paymen

Think about strolling down the sidewalk and being confronted at gunpoint by a criminal.

Open the fee app in your telephone and switch out your hard-earned money, or take a bullet within the head. That’s one telephone money ripoff situation of many enjoying out in real-life America.

Different money app crimes are occurring because of the vulnerability of an unlocked iPhone with out the brand new Stolen Gadget Safety turned on in iOS. These are examples of how cell fee apps can put your cash and your life in danger.

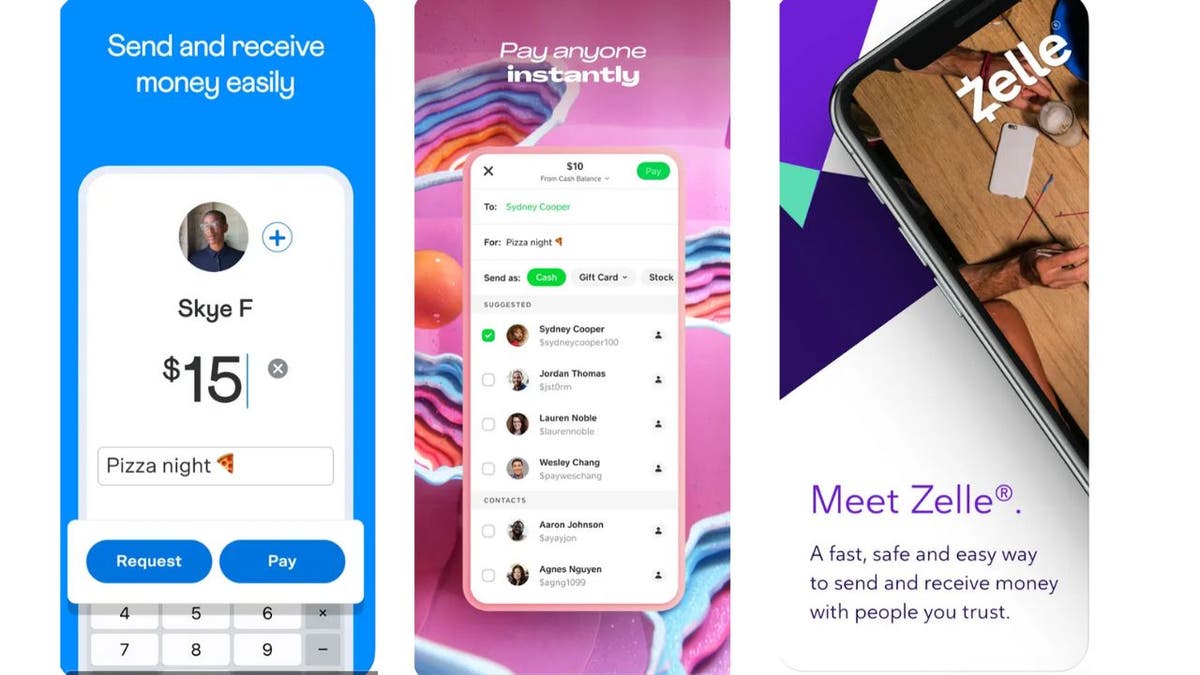

Do you employ cell payment apps like Venmo, Zelle or Money App to ship and obtain cash? In that case, you are not alone. These peer-to-peer fee providers now deal with an estimated $1 trillion in funds. And with that a lot cash concerned, there are additionally now a whole lot of fraud and scams occurring, in response to Alvin Bragg, the Manhattan district legal professional. He says these apps are exposing many individuals to scammers and thieves and are costing them a whole lot of their hard-earned money.

Manhattan District Lawyer Alvin Bragg (manhattanda.org)

In response, Bragg has written letters to the businesses that personal these apps, demanding they enhance their safety and defend their customers from scams and thefts. His particular request is that they impose limits on transactions, require secondary verification of as much as a day and higher monitor uncommon exercise. He says he’s requesting conferences with the businesses to debate these points.

Venmo, Money App and Zelle apps (Kurt “Cyberguy” Knutsson)

How an unlocked system can result in monetary catastrophe and private hurt

Bragg’s letters describe how these monetary apps enable criminals to entry unlocked units and exploit them for monetary achieve and identification theft, saying,

“These crimes involve an unauthorized user gaining access to unlocked devices and then draining bank accounts of significant sums of money, making purchases with mobile financial applications, and using financial information from the applications to open new accounts.

“Offenders additionally take over the telephone’s safety by altering passwords, restoration accounts, and software settings. The benefit with which offenders can acquire five- and even six-figure windfalls in a matter of minutes is incentivizing a lot of people to commit these crimes, that are creating critical monetary, and in some instances bodily, hurt to our residents.”

MANHATTAN DA ALVIN BRAGG CALLS FOR CASH APPS TO CRACK DOWN ON FRAUDSTERS

What are the mobile payment apps doing to prevent fraud?

The companies that own these apps have responded to Bragg’s comments and said that they are doing their best to provide a safe and reliable service to their customers. We reached out to all three companies. Here are their responses to us.

“PayPal and Venmo take the security and safety of our prospects and their info very significantly. Along with proactively leveraging subtle fraud detection instruments, guide investigations, and partnering carefully with regulation enforcement companies to guard our prospects in opposition to widespread scams, we have now a number of choices in place to allow enhanced layers of safety and safety instantly inside our apps.” — PayPal and Venmo spokesperson

“Money App continues to be dedicated to constructing belief with our prospects and investing in areas that assist construct a protected and safe platform. We work proactively and diligently to safeguard our buyer’s cash and mitigate in opposition to the danger of fraud on our platform by means of a mix of preventative controls like multi-factor authentication, account transaction limits, fraud detection, and shopper schooling. We additionally accomplice with regulation enforcement companies to detect and fight felony exercise.” — Cash App spokesperson

“We’re conscious of remoted felony incidents described within the Manhattan District Lawyer’s letter. Offering a protected and dependable service to customers is the highest precedence of Early Warning Providers, LLC, the community operator of Zelle®, and our 2,100 collaborating banks and credit score unions. On account of our continued efforts to construct on Zelle’s robust basis of safety, lower than one tenth of 1 % of transactions are reported as fraud or scams, and that share retains getting smaller. Our efforts embrace implementing industry-leading fraud and rip-off prevention measures for customers like in-app security notifications, and ship limits and restrictions.” — Spokesperson for Early Warning Services, LLC, the network operator of Zelle

What’s the problem with mobile payment apps?

Bragg says that he is seeing a lot of cases where people have lost money or had their personal information stolen by using these apps. He said that this is happening because of the way these apps work on your phone or tablet. Here are three ways that crooks can cheat you or steal from you using these apps.

1) Phishing: This is when someone pretends to be someone else and sends you a message or email asking you to send money or give them your account details. For example, you might get a message from someone who says they are your friend, family member or a charity and they need your help urgently. Or you might get an email from someone who says they are your bank, the IRS or a mobile payment app and they need you to verify your account or update your information.

2) Spoofing: This is when someone creates a fake profile or account that looks like a real one and tries to fool you into sending money or accepting a payment. For example, you might get a payment request from someone who says they are selling something online, but their name, photo, or username is slightly different from the real seller. Or you might get a payment from someone who says they are a buyer, but they are actually using a fake check or a stolen credit card.

3) Device theft: This is when someone takes your phone or tablet and uses your mobile payment apps to take your money or make purchases without your permission. For example, someone might grab your phone while you are using it in public, or break into your car or home and take your device. Or someone might ask to use your phone for a legitimate reason, but then use it to access your mobile payment apps behind your back.

Woman on iPhone. (Kurt “Cyberguy” Knutsson)

How can you protect yourself from mobile payment fraud?

Mobile payment apps have some security features to help protect you, but they are not enough, and you should not rely on them alone. You should also do these 10 things.

1) You should always access the payment app from the official app or website, and not from any third-party platforms or services.

2) Look at the security settings that the payment app offers and make sure they’re all set to the highest and most protective settings.

3) You should create a strong, unique, and complex password for each of your mobile payment apps and change it often. Consider using a password manager to generate and store complex passwords.

4) Enable two-factor authentication, which means that you need to enter a code or use your fingerprint or face to unlock your account to prevent unauthorized access. This way, even if someone knows your password, they can’t log in without your device or confirmation.

5) Lock your device and log out of your apps. You should always lock your phone with a password, PIN, pattern, fingerprint or face. Never share your password, PIN or security code with anyone. You should also log out of your mobile payment apps after each use and turn off the auto-login feature. This way, even if someone takes or borrows your device, they can’t access your mobile payment apps without your approval.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

6) Verify the identity and legitimacy of the sender or receiver. You should always check the name, photo, username and contact information of the person or organization you are sending money to or receiving money from before accepting or sending any payment requests. You should also confirm the reason and amount of the transaction before you agree to it. If you are not sure or have any doubts, you should contact the person or organization directly through another way, such as a phone call, text message or email, but only if you know for sure that those forms of communication are legitimate. You should never send money or give your account details to anyone you don’t know or trust, or anyone who asks you to do so out of the blue.

7) Link your Venmo, Cash App and PayPal account to a credit card as opposed to a debit card, so you can dispute a charge from scammers more easily. Zelle does not allow credit card payments. However, keep in mind that linking a credit card to your payment app can provide additional protection in the event of fraud, but this can come with extra costs in terms of transaction fees.

8) Try not to keep a balance in your money-transferring apps. You have a much better chance of being helped by your bank or credit card company when it comes to fraud than you do from a money-transferring app.

9) Never click on links from unknown sources, especially when an email or text appears to have come from the payment App. Protect yourself from accidentally clicking malicious links by running antivirus software on your device. Get my picks for best antivirus software here.

10) Monitor your account activity and report any suspicious or unauthorized transactions. You should set up notifications from your payment app and your bank via text or email, and check your account activity regularly. Look for any signs of fraud, such as payments you didn’t make or receive, or changes to your account settings or information.

MORE: WATCH OUT FOR THIS ZELLE IMPOSTER SCAM ON FACEBOOK MARKETPLACE

What to do if you believe you have been scammed on Zelle, Cash App or Venmo

1) If you notice any suspicious or unauthorized transactions, report them to the payment app as soon as possible. You can contact their customer support team or use the report feature on the app or website to report any scams, phishing attempts or unauthorized transactions. You can also block or unfriend any users who are involved in scams.

2) Second, if you used your bank account or credit card to fund the transaction, contact your bank or credit card issuer to report the fraud and dispute the charge.

3) The third step is to change your password immediately to prevent further unauthorized transactions. Consider using a password manager to generate and store complex passwords.

4) Also, if you believe you have been scammed, you can file a complaint with the Federal Trade Commission (FTC) to report the fraudulent activity.

5) If you feel your personal data has been stolen, and you want a service that will walk you through every step of the reporting and recovery process, one of the best things you can do to protect yourself from this type of fraud is to subscribe to an identity theft protection company.

This service will monitor personal information like your home title, Social Security Number (SSN), phone number and email address and alert you if it is being sold on the dark web or being used to open an account. It can also assist you in freezing your bank and credit card accounts to prevent further unauthorized use by criminals.

One of the best parts of using some services is that they might include identity theft insurance of up to $1 million to cover losses and legal fees and a white glove fraud resolution team where a U.S.-based case manager helps you recover any losses. Get my review of best identity theft protection software here.

6) Lastly, always report the scammer. If you have any information about the scammer, such as their name, phone number or email address, report it to the app company and the authorities.

CLICK HERE TO GET THE FOX NEWS APP

Kurt’s key takeaways

Mobile payment apps are convenient and useful, but they also come with some risks that you are now aware of. By following these tips, you can protect yourself from mobile payment fraud and enjoy the benefits of these apps safely and securely.

Do you think these payment apps are doing enough to protect you from scammers? Let us know by writing us at Cyberguy.com/Contact

For more of my tech tips & security alerts, subscribe to my free CyberGuy Report Newsletter by heading to Cyberguy.com/Newsletter

Ask Kurt a question or let us know what stories you’d like us to cover.

Answers to the most-asked CyberGuy questions:

Copyright 2024 CyberGuy.com. All rights reserved.