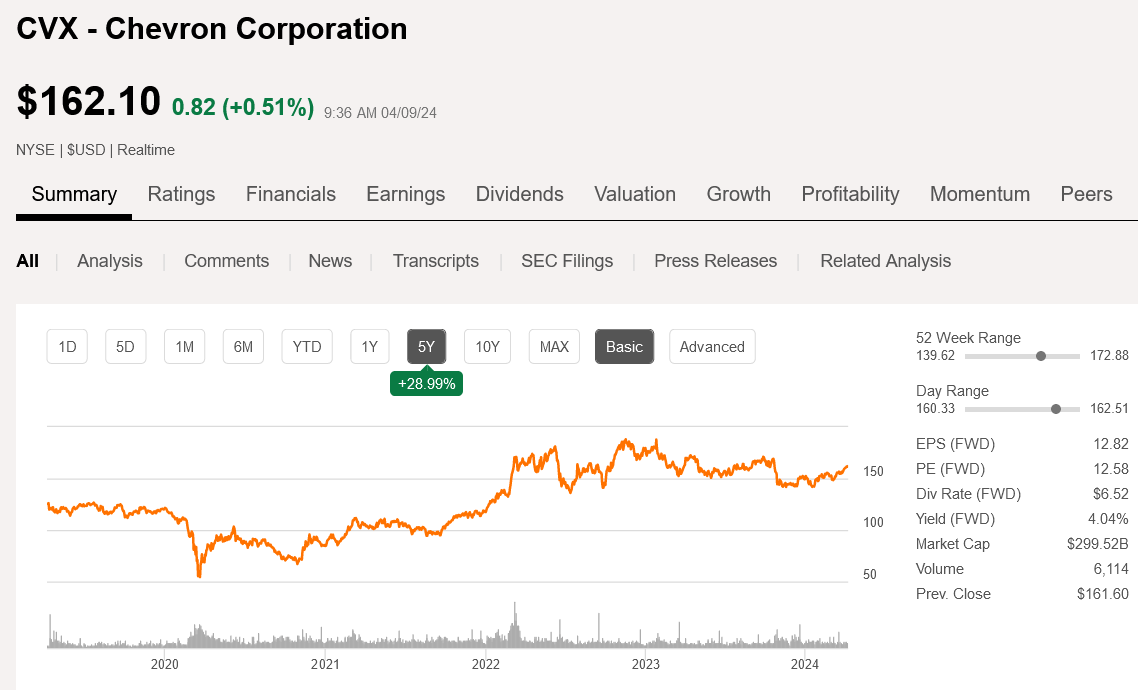

(CVX) $162.10 present value.

Chevron is an built-in oil and gasoline firm or IOC that was based in 1879 that’s headquartered in San Ramon, CA. It was previously often known as Chevron Texaco and altered its identify in 2005 to Chevron. It operates primarily in upstream exploration, manufacturing, transportation and improvement of crude oil and pure gasoline together with downstream refining. It has an “AA-” S&P credit standing.

1. It has paid rising dividends for 37 years in a row.

2. The 12c quarterly elevate from $1.51 to $1.63 = 7.9% giving it a 4.19percentyield and a 12.09% 1-year optimistic development quantity. The 5-year DGR charge is 6.17% giving it a ten.36% Chowder #, which to me is good, however a 12 can be what is suitable.

3. It has been offering common quarterly dividends for no less than 20 years and as already talked about rising ones for 37 years.

The conventional 10-year P/E is 20.73x, and it is promoting at present at 12.4x, which makes it undervalued by that metric. Nevertheless, the 10-year metric to me isn’t related, because it went by a low earnings cycle that triggered the P/E to be elevated throughout that point interval and makes it onerous to judge in that regard.

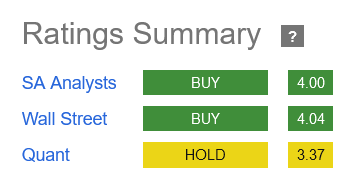

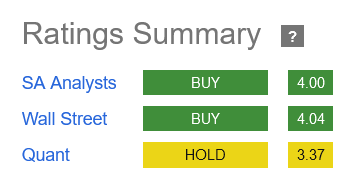

Under is a 5-year value chart from SA service with some technical data supplied and displaying the value motion. Under it’s an analyst scores abstract from SA.

CVX technical 5-year chart (In search of Alpha April ninth, 2024) CVX analyst scores (In search of Alpha April ninth, 2024)

Rose Advice:

Truthful worth and 4% yield is good, I’ll simply maintain and revel in.

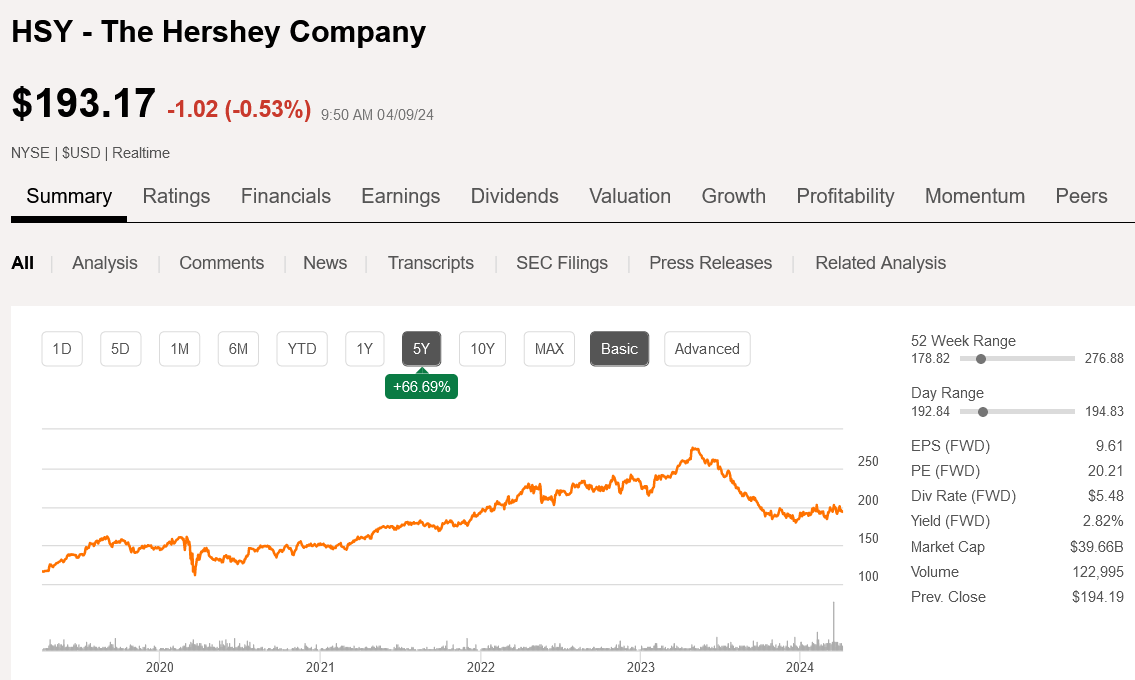

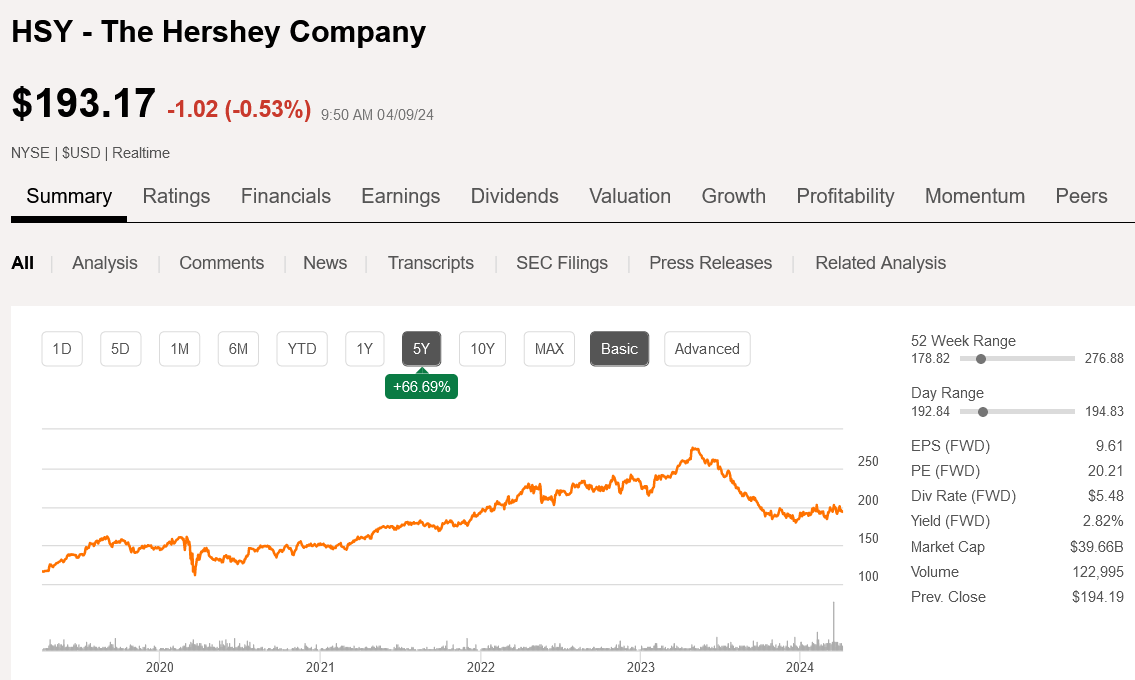

(HSY) $193.17 present value.

The Hershey Co. manufactures and sells confectionery merchandise, pantry gadgets and salty snacks globally. It was based in 1894 and is headquartered in Hershey, PA, has a $39.5 Billion market cap and an “A” S&P credit standing.

1. It has a 15-year file for elevating its dividend.

2. The 17.8c elevate from $1.192 to $1.37 = 14.9% giving it a 2.8% yield and a 17.7% or 1-year excellent optimistic development quantity. The 5-year DGR charge is 10.1% and with the yield has a 12.9% Chowder #. For corporations with a yield larger than 2.5% the minimal C# desired is 12 which it has definitely met and exceedingly so for this 12 months.

3. It has paid routine quarterly dividends for 20+ years and rising ones since 2009.

The conventional 10-year P/E is 24x, and it is promoting at present at 20.18x, which makes it a bit overvalued by that metric.

Under is a 5-year value chart from SA service with some technical data supplied and displaying the value motion. Under it’s an analyst scores abstract from SA.

HSY Technical 5-year chart (In search of Alpha April ninth, 2024) HSY analyst scores (In search of Alpha April 9, 2024)

Rose Advice:

The yield of two.8% may be very honest and truly engaging for HSY. I’m happy to personal a place, however as I wish to be low cost, I’m watching carefully for a dip so as to add extra. I like the standard of this firm and people raises.

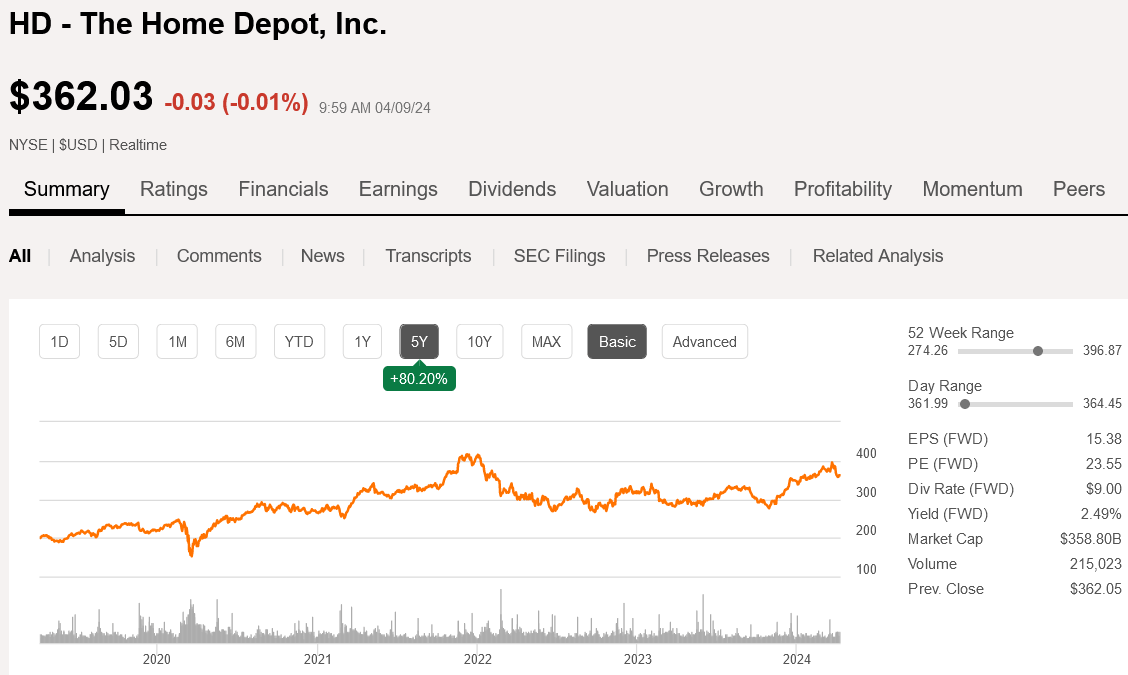

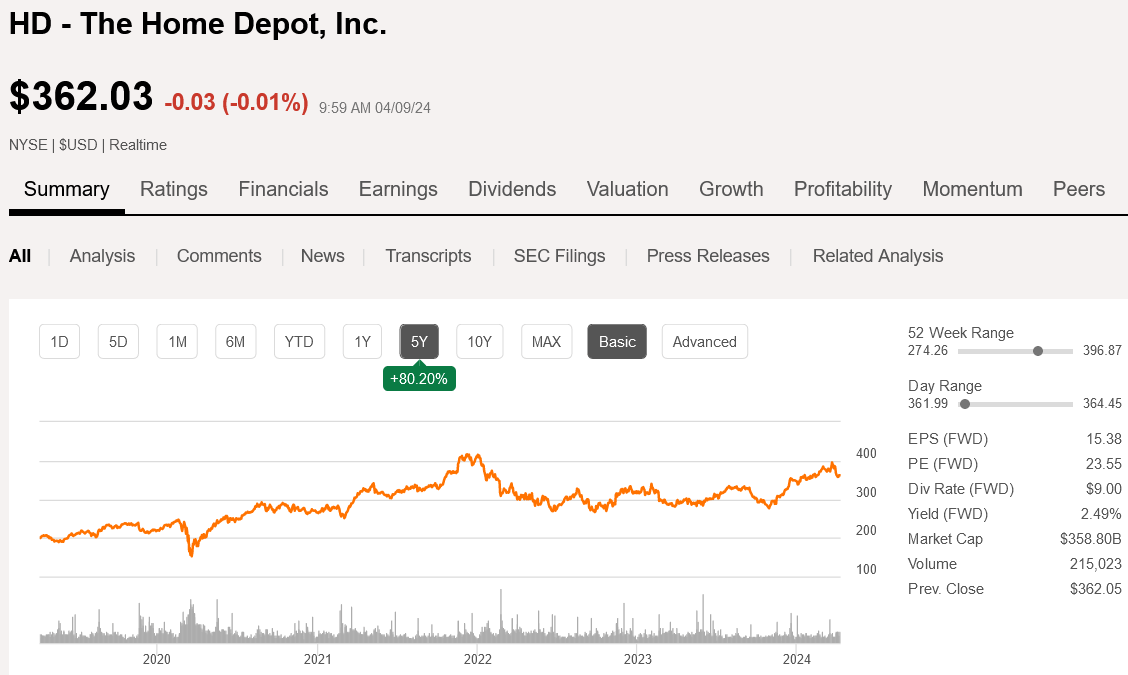

(HD) $362.03 present value.

The Dwelling Depot Inc. is a house enchancment retailer globally providing constructing supplies, garden, backyard and ornamental merchandise. It included in 1978 and is headquartered in Atlanta, GA. It has an “A” S&P credit standing.

1. It has a 15-year file for elevating its dividend.

2. The 16c elevate from $2.09 to $2.25 = 7.65% giving it a 2.5percentyield and a ten.15% or 1-year optimistic development quantity, however not fairly as much as what was anticipated. The 5-year DGR charge is 15.5% giving it a 17.9% Chowder #. For corporations with a yield below 2.5% the minimal C# can be 15. The 7.65% was due to this fact disappointing.

3. It has paid routine quarterly dividends for no less than 20 years and rising ones since 2010.

The conventional 10-year P/E is 22.11x, and it is promoting at present at 24.67x, which makes it overvalued by that metric.

Under is a 5-year value chart from SA service with some technical data supplied and displaying the value motion. The analyst scores are additionally proven from SA beneath the chart.

HD 5-year technical chart (In search of Alpha April ninth, 2024) HD analyst scores (In search of Alpha April 9, 2024)

Rose Advice:

Dwelling Depot is a top quality firm I’ll preserve however wouldn’t add to presently.

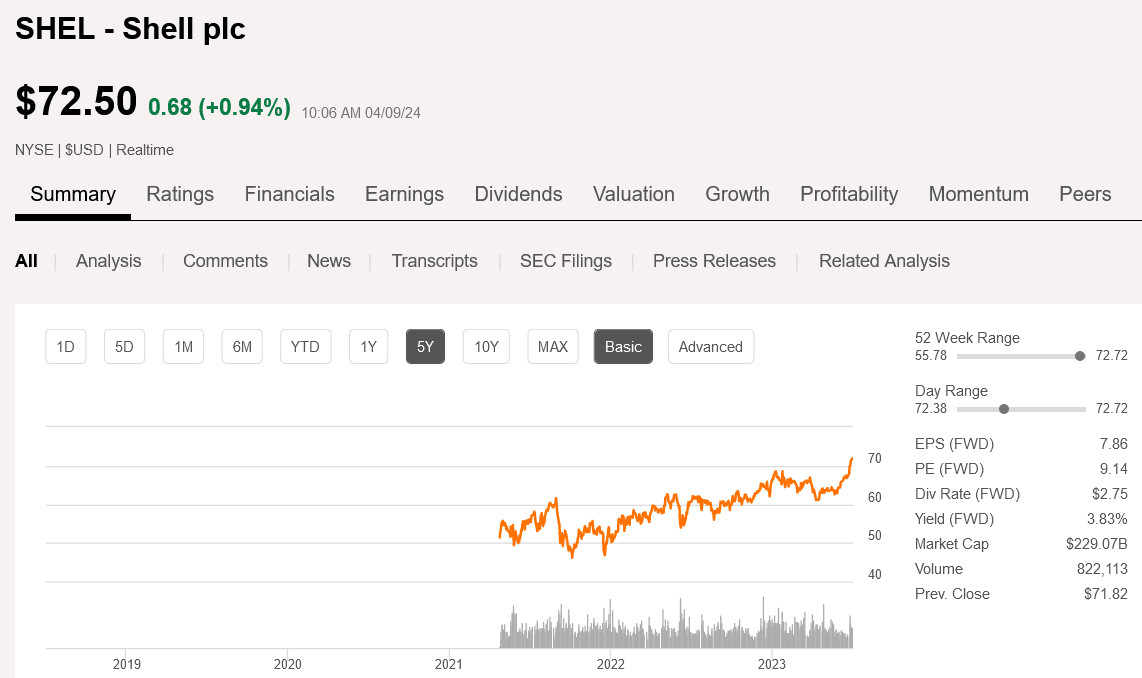

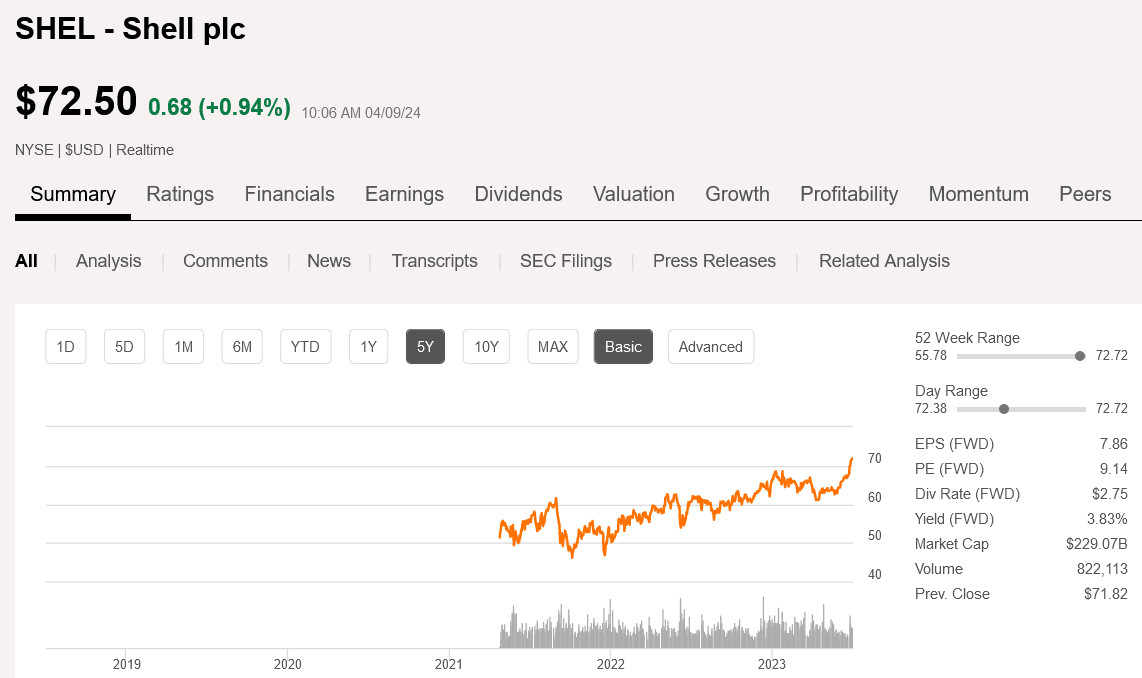

(SHEL) $72.50 present value.

Shell PLC is an built-in oil and gasoline firm or IOC that was based in 1907 and is headquartered in London, UK. It was previously often known as Royal Dutch Shell and altered its identify to Shell Plc January 2022. It’s concerned in up, mid and down-stream actions and infrastructure. It markets and produces chemical substances and oil merchandise, LNG, crude oil together with electrical energy, wind, photo voltaic, renewables, EV charging, sells hydrogen and affords power options. It has an “A+” S&P credit standing.

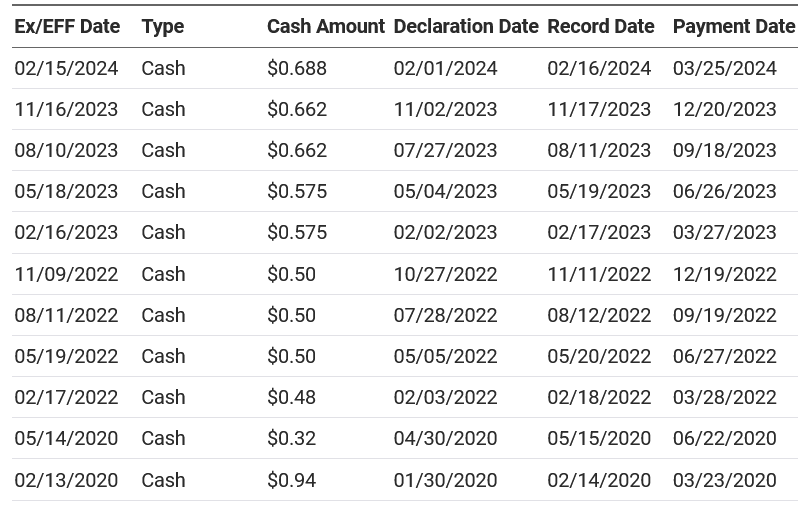

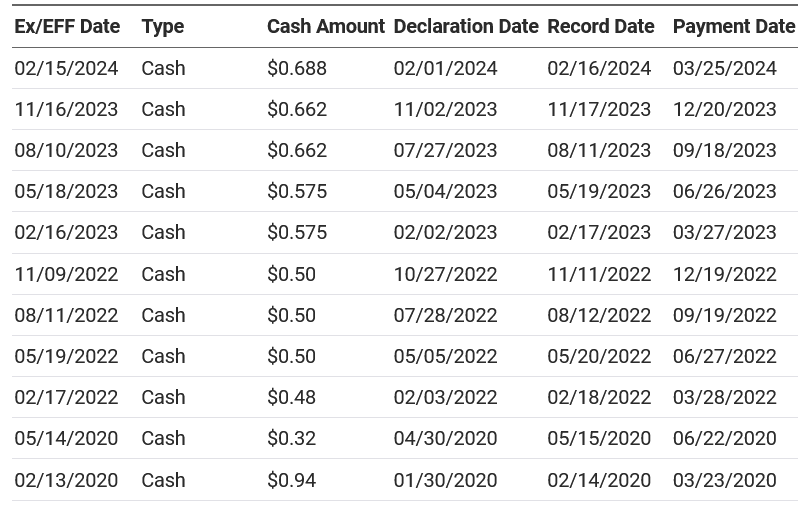

1. It has a now 2-year file for elevating its dividend.

2. The two.6c elevate from $66.2c to 68.8c = 3.9% giving it a 4.18percentyield and a 8.08% or 1-year optimistic development quantity. Because it minimize the dividend about 2 years in the past, the 2-year DGR is 33.5%, which is sort of spectacular. Nevertheless, to make use of the Chowder # the 5-year DGR charge of 0.2% is required which provides it a 4.38% Chowder #, which isn’t spectacular as 12 is fascinating for corporations with a yield over 2.5%.

Under is a have a look at the dividend file from Nasdaq displaying the dividend minimize in 2020 from 95c to 32c. It reveals it has been making up for it with extra raises than simply yearly since then. Providing no less than 2 raises per 12 months, which hopefully will proceed by 2024.

SHEL dividend exercise from 2020. (Nasdaq April 2024. )

3. It has paid routine quarterly dividends for no less than 20 years, but it surely has a technique to go to get again to the 94c it paid earlier than the minimize.

The conventional 10-year P/E is 14.67x, and it is promoting at present at 8.7x, which makes it undervalued by that metric. As with Chevron it additionally was concerned in a poor earnings streak and a long-term P/E to judge the worth might be inappropriate.

Under is a 5-year value chart from SA service with some technical data supplied and displaying the value motion. SA reveals 3 years of technical historical past. The analyst scores are proven beneath the chart, additionally from SA.

SHEL technical chart 5 12 months (In search of Alpha April ninth, 2024)

SHEL analyst scores (In search of Alpha April 9, 2024)

Rose Advice:

High quality power inventory that has been elevating its dividend properly and has accomplished so twice up to now 12 months. I’m happy to personal it and can proceed to carry it fortunately.

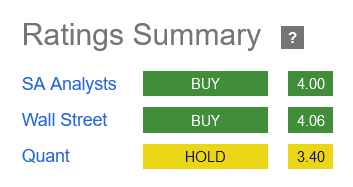

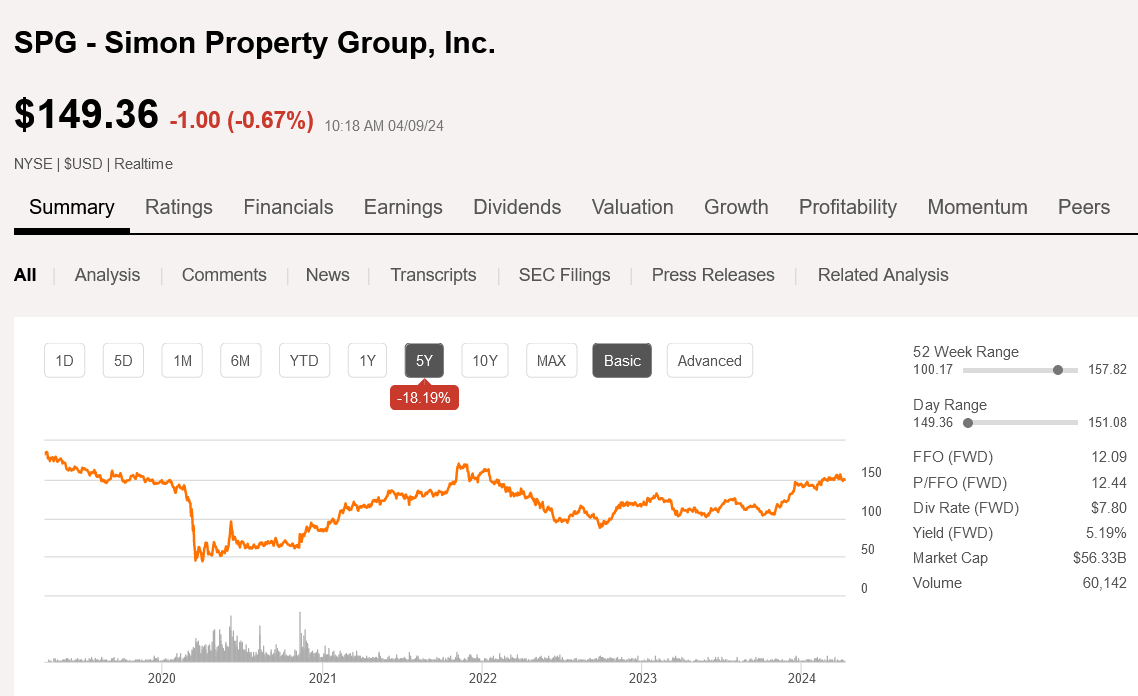

(SPG) $149.36 present value

Simon Property Group is an actual property funding belief proudly owning high quality premier buying, eating, leisure and mixed-use vacation spot property varieties with headquarters in Indianapolis, Indiana. It has an “A-” S&P credit standing.

1. It has 3 years now for elevating the dividend.

2. The 5c elevate from $1.90 to $1.95 = 2.6% giving it a 5.2percentyield and a 7.8% 1-year optimistic development quantity. The dividend was minimize in July 2020 from $2.10 to $1.30. 2020 was a tough time for a lot of corporations and particularly retail operators secondary to covid restrictions. It began to boost it once more in 2021 but it surely nonetheless has not totally reached the outdated charge. The three 12 months DGR is 7.8%, which provides as much as 13% and spectacular. Nevertheless, to make use of the Chowder # the 5-year DGR charge of 0.15% should be used which makes it 5.35%. Not spectacular as 12 is fascinating for corporations with a yield over 2.5%. Decrease is perhaps acceptable for HY corporations if it competes with inflation or bonds and CDs.

3. It has paid routine quarterly dividends for no less than 20 years, with a minimize in 2008 as effectively.

The conventional 10-year P/FFO is 13.3x, and it is promoting at present at 12.14x, which makes it close to honest worth by that metric. FFO or funds from operations is used for monetary actual property corporations.

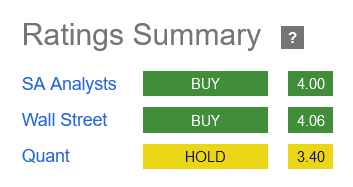

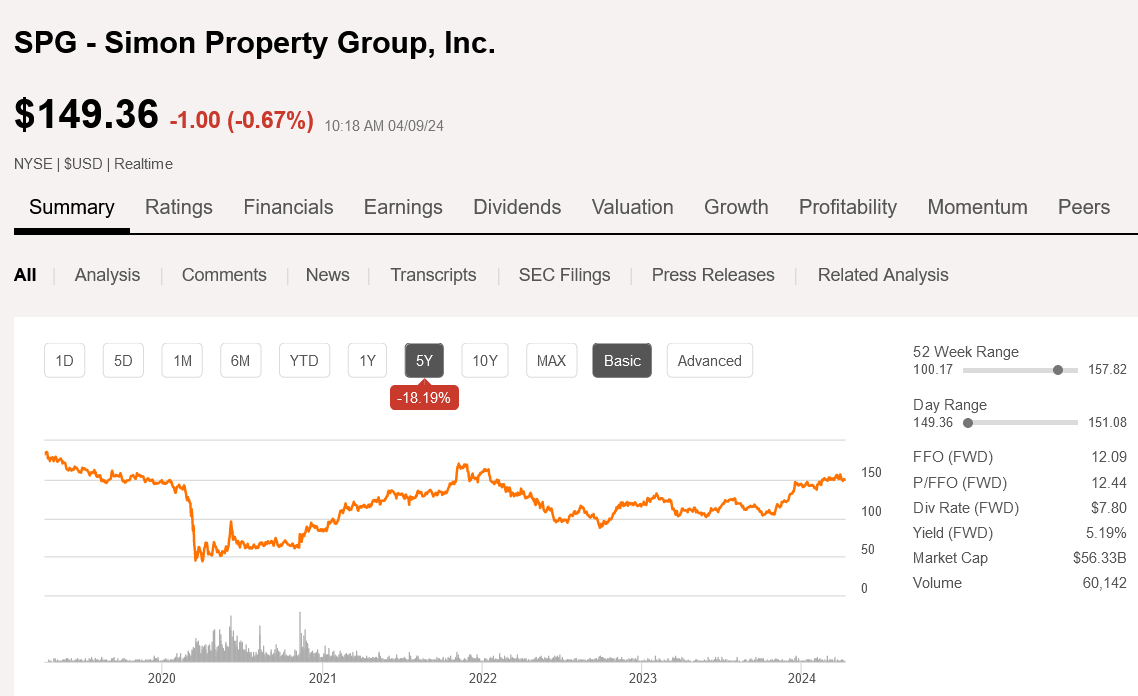

Under is a 5-year value chart from SA service with some technical data supplied and displaying the value motion. The SA analyst scores recommendations comply with the chart.

SPG technical chart 5 12 months (In search of Alpha April ninth, 2024) SPG analyst scores (In search of Alpha April 9, 2024)

Rose Advice:

SPG appears to be at honest worth with a pleasant excessive 5.2% yield. It considerably competes with some CDs, however its future in retail actual property commerce makes it solely a maintain for me at its present value.

Abstract/ Conclusion

The 5 shares with raises are all high-quality candidates to personal in a portfolio and “RIG” was designed to have simply these varieties in it. The dividend payers are what makes for revenue and the dependable and rising revenue additionally maintains worth for the portfolio as effectively. The assessment was to point out what to search for with hopes it is going to provide some good high quality guidelines to assist discover good dividend payers that may assist construct a diversified prime quality revenue portfolio. The purpose of getting 50% of the revenue coming from defensive shares remains to be in impact and can proceed.

Rose’s Revenue Backyard “RIG” portfolio revenue yield at present is 6% with a steady, inexperienced and rising worth, which on March thirtieth was up 5.85% and since inception Sept 21, 2021, by 6.63%. Statistics are stored that repeatedly examine it to SPY which reveals it’s beating it by ~5.93% YTD from inception November 2021. The return since inception, as proven within the efficiency charts has it up 21.66%. Its revenue yield of 6% makes it a really pleasing revenue automobile when contemplating the SPY yield of 1.29%.