An A.I. supercycle

For now, Nvidia resides as much as the lofty title that Goldman Sachs bestowed on it this week — “the most important stock on planet Earth” — after its blowout earnings report.

Markets are trying up on Thursday, as are buyers’ and governments’ hopes for the synthetic intelligence growth, as sturdy demand for the chipmaker’s merchandise counsel that there’s extra room for the development to run.

Nvidia is up 13 % in premarket buying and selling after outcomes that surpassed excessive analyst expectations (and spurred a torrent of exuberant memes). Jensen Huang, the corporate’s C.E.O., mentioned that Nvidia was seeing a “tipping point” in demand for A.I. techniques.

Among the many highlights:

-

Nvidia’s annual revenues leaped a whopping 265 % year-on-year to $22.1 billion. It additionally projected that gross sales this quarter would hit about $24 billion, simply outpacing forecasts of $22 billion.

-

Huang advised analysts that the outcomes symbolize 12 months Certainly one of “a 10-year cycle of spreading this technology into every single industry.” Demand is so sturdy that Huang needed to reassure analysts that they had been allocating chip orders to prospects “fairly.”

-

One pink flag: Gross sales fell in China, a once-vital market that has been affected by U.S. export limits on some superior chips.

Market watchers are crediting Nvidia with turbocharging a worldwide rally. Shares in Asia and Europe rallied on the information, together with ASML, the Dutch chips-equipment maker. In the meantime, the Nikkei 225, a benchmark index in Japan, closed at a report that surpassed a level last seen 34 years ago as international buyers proceed to promote Chinese language shares in favor of Japanese shares.

Sky-high A.I. expectations transcend shares. Some economists have begun to talk of once-in-a-generation productivity gains delivered by the know-how automating duties, like drafting emails and proposals.

Washington is betting even larger on A.I., too. Gina Raimondo, the commerce secretary, mentioned on Wednesday that the CHIPS and Science Act, handed in 2022 to turbocharge home chips manufacturing with $39 billion in manufacturing incentives, wouldn’t be large enough “if we want to lead the world.”

In calling for a “CHIPS Two,” Raimondo name-checked OpenAI, a giant Nvidia buyer, as a tech firm with a “mind boggling” want for high-end chips to run its merchandise like ChatGPT. (Raimondo made her comments at an Intel occasion the place that firm introduced a greater than $15 billion deal to make personalized chips, together with A.I. processors, for Microsoft.)

However there may be some rising skepticism concerning the A.I. growth. Some hedge funds have begun to reduce their holdings in Nvidia and different Magnificent Seven tech shares earlier than Wednesday’s earnings name.

In different A.I. information:

-

Google mentioned it could quickly suspend an image-generation feature for Gemini after the A.I. software was discovered to depict some historic figures, just like the founding fathers, as people of color.

-

Sam Altman, the C.E.O. of OpenAI, pushed back on a report by The Wall Avenue Journal that his firm is in search of to lift as much as $7 trillion.

-

Chinese language firms stay highly reliant on U.S. tech to advance their A.I. ambitions.

-

A quiet backer of A.I. analysis is Steve Schwarzman, Blackstone’s co-founder and C.E.O.

HERE’S WHAT’S HAPPENING

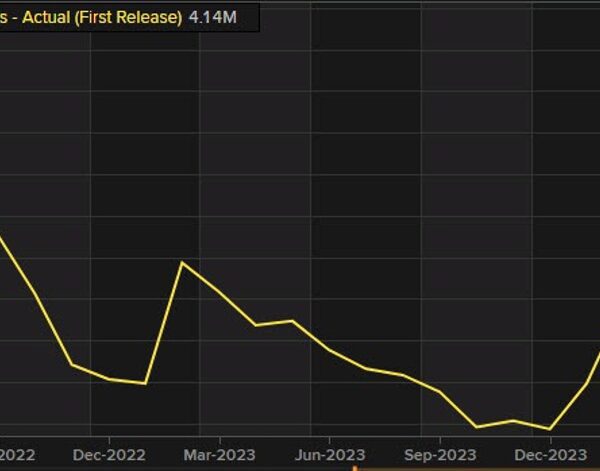

The Fed is in no hurry to decrease borrowing prices. Minutes from the central financial institution’s January rate-setting assembly confirmed that whereas officers noticed “significant progress” in moderating inflation, they remained cautious about lowering rates too quickly. The futures market on Thursday was predicting three to 4 charge cuts this 12 months, down sharply from a month in the past, when merchants noticed six to seven such strikes.

Boeing replaces the pinnacle of its 737 Max program. Ed Clark, who oversaw the manufacturing unit that makes the 737 Max 9, was essentially the most outstanding govt to be ousted in a management shake-up on the aerospace large. The modifications symbolize the largest transfer Boeing has made but within the wake of an episode through which a door plug on an Alaska Airways 737 Max 9 fell off mid-flight.

An Alabama courtroom ruling places fertility therapies in limbo. The College of Alabama at Birmingham well being system mentioned it could pause in vitro fertilization treatments after the state’s Supreme Courtroom dominated that frozen embryos needs to be thought of kids. There are issues that different conservative states will follow Alabama’s lead, including to confusion across the legality of such procedures there and driving up costs.

Nestlé warns that inflation will damage development. The maker of Nescafe espresso, chocolate bars and pet meals sees “unprecedented inflation” sapping prospects’ spending energy, as its 2023 earnings fell wanting expectations. Earlier this month, Krispy Kreme and Heineken additionally warned that inflation would drive up enter prices and chill gross sales.

Common Music strikes a brand new tune

The deal this week that has had the digital media business speaking is BuzzFeed’s $108.6 million sale of Complex, the tradition media publication, to Ntwrk, a livestream procuring firm backed by the likes of the music impresario Jimmy Iovine.

The transaction is an extra unwinding of the embattled BuzzFeed. However maybe essentially the most fascinating angle is Common Music Group’s funding in Ntwrk as a part of the deal — and the way that underscores the way in which that the music business is aiming to harness new income streams and increase their artists’ attain.

The deal is about creating a brand new hub for “‘superfan’ culture,” Ntwrk mentioned in a news release. The e-commerce firm — whose founders embody Iovine’s son Jamie Iovine — has labored with musical acts together with Blackpink and Publish Malone on industrial partnerships. Complicated has lengthy been identified for its protection of areas like hip-hop, sneaker tradition and streetwear.

“I think as time has gone on, there’s been a lot of publishers who aspire to get into shopping, or a lot of commerce platforms and aspire to get into media storytelling to drive more commerce,” Aaron Levant, one other Ntwrk co-founder who’s the brand new C.E.O. of Complicated, advised The Hollywood Reporter.

That’s what Common is in search of to faucet into, in line with John Janick, the chairman and C.E.O. of the corporate’s Interscope Geffen A&M label, who’s becoming a member of the board of the newly mixed Ntwrk and Complicated. “This partnership will give our artists access to a dynamic network to deepen connections with superfans through unique collaborations and cultural moments,” he mentioned within the launch.

Lucian Grainge, Common Music’s C.E.O., has additionally referred to as for strengthening the connection between artists and followers, together with partnerships with different platforms. The corporate’s merchandise division, Bravado, has labored with artists like Billie Eilish and Justin Bieber to collaborate with manufacturers.

Common has been seeking to create an up to date mannequin for its business. That has included coping with the proliferation of synthetic intelligence and revamping streaming royalties — two causes the corporate cited in pulling its music off TikTok.

“Eras”

— The code identify that advisers gave to Capital One’s $35.3 billion takeover of Uncover Monetary, DealBook hears. It’s a reference to Taylor Swift’s blockbuster tour, which raises the query of whether or not executives gave each other friendship bracelets.

How the I.R.S. is supercharging a crackdown on tax dishonest

Among the many Biden administration’s largest fiscal priorities was offering extra funding for the I.R.S. to gather extra taxes.

Armed with tens of billions in new funds allotted by the Inflation Discount Act of 2022, the company is beginning to showcase its new efforts, together with going after improper use of personal planes and billionaires utilizing subtle tax avoidance methods.

The I.R.S. is cracking down on company jet abuse by pursuing those that claimed thousands and thousands in deductions on airplanes that had been typically used for private journey. That can start with dozens of new audits specializing in firms, partnerships and the passengers themselves (who the company says ought to report these journeys as revenue).

Making this potential, the I.R.S. says, is the Inflation Discount Act, which helped pay for brand spanking new analytics instruments. And some huge cash is at stake, in line with Daniel Werfel, the company’s commissioner: “On a given taxpayer’s tax return, the amount of the deduction for aircraft travel can be in the tens of millions of dollars,” he mentioned.

It’s a part of a broader marketing campaign to step up enforcement. The Worldwide Consortium of Investigative Journalists took a take a look at the company’s efforts to more closely scrutinize the extremely wealthy, together with by:

-

Utilizing synthetic intelligence instruments to assist map out advanced partnerships that assist taxpayers masks their revenue, one thing that wasn’t potential earlier than: “We would ask for reports on partnerships, but there were only three or four people in the data unit of I.R.S. high wealth,” a former Treasury Division official advised the I.C.I.J.

-

Extra subtle analyses of cryptocurrencies

-

Asserting the hiring of three,700 new brokers

However these efforts face headwinds, together with strikes by congressional Republicans to claw again the expanded I.R.S. funding, in addition to really proving these circumstances in courtroom. “Enforcement has been so low for so long, there are very few people in the I.R.S. or Justice Department who have the relevant experience to actually go to trial in criminal tax cases,” Rod Rosenstein, a deputy legal professional common underneath President Donald Trump, advised the I.C.I.J.

THE SPEED READ

Offers

-

Reddit is claimed to have signed a $60 million-a-year deal with Google that will permit the tech large to make use of the social media platform’s content material to coach its A.I. fashions. (Reuters)

-

Chord Vitality has agreed to acquire Canada’s Enerplus for about $3.7 billion, the most recent in a wave of offers within the North American oil and fuel sector. (Bloomberg)

-

“A Billionaire Bought a Chunk of Manchester United. Now He Has to Fix It.” (NYT)

Coverage

Better of the remainder

-

How Instagram grew to become an more and more essential information web site even because it de-emphasizes “political content.” (NYT)

-

The F.T.C. mentioned that Twitter staff saved Elon Musk from a hefty fine for breaking knowledge safety guidelines by ignoring a few of his calls for. (Enterprise Insider)

-

“The Ozempic Effect Gives Sweetgreen a Boost” (Bloomberg)

We’d like your suggestions! Please electronic mail ideas and options to [email protected].