On the primary enterprise day of the brand new 12 months, Missouri Treasurer Vivek Malek started accepting purposes for about $120 million of state-subsidized, low-interest loans to small companies, farmers and reasonably priced housing builders.

Inside six hours, Malek had so many requests for the cash that he needed to minimize off purposes.

“The demand is huge, and it is real,” Malek stated.

MISSOURI’S FIRST NON-WHITE TREASURER VIVEK MALEK TAKES OFFICE

Missouri’s scenario, although excessive, is just not completely distinctive. From New York to Illinois to Montana, states have seen surging public curiosity in little-known applications that use state funds to spur non-public funding with bargain-priced loans. The applications have taken off after a sequence of key rate of interest hikes by the Federal Reserve made just about all loans dearer, whether or not for farmers buying seed or companies desirous to develop.

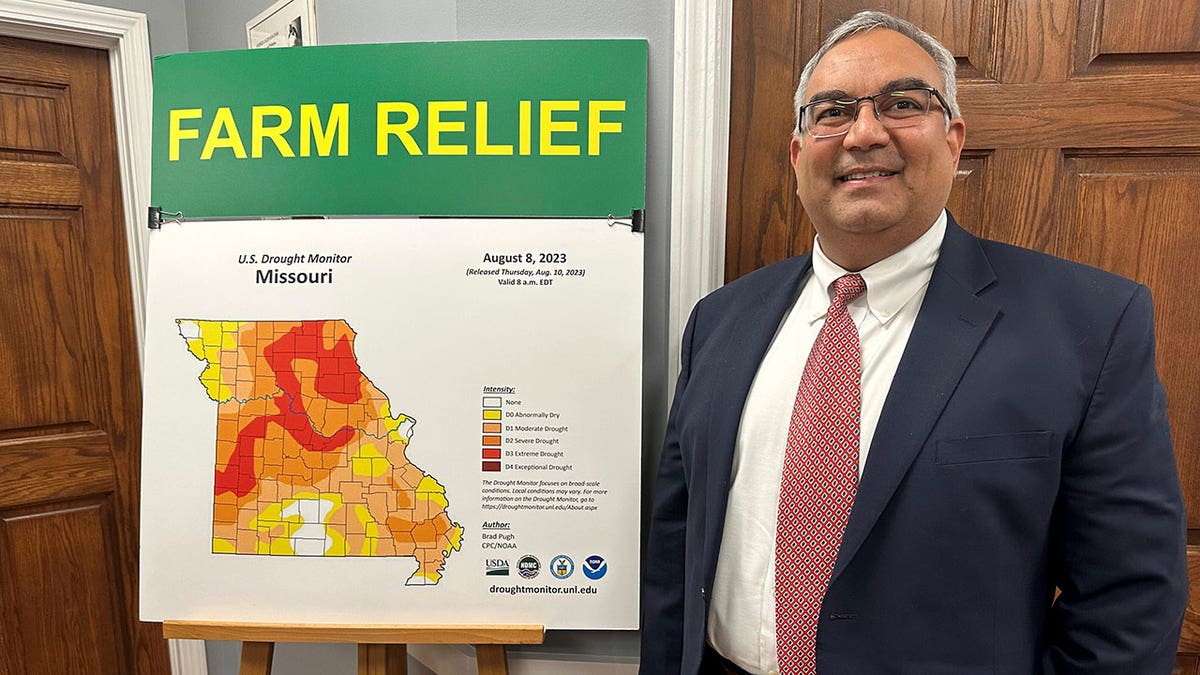

Missouri Treasurer Vivek Malek stands close to a poster selling state help applications on Jan. 4, 2024, at his Capitol workplace in Jefferson Metropolis. A number of classes of companies can obtain low-interest loans, and participation in such applications has grown in varied states. (AP Picture/David A. Lieb)

To fight inflation in client costs, the Fed raised its benchmark rate of interest 11 instances from March 2022 to final July, setting it at a two-decade excessive.

Below so-called linked-deposit applications, states deposit cash in banks at below-market rates of interest. Banks then leverage these funds to supply short-term, low-interest loans to explicit debtors, typically in agriculture or small enterprise. The applications can save 1000’s of {dollars} for debtors by lowering their rates of interest by a mean 2-3 share factors.

MISSOURI HOUSE PASSES DIVERSITY SPENDING BAN, PROPOSAL LIKELY ILL-FATED IN SENATE

States usually cap the sum of money out there for such discounted charges at both a flat greenback quantity or a share of their whole fund balances, as a result of the applications end in much less earnings for the state. Many states have constructed giant surpluses from pandemic-era revenues, which means they’ve extra money out there to deposit in banks.

Although most states do not at present supply such applications, some that shelved them when rates of interest had been low are actually contemplating whether or not to revive them to help financially-strapped companies and residents.

“I can say in talks with other state treasurers that there is a definite increased interest in treasury money, whether that is through a linked-deposit program or a different vehicle,” stated Illinois Treasurer Michael Frerichs, who’s president of the Nationwide Affiliation of State Treasurers.

Illinois has practically $950 million of deposits linked to low-interest loans for farmers, companies and people. That is up considerably from previous years. In 2015, Frerichs stated, the state’s agricultural funding program had simply two low-interest loans. By 2022, that had grown to $51 million of loans. Final 12 months, Illinois made $667 million of low-rate deposits for agricultural loans.

With rising demand, Frerichs just lately raised this system’s general cap from $1 billion to $1.5 billion.

Although smaller in scope, New York’s program additionally has seen an explosion of candidates.

In 2022, New York had 42 purposes for state deposits in monetary establishments linked to $20 million in low-interest loans. Final 12 months, that rose to 317 purposes linked to greater than $220 million of loans, stated Rafael Salaberrios, a senior vp who manages capital entry applications at Empire State Growth, New York’s financial improvement company.

“As the banks see the benefit, they are inundating us with applications – and that’s a good thing,” Salaberrios stated. “The linked deposit has allowed for the growth of small businesses to continue even during these high (interest) rate environments.”

Due to rising demand, Missouri’s linked-deposit mortgage program neared its statutory cap of $800 million final Might. After some current loans expired, the treasurer’s workplace was capable of reopen purposes at 10 a.m. on Jan. 2. By 4 p.m. that day, it had approached the cap once more – receiving 142 purposes totaling over $119 million – and closed the appliance window.

About half the purposes got here on behalf of consumers of simply two monetary establishments – OakStar Financial institution and FCS Monetary, a number one agricultural lender. FCS Monetary had over 100 further purposes in line to submit when purposes had been minimize off, stated Brian Zimmerschied, vp for its business crop lending staff.

BTC Financial institution in rural Bethany, Missouri, had deliberate to show in about dozen purposes on behalf of its clients. Nevertheless it missed out completely due to the fast cutoff, financial institution CEO Doug Fish stated.

Amongst these left dissatisfied was Jason Bernard, a farmer close to Bethany who had hoped for a low-interest mortgage to assist buy this 12 months’s provide of seed, fertilizer and chemical spray.

With increased rates of interest, “it’s a lot harder to make it, just because your payments,” Bernard stated.

The Missouri treasurer’s workplace is backing laws to lift this system’s cap from $800 million to $1.2 billion, which might mark a 50% enhance in capability. The enlargement may price the state $12 million of potential earnings, although that might be partly offset by the financial exercise generated from these loans, in response to a legislative fiscal evaluation.

In Montana, lawmakers final 12 months licensed a brand new program to deal with a scarcity of reasonably priced housing. The Montana Board of Investments launched a linked-deposit mortgage initiative in October that acquired $77 million of purposes inside two months, reaching a self-imposed cap and forcing it to shut purposes before anticipated.

Republican state Rep. Mike Hopkins, who sponsored the housing incentive legislation, was thrilled with the response.

“We’re in a bit of a jam in the state of Montana” for reasonably priced housing, Hopkins stated, and “we were able to get money out the door as quickly as possible.”

TOP MISSOURI LAWMAKER MOVES TO CUT FUNDING OF PUBLIC LIBRARIES BY $4.5M

Officers in Iowa, Kansas and Ohio additionally advised the AP they’d elevated demand for applications that deposit state cash in banks to supply low-interest loans. The variety of such mortgage recipients in Kansas tripled from 2022 to 2023. In Ohio, the sum of money offered for these loans rose by two-thirds throughout that point, to greater than $600 million.

Oklahoma’s linked-deposit program has been dormant since 2010 amid low rates of interest, however at the very least two banks just lately contacted the treasurer’s workplace about the opportunity of restarting it, stated Deputy Treasurer Jordan Harvey.

Texas Agriculture Commissioner Sid Miller stated he hadn’t authorised any linked deposits for low-interest loans since taking workplace in 2015 – till final 12 months, when he authorised his first two.

“There wasn’t much need because interest rates were cheap,” Miller stated.

“But now that the rates are up,” Miller added, “it could be a viable program, and we could help some people.”