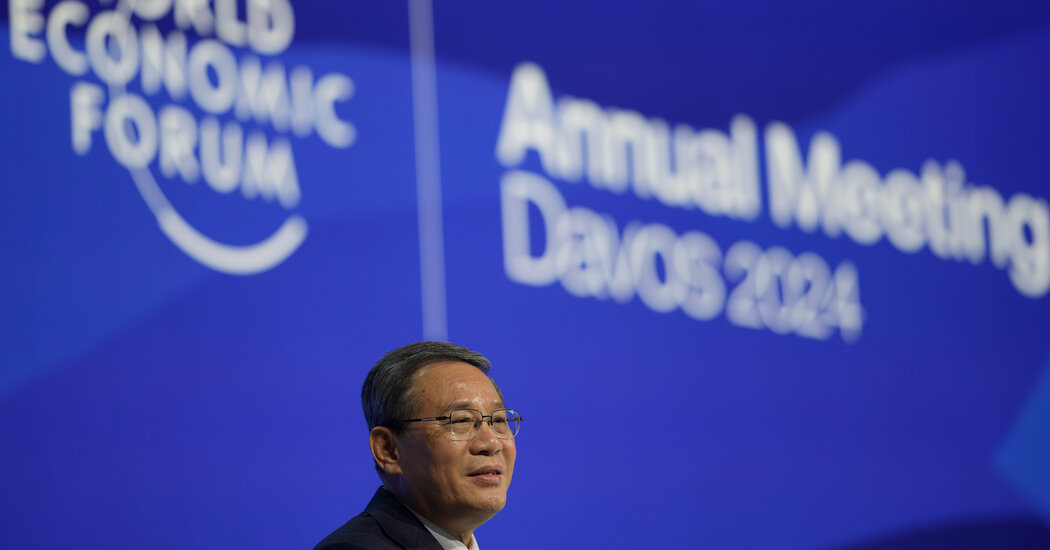

China’s No. 2 chief, Li Qiang, traveled to Switzerland with a message for the titans of the enterprise world gathered for the World Financial Discussion board.

“Choosing the Chinese market is not a risk, but an opportunity,” Mr. Li, China’s premier, told an viewers in Davos on Tuesday.

However there’s a unique sentiment about China enjoying out within the inventory market and it’s not so optimistic. The concerns over China’s economic system have been seen for months in Hong Kong, the place shares plunged 14 p.c final yr, the fourth consecutive annual decline.

The brand new yr hasn’t supplied any aid, both, and economic data released by China on Wednesday prompted one other sell-off.

In Hong Kong, the place lots of China’s greatest corporations commerce, shares fell 3.7 p.c on Wednesday. Up to now this yr, the market has misplaced one-tenth of its worth. In China’s monetary capital of Shanghai, shares dropped 2.1 p.c, extending this yr’s decline to just about 5 p.c.

At the same time as China stated its economy grew by 5.2 p.c in 2023, which is excessive by most requirements, it’s present process large change. China’s leaders try to wean the nation off property and building, which have lengthy been pillars of development, whereas additionally lowering reliance on borrowed cash.

An anticipated increase in consumption after China reversed its “zero-Covid” coverage in late 2022 hasn’t performed out, both.

A shrinking inhabitants and growing old work power are including to the headwinds. China on Wednesday additionally stated that its population shrank by 2 million folks and was growing old quickly, placing additional pressure on its already-weak well being care system and underfunded state pension.

Whereas China’s economic system has proven some slight enchancment just lately, “the recovery clearly remains shaky,” economists at Capital Economics wrote in a report.

Actual property and client corporations had been among the many worst hit by the sell-off in Hong Kong, which for years has been a gateway for international buyers wanting to place cash into mainland China. Longfor Group, a Chinese language property developer, fell 6.8 p.c, whereas Meituan, the Chinese language supply service, dropped 7 p.c.

Shares in the US this yr thus far are flat, whereas share costs in Japan are surging, up over 6 p.c.

Many buyers have been seeking to China to fireplace up its economic system with an enormous stimulus prefer it has prior to now throughout financial stress, however policymakers have stated this time is completely different.

Mr. Qiang reiterated this reluctance in his tackle on the World Financial Discussion board. “We have held to avoiding major stimulus,” he stated, “and have not sought short-term growth at the price of accumulating long-term risks.”